Answer the below QN

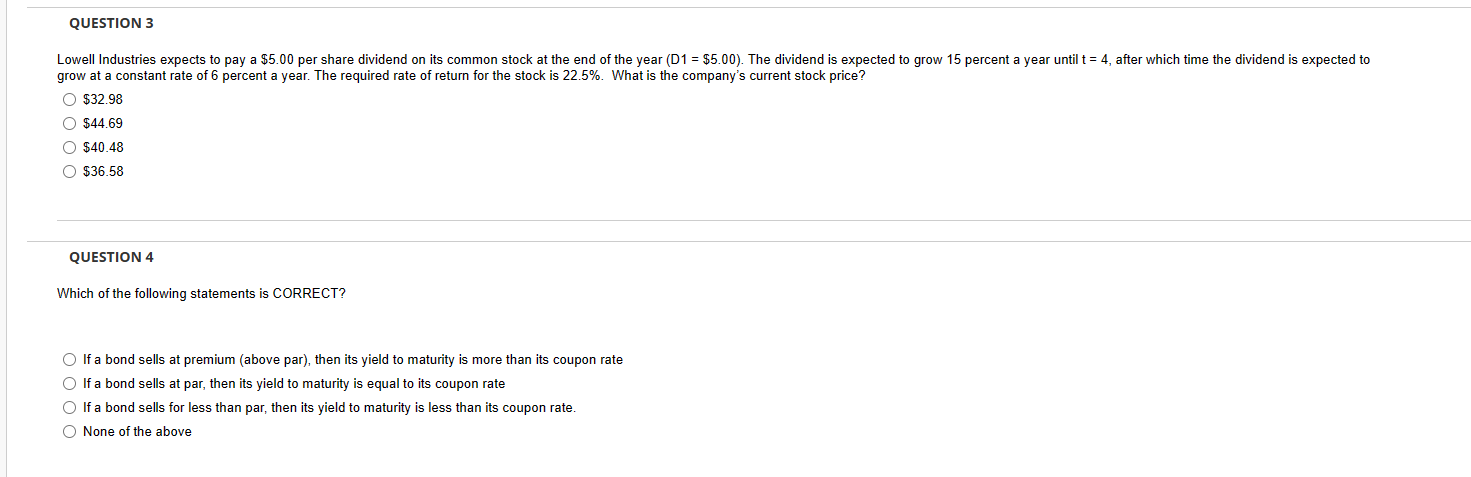

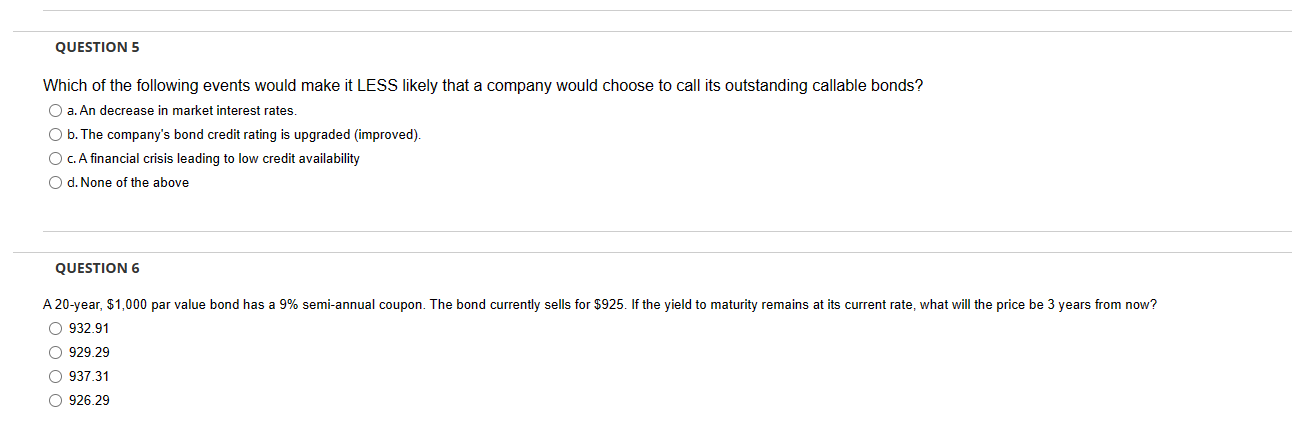

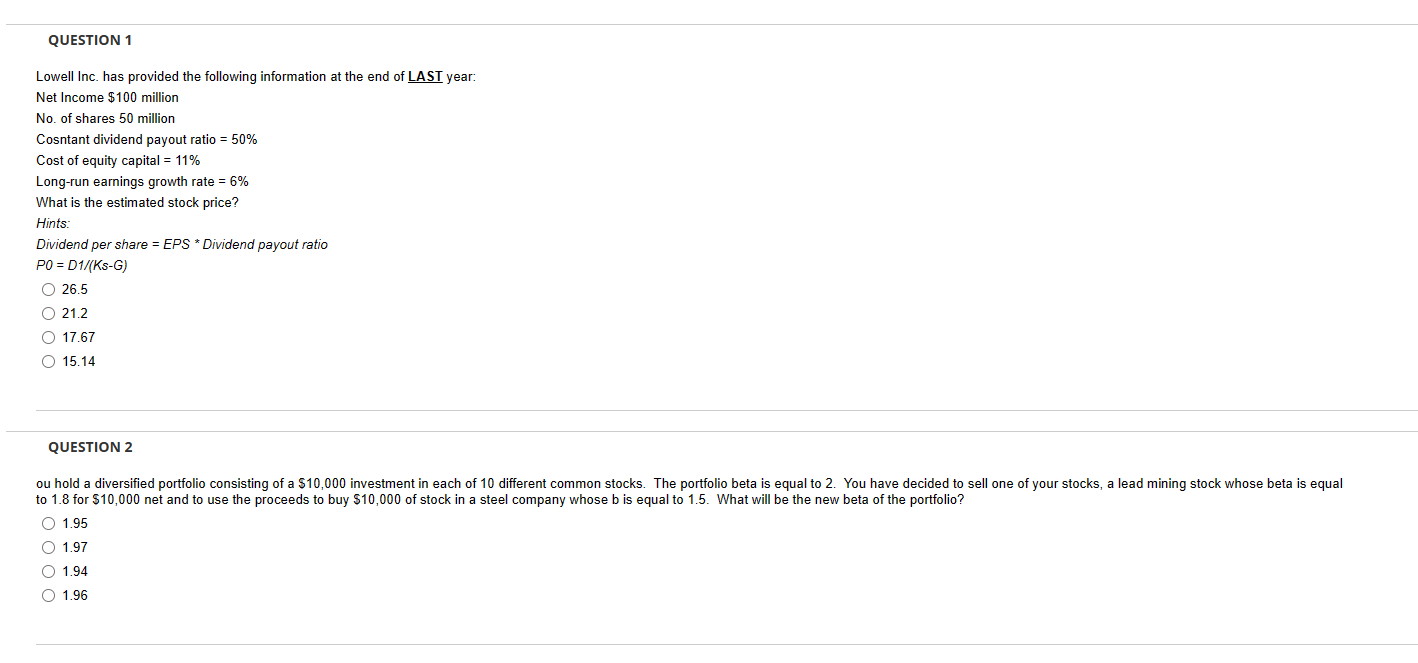

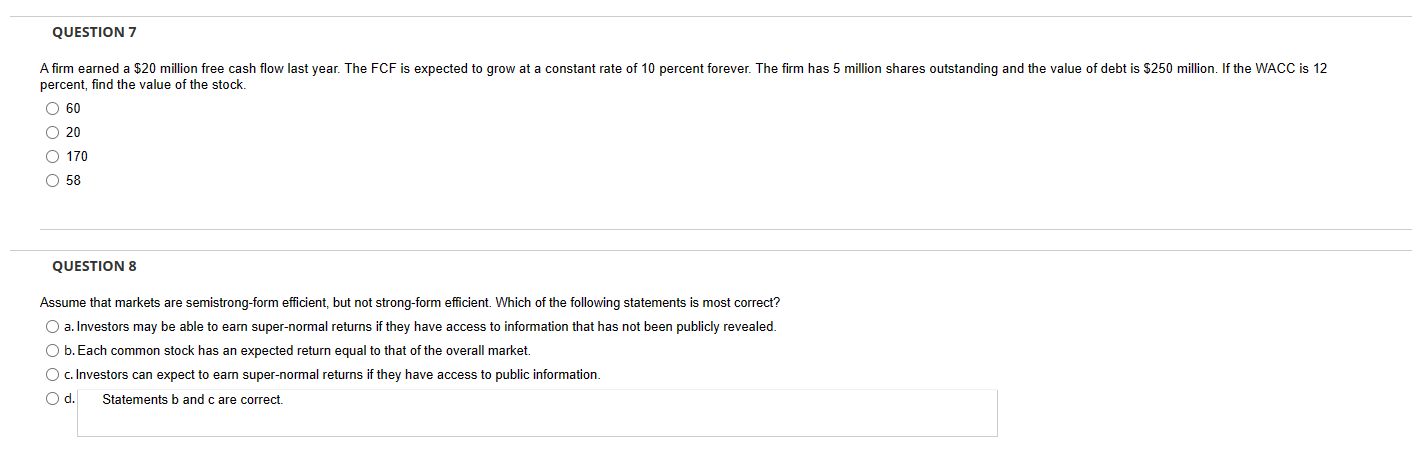

QUESTION 3 Lowell Industries expects to pay a $5 00 per share dividend on its common stock at the end of the year (Di = $5 00). The dividend is expected to grow 15 percent a year until t = 4. after which time the dividend is expected to grow at a constant rate of 6 percent a year. The required rate of return for the stock is 22 5% What is the companyis current stock price? {a $32 93 is $44 69 iii $40.48 it $36.58 QUESTION 4 Which of the following statements is CORRECT? ' ..i If a bond sells at premium (above par), then its yield to maturity is more than its coupon rate ' 2" If a bond sells at par' then its yield to maturity is equal to its coupon rate - 'i If a bond sells for less than par' then its yield to maturity is less than its coupon rate - 3 None oi the above QUESTION 5 Which of the following events would make it LESS