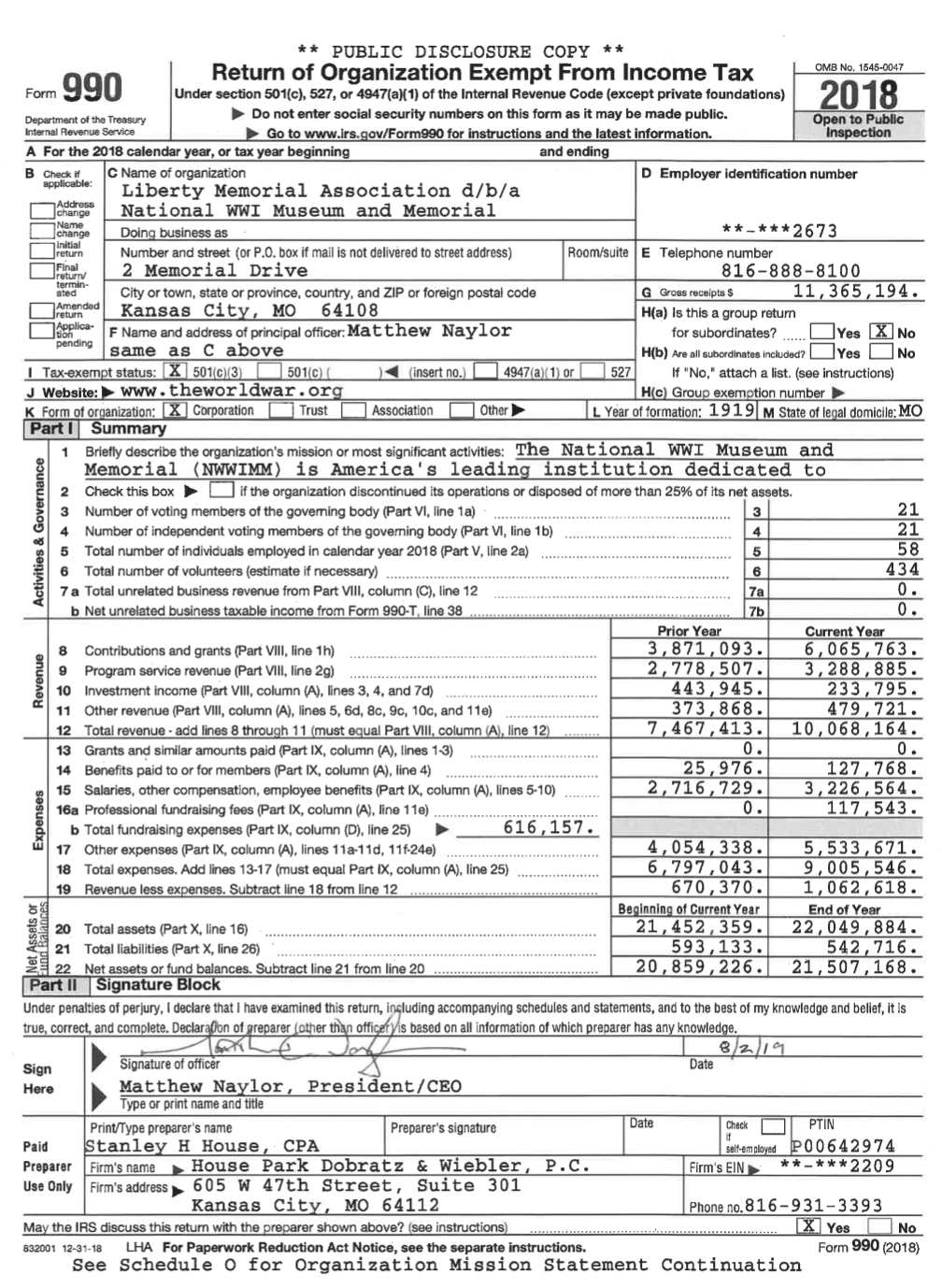

Answer the following questions about an organization, based on the Sample Form 990 below.

A. Provide:

- Total revenue

- Total expenditures

- End-of-year cash balance

- Public support percentage

- Fundraising expenditures

B. Based on the Sample IRS Form 990 for the National World War I Museum, evaluate the financial viability and health of the organization in a paragraph or two. In particular, focus on how the written material affects your evaluation.

