Answered step by step

Verified Expert Solution

Question

1 Approved Answer

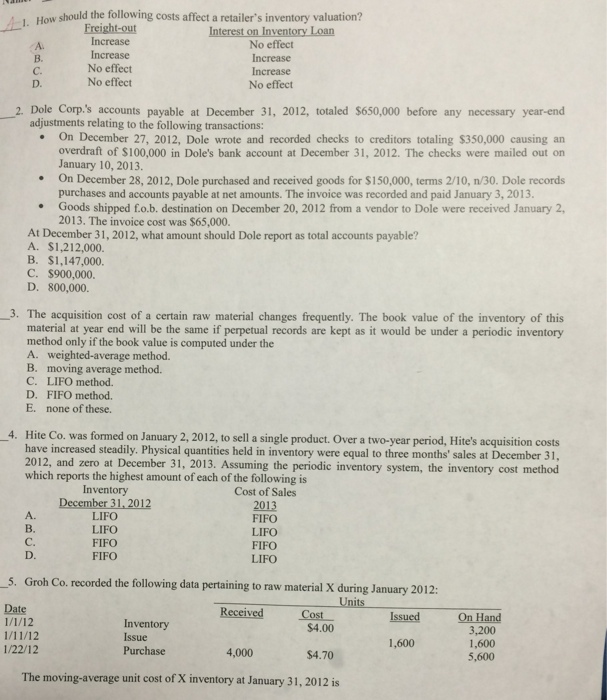

Answer the following multiple choice questions . How should the following costs affect a retailer's inventory valuation? Interest on Inventory Loan No effect Increase Increase

Answer the following multiple choice questions

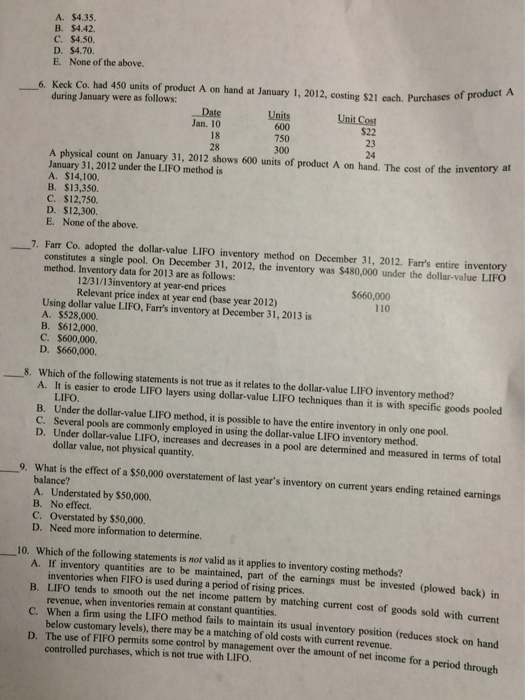

. How should the following costs affect a retailer's inventory valuation? Interest on Inventory Loan No effect Increase Increase No effect No effect A. C. D. Increase No effect 2 Dole Corp.s accounts payable at December 31, 2012, totaled $650,000 before any necessary year-end adjustments relating to the following transactions: . On December 27, 2012, Dole wrote and recorded checks to creditors totaling $350,000 causing an overdraft of $100,000 in Dole's bank account at December 31, 2012The checks were mailed out on January 10, 2013 On December 28, 2012, Dole purchased and received goods for $150,000, terms 2/10, n/30. Dole records purchases and accounts payable at net amounts. The invoice was recorded and paid January 3, 2013. . e Goods shipped f.o.b. destination on December 20, 2012 from a vendor to Dole were received January 2, 2013The invoice cost was $65,000. At December 31, 2012, what amount should Dole report as total accounts payable? A. $1,212,000. B. $1,147,000. C. $900,000. D. 800,000. -3 The acquisition cost of a certain raw nnaterial changes frequently. The book value of the inventory of this material at year end will be the same if perpetual records are kept as it would be under a periodic inventory method only if the book value is computed under the A. weighted-average method. B. moving average method. C. LIFO method. D. FIFO method. E. none of these. _4. Hite Co. was formed on January 2, 2012, to sell a single product. Over a two-year period, Hite's acquisition costs have increased steadily. Physical quantities held in inventory were equal to three months' sales at December 31, 2012, and zero at December 31, 2013. Assuming the periodic inventory system, the inventory cost method which reports the highest amount of each of the following is A. B. C. D. Inventory December 31. 2012 LIFO LIFO FIFO FIFO Cost of Sales 2013 FIFO LIFO FIFO LIFO 5. Groh Co. recorded the following data pertaining to raw material X during January 2012 Received Cost Inventory $4.00 3,200 1,600 5,600 1,600 1/22/12 Purchase 4,000 $4.70 The moving-average unit cost of X inventory at January 31, 2012 is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started