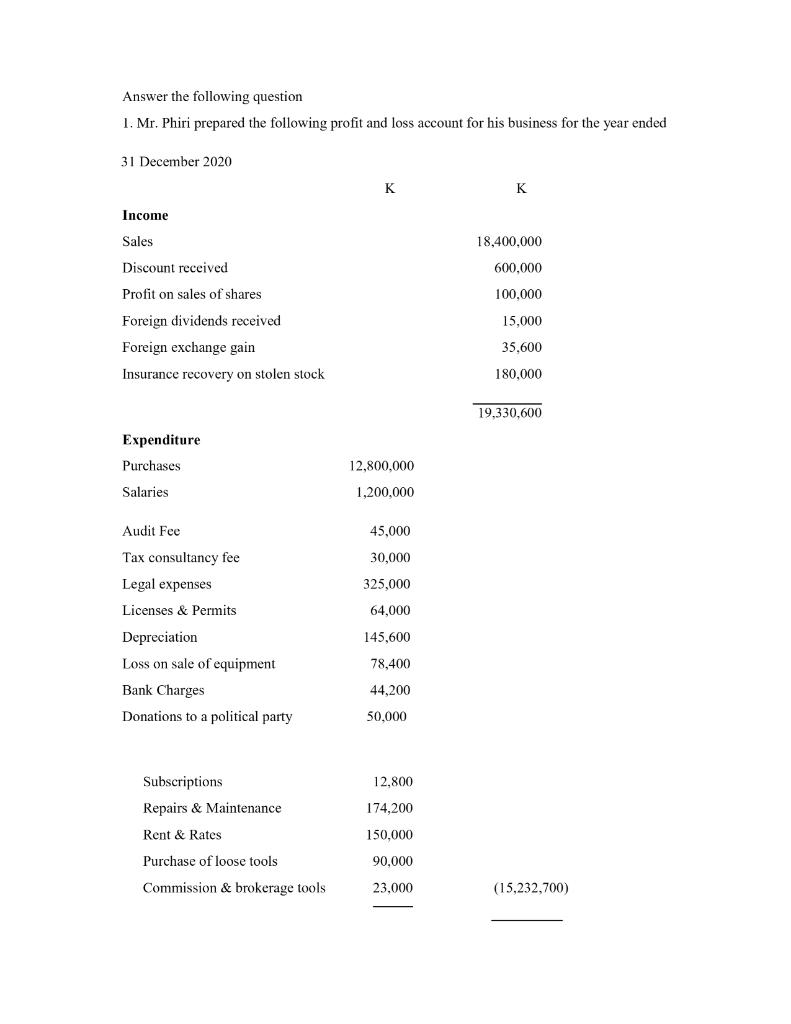

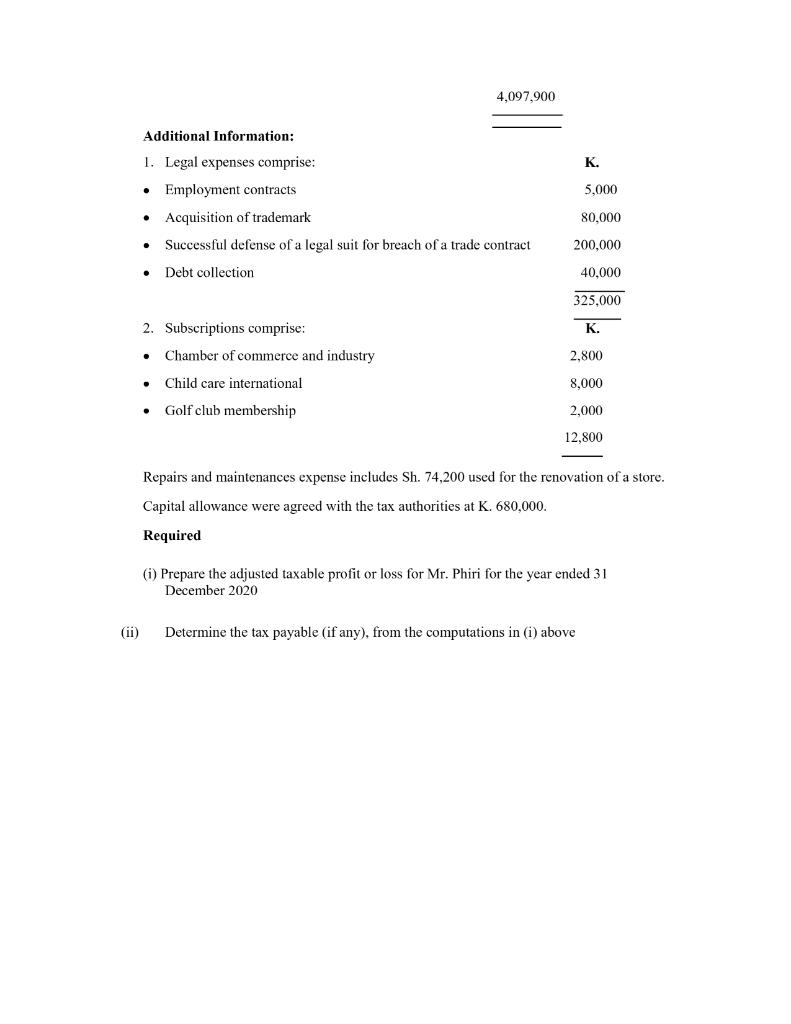

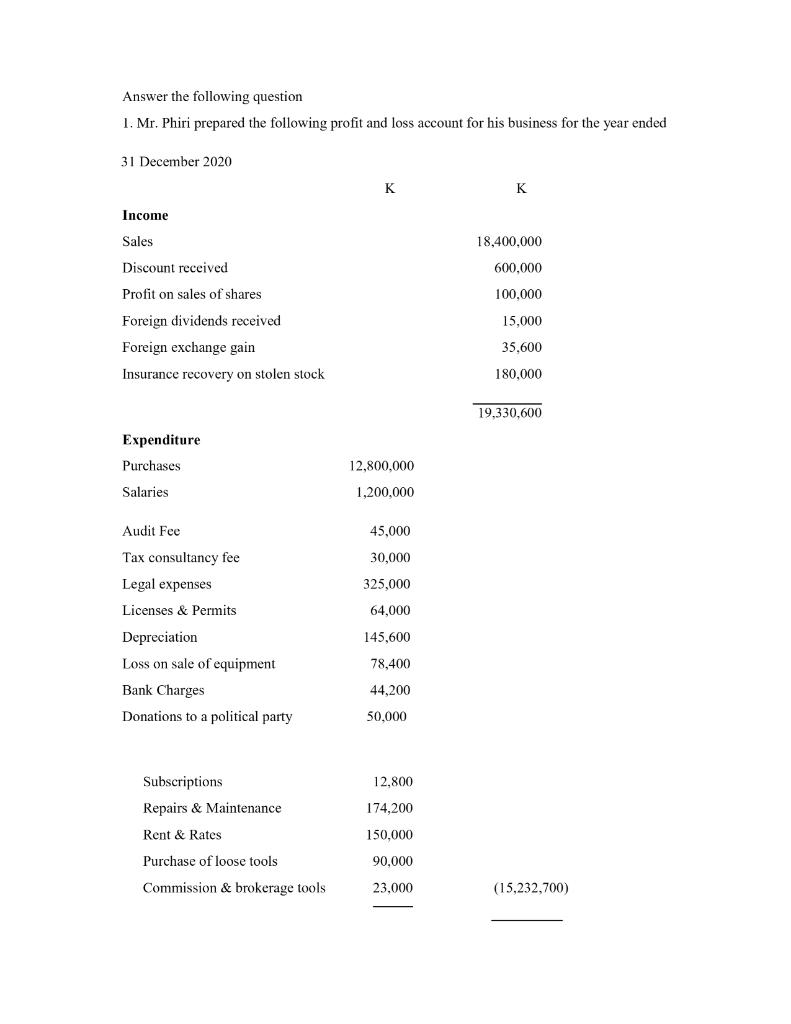

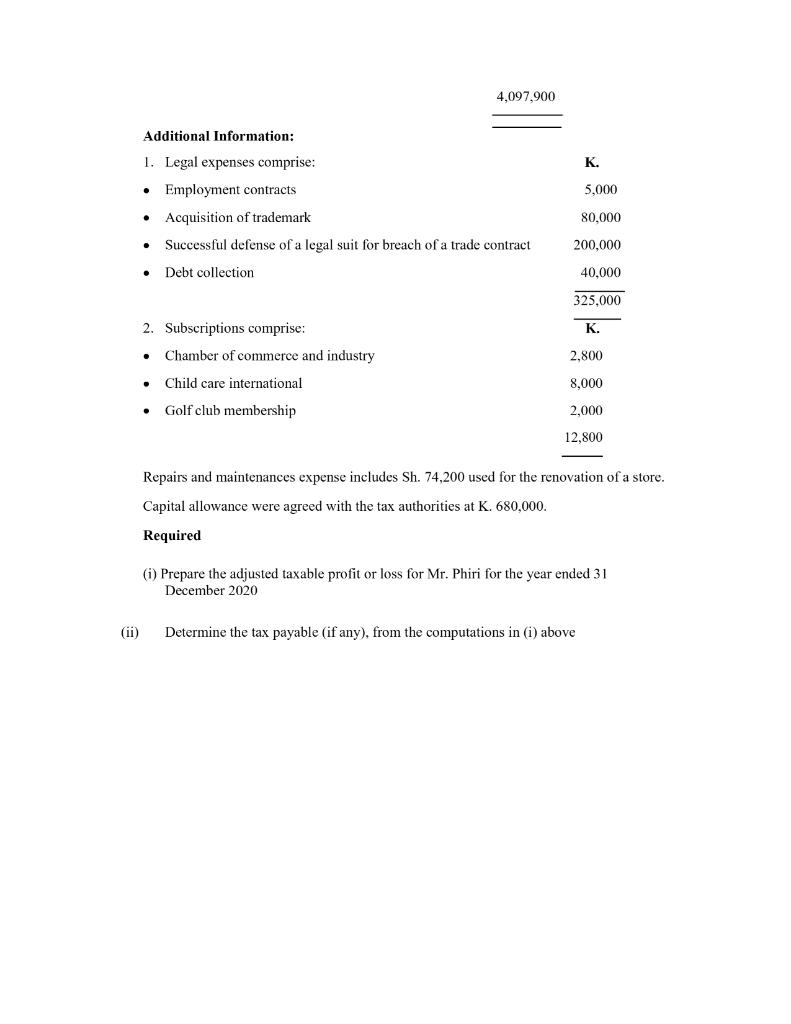

Answer the following question 1. Mr. Phiri prepared the following profit and loss account for his business for the year ended 31 December 2020 K K Income Sales 18,400.000 Discount received 600.000 Profit on sales of shares 100.000 15.000 Foreign dividends received Foreign exchange gain Insurance recovery on stolen stock 35,600 180,000 19,330,600 Expenditure Purchases Salaries 12,800,000 1,200,000 Audit Fee 45,000 30,000 Tax consultancy fee Legal expenses 325,000 Licenses & Permits 64,000 145,600 78,400 Depreciation Loss on sale of equipment Bank Charges Donations to a political party 44,200 50.000 Subscriptions 12,800 Repairs & Maintenance 174,200 Rent & Rates 150,000 Purchase of loose tools 90,000 Commission & brokerage tools 23,000 (15,232,700) 4,097,900 Additional Information: 1. Legal expenses comprise: Employment contracts K. . 5,000 . Acquisition of trademark 80,000 . 