Answer the directions

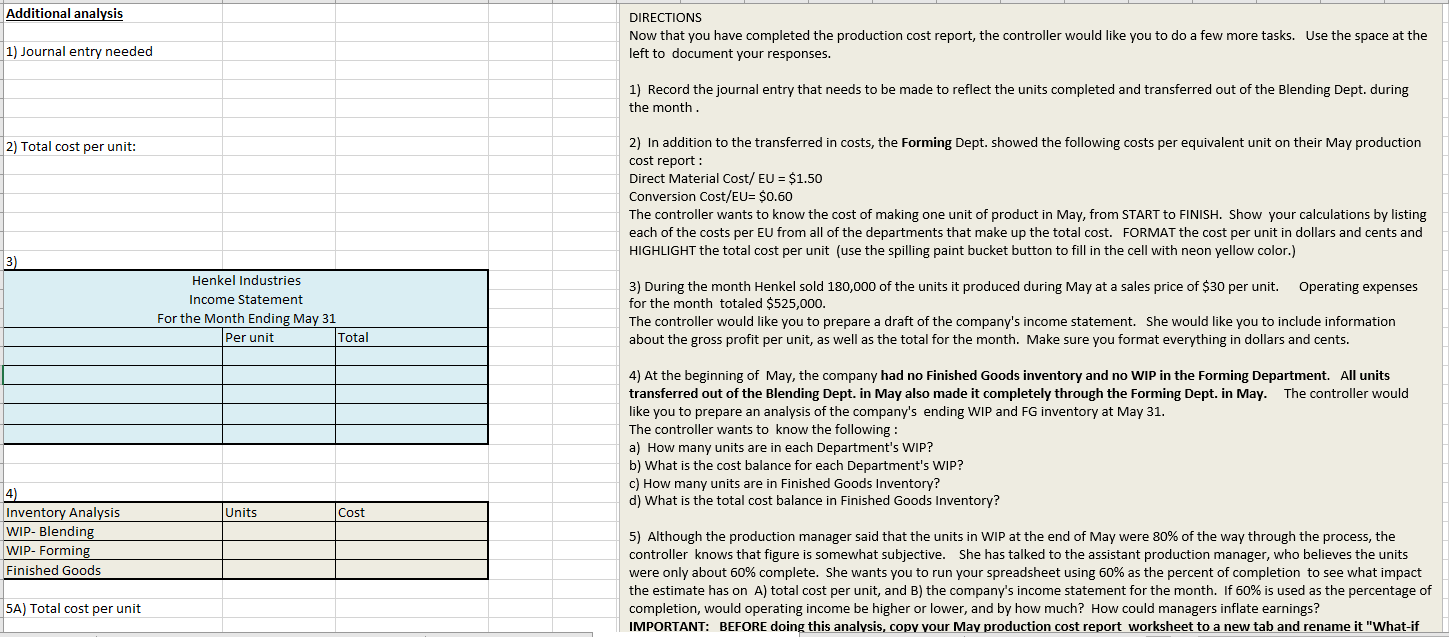

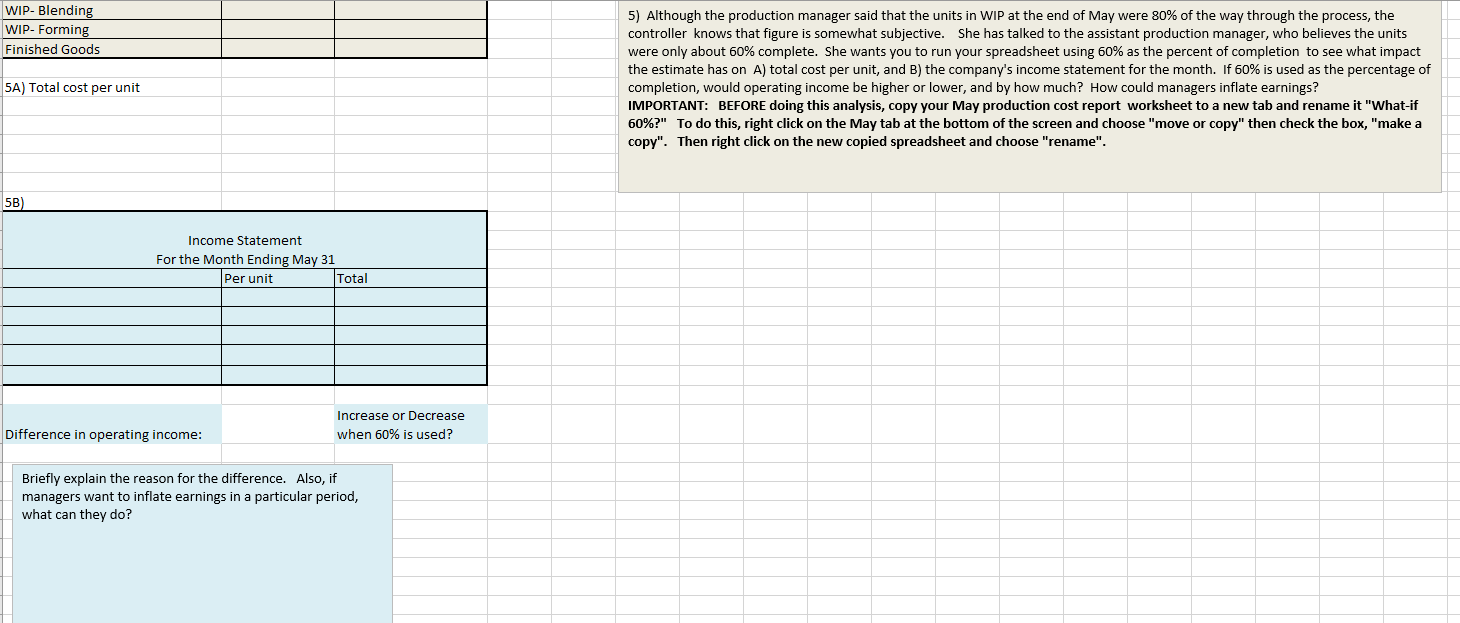

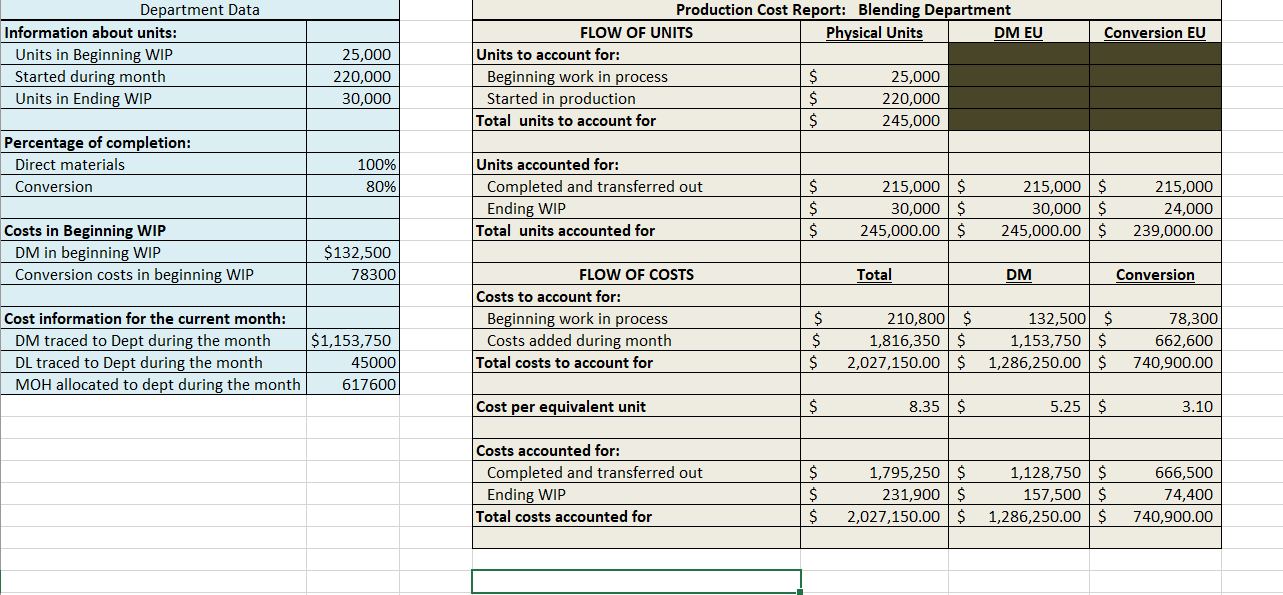

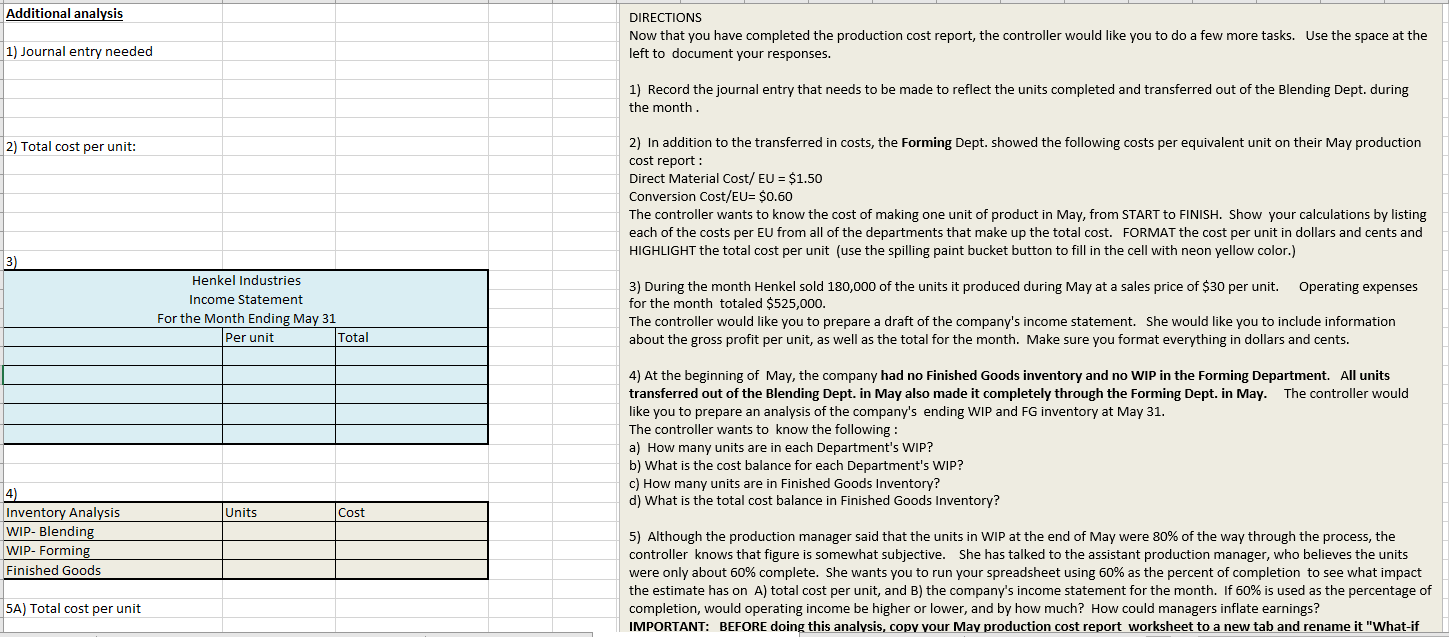

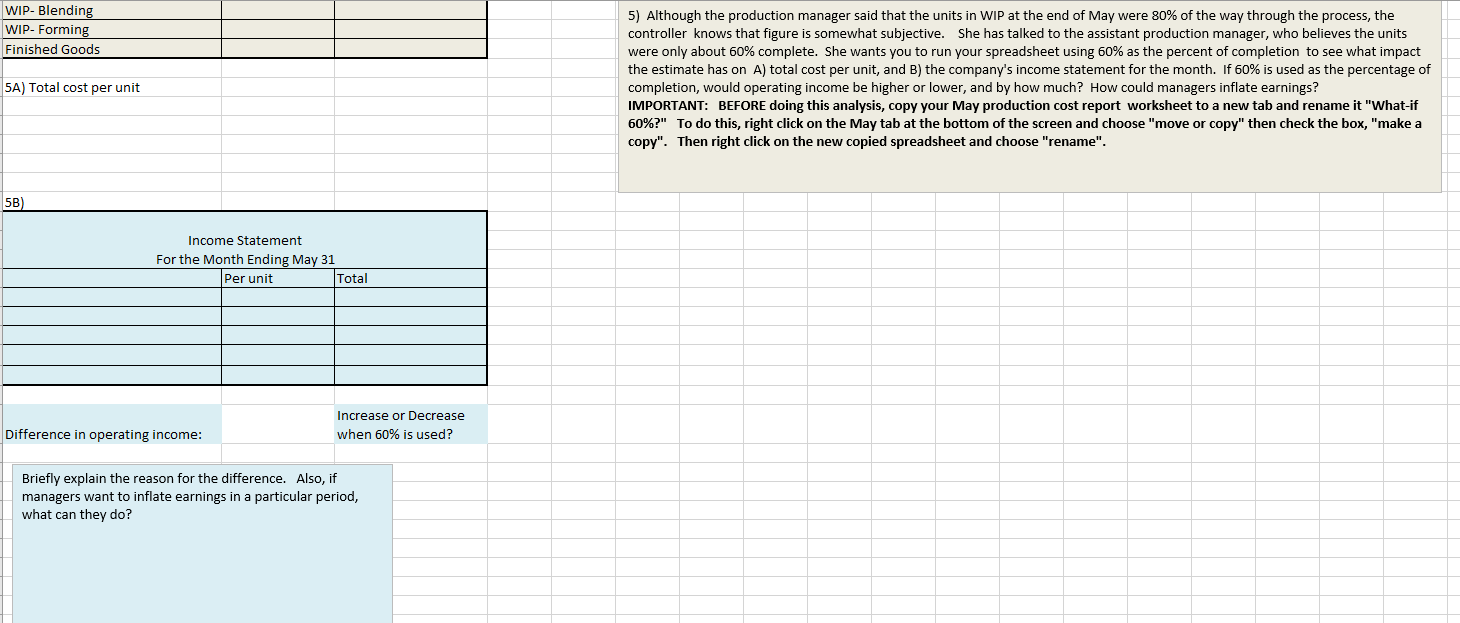

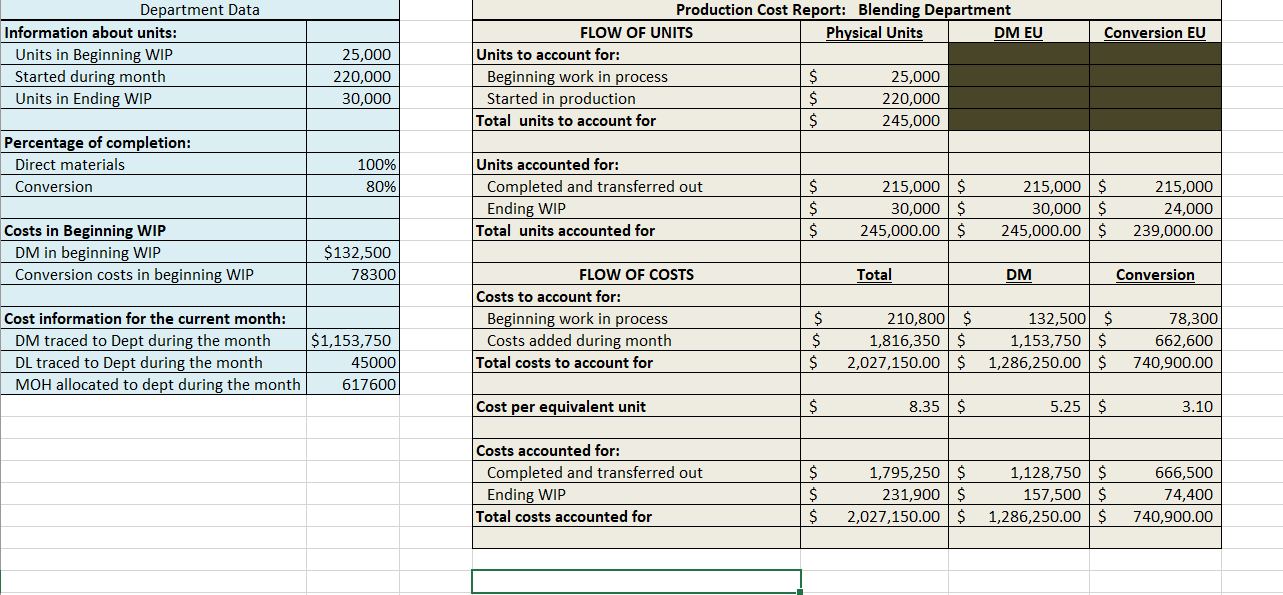

Additional analysis DIRECTIONS Now that you have completed the production cost report, the controller would like you to do a few more tasks. Use the space at the left to document your responses. 1) Journal entry needed 1) Record the journal entry that needs to be made to reflect the units completed and transferred out of the Blending Dept. during the month 2) Total cost per unit: 2) In addition to the transferred in costs, the Forming Dept. showed the following costs per equivalent unit on their May production cost report: Direct Material Cost/ EU = $1.50 Conversion Cost/EU= $0.60 The controller wants to know the cost of making one unit of product in May, from START TO FINISH. Show your calculations by listing each of the costs per EU from all of the departments that make up the total cost. FORMAT the cost per unit in dollars and cents and HIGHLIGHT the total cost per unit (use the spilling paint bucket button to fill in the cell with neon yellow color.) 