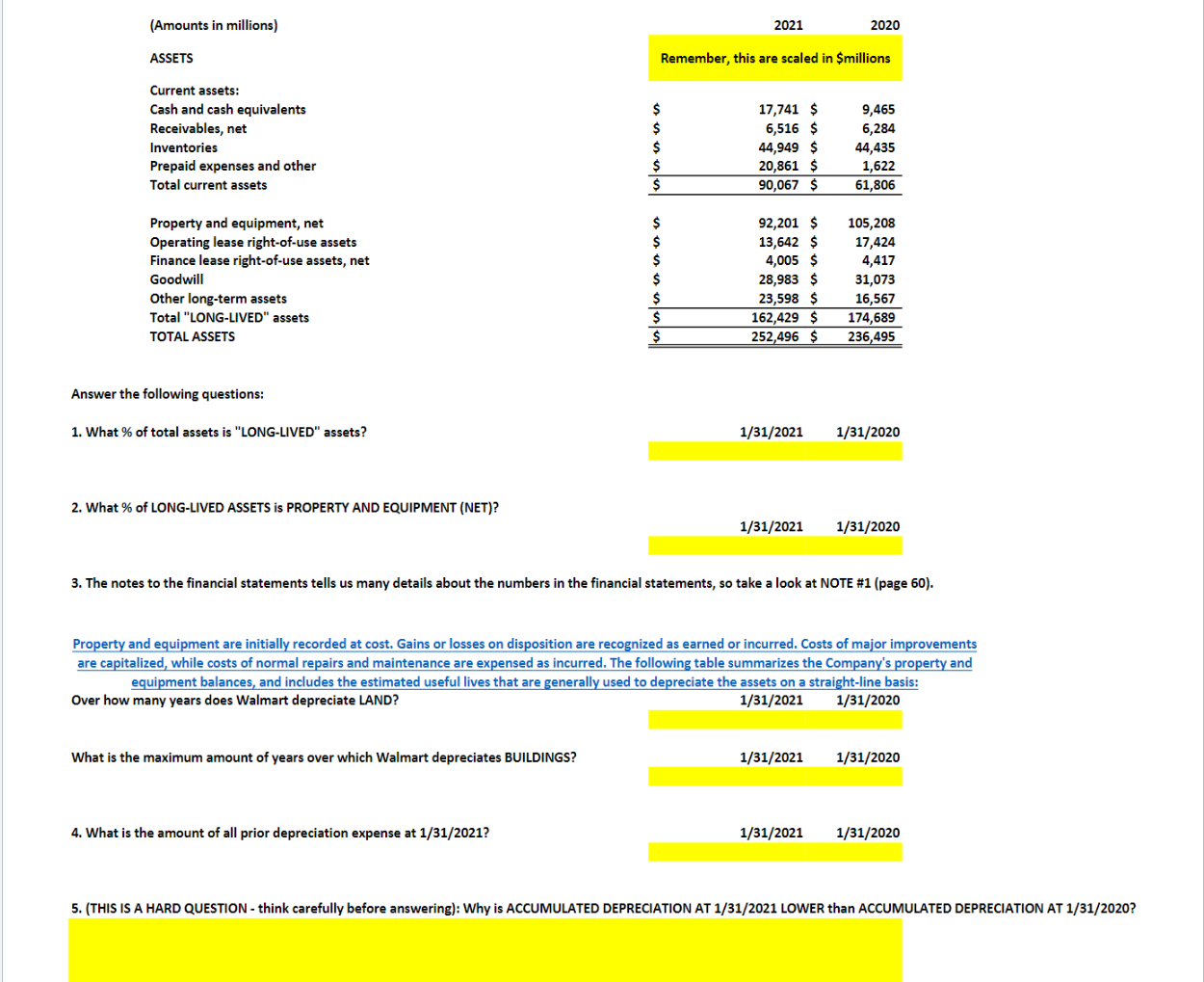

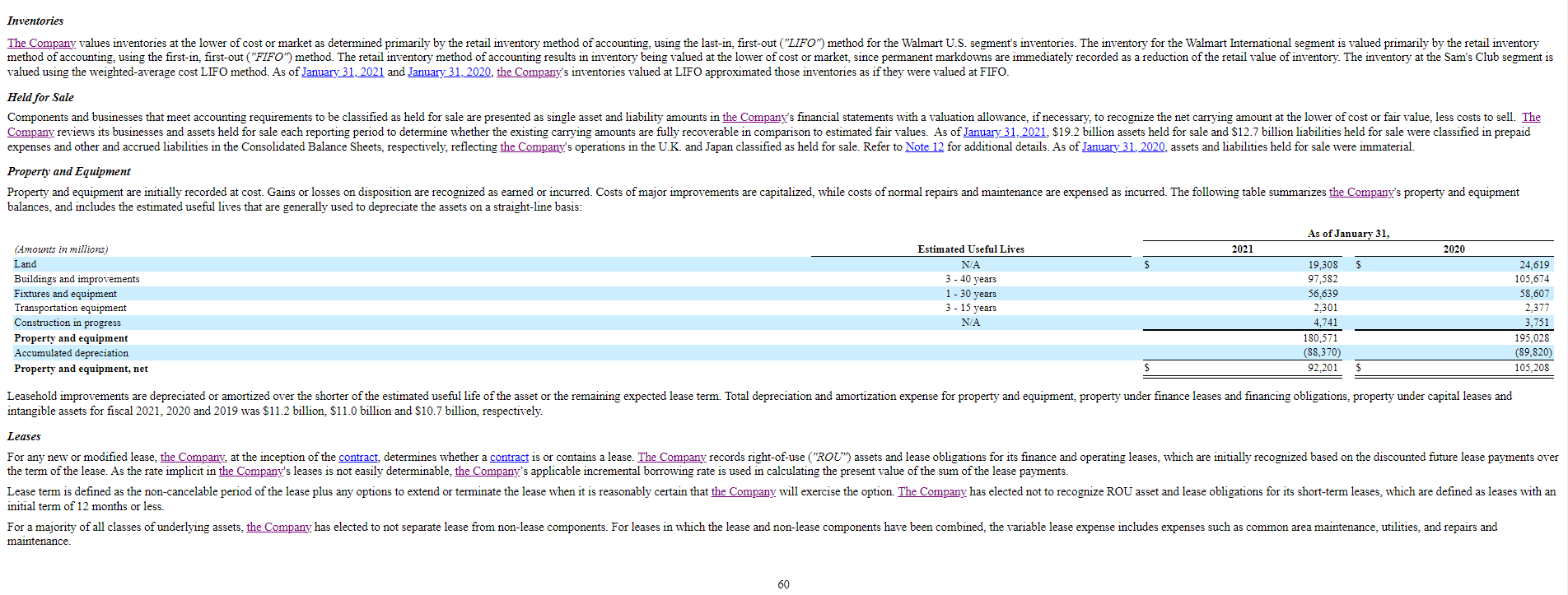

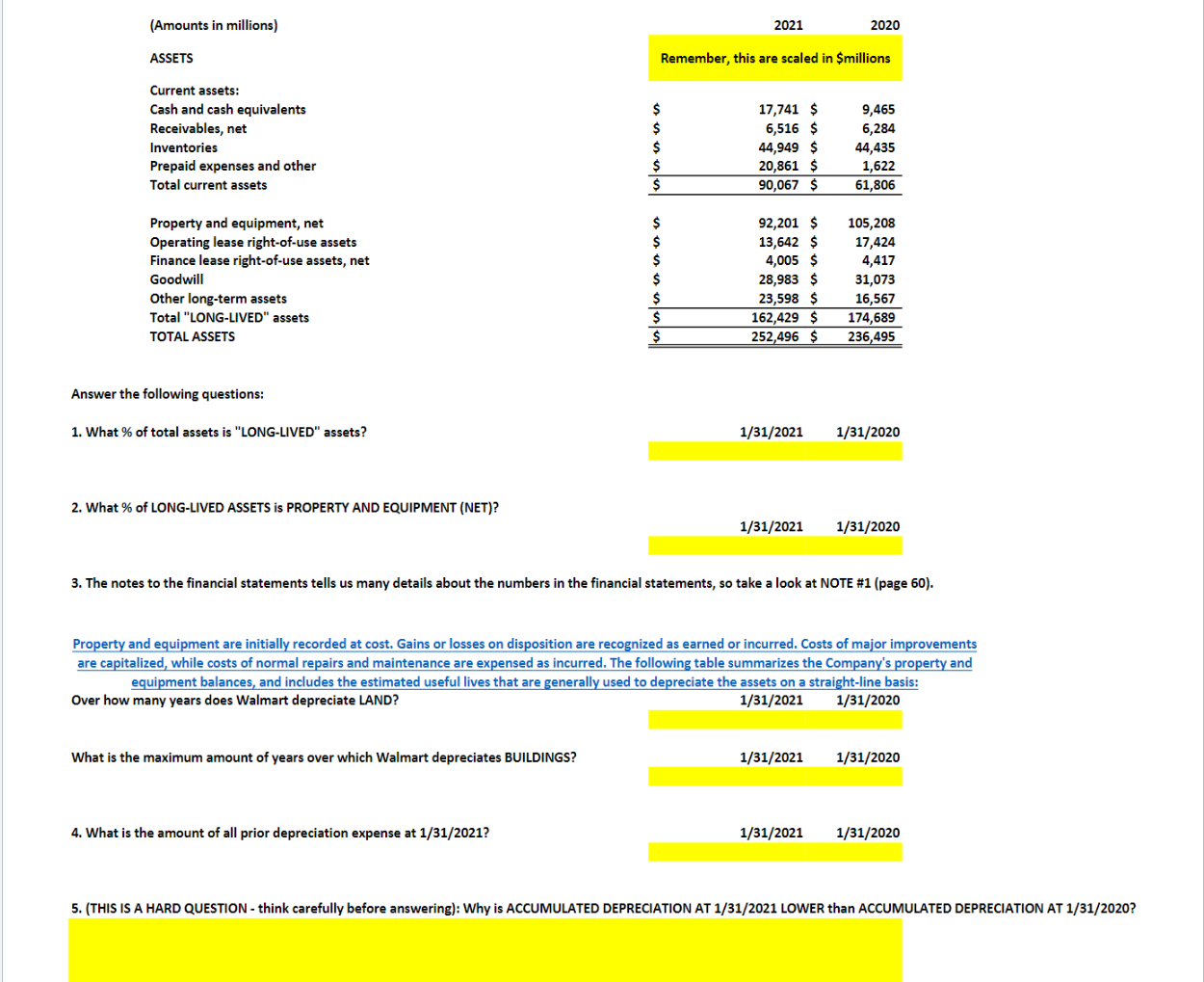

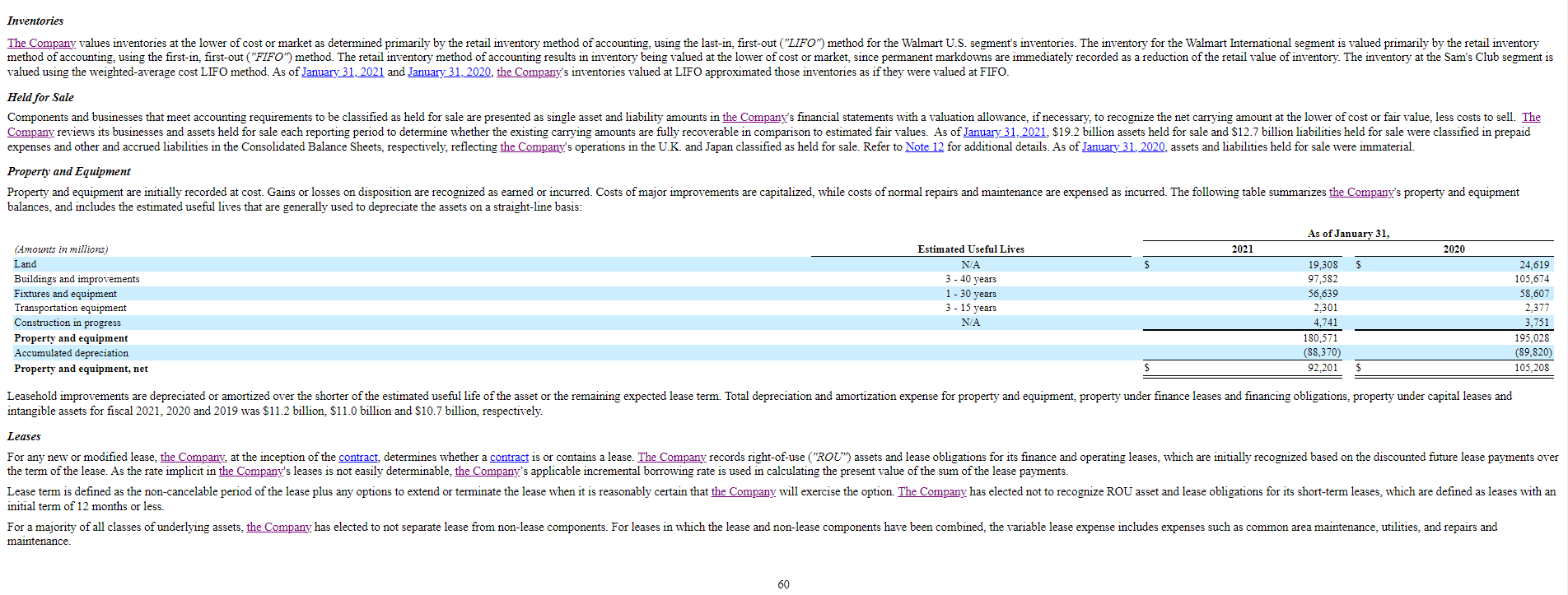

Answer the following questions: 1. What % of total assets is "LONG-LIVED" assets? 1/31/20211/31/2020 2. What \% of LONG-LIVED ASSETS is PROPERTY AND EQUIPMENT (NET)? 1/31/20211/31/2020 3. The notes to the financial statements tells us many details about the numbers in the financial statements, so take a look at NOTE #1 (page 60). Property and equipment are initially recorded at cost. Gains or losses on disposition are recognized as earned or incurred. Costs of major improvements are capitalized, while costs of normal repairs and maintenance are expensed as incurred. The following table summarizes the Company's property and equipment balances, and includes the