likely that a company would choose to call its outstanding callable bonds? a. An decrease in market interest rates. b. The company's bond credit rating is upgraded (improved). c. Anancial crisis leading to lowI credit availability d. None of the above QUESTION 6 A20-year. $1.000 par value bond has a 9% semi-annual coupon. The bond currently sells for $925. If the yield to maturity remains at its current rate, what will the price he 3 years from now? 932.91 929.29 937.31 926.29 QUESTION 1 Lowell Inc. has provided the following information at the end of LAST year: Net Income $100 million No. of shares 50 million Cosntant dividend payout ratio = 50% Cost of equity capital = 11% Long-run earnings growth rate = 6% What is the estimated stock price? Hints: Dividend per share = EPS * Dividend payout ratio PO = D1/(Ks-G) O 26.5 O 21.2 O 17.67 O 15.14 QUESTION 2 ou hold a diversified portfolio consisting of a $10,000 investment in each of 10 different common stocks. The portfolio beta is equal to 2. You have decided to sell one of your stocks, a lead mining stock whose beta is equal to 1.8 for $10,000 net and to use the proceeds to buy $10,000 of stock in a steel company whose b is equal to 1.5. What will be the new beta of the portfolio? O 1.95 O 1.97 O 1.94 O 1.96QUESTION 7 A firm earned a $20 million free cash flow last year. The FCF is expected to grow at a constant rate of 10 percent forever. The firm has 5 million shares outstanding and the value of debt is $250 million. If the WACC is 12 percent, find the value of the stock. O 60 O 20 O 170 O 58 QUESTION 8 Assume that markets are semistrong-form efficient, but not strong-form efficient. Which of the following statements is most correct? O a. Investors may be able to earn super-normal returns if they have access to information that has not been publicly revealed. O b. Each common stock has an expected return equal to that of the overall market. O c. Investors can expect to earn super-normal returns if they have access to public information. O d. Statements b and c are correct