3) Henkel Industries Income Statement For the Month Ending May 31 Per unit Total 3) During the month Henkel sold 180,000 of the units it produced during May at a sales price of $30 per unit. Operating expenses for the month totaled $525,000. The controller would like you to prepare a draft of the company's income statement. She would like you to include information about the gross profit per unit, as well as the total for the month. Make sure you format everything in dollars and cents. 4) At the beginning of May, the company had no Finished Goods inventory and no WIP in the Forming Department. All units transferred out of the Blending Dept. in May also made it completely through the Forming Dept. in May. The controller would like you to prepare an analysis of the company's ending WIP and FG inventory at May 31. The controller wants to know the following: a) How many units are in each Department's WIP? b) What is the cost balance for each Department's WIP? c) How many units are in Finished Goods Inventory? d) What is the total cost balance in Finished Goods Inventory? Units Cost 4) Inventory Analysis WIP-Blending WIP- Forming Finished Goods 5) Although the production manager said that the units in WIP at the end of May were 80% of the way through the process, the controller knows that figure is somewhat subjective. She has talked to the assistant production manager, who believes the units were only about 60% complete. She wants you to run your spreadsheet using 60% as the percent of completion to see what impact the estimate has on A) total cost per unit, and B) the company's income statement for the month. If 60% is used as the percentage of completion, would operating income be higher or lower, and by how much? How could managers inflate earnings? IMPORTANT: BEFORE doing this analysis, copy your May production cost report worksheet to a new tab and rename it "What-if 5A) Total cost per unit WIP-Blending WIP- Forming Finished Goods 5A) Total cost per unit 5) Although the production manager said that the units in WIP at the end of May were 80% of the way through the process, the controller knows that figure is somewhat subjective. She has talked to the assistant production manager, who