C. Based on the 990 form, explain your understanding of the organization's (a) finances and (b) overall condition?

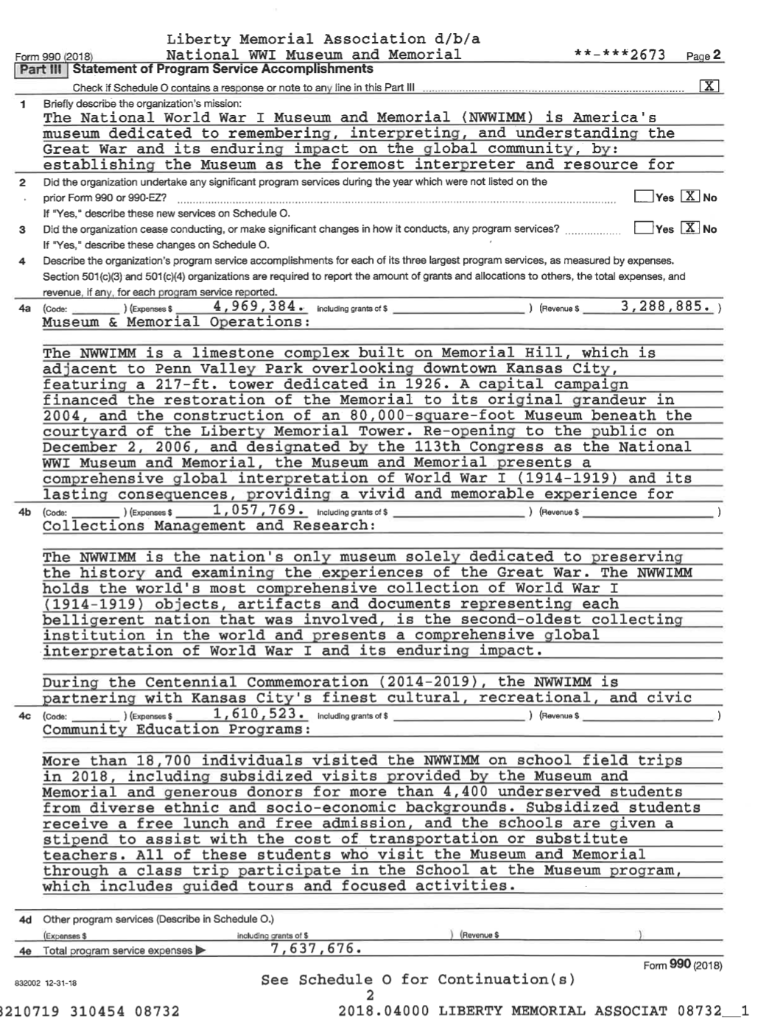

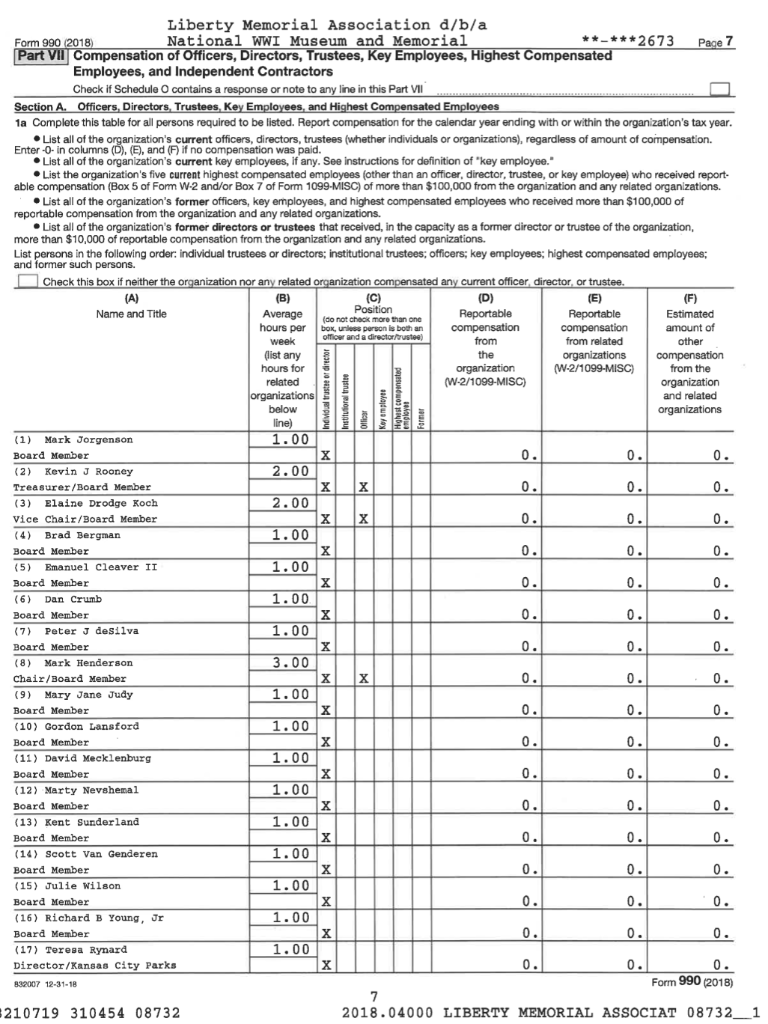

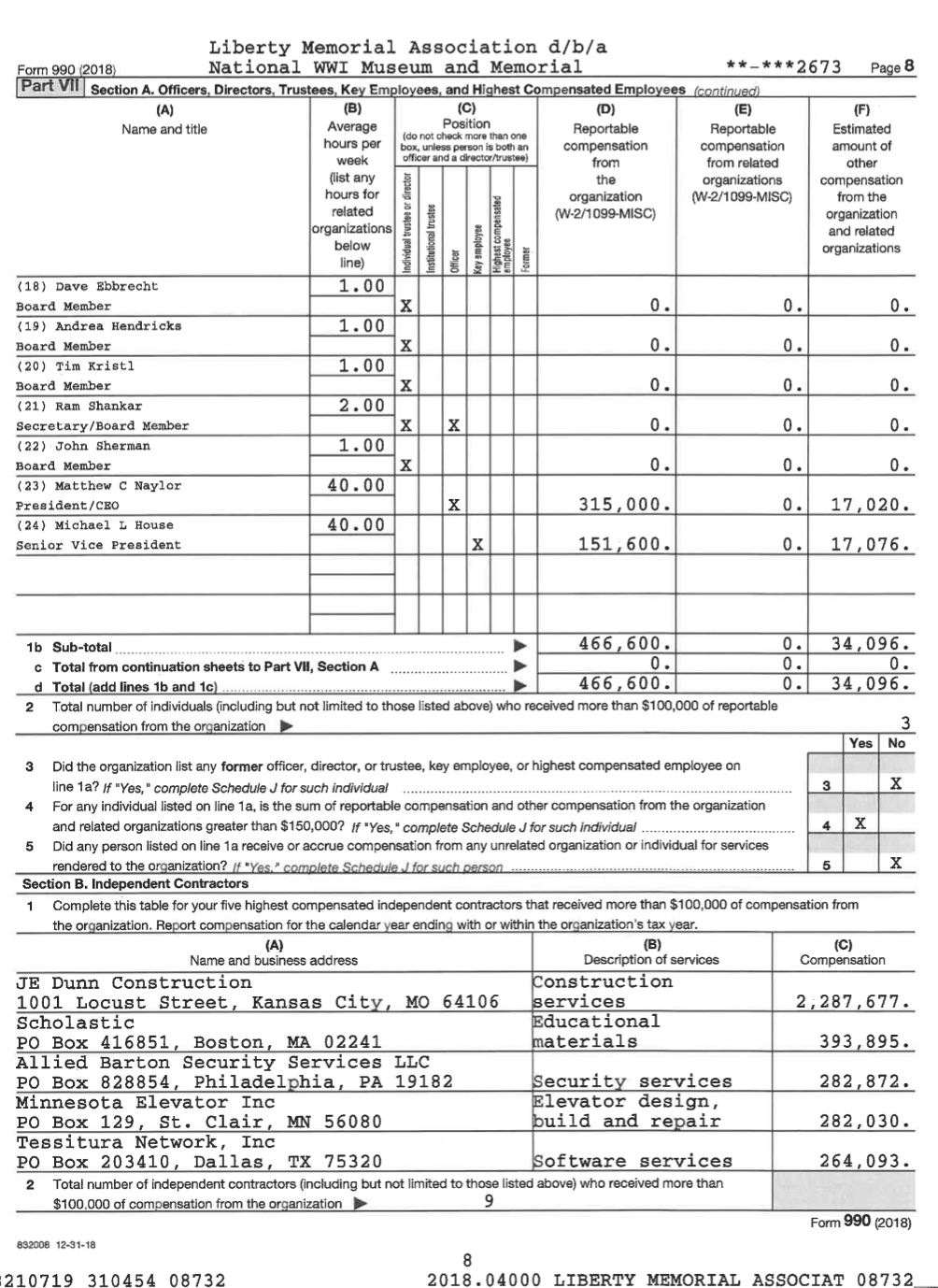

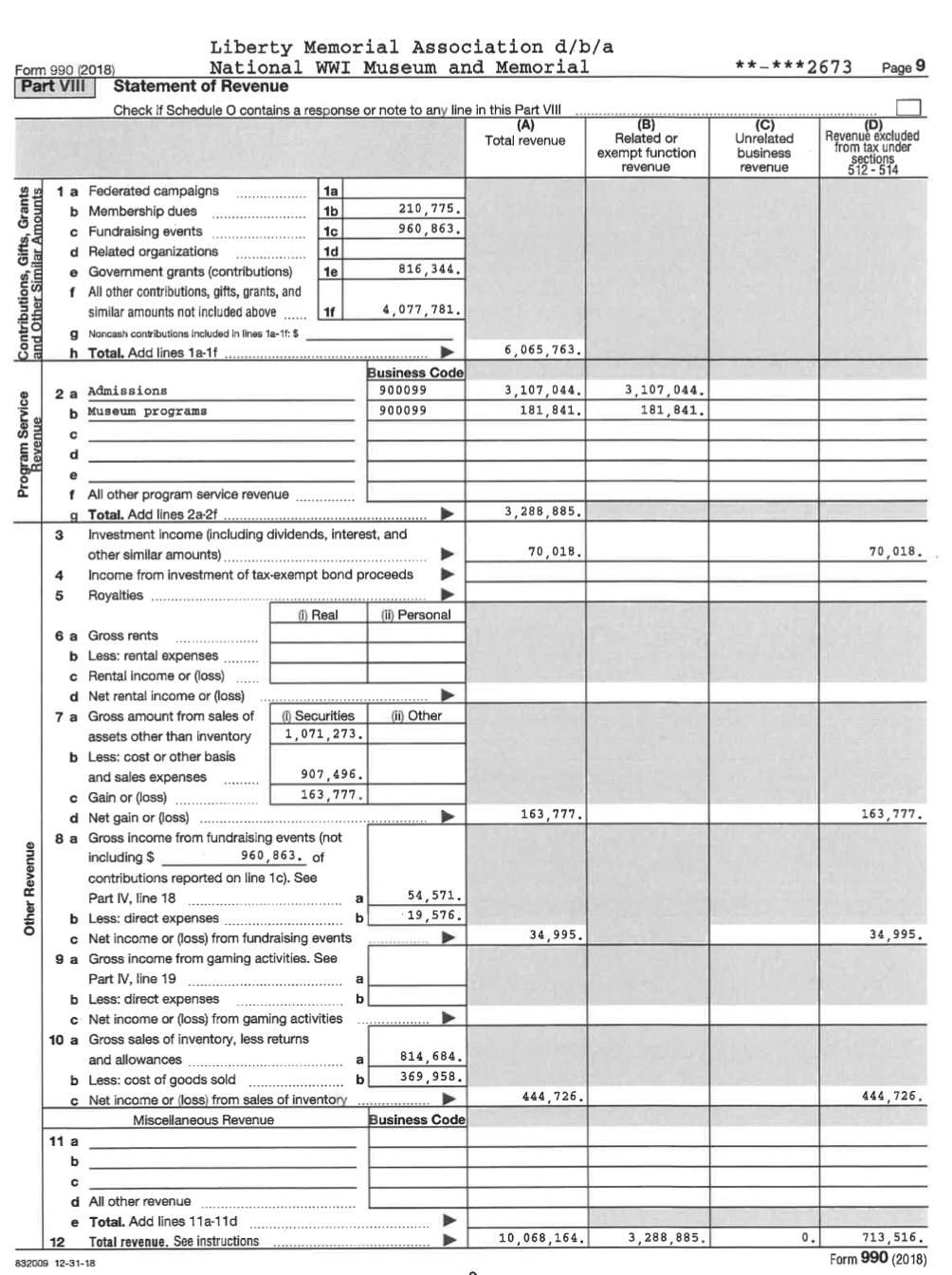

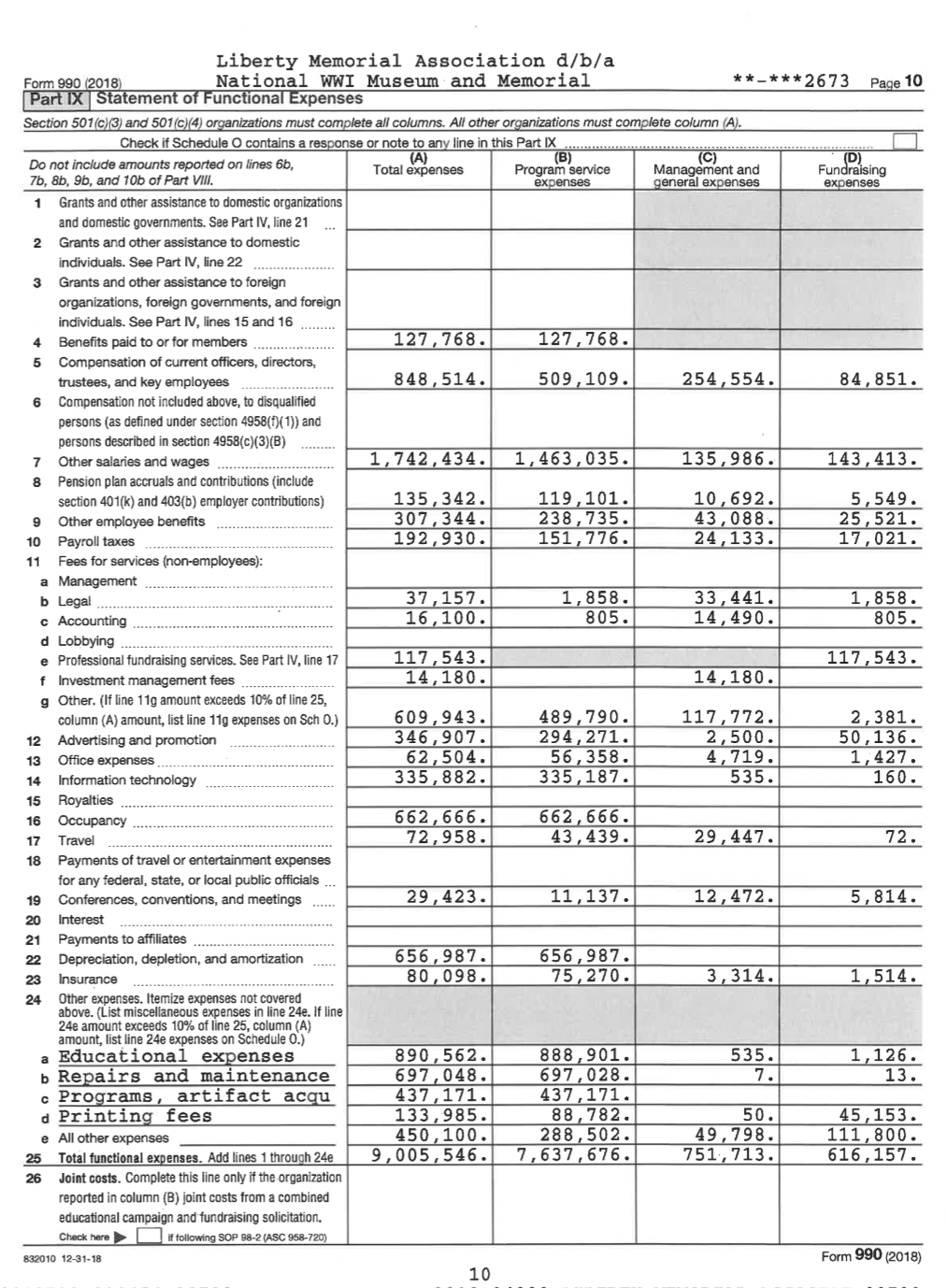

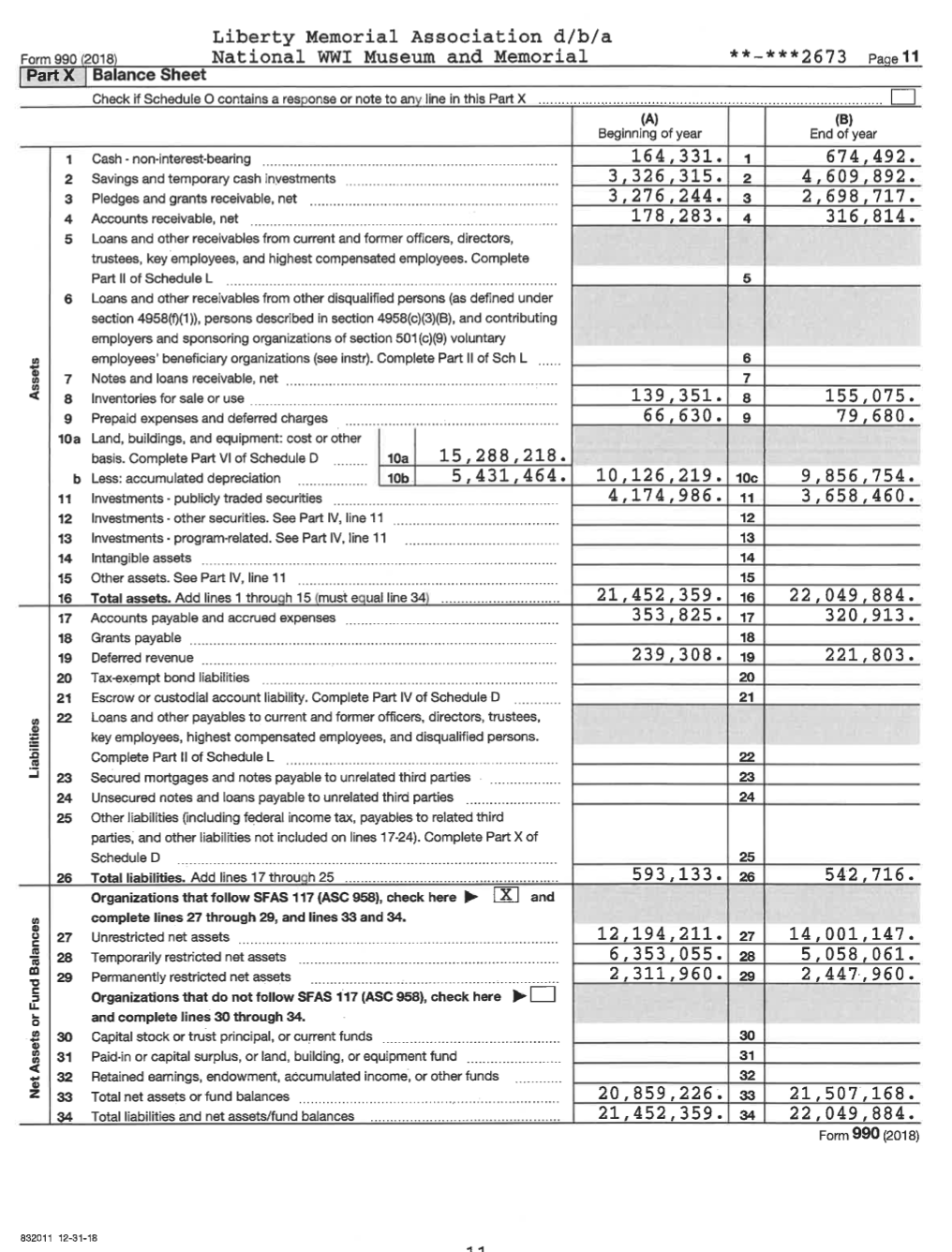

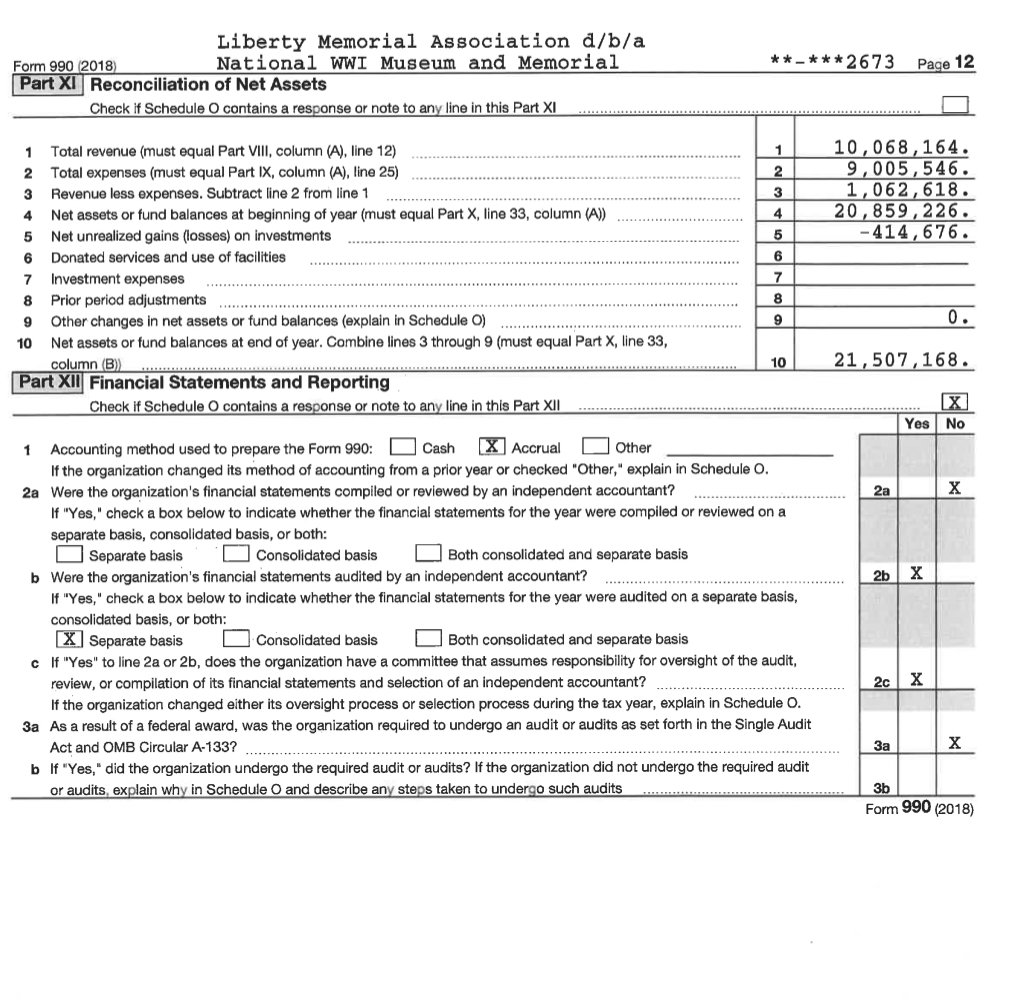

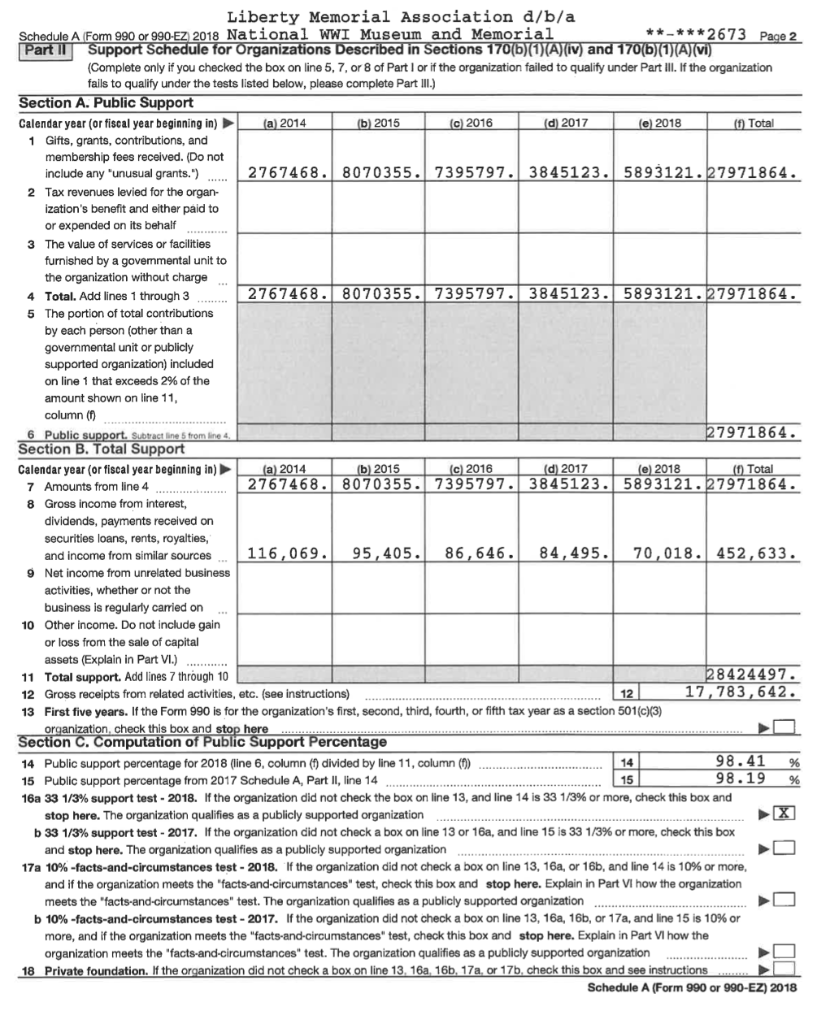

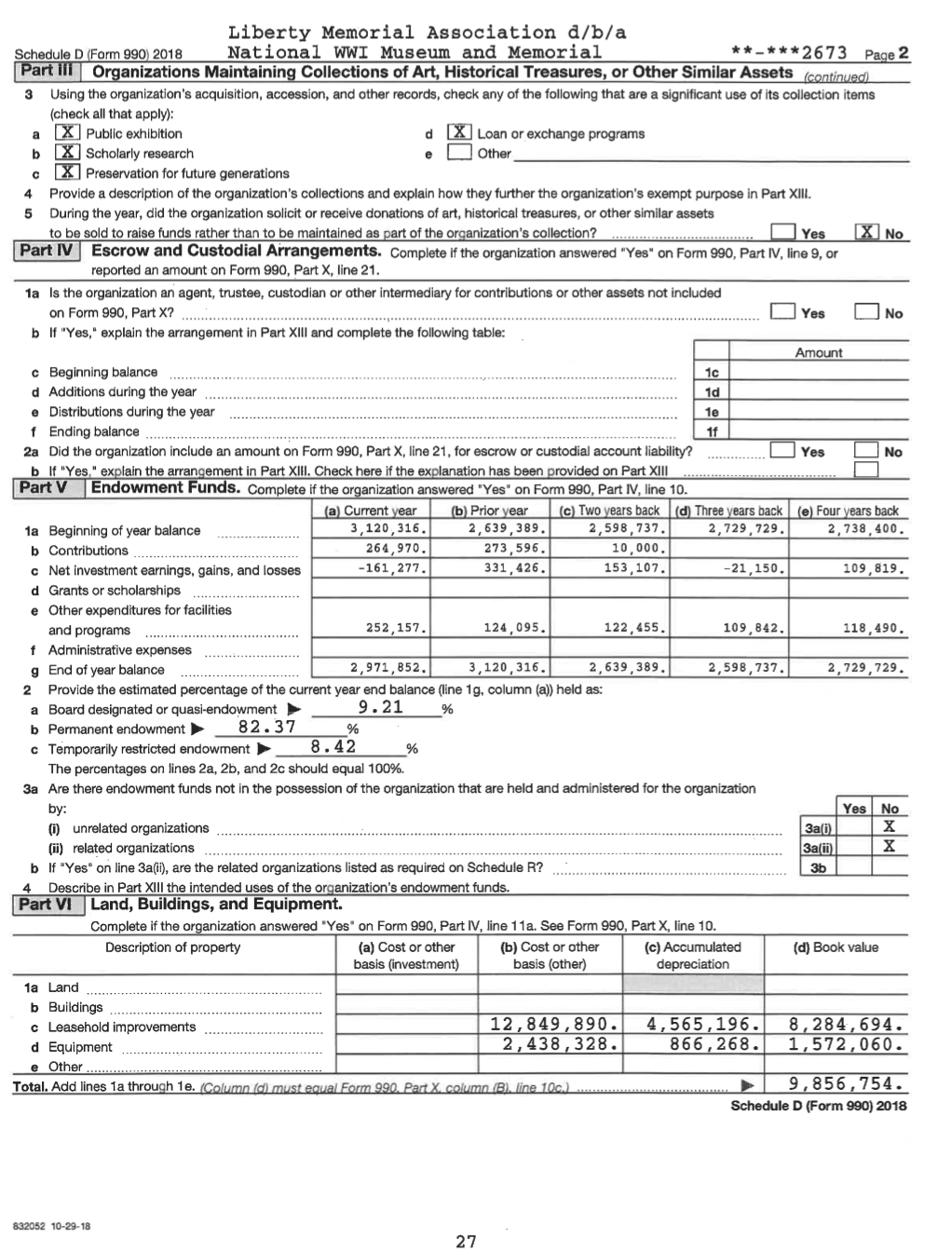

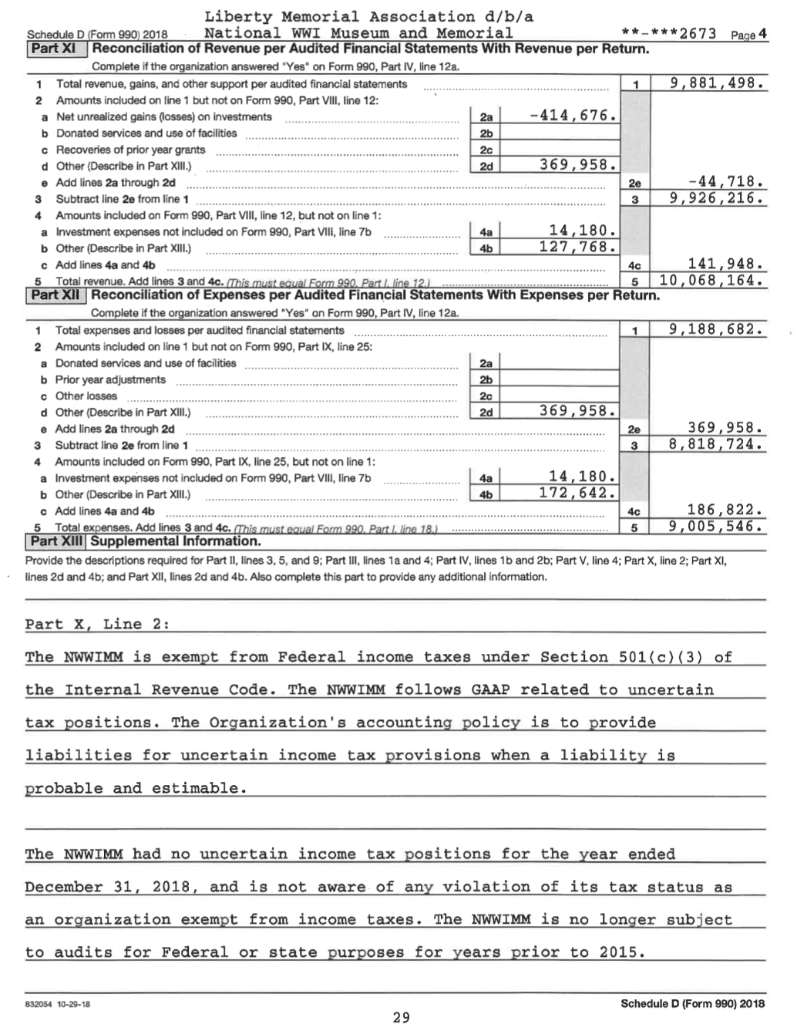

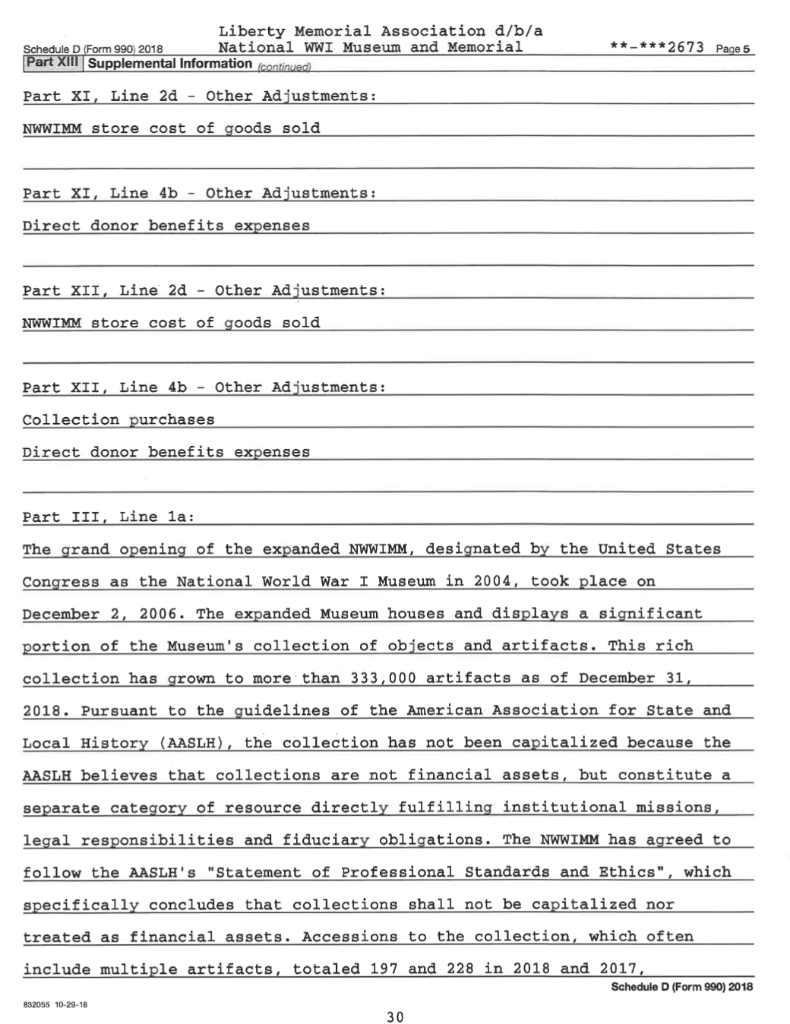

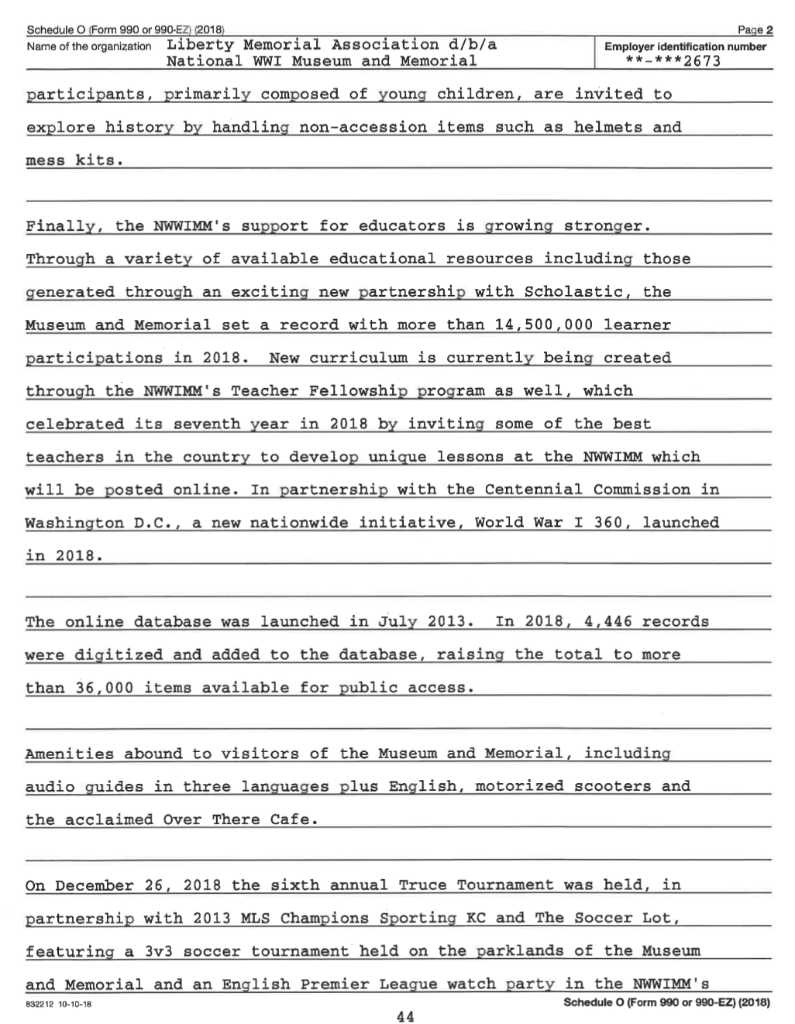

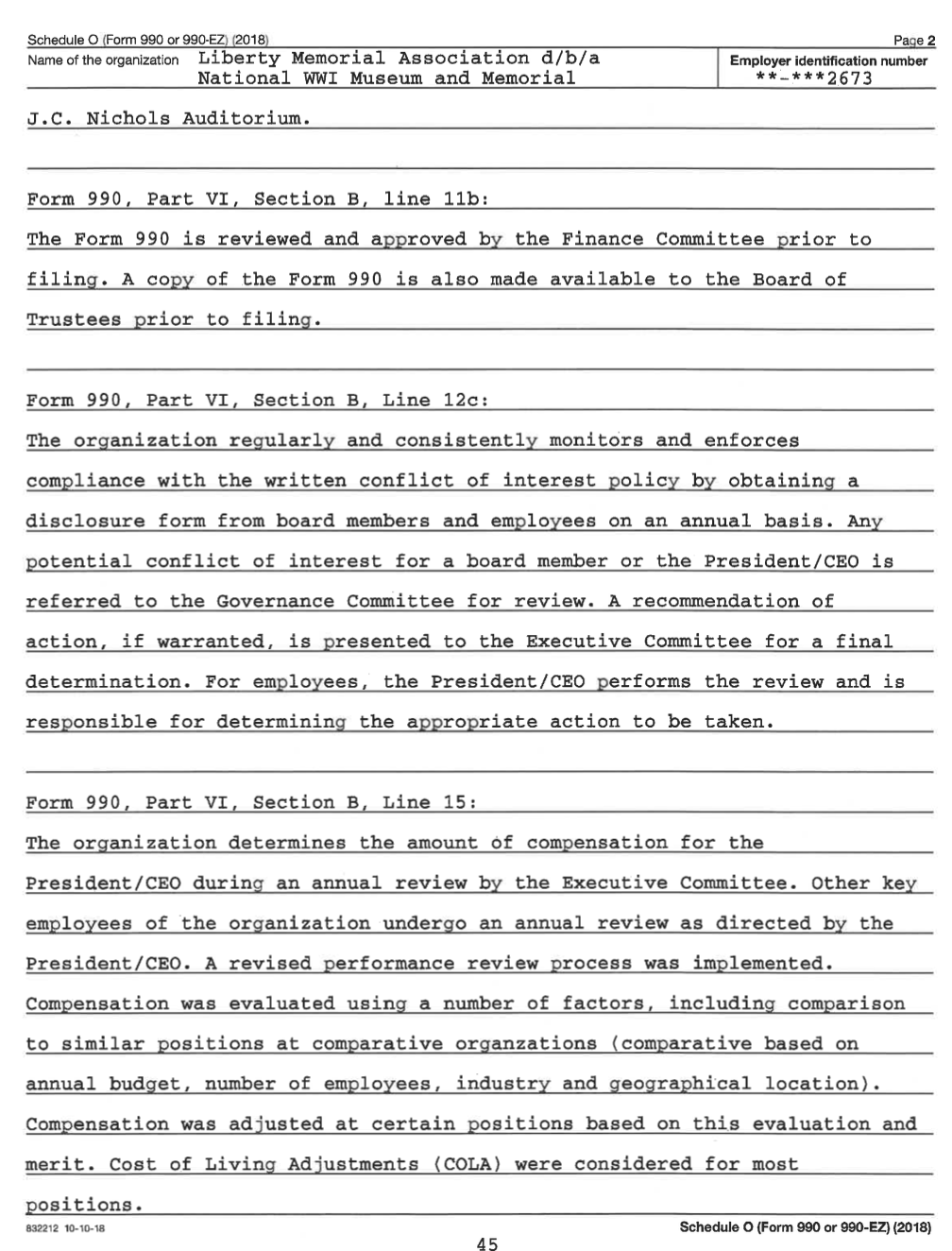

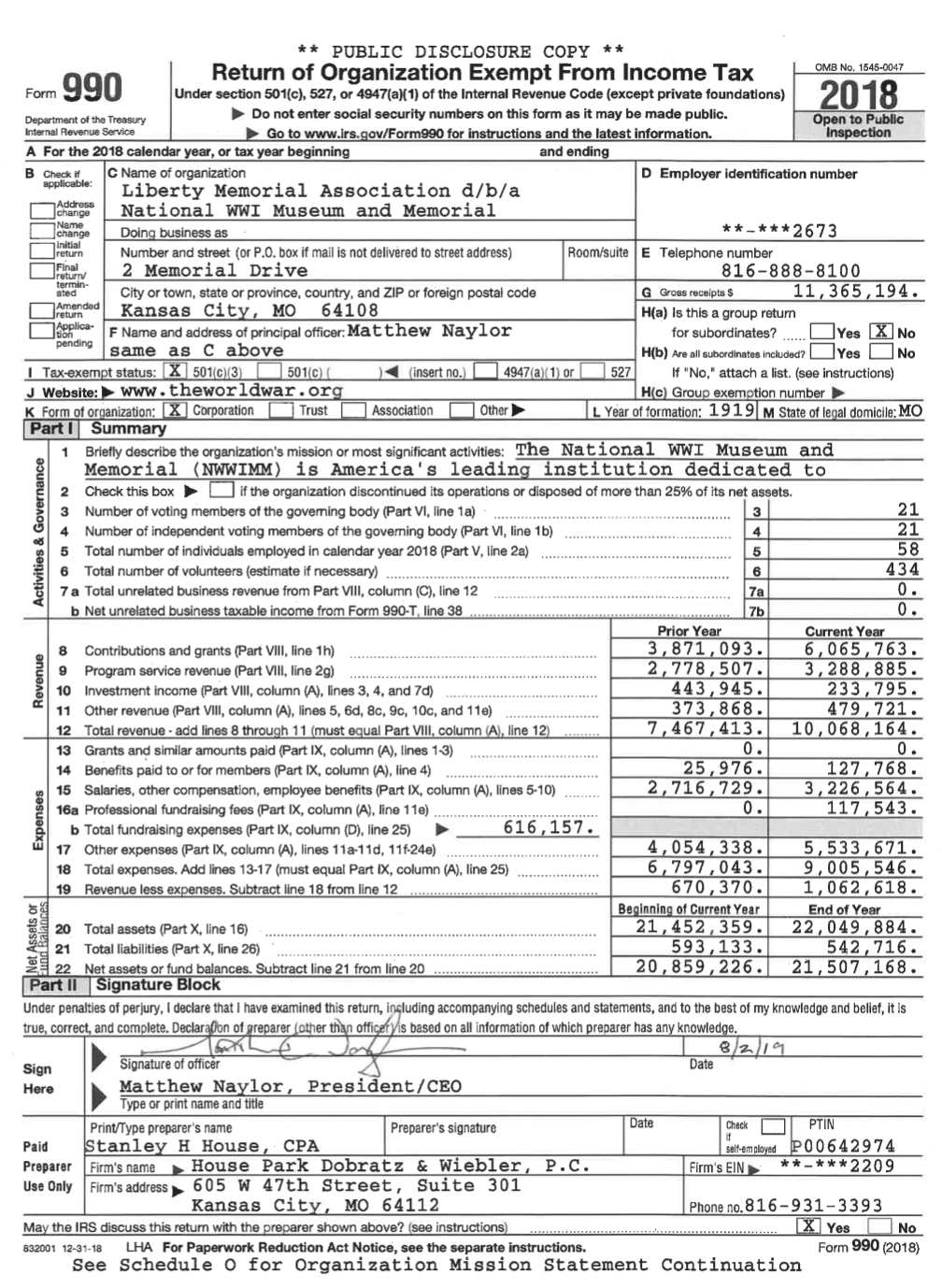

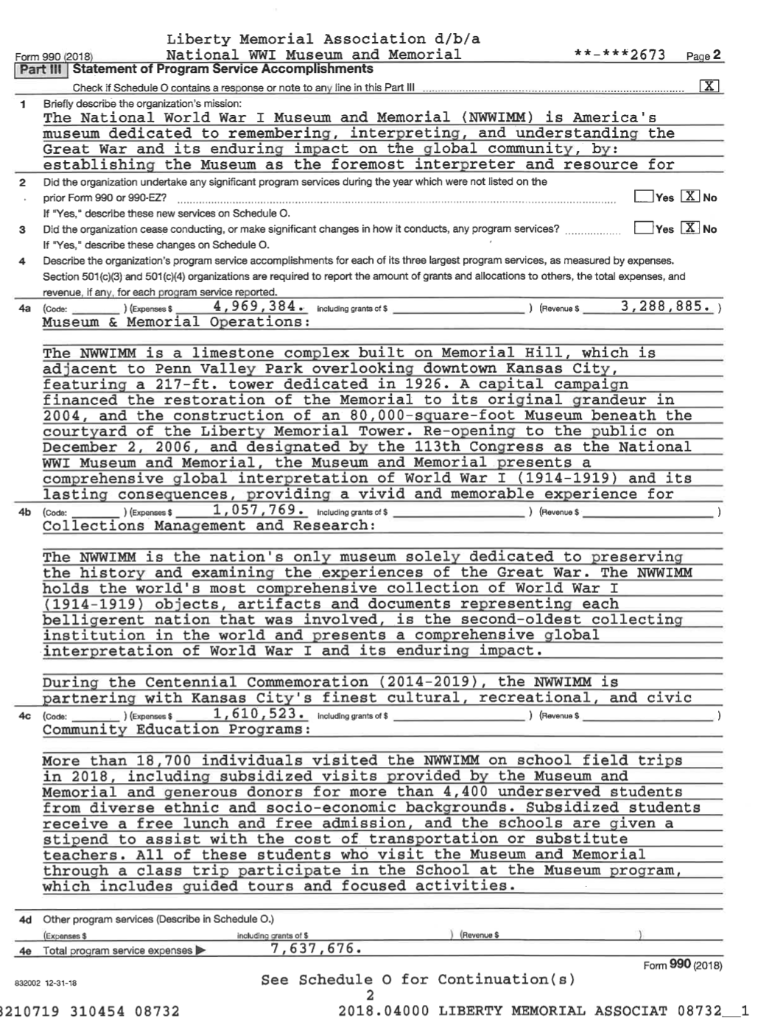

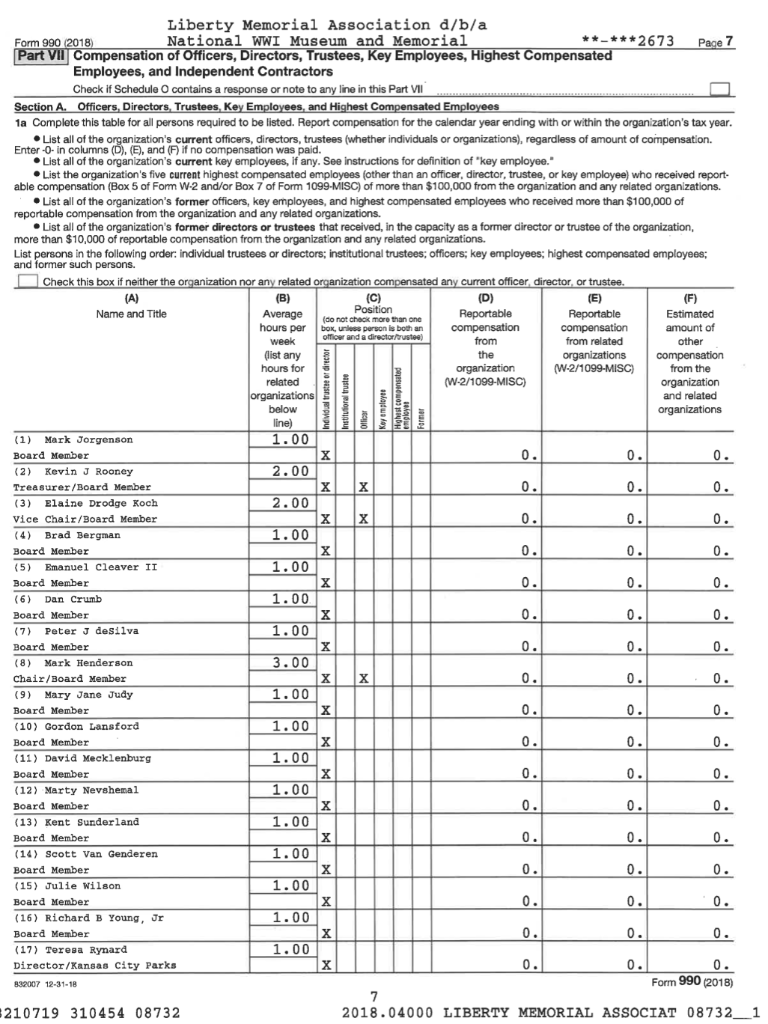

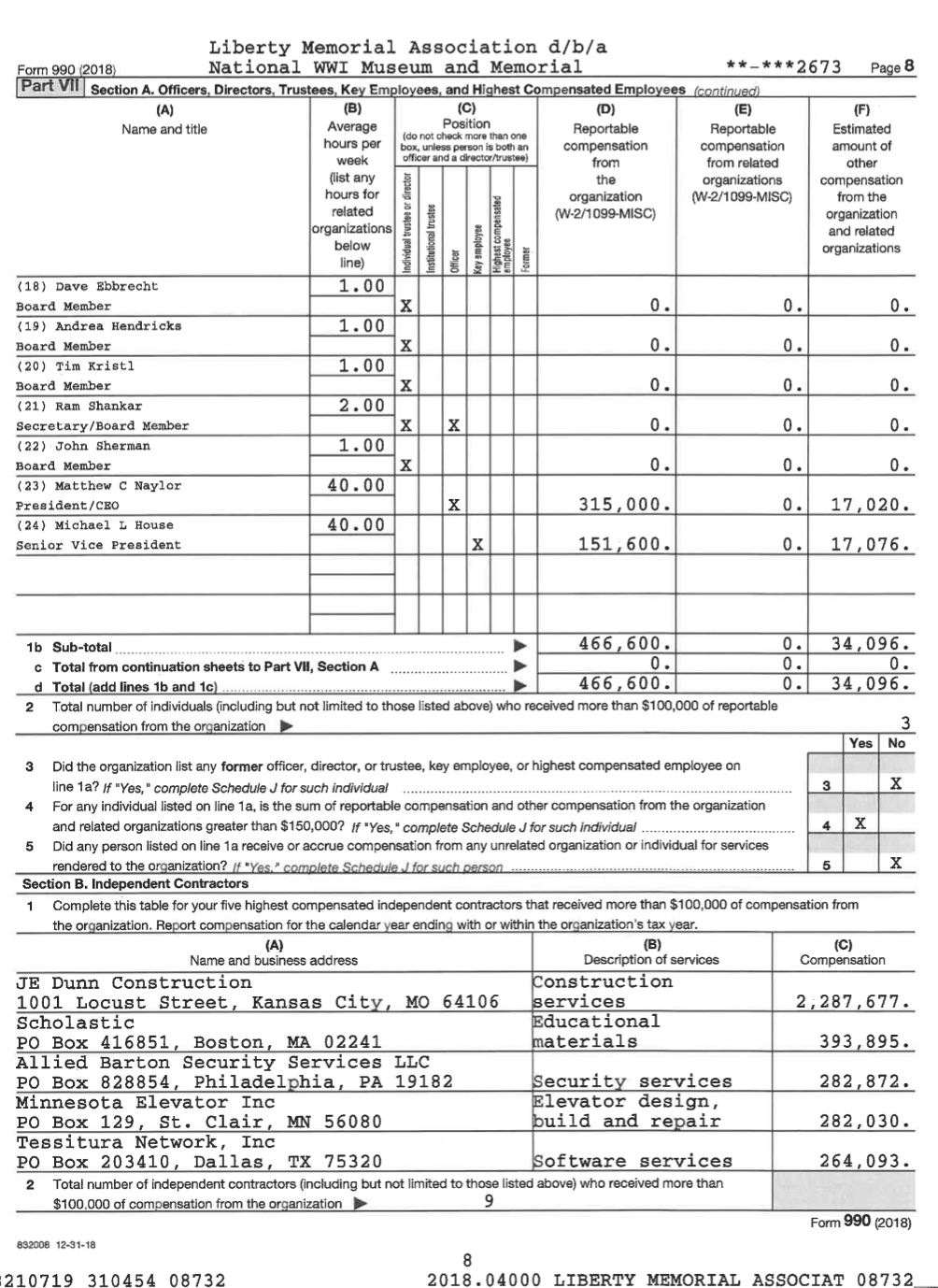

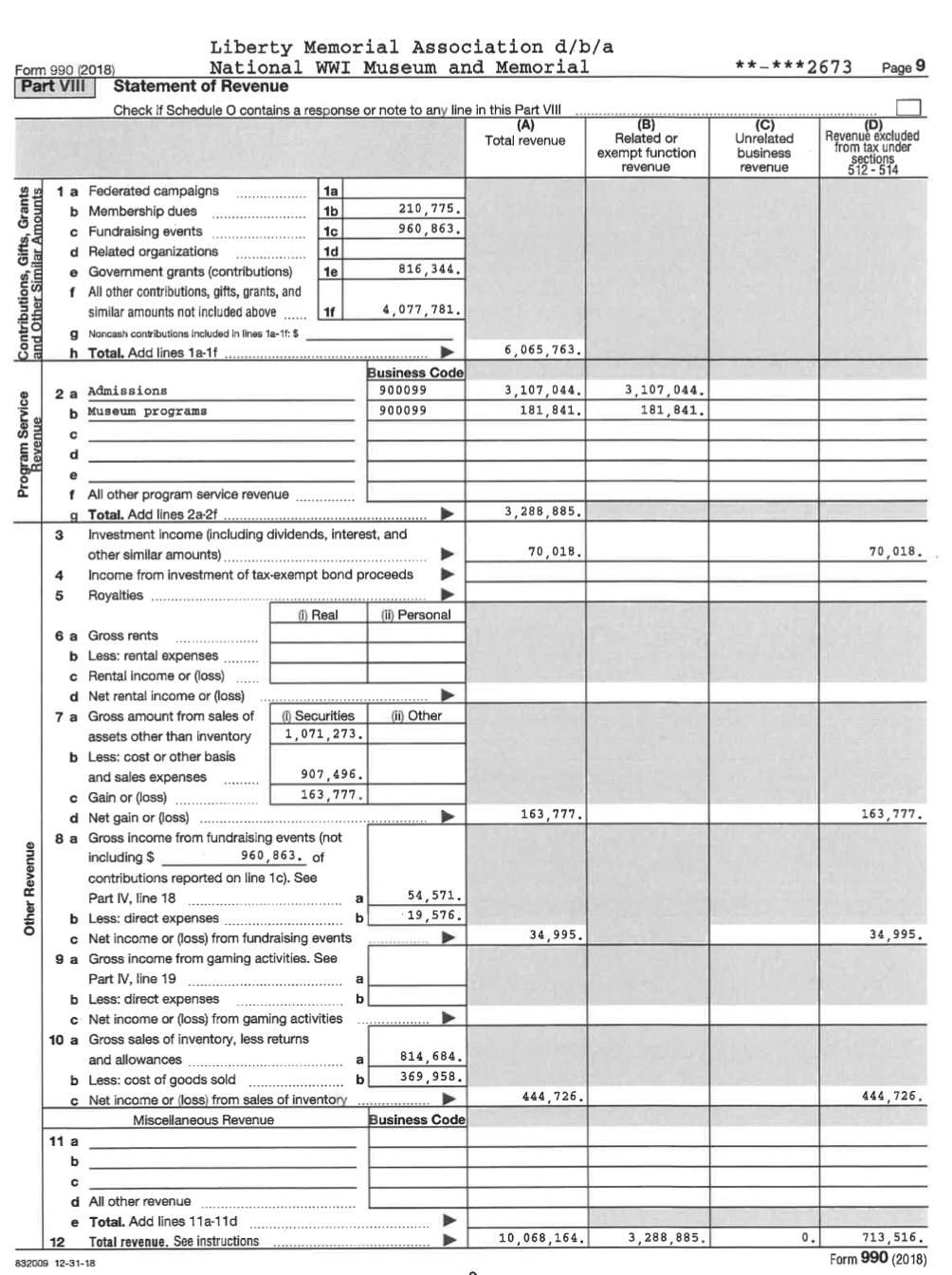

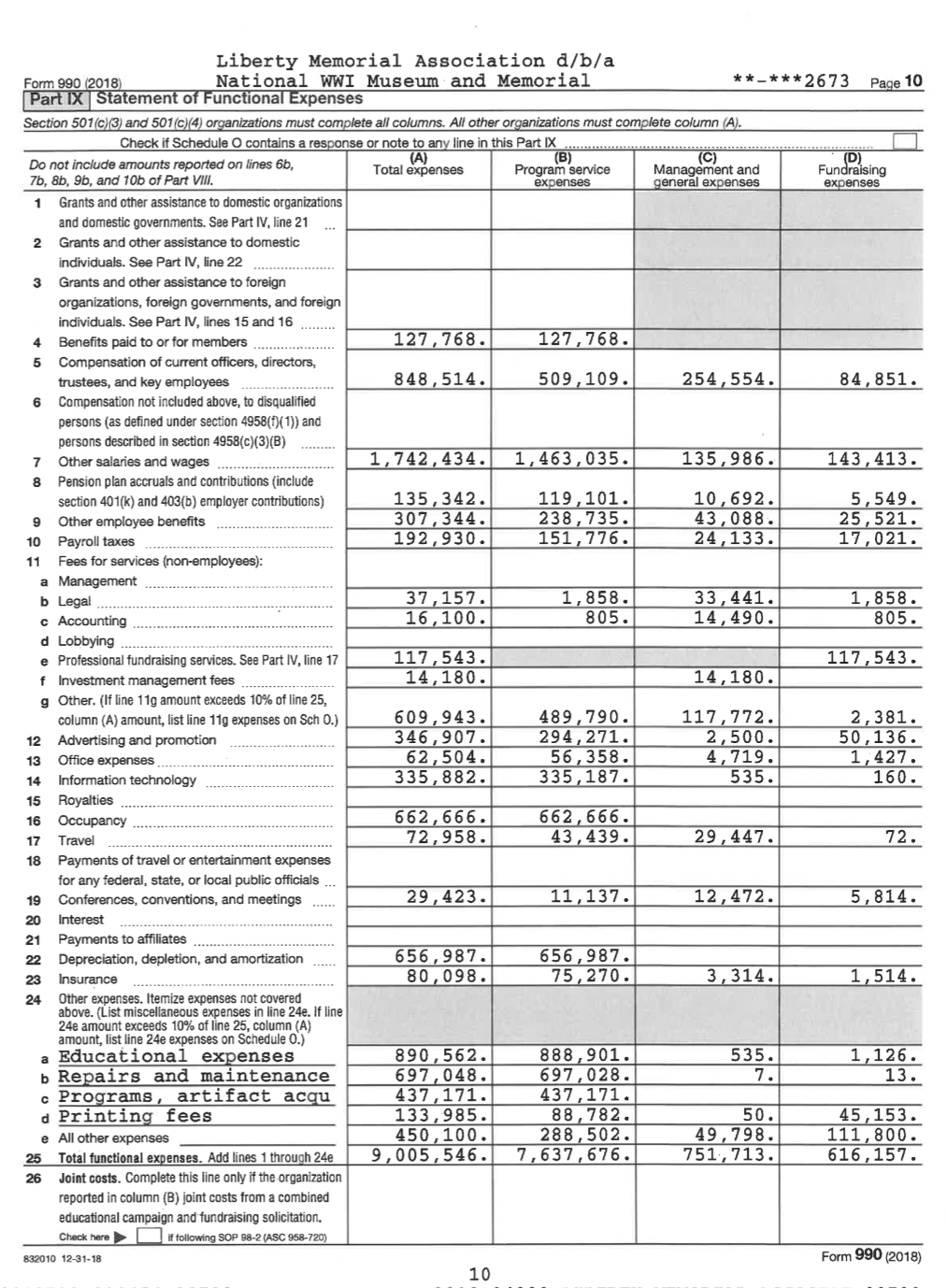

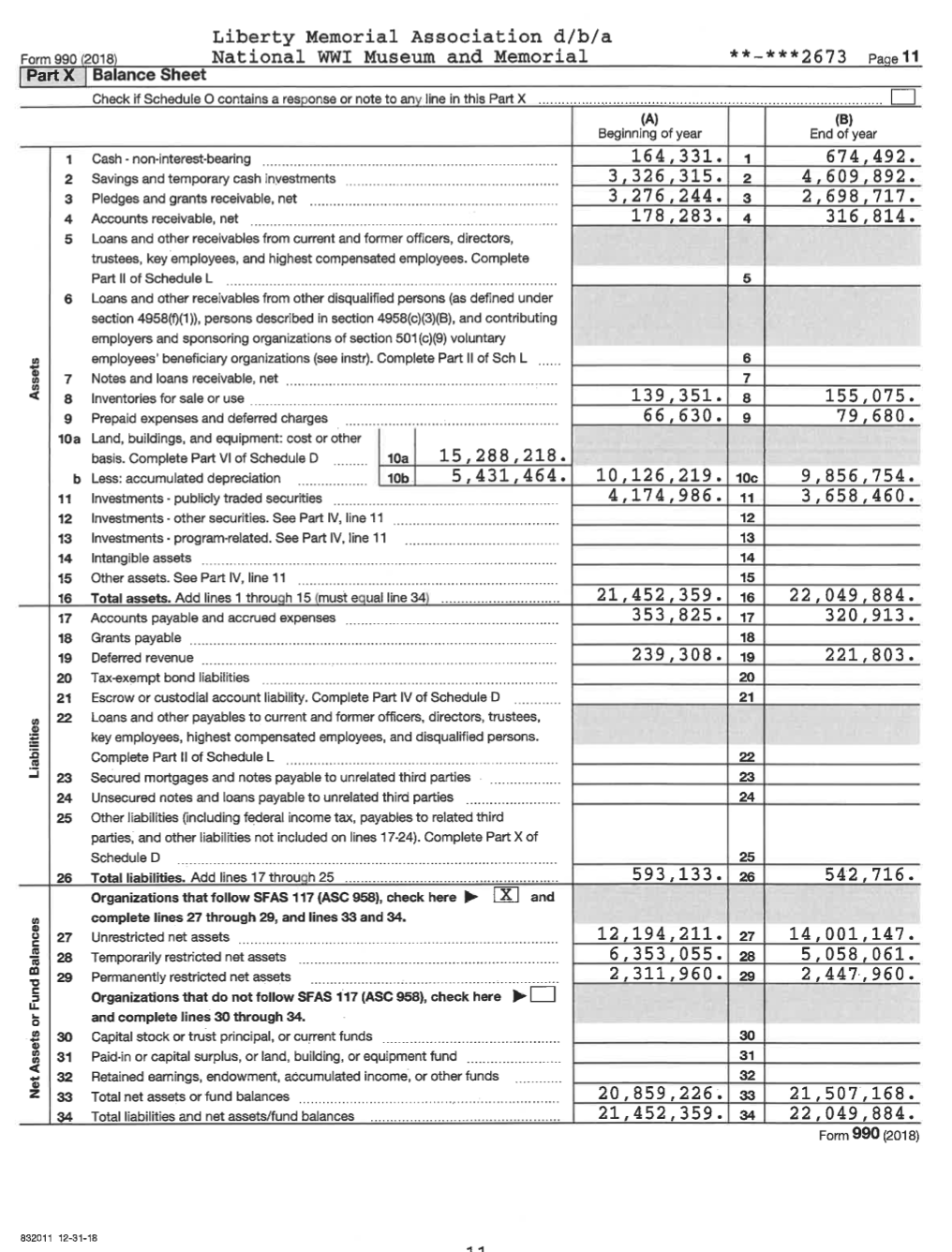

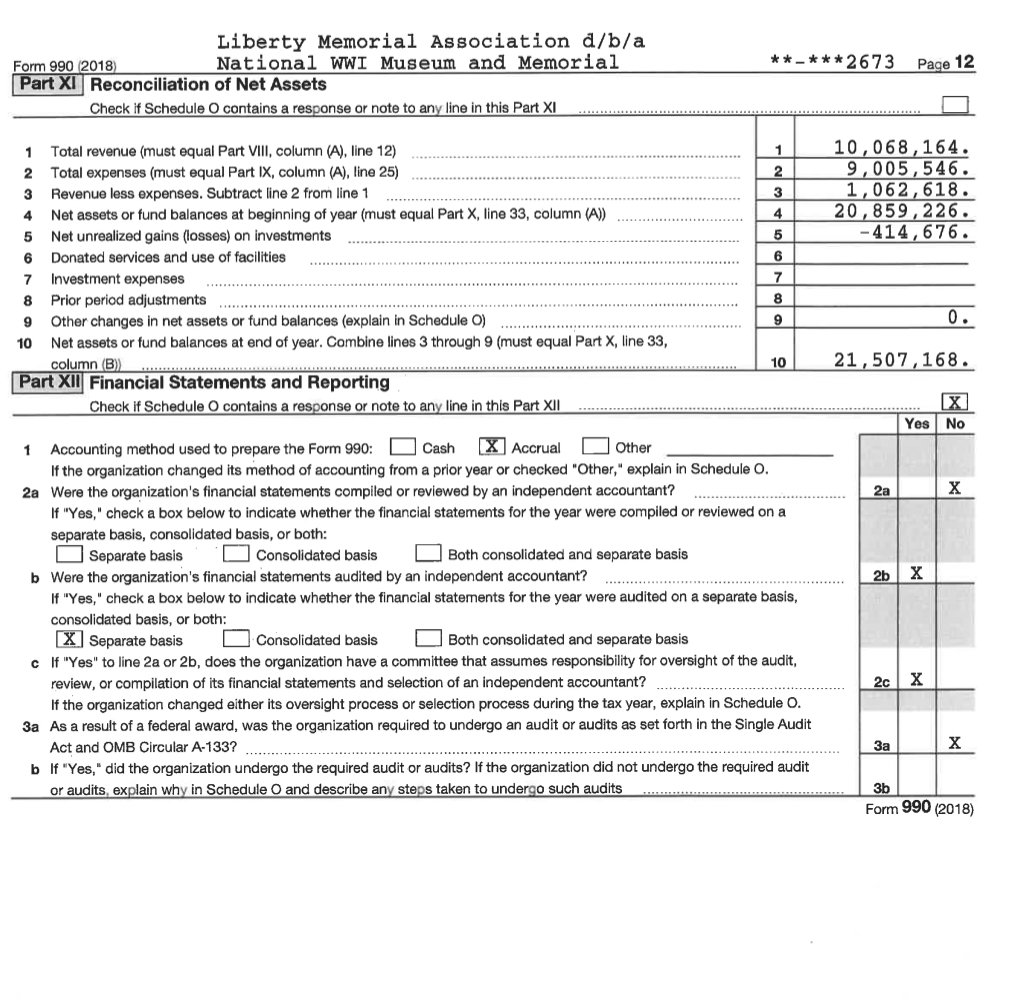

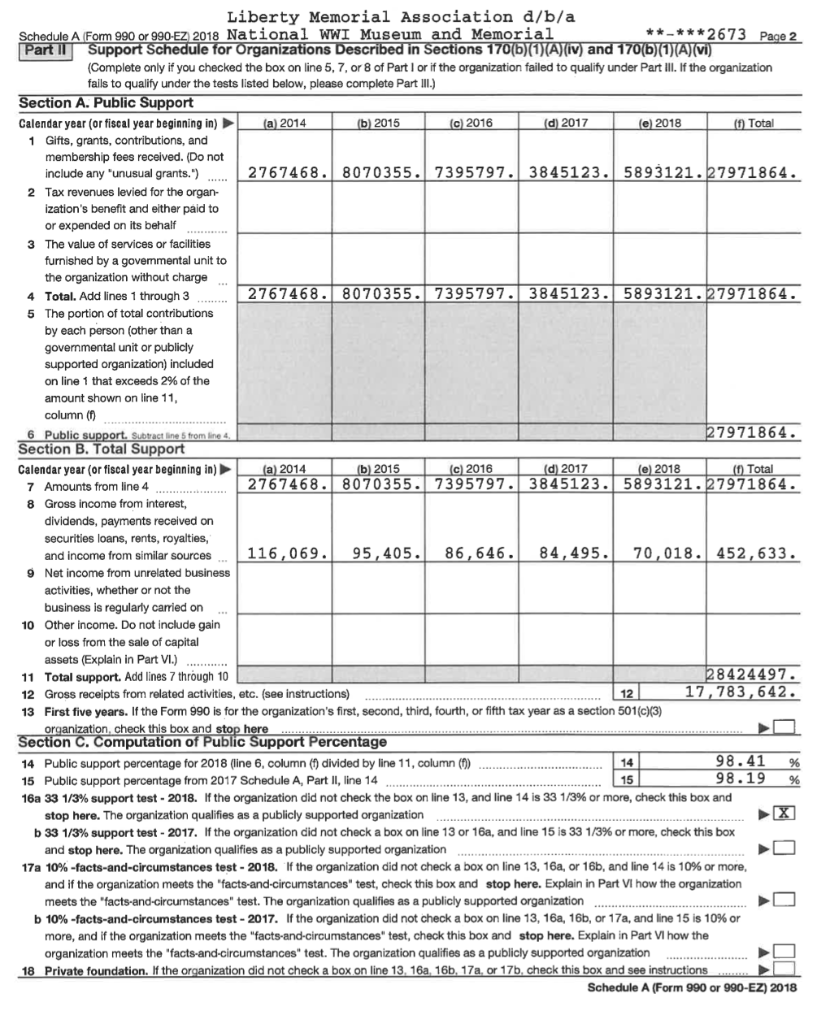

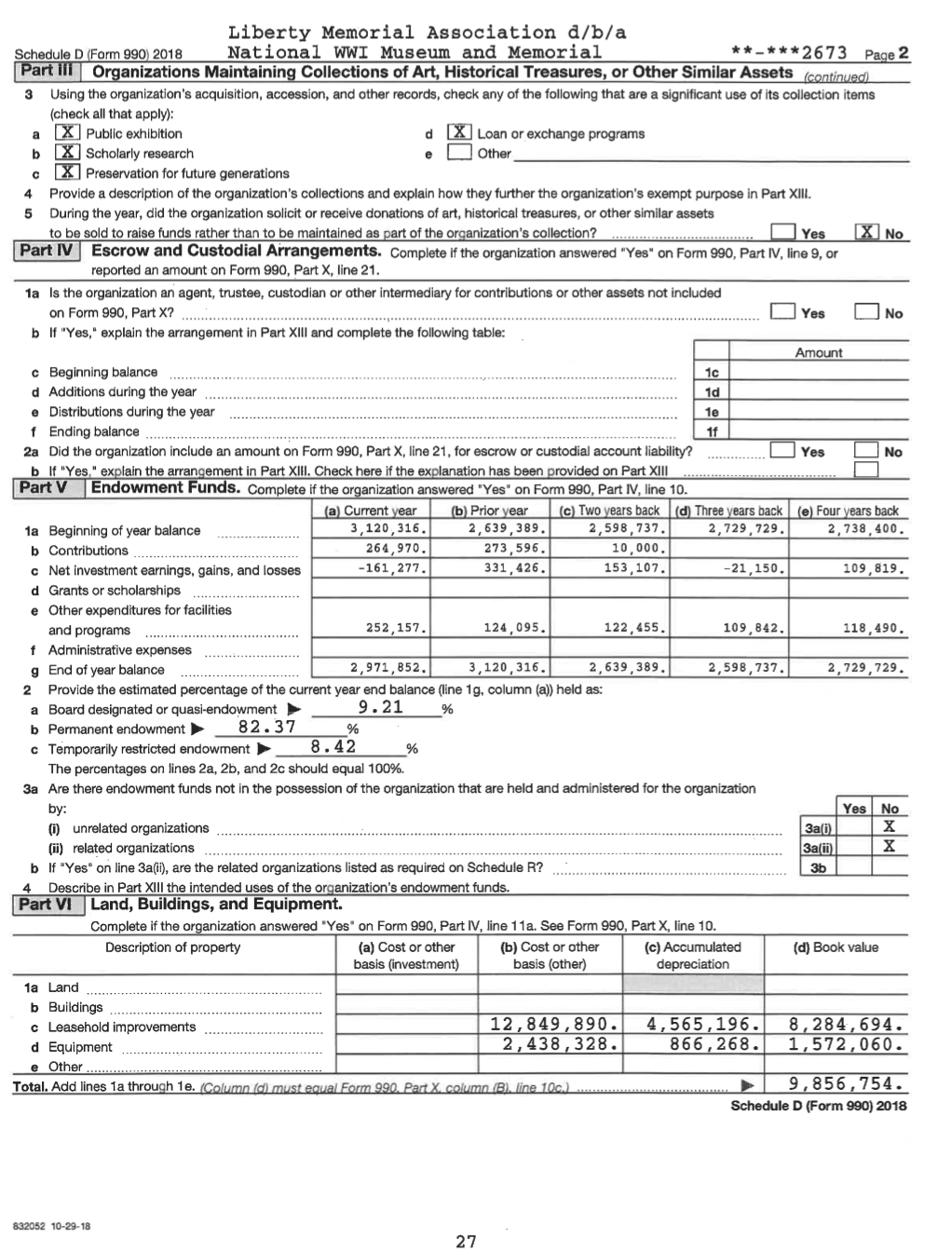

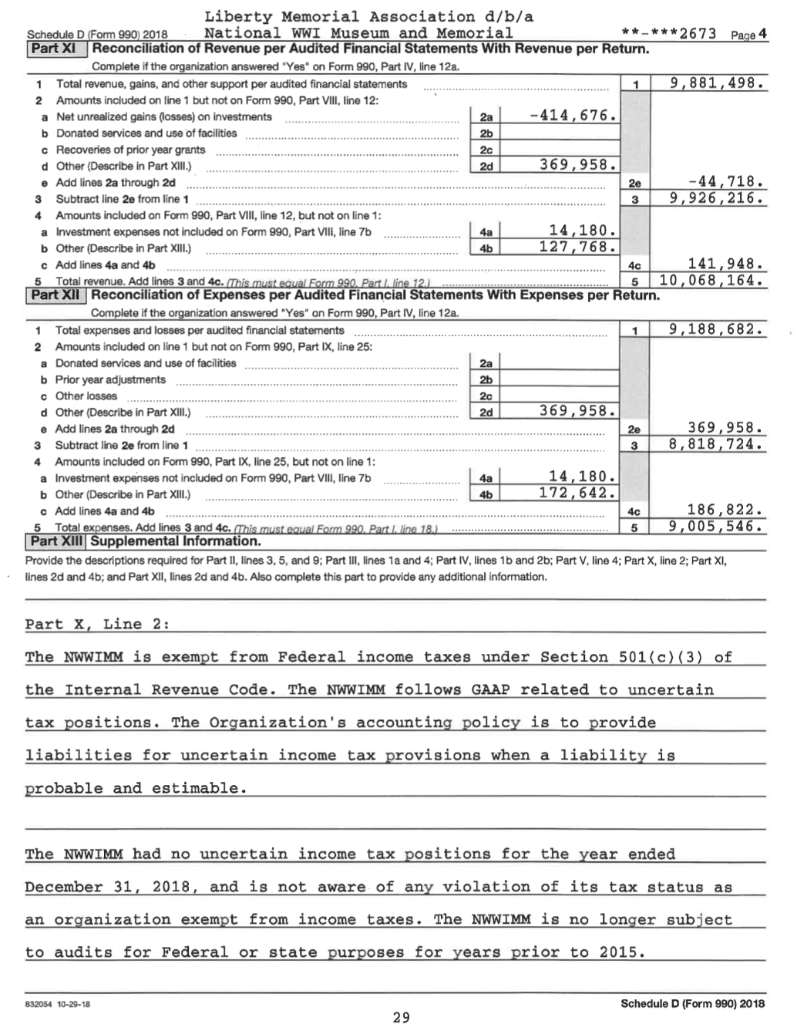

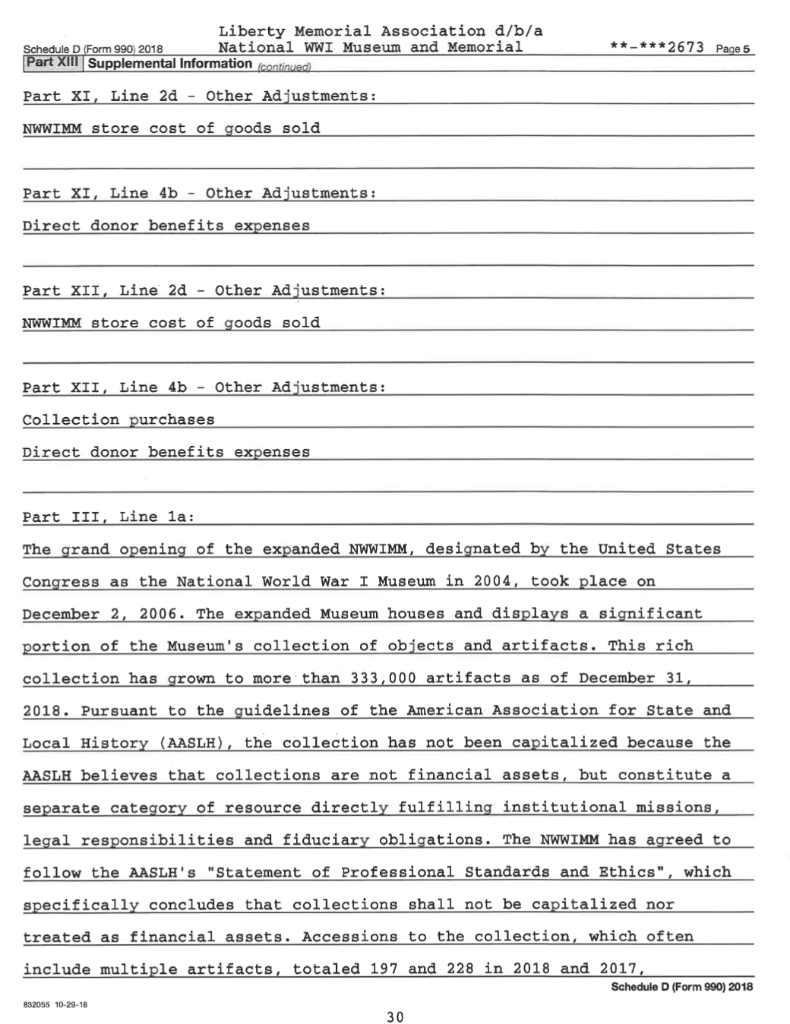

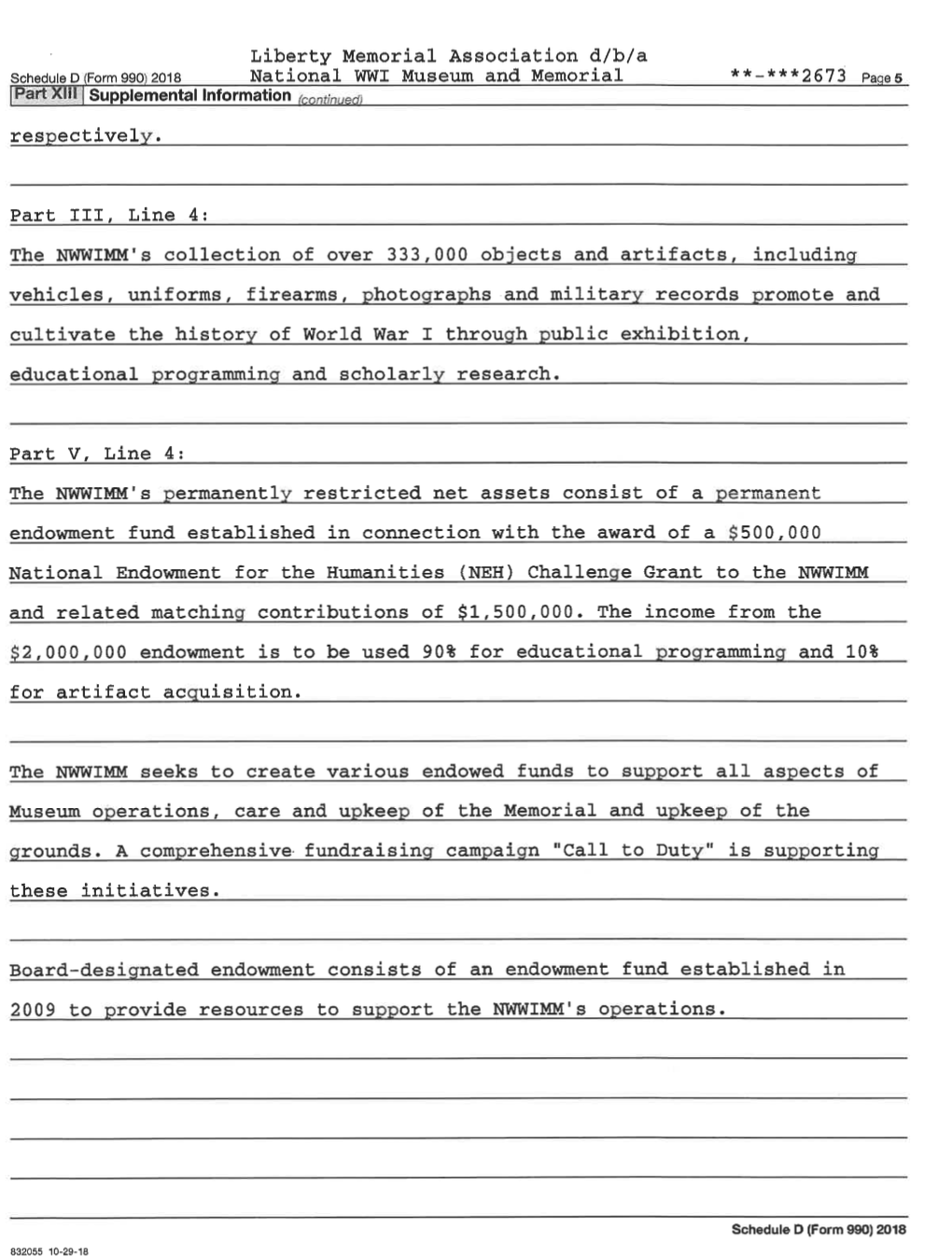

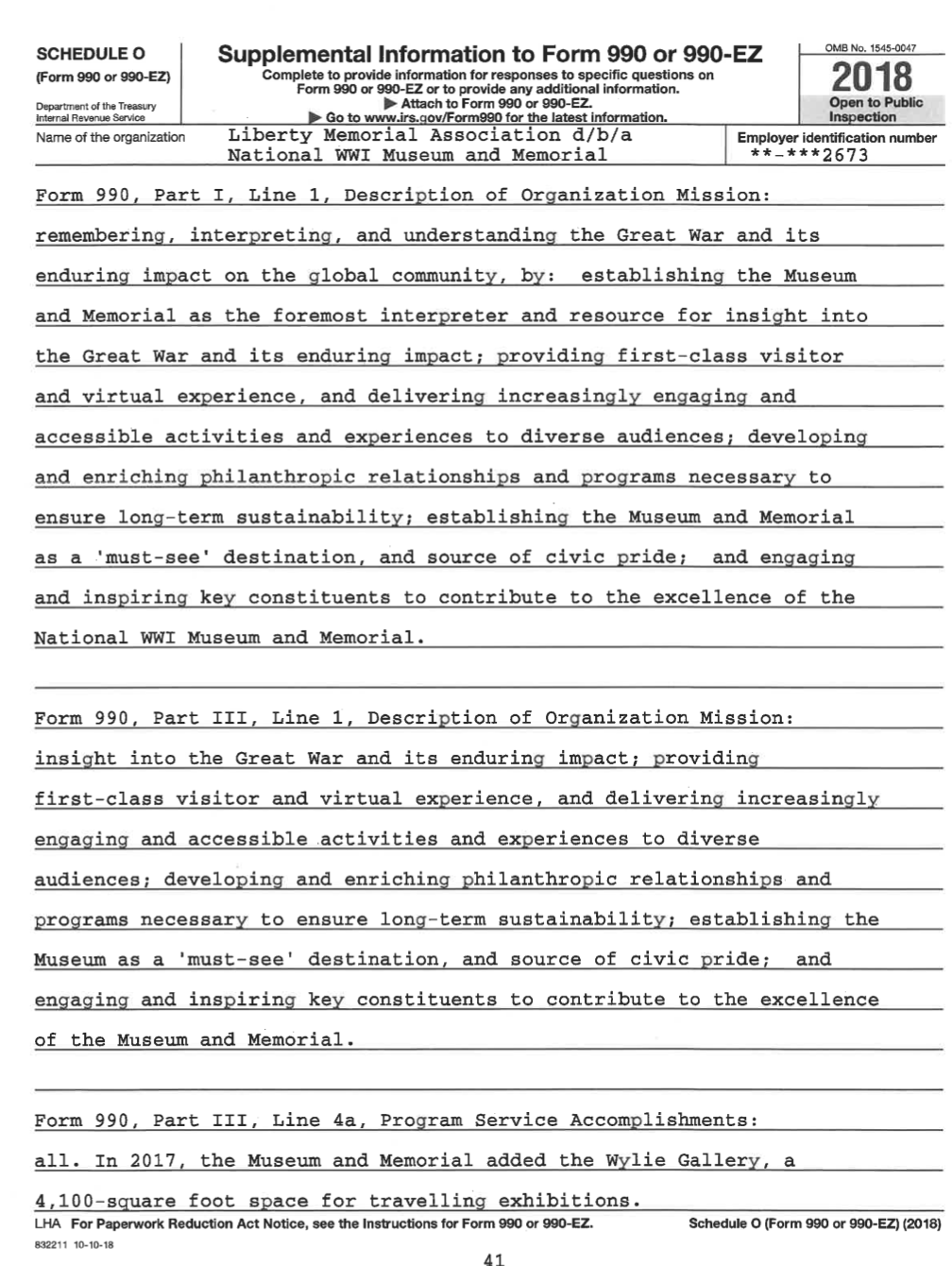

1 Liberty Memorial Association d/b/a Form 990 (2018) National WWI Museum and Memorial **-***2673 Page 2 Part III Statement of Program Service Accomplishments Check if Schedule o contains a response or note to any line in this part III Briefly describe the organization's mission: The National World War I Museum and Memorial (NWWIMM) is America's museum dedicated to remembering, interpreting, and understanding the Great War and its enduring impact on the global community, by: establishing the Museum as the foremost interpreter and resource for 2 Did the organization undertake any significant program services during the year which were not listed on the prior Form 990 990-EZ? www Yes X No f "Yes, describe these new services on Schedule O. Did the organization cease conducting, or make significant changes in how it conducts, any program services? Yes X No If "Yes," describe these changes on Schedule O. Describe the organization's program service accomplishments for each of its three largest program services, as measured by expenses. Section 501(c)(3) and 501(c)(4) organizations are required to report the amount of grants and allocations to others, the total expenses, and revenue, if any, for each program service reported. 4a (Code (Expenses 4,969,384. including grants et ) (Revenues 3,288,885.) Museum & Memorial Operations : 3 4 ) venues The NWWIMM is a limestone complex built on Memorial Hill, which is adjacent to Penn Valley Park overlooking downtown Kansas City, featuring a 217-ft. tower dedicated in 1926. A capital campaign financed the restoration of the Memorial to its original grandeur in 2004, and the construction of an 80,000-square-foot Museum beneath the courtyard of the Liberty Memorial Tower. Re-opening to the public on December 2, 2006, and designated by the 113th Congress as the National WWI Museun Memorial, the an Memorial presents a comprehensive global interpretation of World War I (1914-1919) and its lasting consequences, providing a vivid and memorable experience for 4b (Code: (Expenses 1,057, 769. Including grunts of Collections Management and Research: The NWWIMM is the nation's only museum solely dedicated to preserving the history and