Question

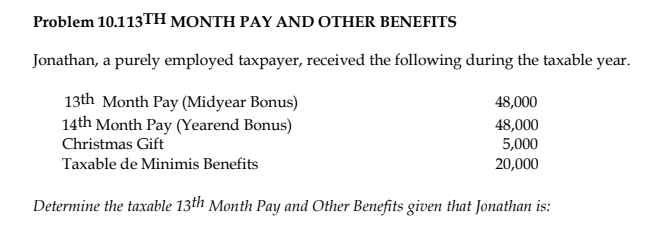

ANSWER THE FOLLOWING QUESTION WITH A CLEAR SOLUTION AND FORMAT. Problem 10.113TH MONTH PAY AND OTHER BENEFITS Jonathan, a purely employed taxpayer, received the following

ANSWER THE FOLLOWING QUESTION WITH A CLEAR SOLUTION AND FORMAT.

Problem 10.113TH MONTH PAY AND OTHER BENEFITS Jonathan, a purely employed taxpayer, received the following during the taxable year. 13th Month Pay (Midyear Bonus) 14th Month Pay (Yearend Bonus) Christmas Gift Taxable de Minimis Benefits Determine the taxable 13th Month Pay and Other Benefits given that Jonathan is: 48,000 48,000 5,000 20,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Problem 10113 Jonathan is a rankandfile employee Taxable 13th Month Pay is P48000 fully taxab...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Payroll Accounting 2016

Authors: Bernard J. Bieg, Judith Toland

26th edition

978-1305665910, 1305665910, 1337072648, 978-1337072649

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App