Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer the following question Prepare journal entries for each of the transactions described On September 5. Maria Smith, owner of Super Gym Personal Service, provided

Answer the following question

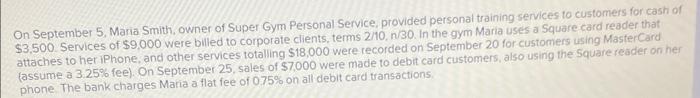

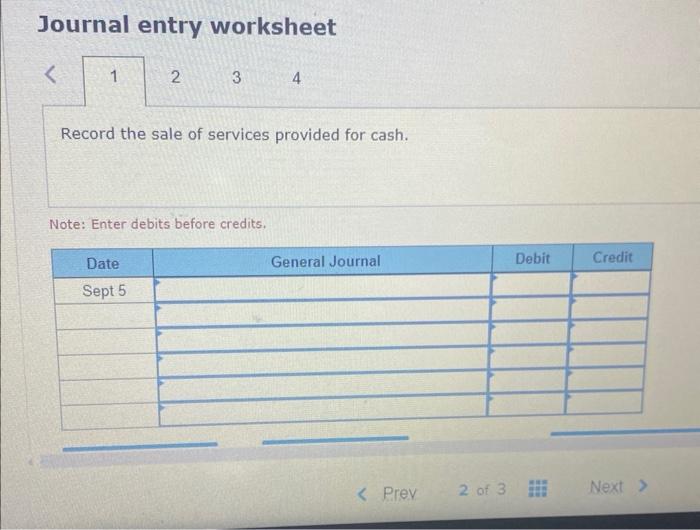

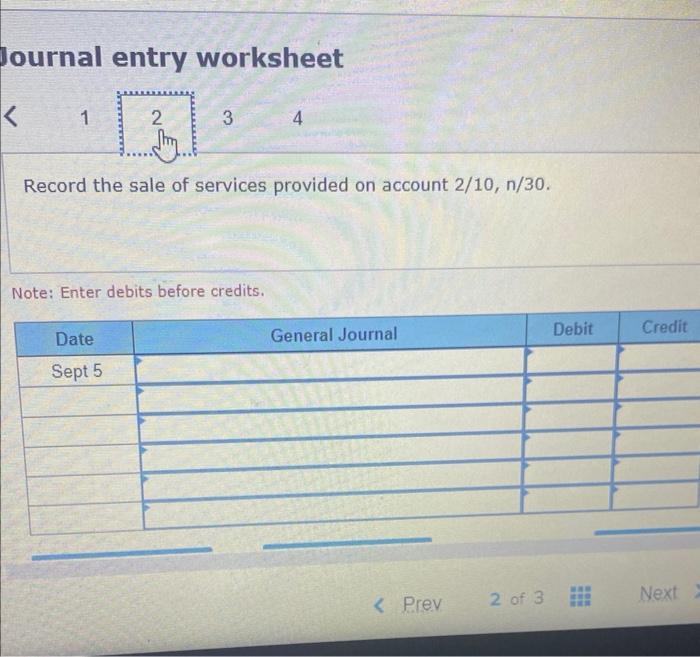

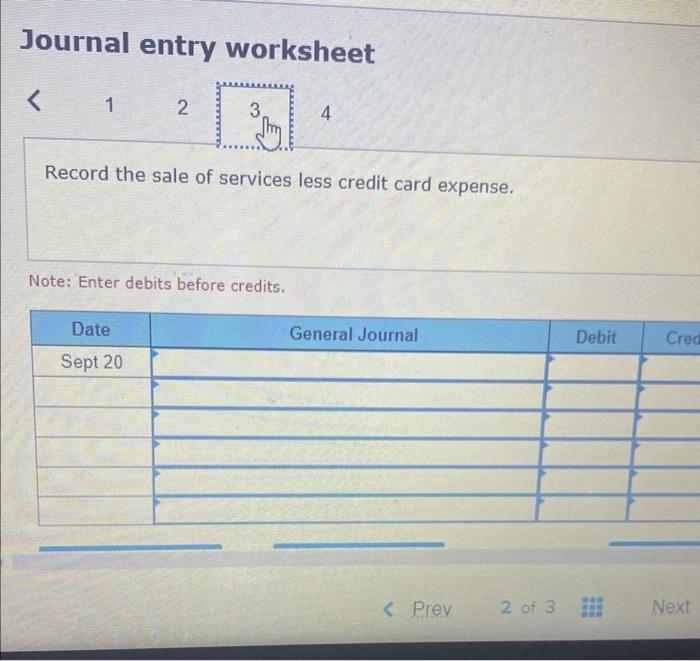

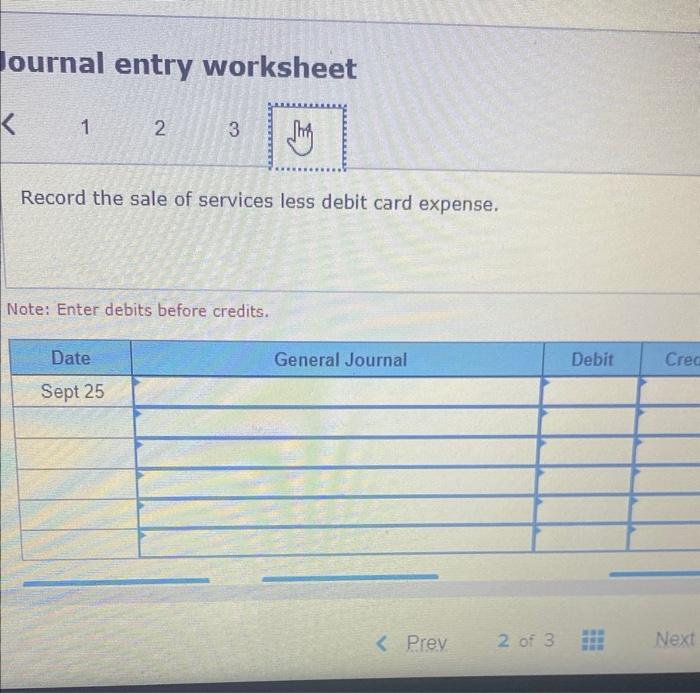

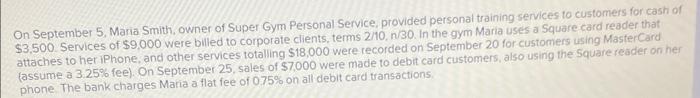

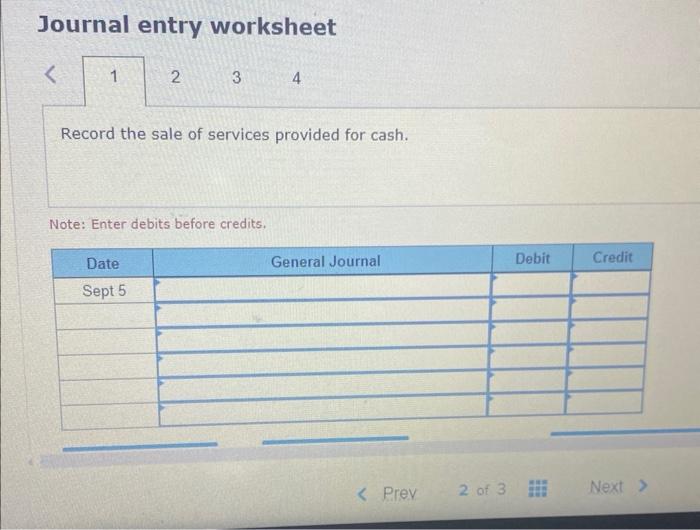

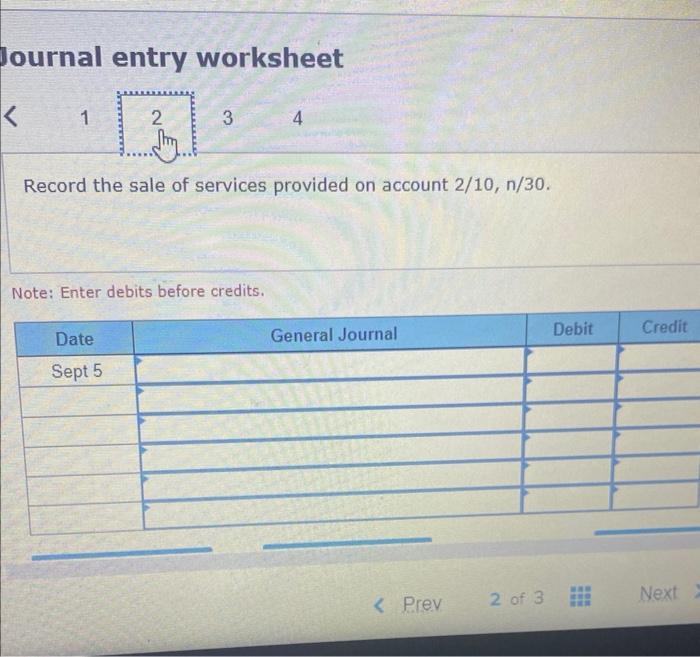

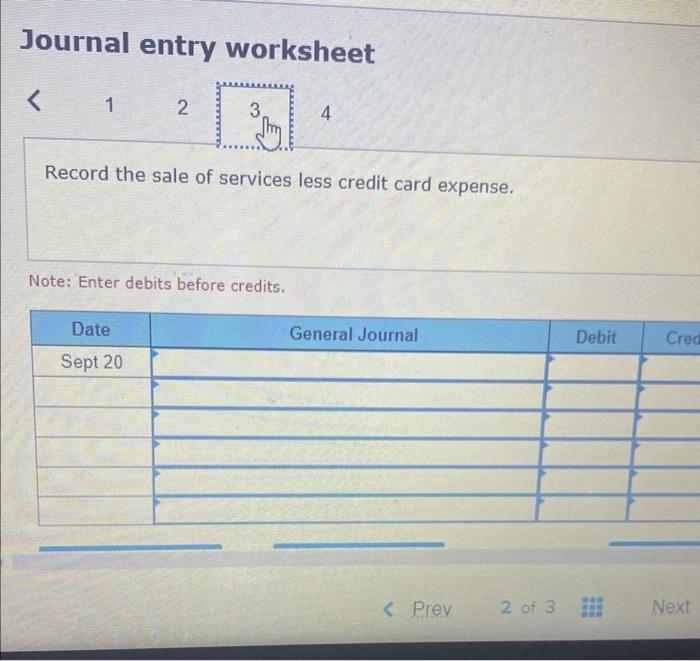