examining the experiences of the Great War. The NWWIMM holds the world's most comprehensive collection of World War (1914-1919) objects artifacts and documents representing each belligerent nation that was involved, is the second-oldest collecting institution in the world and presents a comprehensive global interpretation of World War I and its enduring impact. During the Centennial Commemoration (2014-2019), the NWWIMM is partnering with Kansas City's finest cultural, recreational, and civic (expenses 1,610,523. Including grants of (Revenue $ Community Education Programs : 4c (Code More than 18,700 individuals visited the NWWIMM on school field trips in 2018 including subsidized visits provided by the Museum and Memorial and generous donors for more than 4,400 underserved students from diverse ethnic and socio-economic backgrounds. Subsidized students receive a free lunch and free admission, and the schools are given a stipend to assist with the cost of transportation or substitute teachers. All of these students who visit the Museum and Memorial through a class trip participate in the School at the Museum program, which includes guided tours and focused activities. 4d Other program services (Describe in Schedule O.) (Expenses including grants of Revenues 4e Total program service expenses 7,637,676. Form 990 (2018) 832002 12-31-18 See Schedule o for Continuation(s) 2 210719 310454 08732 2018.04000 LIBERTY MEMORIAL ASSOCIAT 08732_1 Liberty Memorial Association d/b/a Form 990 (2018) National WWI Museum and Memorial **-***2673 Page 7 Part VII Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees, and independent Contractors Check if Schedule o contains a response or note to any line in this Part VII Section A. Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees 1a Complete this table for all persons required to be listed. Report compensation for the calendar year ending with or within the organization's tax year. List all of the organization's current officers, directors, trustees (whether individuals or organizations), regardless of amount of compensation. Enter-O- in columns (D). (E), and (F) if no compensation was paid. List all of the organization's current key employees, if any. See instructions for definition of "key employee." List the organization's five current highest compensated employees (other than an officer, director, trustee, or key employee) who received report- able compensation (Box 5 of Form W-2 and/or Box 7 of Form 1099-MISC) of more than $100,000 from the organization and any related organizations. List all of the organization's former officers, key employees, and highest compensated employees who received more than $100,000 of reportable compensation from the organization and any related organizations. List all of the organization's former directors or trustees that received, in the capacity as a former director or trustee of the organization, more than $10,000 of reportable compensation from the organization and any related organizations. List persons in the following order: individual trustees or directors; institutional trustees, officers; key employees; highest compensated employees; and former such persons. Check this box if neither the organization nor any related organization compensated any current officer director, or trustee. (A) (B) (C) (D) (E) (F) Name and Title Average Position (do not check more than one Reportable Reportable Estimated hours per box, unless person is both an compensation compensation amount of week officer and a director frusteel from from related other (list any the organizations compensation hours for organization (W-2/1099-MISC) from the related (W-2/1099-MISC) organization organizations and related below organizations line) (1) Mark Jorgenson 1.00 Board Member X 0. 