Answered step by step

Verified Expert Solution

Question

1 Approved Answer

answer the above 4 slides Sharon Stones 3 Q Search Sheet Home Insert Draw Page Layout Formulas Data Review View + Share A Cut Times

answer the above 4 slides

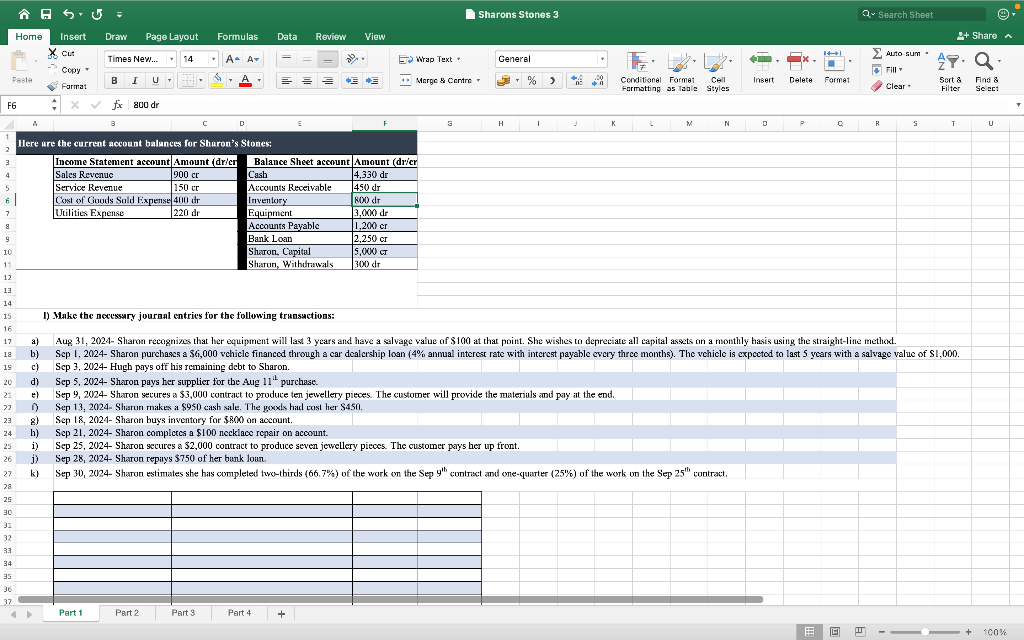

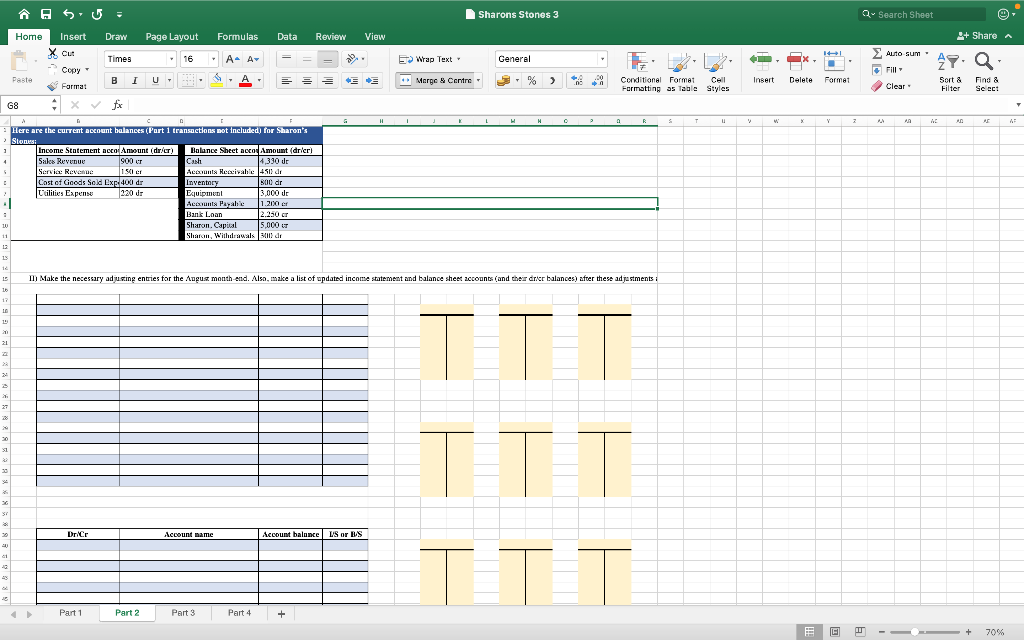

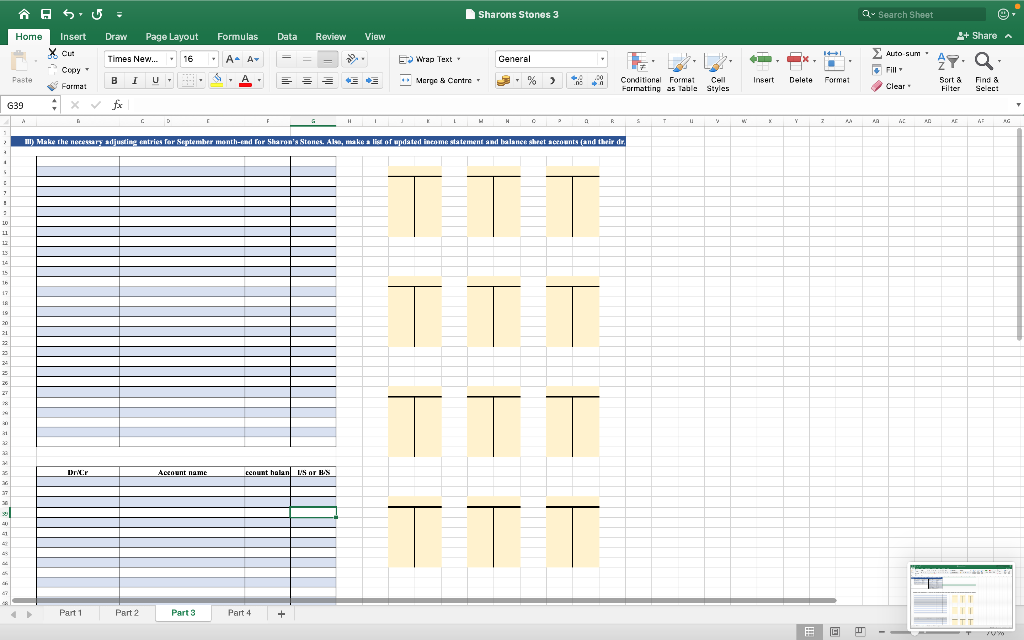

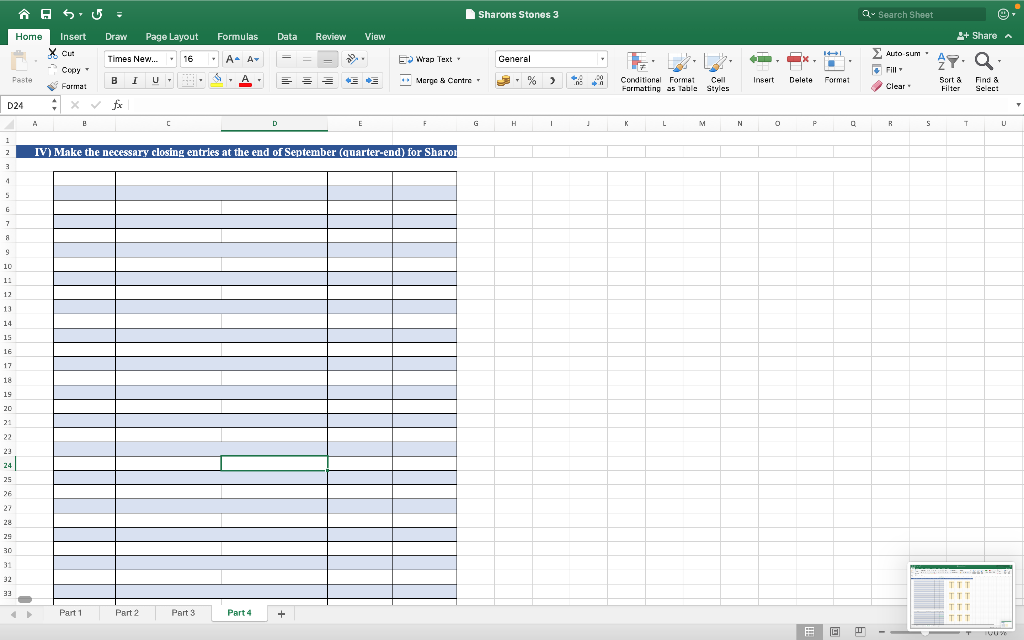

Sharon Stones 3 Q Search Sheet Home Insert Draw Page Layout Formulas Data Review View + Share A Cut Times New. - 14 - A- A > > Wrap Text General X Autosum FIL 49. Q a Copy Peste S, A = *Merge & Centre % > Insert Delete Format Conditional Format Formatting as Table Styles Forma: Clear Sort & Filter Find & Se ect F6 X fx 800 dr A 3 D H 1 1 K M N R S s T U 3 4 5 Here are the current account balances for Sharon's Stones: Income Statement account Amount (dr/cr Balance Sheet account Amount (dr/cr Sales Revenue 900 cr Cash 4,330 dr Service Revenue 150 CC Accounts Receivable 450 dr Cost of Goods Sold Expense 400 ir Inventory INX) dr Utilities Expense 220 dr Equipment 3,000 dr Accounts Payable 1.200) er Bank Loan ,250 cr Sharon, Capital 5.000 Sharon, Withdrawals 300 dr 7. 9 10 1 11 12 13 14 I) Make the necessary journal entries for the following transactions: 15 16 17 a) 18 b) 19 c) 20 d) 21 el 22 ) D 23 24 h) 25 i i) 26 j) 27 k) 28 29 30 Aug 31, 2024- Sharon recognizes that her equipment will last 3 years and have a salvage value of $100 at that point. She wishes to depreciate all capital assets on a monthly basis using the straight-line method. Sep 1, 2024- Sharon purchases a $6,000 vchicle financed through a car dealership loan (4% annual interest rate with interest