Answer the following problems and show your solution.

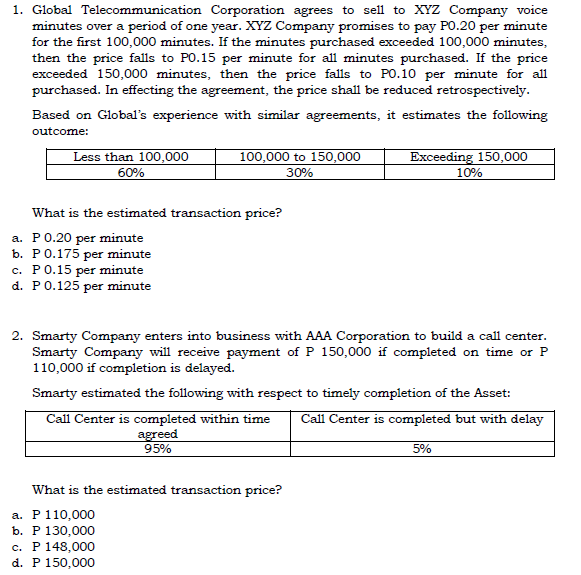

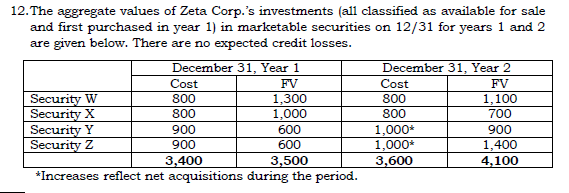

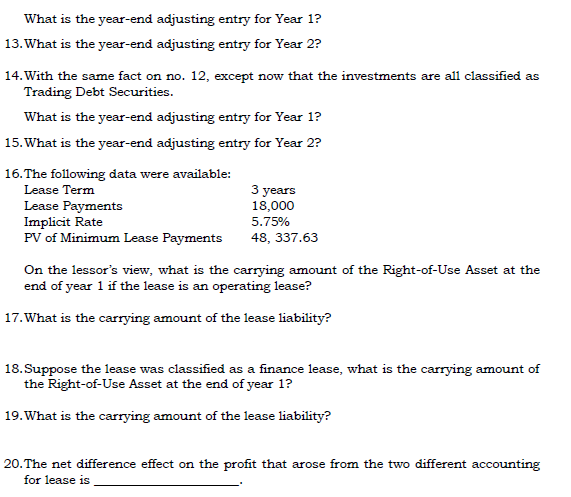

1. Global Telecommunication Corporation agrees to sell to XYZ Company voice minutes over a period of one year. XYZ Company promises to pay P0.20 per minute for the first 100,000 minutes. If the minutes purchased exceeded 100,000 minutes, then the price falls to PO.15 per minute for all minutes purchased. If the price exceeded 150,000 minutes, then the price falls to PO.10 per minute for all purchased. In effecting the agreement, the price shall be reduced retrospectively. Based on Global's experience with similar agreements, it estimates the following outcome: Less than 100,000 100,000 to 150,000 Exceeding 150,000 50% 30% 10% What is the estimated transaction price? a. P 0.20 per minute b. PO.175 per minute c. PO.15 per minute d. PO.125 per minute 2. Smarty Company enters into business with AAA Corporation to build a call center. Smarty Company will receive payment of P 150,000 if completed on time or P 110,000 if completion is delayed. Smarty estimated the following with respect to timely completion of the Asset: Call Center is completed within time Call Center is completed but with delay agreed 95% 5% What is the estimated transaction price? a. P 110,000 b. P 130,000 P 148,000 d. P 150,0003. On January 5, 2018 BBB Company enters into a cancellable contract to transfer a product AA to Mr. Ysmael on April 5, 2018. The contract requires that Mr. Ysmael pay consideration of P 2,000 in advance on January 15, 2018. Mr, Ysmael paysthe consideration on March 5, 2018. Then BBB delivered the product on March 31, 2018. What is the entry on January 15, 2018 when payment of the contract is due? a. DR Receivable CR Contract Liability P 2,000 b. DR Receivable CR Revenue P 2, 000 c. DR Contract Liability CR Revenue P 2,000 d. No entry . What is the entry to record the receipt of cash of P 2,000 on March 5, 2018? a. DR Cash CR Revenue P 2,000 b. DR Cash CR Receivable P 2,000 c. DR Receivable CR Revenue P 2,000 d. DR Cash CR Contract Liability P 2,000 5. What is the entry on March 31, 2018 to record satisfaction of performance obligation? a. DR Cash CR Receivable P 2,000 b. DR Receivable CR Revenue P 2,000 c. DR Contract Liability CR Revenue P 2,000 d. No entry 6. ABC Corporation establishes an employee stock option plan on January 1, year 1. The plan allows its employees to acquire 10,000 shares of its P 1 par value common stock at P 52 per share, when the market price is also P 52. The options may not be exercised until 5 years from the grant date. The grant- date fair value of an option with similar terms and conditions is P 8.62. What is the journal entry to record deferral of compensation expense if the company is using the liability method? 7. What is the annual adjusting entry? 8. What is the journal entry upon exercise of the options? 9. A company grants 100 SAR, payable in cash, to an employee on 1/1/Y1. The predetermined amount for the SAR plan is P 50 per right, and the market value of the stock is P 55 on 12/31/Y1, P 53 on 12/31/Y2 and P 61 on 12/31/Y3. What is the journal entry on Year 1 to accrue compensation? 10. What is the journal entry on year 2 to accrue compensation? 11. What is the journal entry on year 3 to accrue compensation?12. The aggregate values of Zeta Corp.'s investments (all classified as available for sale and first purchased in year 1) in marketable securities on 12/31 for years 1 and 2 are given below. There are no expected credit losses. December 31, Year 1 December 31, Year 2 Cost FV Cost FV Security W 800 1,300 800 1, 100 Security X 800 1,000 800 700 Security Y 900 600 1,000* 900 Security Z 900 600 1,000* 1,400 3,400 3,500 3,600 4,100 *Increases reflect net acquisitions during the period.What is the year-end adjusting entry for Year 1? 13. What is the year-end adjusting entry for Year 2? 14. With the same fact on no. 12, except now that the investments are all classified as Trading Debt Securities. What is the year-end adjusting entry for Year 1? 15. What is the year-end adjusting entry for Year 2? 16. The following data were available: Lease Term 3 years Lease Payments 18,000 Implicit Rate 5.75% PV of Minimum Lease Payments 48, 337.63 On the lessor's view, what is the carrying amount of the Right-of-Use Asset at the end of year 1 if the lease is an operating lease? 17. What is the carrying amount of the lease liability? 18. Suppose the lease was classified as a finance lease, what is the carrying amount of the Right-of-Use Asset at the end of year 1? 19. What is the carrying amount of the lease liability? 20. The net difference effect on the profit that arose from the two different accounting for lease is