0. 0. (2) Kevin J Rooney 2.00 Treasurer/Board Member x X 0. 0. 0. (3) Elaine Drodge Koch 2.00 Vice Chair/Board Member x X 0. 0. 0. Brad Bergman 1.00 Board Member X 0. 0. 0. (5) Emanuel Cleaver IT 1.00 Board Member x 0. 0. 0. (6) Dan Crumb 1.00 Board Member x 0. 0. 0. (7) Peter J desilva 1.00 Board Member 0. 0. (8) Mark Henderson 3.00 Chair/Board Member X 0. 0. (9) Mary Jane Judy 1.00 Board Member X 0. 0. 0. (10) Gordon Lansford 1.00 Board Member 0. 0. 0. (11) David Mecklenburg 1.00 her Board Member X 0. 0. 0. (12) Marty Nevshemal 1.00 ha Board Member X 0. 0. 0. - (13) Kent Sunderland 1.00 Board Member X 0. 0. 0. an (14) Scott Van Genderen 1.00 Board Member X 0. 0. 0. (15) Julie Wilson 1.00 Board Member X cice 0. 0. 0. (16) Richard B Young, Jr 1.00 Board Member x 0. 0. 0. (17) Teresa Rynard 1.00 Director/Kansas City Parks 0. 0. 0. 932007 12-31-18 Form 990 (2018) 7 210719 310454 08732 2018.04000 LIBERTY MEMORIAL ASSOCIAT 08732 (4) 0. 0. 1 Individual trustee or director Institutional truste ay employee Officer employee Liberty Memorial Association d/b/a Form 990 (2018) National WWI Museum and Memorial **-***2673 Page 8 Part VII Section A. Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees (continued) (A) (B) (C) (D) (E) (F) Name and title Average Position (do not check more than one Reportable Reportable Estimated hours per box, unless person is both an compensation compensation amount of week officer and a director/trustee) from from related other (list any the organizations compensation hours for organization (W-2/1099-MISC) from the related (W-2/1099-MISC) organization organizations and related below organizations line) (18) Dave Ebbrecht 1.00 Board Member X 0 0. 0. (19) Andrea Hendricks 1.00 Board Member X 0 0 0. (20) Tim Kristl 1.00 Board Member X 0. 0. 0. (21) Ram Shankar 2.00 Secretary/Board Member X 0 0. 0. (22) John Sherman 1.00 Board Member X 0. 0. 0. (23) Matthew C Naylor 40.00 President/CEO x 315,000. 0. 17,020. (24) Michael L House 40.00 Senior Vice President X 151,600. 0. 17,076. 4 5 1b Sub-total 466,600. 0. 34,096. c Total from continuation sheets to Part VII, Section A 0. 0. 0. d Total (add lines 1b and 10........ 466,600. 0. 34,096. 2 Total number of individuals (including but not limited to those listed above) who received more than $100,000 of reportable compensation from the organization 3 Yes No 3 Did the organization list any former officer, director, or trustee, key employee, or highest compensated employee on line 1a? if "Yes," complete Schedule J for such individual 3 X For any individual listed on line 1a, is the sum of reportable compensation and other compensation from the organization and related organizations greater than $150,000? If "Yes," complete Schedule J for such individual 4 X 5 Did any person listed on line 1a receive or accrue compensation from any unrelated organization or individual for services rendered to the organization? If "Yes." complete Schedule J for such person ....... X Section B. Independent Contractors 1 Complete this table for your five highest compensated independent contractors that