payable every three months). The vchicle is expectod to last 5 years with a salvage value of $1.000. Sep 3, 2024- Hugh pays off his remaining debt to Sharon. Sep 5, 2024- Sharon pays her supplier for the Aug 114 purchase. Sep 9, 2024- Sharon secures a $3,000 contract to produce ten jewellery pieces. The customer will provide the materiuls and pay at the end. Sep 13, 2024- Sharon makes a $950 cash sale. The goxxis hac cost her S450. Sep 18, 2024- Sharon buys inventory for $800 on account. Sep 21, 2024- Sharon completes a $100 necklace repair on account. Sep 25, 2024- Sharon secures a $2,000 contract to produce seven jewellery pieces. The customer pays her up front. Sep 28, 2024- Sharon repays $750 of her bank loun. Sep 30, 2024- Sharon estimates she has completed two-thirds (66.7%) of the work on the Sep y contract and one-quarter (25%) of the work on the Sep 25" Contract 32 33 34 35 36 37 Part 1 Part 2 Part 3 Part 4 + a + 100% A Su = Sharons Stones 3 Q Search Sheet Home Insert Draw Page Layout Formulas Data Review View 9+ Share A Auto sum > General > Wrap Text X 9. Q. 42 Fill Merge & Centre > . Insert Delete Format Conditional Format Cell Formatting as Table Styles Clear Sort & Filter Find & Se ect H 1 1 H 2 a R u Y 2 ar AF Cut Times 16 - A A Copy * Paste BIU U. A E Format G8 fx D . Here are the current account balances (Part 1 transactions not included) for Sharon's 1 Stones: 1 Income Statement accoAnunt (drier) Balance Sheet acco Amount (drier) 4 Saks Revenue SOO CT Cash 1,330 d Service Revenue 151 er Acxlx Hewivalle 450 de Cost of Goods Sold Ex: 400 dr Inventory 300 dr Utilities Expense . Acounts Payable 1.200 er Bank Loan 2.250 gr Sharon, Capital 5.000 11 