Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer the following question? Xavier is planning to set-up an education fund for his grandchildren. He plans to invest $18,000 annually at the end of

Answer the following question?

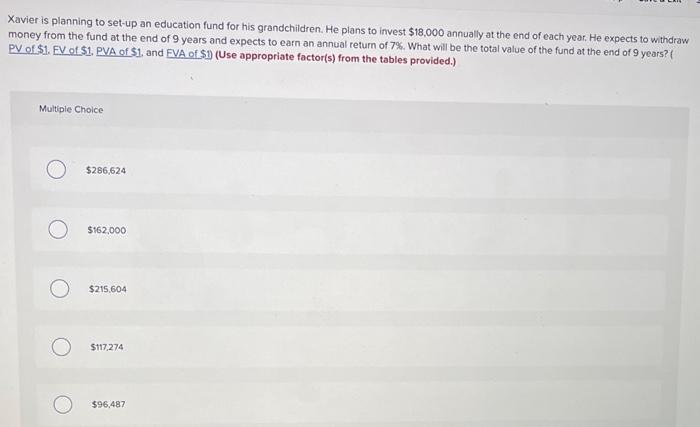

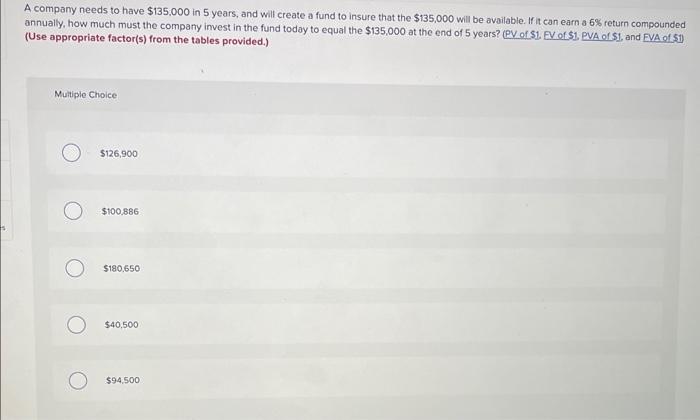

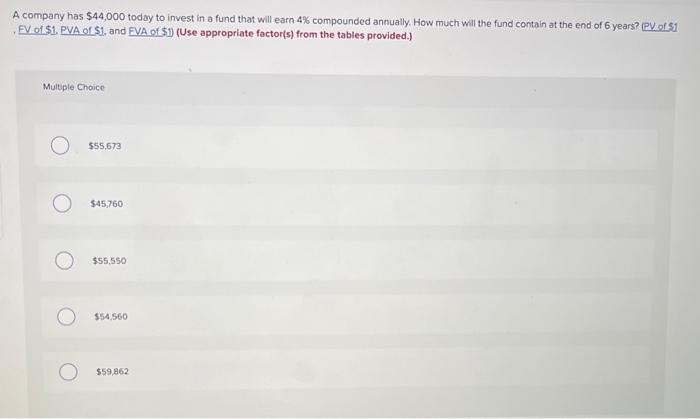

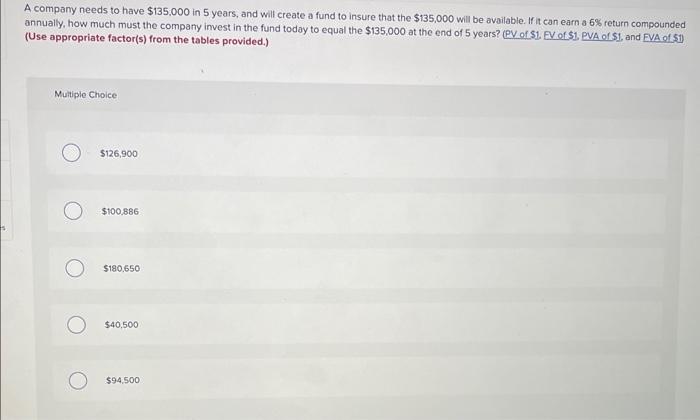

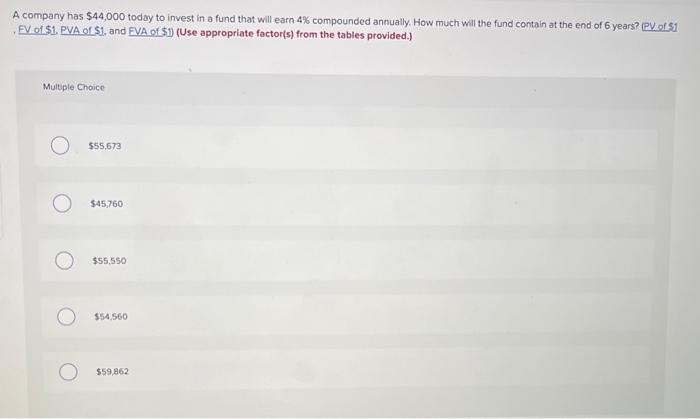

Xavier is planning to set-up an education fund for his grandchildren. He plans to invest $18,000 annually at the end of each year. He expects to withdraw money from the fund at the end of 9 years and expects to earn an annual return of 7%. What will be the total value of the fund at the end of 9 years? PV of \$1. EV of \$1. PVA of \$1. and EVA of \$1) (Use appropriate factor(s) from the tables provided.) Multiple Choice $286.624 $162.000 $215.604 $117,274 $96,487 A company needs to have $135,000 in 5 years, and will create a fund to insure that the $135,000 will be available. If it can earn a 6% return compounded annually, how much must the company invest in the fund today to equal the $135,000 at the end of 5 years? (PV of \$1. EV of \$1. PVA of S1, and EVA of S1) (Use appropriate factor(s) from the tables provided.) Mutiple Choice $126,900 $100.886 $180.650 $40,500 $94.500 A company has $44,000 today to invest in a fund that will earn 4% compounded annually. How much will the fund contain at the end of 6 years? PV of $1. . EV of \$1. PVA of $1, and FVA of \$1) (Use appropriate factor(s) from the tables provided.) Multiple Choice 555,673 545,760 $55,550 $54.560 $59,862

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started