received more than $100,000 of compensation from the organization. Report compensation for the calendar year ending with or within the organization's tax year. (A) (B) (C) Name and business address Description of services Compensation JE Dunn Construction Construction 1001 Locust Street, Kansas City, MO 64106 services 2,287,677. Scholastic Educational PO Box 416851, Boston, MA 02241 materials 393,895. Allied Barton Security Services LLC PO Box 828854, Philadelphia, PA 19182 Security services 282,872. Minnesota Elevator Inc Elevator design, PO Box 129, St. Clair, MN 56080 build and repair 282,030. Tessitura Network, Inc PO Box 203410, Dallas, TX 75320 software services 264,093. 2 Total number of independent contractors (including but not limited to those listed above) who received more than $100,000 of compensation from the organization 9 Form 990 (2018) 83200B 12-31-18 8 210719 310454 08732 2018.04000 LIBERTY MEMORIAL ASSOCIAT 08732 **-*** 2673 Page 9 (C) Unrelated business revenue (D) Revenue excluded from tax under 512 - 514 sections 1a Contributions, Gifts, Grants and Other Similar Amounts Liberty Memorial Association d/b/a Form 990 (2018) National WWI Museum and Memorial Part VIII Statement of Revenue Check if Schedule o contains a response or note to any line in this Part VIII (A) (B) Total revenue Related or exempt function revenue 1 a Federated campaigns b Membership dues 1b 210, 775. c Fundraising events 1c 960, 863 d Related organizations 1d e Government grants (contributions) 1e 816,344. f All other contributions, gifts, grants, and similar amounts not included above 16 4,077,781. g Nancash contributions Included in lines 1a-16: $ h Total. Add lines 1a-1f 6,065, 763. Business Code 2 a Admissions 900099 3,107,044. 3,107,044. b Museum programs 900099 181,841. 181, 841. Program Service Revenu e 3,288,885. 70,018, 70,018. 163,777. 163,777. f All other program service revenue 9 Total. Add lines 2a-2f 3 Investment income (including dividends, interest, and other similar amounts) 4 Income from investment of tax-exempt bond proceeds 5 Royalties O Real W Personal 6 a Gross rents b Less: rental expenses ......... c Rental income or (loss) d Net rental income or (loss) 7 a Gross amount from sales of (1) Securities (ii) Other assets other than inventory 1,071,273. b Less: cost or other basis and sales expenses 907, 496. c Gain or loss) 163,777. d Net gain or loss) 8 a Gross income from fundraising events (not including $ 960,863, of contributions reported on line 1c). See Part IV, line 18 54,571. b Less: direct expenses b 19,576. c Net income or (loss) from fundraising events 9 a Gross income from gaming activities. See Part I, line 19 b Less: direct expenses c Net income or loss) from gaming activities 10 a Gross sales of inventory, less returns and allowances 814,684. b Less: cost of goods sold b 369,958. c Net income or loss from sales of inventory Miscellaneous Revenue Business Code 11 a b Other Revenue a 34,995. 34,995. b 444,726. 444,726. d All other revenue e Total. Add lines 11a-11d Total revenue. See instructions 12 10,068, 164, 3,288,885. 0. 