Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer the following question? A company needs to have $135,000 in 5 years, and will create a fund to insure that the $135,000 will be

Answer the following question?

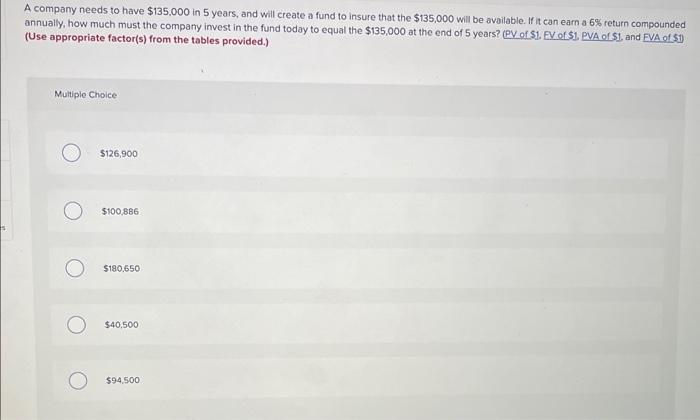

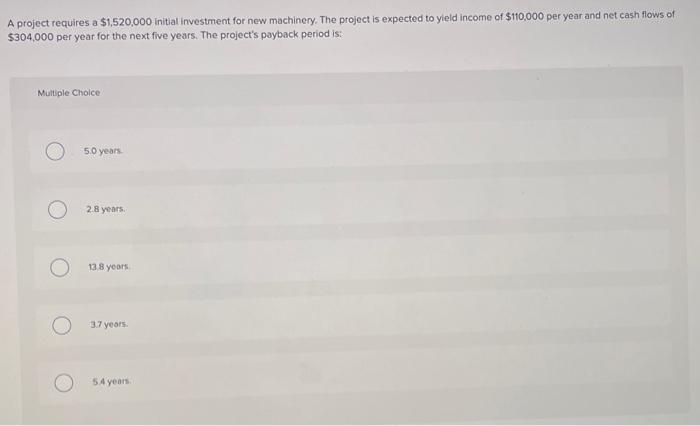

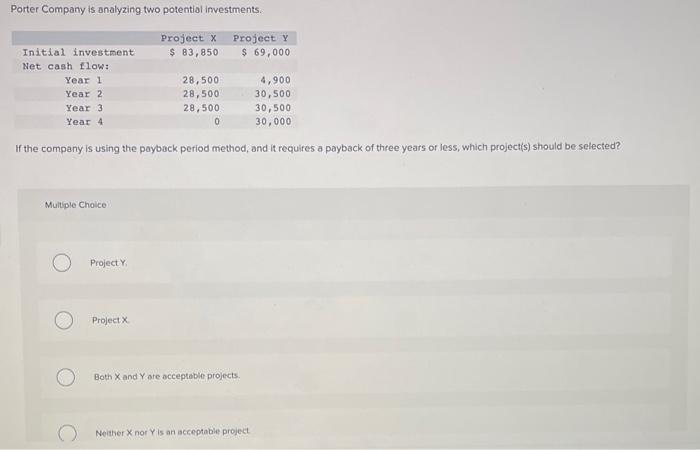

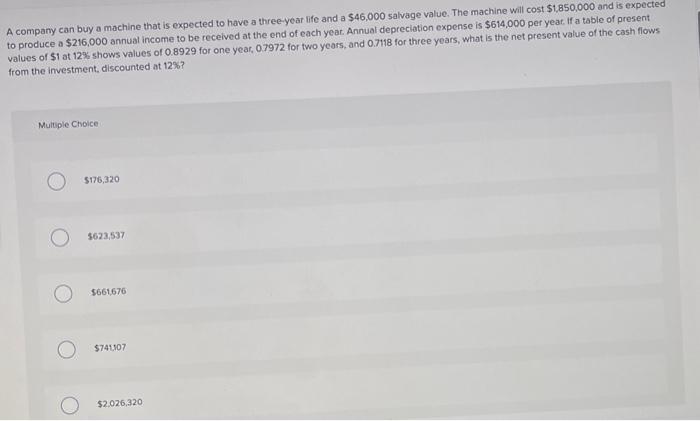

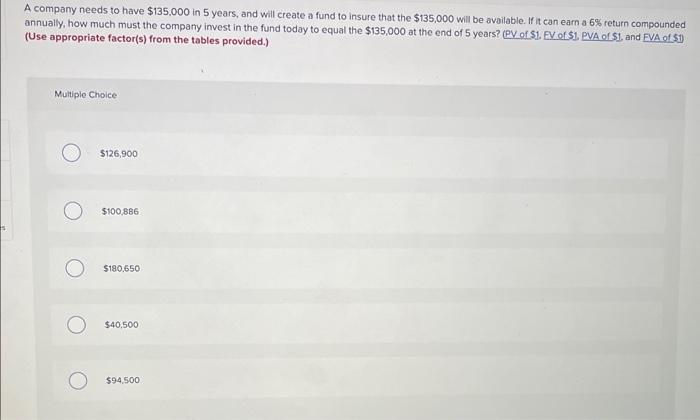

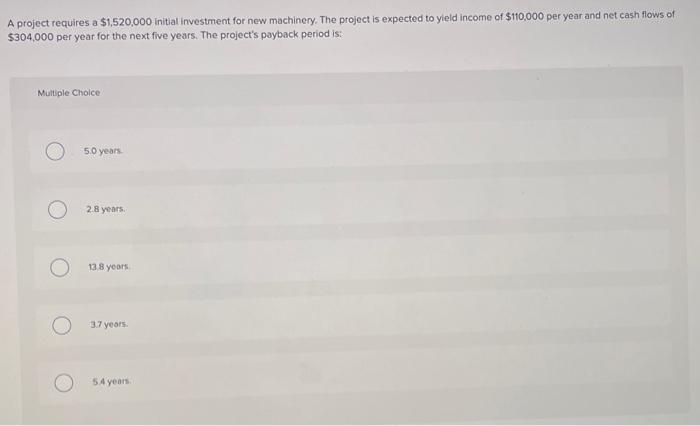

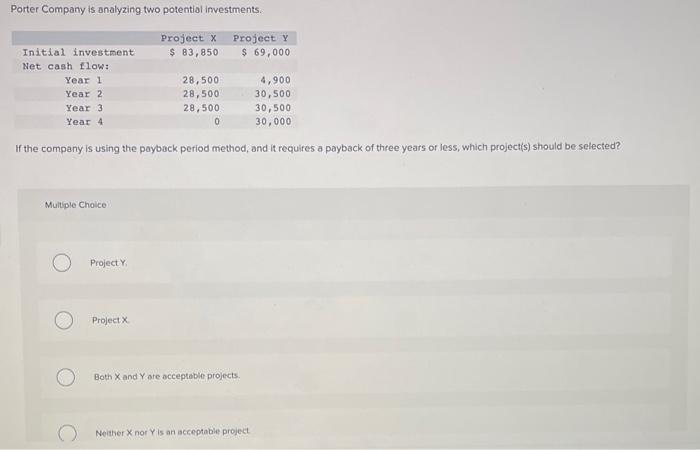

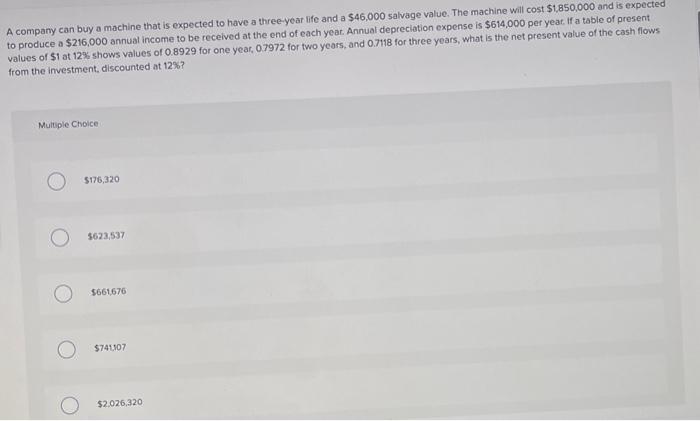

A company needs to have $135,000 in 5 years, and will create a fund to insure that the $135,000 will be avoilable. If it can earn a 6% return compounded annually, how much must the company invest in the fund today to equal the $135,000 at the end of 5 years? (PV of $1, EV of $1, PVA of S1, and EVA of 51 ) (Use appropriate factor(s) from the tables provided.) Multiple Choice $126,900 $100.886 $180.650 $40,500 $94,500 A project requires a $1,520,000 initial investment for new machinery. The project is expected to yield income of $110,000 per year and net cash flows of $304,000 per year for the next five years. The project's payback period is: Multiple Choice 5.0 years. 2.8 years. 13.8 years 37 years. 5 A years. Porter Company is analyzing two potential investments. If the company is using the payback period method, and it requires a payback of three years or less, which project(s) should be selected Multiple Choice Project Y, Project x Both X and Y are acceptable projects. Nother X nor Y is an acceptabie project A company can buy a machine that is expected to have a three-year life and a $46,000 salvage value. The machine will cost $1,850,000 and is expected to produce a $216,000 annual income to be recelved at the end of each year. Annual depreciation expense is $614,000 per year, If a table of present values of $1 at 12% shows values of 0.8929 for one year, 0.7972 for two years, and 0.718 for three years, what is the net present value of the cash flows from the investment, discounted at 12% ? Muliple Choice 5176,320 5623,537 $661,676 574407 $2.026,320

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started