Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ANSWER THE FOLLOWING: How much is the net adjustment to Salve, Capital as a result of the foregoing? How much is the total partners equity

ANSWER THE FOLLOWING:

How much is the net adjustment to Salve, Capital as a result of the foregoing?

How much is the total partners equity immediately after the formation of the partnership?

What is the amortized cost of accounts receivable?

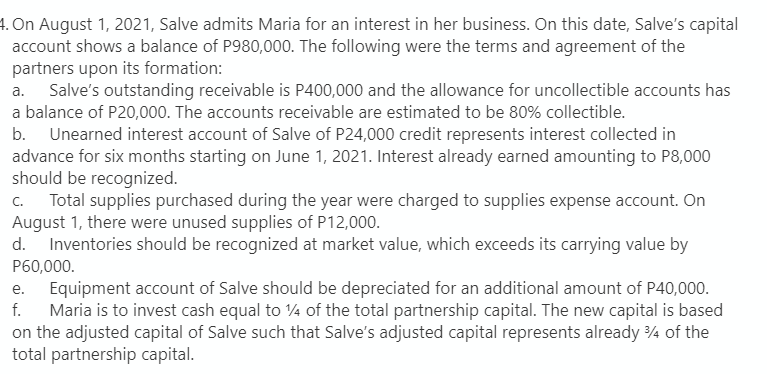

a. 4. On August 1, 2021, Salve admits Maria for an interest in her business. On this date, Salve's capital account shows a balance of P980,000. The following were the terms and agreement of the partners upon its formation: Salve's outstanding receivable is P400,000 and the allowance for uncollectible accounts has a balance of P20,000. The accounts receivable are estimated to be 80% collectible. b. Unearned interest account of Salve of P24,000 credit represents interest collected in advance for six months starting on June 1, 2021. Interest already earned amounting to P8,000 should be recognized. C. Total supplies purchased during the year were charged to supplies expense account. On August 1, there were unused supplies of P12,000. d. Inventories should be recognized at market value, which exceeds its carrying value by P60,000. Equipment account of Salve should be depreciated for an additional amount of P40,000. f. Maria is to invest cash equal to 1/4 of the total partnership capital. The new capital is based on the adjusted capital of Salve such that Salve's adjusted capital represents already 3/4 of the total partnership capital. e

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started