713,516. Form 990 (2018) 832009 12-31-18 Page 10 Liberty Memorial Association d/b/a Form 990 (2018) National WWI Museum and Memorial **_*** 2673 Part IX Statement of Functional Expenses Section 501(c) 3) and 501(c)(4) organizations must complete all columns. All other organizations must complete column A). Check if Schedule o contains a response or note to any line in this part IX Do not include amounts reported on lines 6b, (A) (B) (C) (D) Total expenses Program service Management and Fundraising 7b, 8b, 9b, and 10b of Part VIII. expenses general expenses expenses 1 Grants and other assistance to domestic organizations and domestic governments. See Part IV, line 21 2 Grants and other assistance to domestic individuals. See Part IV, line 22 3 Grants and other assistance to foreign organizations, foreign governments, and foreign individuals. See Part IV, lines 15 and 16 4 Benefits paid to or for members 127,768. 127,768. 5 Compensation of current officers, directors, trustees, and key employees 848,514. 509,109. 254,554. 84,851. 6 Compensation not included above, to disqualified persons (as defined under section 4958(1)(1)) and persons described in section 4958(c)(3)(B) 7 Other salaries and wages 1,742,434. 1,463,035. 135,986. 143,413. 8 Pension plan accruals and contributions (include section 401(k) and 403(b) employer contributions) 135,342. 119,101. 10,692. 5,549. 9 Other employee benefits 307,344. 238,735. 43,088. 25,521 10 Payroll taxes 192,930. 151,776. 24,133. 17,021. 11 Fees for services (non-employees): a Management b Legal 37,157. 1,858. 33, 441. 1,858. c Accounting 16,100. 805. 14,490. 805. d Lobbying e Professional fundraising services. See Part IV, line 17 117,543. 117,543. f Investment management fees 14,180. 14,180. g Other. (If line 11g amount exceeds 10% of line 25, column (A) amount, list line 11g expenses on Sch O.) 609,943. 489,790. 117,772. 2,381. 12 Advertising and promotion 346,907. 294, 271. 2,500. 50,136. 13 Office expenses 62,504. 56,358. 4,719. 1,427. 14 Information technology 335,882. 335, 187. 535. 160. 15 Royalties 16 Occupancy 662,666. 662,666. 17 Travel 72,958. 43,439. 29,447. 72. 18 Payments of travel or entertainment expenses for any federal, state, or local public officials 19 Conferences, conventions, and meetings 29,423. 11,137. 12,472. 5,814. 20 Interest 21 Payments to affiliates 22 Depreciation, depletion, and amortization 656,987. 656,987 23 Insurance 80,098. 75, 270. 3,314. 1,514. 24 Other expenses. Itemize expenses not covered above. (List miscellaneous expenses in line 24e. If line 24e amount exceeds 10% of line 25, column (A) amount, list line 24e expenses on Schedule 0.) Educational expenses 890,562. 888,901. 535. 1,126. b Repairs and maintenance 697,048. 697,028. 7. 13. c Programs, artifact acqu 437, 171. 437,171. d Printing fees 133,985. 88,782. 50. 45,153. e All other expenses 450,100. 288,502. 49,798. 111,800. 25 Total functional expenses. Add lines 1 through 24e 9,005,546. 7,637,676. 751, 713. 616,157. 26 Joint costs. Complete this line only if the organization reported in column (B) joint costs from a combined educational campaign and fundraising solicitation. Check here Diffollowing SOP 98-2 (ASC 958-720) 832010 12-31-18 Form 990 (2018) 10 Assets Liberty Memorial Association d/b/a Form 990 (2018) National WWI Museum and Memorial **-*** 2673 Page 11 Part X Balance Sheet Check if Schedule O contains a response or note to any line in this part X (A) (B) Beginning of year End of year 1 Cash -non-interest-bearing 164, 331. 1 674,492. 2 Savings and temporary cash investments 3,326,315. 2 4,609,892. 3 Pledges and grants receivable, net 3,276,244. 3 2,698,717. 4 Accounts receivable, net 178,283.4 316,814. 