Question

Answer the following: (a) What portfolio combination of the two ETFs (no risk-free security at this point) would you hold so that the portfolio has

Answer the following: (a) What portfolio combination of the two ETFs (no risk-free security at this point) would you hold so that the portfolio has the highest Sharpe Ratio possible? What would be the expected return to this portfolio? What would be its standard deviation? What would be the Sharpe Ratio?

(b) Suppose that after you constructed the portfolio above, you now consider an additional ETF. Call this ETF A. You run a regression of the excess returns to A on the excess returns to the portfolio you constructed in part 2a. The intercept of this regression is 2% with a slope coefficient of 1. Would you want to add this ETF to your portfolio if in addition you could use the risk-free security in designing the new portfolio? Why or why not?

(c) Suppose in addition to the intercept and slope coefficient from part 2b you find that the R-squared of the regression is 50%. What are the predicted expected return and standard deviation of the return to ETF A?

(d) You wish to target the expected return of the portfolio in part 2a. Given the information from previous questions, construct a portfolio combining the fixed portfolio from part 2a (a fixed combination of M and VMG) with the ETF A and the risk-free security such that the new portfolio has lowest possible standard deviation while achieving the targeted expected return.

(e) If you had the freedom to use alternative weights on M and VMG along with A and the risk-free security to construct the new portfolio as in part 2d, would you potentially want to do that? Why or why not? Besides the information provided in previous questions, what additional information would you need?

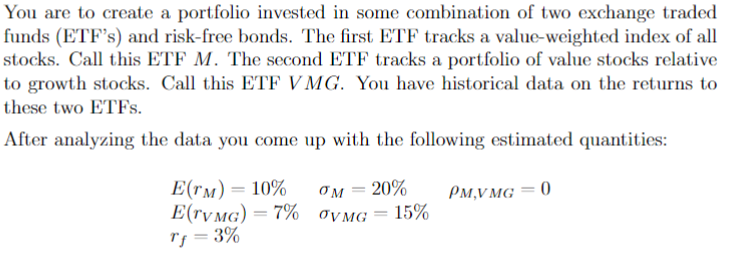

You are to create a portfolio invested in some combination of two exchange traded funds (ETF's) and risk-free bonds. The first ETF tracks a value-weighted index of all stocks. Call this ETF M. The second ETF tracks a portfolio of value stocks relative to growth stocks. Call this ETF VMG. You have historical data on the returns to these two ETFs. After analyzing the data you come up with the following estimated quantities: E(rM)=10%E(rVMG)=7%rf=3%M=20%VMG=15%M,VMG=0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started