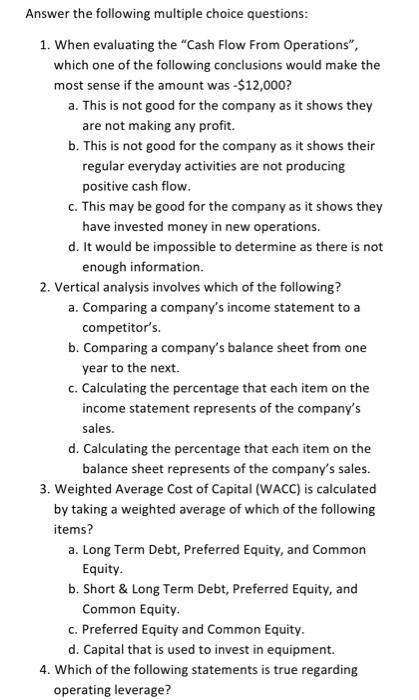

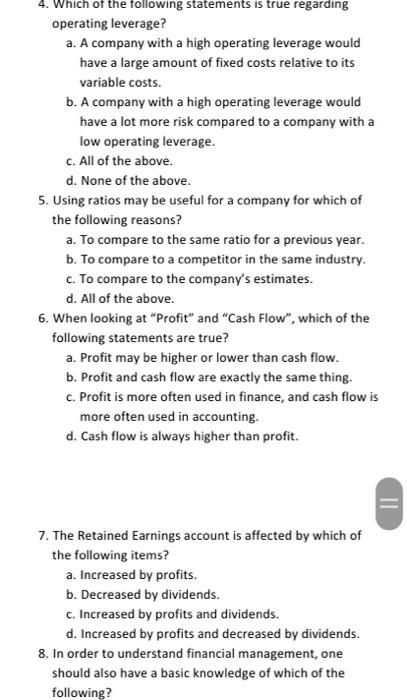

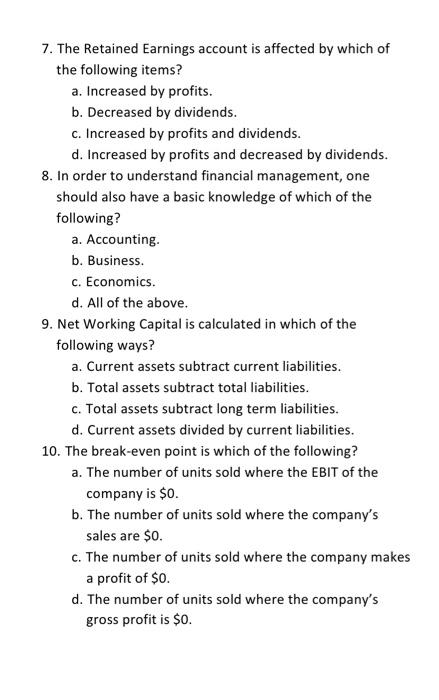

Answer the following multiple choice questions: 1. When evaluating the "Cash Flow From Operations", which one of the following conclusions would make the most sense if the amount was -$12,000? a. This is not good for the company as it shows they are not making any profit. b. This is not good for the company as it shows their regular everyday activities are not producing positive cash flow. c. This may be good for the company as it shows they have invested money in new operations. d. It would be impossible to determine as there is not enough information. 2. Vertical analysis involves which of the following? a. Comparing a company's income statement to a competitor's. b. Comparing a company's balance sheet from one year to the next. c. Calculating the percentage that each item on the income statement represents of the company's sales. d. Calculating the percentage that each item on the balance sheet represents of the company's sales. 3. Weighted Average Cost of Capital (WACC) is calculated by taking a weighted average of which of the following items? a. Long Term Debt, Preferred Equity, and Common Equity. b. Short & Long Term Debt, Preferred Equity, and Common Equity. c. Preferred Equity and Common Equity. d. Capital that is used to invest in equipment. 4. Which of the following statements is true regarding operating leverage? 4. Which of the following statements is true regarding operating leverage? a. A company with a high operating leverage would have a large amount of fixed costs relative to its variable costs. b. A company with a high operating leverage would have a lot more risk compared to a company with a low operating leverage. c. All of the above. d. None of the above. 5. Using ratios may be useful for a company for which of the following reasons? a. To compare to the same ratio for a previous year. b. To compare to a competitor in the same industry. c. To compare to the company's estimates. d. All of the above. 6. When looking at "Profit" and "Cash Flow", which of the following statements are true? a. Profit may be higher or lower than cash flow. b. Profit and cash flow are exactly the same thing. c. Profit is more often used in finance, and cash flow is more often used in accounting. d. Cash flow is always higher than profit. 7. The Retained Earnings account is affected by which of the following items? a. Increased by profits. b. Decreased by dividends. c. Increased by profits and dividends. d. Increased by profits and decreased by dividends. 8. In order to understand financial management, one should also have a basic knowledge of which of the following? || 7. The Retained Earnings account is affected by which of the following items? a. Increased by profits. b. Decreased by dividends. c. Increased by profits and dividends. d. Increased by profits and decreased by dividends. 8. In order to understand financial management, one should also have a basic knowledge of which of the following? a. Accounting. b. Business. c. Economics. d. All of the above. 9. Net Working Capital is calculated in which of the following ways? a. Current assets subtract current liabilities. b. Total assets subtract total liabilities. c. Total assets subtract long term liabilities. d. Current assets divided by current liabilities. 10. The break-even point is which of the following? a. The number of units sold where the EBIT of the company is $0. b. The number of units sold where the company's sales are $0. c. The number of units sold where the company makes a profit of $0. d. The number of units sold where the company's gross profit is $0