5 Loans and other receivables from current and former officers, directors, trustees, key employees, and highest compensated employees. Complete Part II of Schedule L 6 Loans and other receivables from other disqualified persons (as defined under section 4958(1)(1)), persons described in section 4958(c)(3)(B), and contributing employers and sponsoring organizations of section 501(C)(9) voluntary employees' beneficiary organizations (see instr). Complete Part II of SchL 6 7 Notes and loans receivable, net 7 8 Inventories for sale or use 139,351. 8 155,075. 9 Prepaid expenses and deferred charges 66,630. 9 79,680. 10a Land, buildings, and equipment: cost or other basis. Complete Part VI of Schedule D 10a 15, 288, 218. b Less: accumulated depreciation 10b 5,431,464. 10,126 , 219 10c 9,856,754. 11 Investments - publicly traded securities 4,174,986. 11 3,658,460. 12 Investments - other securities. See Part IV, line 11 12 13 Investments - program-related. See Part IV, line 11 13 14 Intangible assets 14 15 Other assets. See Part IV, line 11 15 16 Total assets. Add lines 1 through 15 (must equal line 34) 21,452 ,359. 16 22,049,884. 17 Accounts payable and accrued expenses 353,825. 17 320,913. 18 Grants payable 18 19 Deferred revenue 239, 308. 19 221,803. 20 Tax-exempt bond liabilities 20 21 Escrow or custodial account liability. Complete Part IV of Schedule D 21 22 Loans and other payables to current and former officers, directors, trustees, key employees, highest compensated employees, and disqualified persons. Complete Part II of ScheduleL 22 23 Secured mortgages and notes payable to unrelated third parties 23 24 Unsecured notes and loans payable to unrelated third parties 24 25 Other liabilities (including federal income tax, payables to related third parties, and other liabilities not included on lines 17-24). Complete Part X of Schedule D 25 26 Total liabilities. Add lines 17 through 25 593,133. 26 542,716. Organizations that follow SFAS 117 (ASC 958), check here X and complete lines 27 through 29, and lines 33 and 34. 27 Unrestricted net assets 12,194,211.27 14,001,147. 28 Temporarily restricted net assets 6,353,055. 28 5,058, 061. 29 Permanently restricted net assets 2,311,960. 29 2,447,960. Organizations that do not follow SFAS 117 (ASC 958), check here and complete lines 30 through 34. 30 Capital stock or trust principal, or current funds 30 31 Paid-in or capital surplus, or land, building, or equipment fund 31 32 Retained earings, endowment, accumulated income, or other funds 32 Total net assets or fund balances 20,859, 226. 33 33 21,507,168. 34 Total liabilities and net assets/fund balances 21,452 ,359.34 22,049,884. Form 990 (2018) Liabilities Net Assets or Fund Balances 832011 12-31-18 **-***2673 Page 12 Liberty Memorial Association d/b/a Form 990 2018) National WWI Museum and Memorial Part XI Reconciliation of Net Assets Check if Schedule O contains a response or note to any line in this part XI. 1 10,068, 164. 9,005,546. 1,062,618. 20,859, 226. - 414,676. 5 1 Total revenue (must equal Part VIII, column (A), line 12) 2 Total expenses (must equal Part IX, column (A), line 25) 3 Revenue less expenses. Subtract line 2 from line 1 4 Net assets or fund balances at beginning of year (must equal Part X, line 33, column (A)) Net unrealized gains (losses) on investments 6 Donated services and use of facilities 7 Investment expenses 8 Prior period adjustments 9 Other changes in net assets or fund balances (explain in Schedule 0) 10 Net assets or fund balances at end of year. Combine lines 3 through 9 (must equal Part X, line 33, column (B) Part XII Financial Statements and Reporting Check if Schedule O contains a response or note to any line in this part XII 6 7 8 9 0. 