believes the units were only about 60% complete. She wants you to run your spreadsheet using 60% as the percent of completion to see what impact the estimate has on A) total cost per unit, and B) the company's income statement for the month. If 60% is used as the percentage of completion, would operating income be higher or lower, and by how much? How could managers inflate earnings? IMPORTANT: BEFORE doing this analysis, copy your May production cost report worksheet to a new tab and rename it "What-if 60%?" To do this, right click on the May tab at the bottom of the screen and choose "move or copy" then check the box, "make a copy". Then right click on the new copied spreadsheet and choose "rename". 5B) Income Statement For the Month Ending May 31 Per unit Total Increase or Decrease Difference in operating income: when 60% is used? Briefly explain the reason for the difference. Also, if managers want to inflate earnings in a particular period, what can they do? Conversion EU Department Data Information about units: Units in Beginning WIP Started during month Units in Ending WIP 25,000 220,000 30,000 Production Cost Report: Blending Department FLOW OF UNITS Physical Units DM EU Units to account for: Beginning work in process $ 25,000 Started in production $ 220,000 Total units to account for $ 245,000 Percentage of completion: Direct materials 100% Conversion 80% Units accounted for: Completed and transferred out Ending WIP Total units accounted for $ $ $ 215,000 $ 30,000 $ 245,000.00 $ 215,000 $ 30,000 $ 245,000.00 $ 215,000 24,000 239,000.00 Costs in Beginning WIP DM in beginning WIP Conversion costs in beginning WIP $132,500 78300 FLOW OF COSTS Total DM Conversion Costs to account for: Beginning work in process Costs added during month Total costs to account for Cost information for the current month: DM traced to Dept during the month DL traced to Dept during the month MOH allocated to dept during the month $1,153,750 $ $ $ 210,800 $ 1,816,350 $ 2,027,150.00 $ 132,500 $ 1,153,750 $ 1,286,250.00 $ 78,300 662,600 740,900.00 45000 617600 Cost per equivalent unit $ 8.35 $ 5.25$ 3.10 Costs accounted for: 666,500 Completed and transferred out Ending WIP Total costs accounted for $ $ $ 1,795,250 $ 231,900 $ 2,027,150.00 $ 1,128,750 $ 157,500 $ 1,286,250.00 $ 74,400 740,900.00