estimated useful lives that are generally used to depreciate the assets on a straight-line basis: Over how many years does Walmart depreciate LAND? 1/31/20211/31/2020 What is the maximum amount of years over which Walmart depreciates BUILDINGS? 1/31/20211/31/2020 4. What is the amount of all prior depreciation expense at 1/31/2021 ? 1/31/20211/31/2020 valued using the weighted-average cost LIFO method. As of January 31.2021 and January 31.2020, the Company's inventories valued at LIFO approximated those inventories as if they were valued at FIFO. Held for Sale Property and Equipment balances, and includes the estimated useful lives that are generally used to depreciate the assets on a straight-line basis: Yroperty and equipment, net 12,2US intangible assets for fiscal 2021,2020 and 2019 was $11.2 billion, $11.0 billion and $10.7 billion, respectively. Leases initial term of 12 months or less. maintenance. Answer the following questions: 1. What % of total assets is "LONG-LIVED" assets? 1/31/20211/31/2020 2. What \% of LONG-LIVED ASSETS is PROPERTY AND EQUIPMENT (NET)? 1/31/20211/31/2020 3. The notes to the financial statements tells us many details about the numbers in the financial statements, so take a look at NOTE #1 (page 60). Property and equipment are initially recorded at cost. Gains or losses on disposition are recognized as earned or incurred. Costs of major improvements are capitalized, while costs of normal repairs and maintenance are expensed as incurred. The following table summarizes the Company's property and equipment balances, and includes the estimated useful lives that are generally used to depreciate the assets on a straight-line basis: Over how many years does Walmart depreciate LAND? 1/31/20211/31/2020 What is the maximum amount of years over which Walmart depreciates BUILDINGS? 1/31/20211/31/2020 4. What is the amount of all prior depreciation expense at 1/31/2021 ? 1/31/20211/31/2020 valued using the weighted-average cost LIFO method. As of January 31.2021 and January 31.2020, the Company's inventories valued at LIFO approximated those inventories as if they were valued at FIFO. Held for Sale Property and Equipment balances, and includes the estimated useful lives that are generally used to depreciate the assets on a straight-line basis: Yroperty and equipment, net 12,2US intangible assets for fiscal 2021,2020 and 2019 was $11.2 billion, $11.0 billion and $10.7 billion, respectively. Leases initial term of 12 months or less. maintenance