Sharcol, Withdrawals 30113 dr 12 730 dr mun 3.000 de w 12 I Make the necessary adjusting entries for the August month-end. Also, make a list of updated income statement and balance sheet accounts and their drier balances) after these adjustments : 20 17 ID 10 21 TET 27 20 3 30 * Drice Account name Account balance usor IS 15 Part 1 Part 2 Part 3 Part 4 + 70% AOS = Sharon Stones 3 Q Search Sheet Home Insert Draw Page Layout Formulas Data Review View 9+ Share A Cut Times New... 16 A A A- A+ Auto sum > > Wrap Text General X 49. a 42 Q Copy Fill Peste B B 1 U. A = + Merge Centre % > . . Insert Delete Conditional Format Formatting as Table Styles Format Clear Sort & Filter Find & Se ec: Format : X x G39 fx C D 1 H 0 a R s T u Y AP ar AG m) Make the necessary adjusting entries for September month-end for Sharon Stones. Als, make a list of updated income statement and balance sheet accounts and their dr. 3 3 LD 1 13 14 25 16 17 18 19 20 21 22 24 2 ZY X 2 23 DC Account name ccount holan Sor TTT TTT 27 20 20 1 T Part 1 Part 2 Part 3 Part 4 + w AOS = Sharon Stones 3 Q Search Sheet Home Insert Draw Page Layout Formulas Data Review View 3+ Share A Times New. 16 Auto sum A A A- A+ > General > Wrap Text X 49. Qi Copy Peste B 1 U S, A = + Merge Centre % > . Insert Delete Format Format : Conditional Format Cell Formatting as Table Styles Clear Sort & Filter Find & Se ect D24 x fx A e C D E G . 1 1 K L M N O P 0 R s T U 1 2 IV) Make the necessary closing entries at the end of September (quarter-end) for Sharoi 3 1 5 G 7 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 3 32 TTT 33 Part 1 Part 2 Part 3 Part 4 + TTT TTTStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started