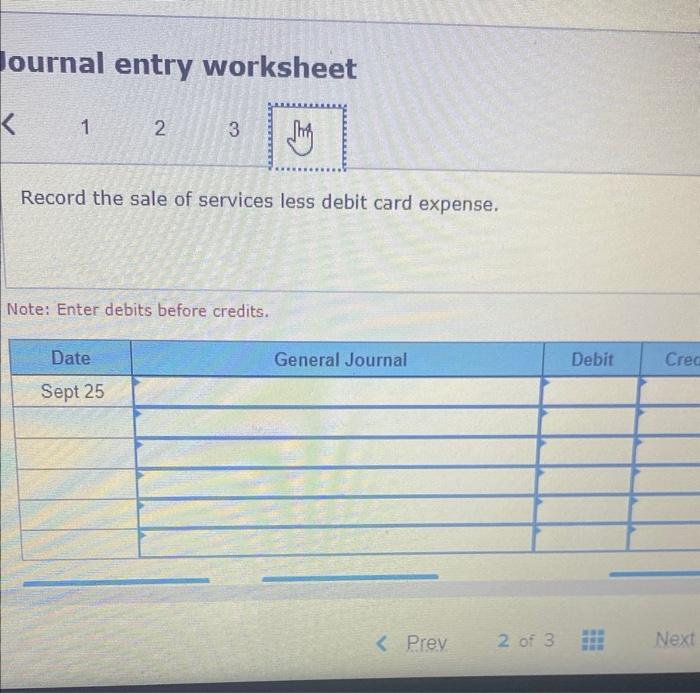

On September 5. Maria Smith, owner of Super Gym Personal Service, provided personal training services to customers for cash of $3,500. Services of $9,000 were billed to corporate clients, terms 2/10,n/30. In the gym Maria uses a Square card reader that attaches to her iPhone, and other services totalling $18,000 were recorded on September 20 for customers using MasterCard (assume a 3.25% fee). On September 25 , sales of $7,000 were made to debit card customers, also using the Square reader on her phone The bank charges Maria a flat fee of 0.75% on all debit card transactions. Journal entry worksheet Record the sale of services provided for cash. Note: Enter debits before credits. Journal entry worksheet 1 4 Record the sale of services provided on account 2/10,n/30. Note: Enter debits before credits. Journal entry worksheet Record the sale of services less credit card expense. Note: Enter debits before credits. lournal entry worksheet Record the sale of services less debit card expense. Note: Enter debits before credits

Prepare journal entries for each of the transactions described

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started