200,000 Successful defense of a legal suit for breach of a trade contract Debt collection . 40,000 325.000 K. 2. Subscriptions comprise: Chamber of commerce and industry . 2.800 . Child care international 8,000 . Golf club membership 2,000 12,800 Repairs and maintenances expense includes Sh. 74,200 used for the renovation of a store. Capital allowance were agreed with the tax authorities at K. 680,000. Required (1) Prepare the adjusted taxable profit or loss for Mr. Phiri for the year ended 31 December 2020 (ii) Determine the tax payable (if any), from the computations in (i) above Answer the following question 1. Mr. Phiri prepared the following profit and loss account for his business for the year ended 31 December 2020 K K Income Sales 18,400.000 Discount received 600.000 Profit on sales of shares 100.000 15.000 Foreign dividends received Foreign exchange gain Insurance recovery on stolen stock 35,600 180,000 19,330,600 Expenditure Purchases Salaries 12,800,000 1,200,000 Audit Fee 45,000 30,000 Tax consultancy fee Legal expenses 325,000 Licenses & Permits 64,000 145,600 78,400 Depreciation Loss on sale of equipment Bank Charges Donations to a political party 44,200 50.000 Subscriptions 12,800 Repairs & Maintenance 174,200 Rent & Rates 150,000 Purchase of loose tools 90,000 Commission & brokerage tools 23,000 (15,232,700) 4,097,900 Additional Information: 1. Legal expenses comprise: Employment contracts K. . 5,000 . Acquisition of trademark 80,000 . 200,000 Successful defense of a legal suit for breach of a trade contract Debt collection . 40,000 325.000 K. 2. Subscriptions comprise: Chamber of commerce and industry . 2.800 . Child care international 8,000 . Golf club membership 2,000 12,800 Repairs and maintenances expense includes Sh. 74,200 used for the renovation of a store. Capital allowance were agreed with the tax authorities at K. 680,000. Required (1) Prepare the adjusted taxable profit or loss for Mr. Phiri for the year ended 31 December 2020 (ii) Determine the tax payable (if any), from the computations in (i) above