Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer the following. a. b. It is Jan 1. The Rumpel Company purchased a felt press last year at a cost of $7,500. The machine

Answer the following.

a.

b.

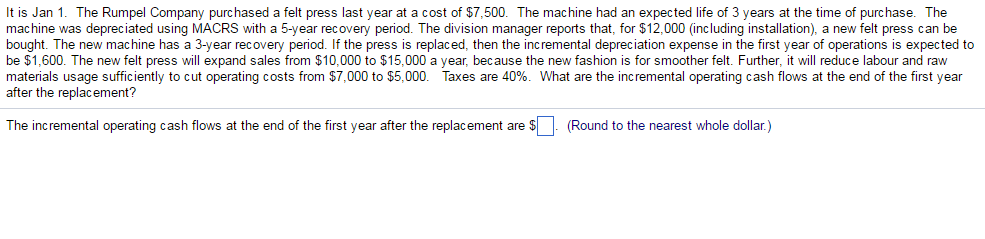

It is Jan 1. The Rumpel Company purchased a felt press last year at a cost of $7,500. The machine had an expected life of 3 years at the time of purchase. The machine was depreciated using MACRS with a 5-year recovery period. The division manager reports that, for $12,000 (including installation), a new felt press can be machine has a 3-year recovery period If the press is replaced, then the incremental depreciation expense in the first year of operations is expected to bought. The new be $1,600. The new felt press will expand sales from $10,000 to $15,000 a year because the new fashion is for smoother felt. Further, it will reduce labour and raw materials usage sufficiently to cut operating costs from $7,000 to $5,000. Taxes are 40%. What are the incremental operating cash flows at the end of the first year after the replacement? The incremental operating cash flows at the end of the first year after the replacement are Round to the nearest whole dollar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started