10 21,507,168. Yes No 2a X 2b X 1 Accounting method used to prepare the Form 990: Cash X Accrual Other If the organization changed its method of accounting from a prior year or checked "Other," explain in Schedule O. 2a Were the organization's financial statements compiled or reviewed by an independent accountant? If "Yes," check a box below to indicate whether the financial statements for the year were compiled or reviewed on a separate basis, consolidated basis, or both: O Separate basis DConsolidated basis O Both consolidated and separate basis b Were the organization's financial statements audited by an independent accountant? If "Yes," check a box below to indicate whether the financial statements for the year were audited on a separate basis, consolidated basis, or both: X Separate basis Consolidated basis O Both consolidated and separate basis c If "Yes" to line 2a or 2b, does the organization have a committee that assumes responsibility for oversight of the audit, review, or compilation of its financial statements and selection of an independent accountant? If the organization changed either its oversight process or selection process during the tax year, explain in Schedule O. 3a As a result of a federal award, was the organization required to undergo an audit or audits as set forth in the Single Audit Act and OMB Circular A-133? b If "Yes," did the organization undergo the required audit or audits? If the organization did not undergo the required audit or audits, explain why in Schedule and describe any steps taken to undergo such audits 2c X 3a X 3b Form 990 (2018) Liberty Memorial Association d/b/a Schedule A (Form 990 or 990-EZ 2018 National WWI Museum and Memorial **-*** 2673 Page 2 Part II Support Schedule for Organizations Described in Sections 170(b)(1)(A)(iv) and 170(b)(1)(A) (vi) (Complete only if you checked the box on line 5, 7, or 8 of Part I or if the organization failed to qualify under Part III. If the organization fails to qualify under the tests listed below, please complete Part III.) Section A. Public Support Calendar year (or fiscal year beginning in) (a) 2014 (b2015 (c) 2016 (d) 2017 le) 2018 Total 1 Gifts, grants, contributions, and membership fees received. (Do not include any unusual grants.") 2767468. 8070355. 7395797. 3845123. 5893121.27971864. 2 Tax revenues levied for the organ- ization's benefit and either paid to or expended on its behalf 3 The value of services or facilities furnished by a govermental unit to the organization without charge 4 Total. Add lines 1 through 3 2767468. 8070355. 7395797. 3845123.5893121.27971864. 5 The portion of total contributions by each person (other than a governmental unit or publicly supported organization) included on line 1 that exceeds 2% of the amount shown on line 11, column () 6 Public support. Subtract line 5 from line 4 27971864. Section B. Total Support Calendar year (or fiscal year beginning in) (a) 2014 (b) 2015 (c) 2016 (d) 2017 (2018 Total 7 Amounts from line 4 2767468. 8070355. 7395797. 3845123. 5893121. 27971864. 8 Gross income from interest, dividends, payments received on securities loans, rents, royalties, and income from similar sources 116,069 95, 405. 86,646. 84,495. 70,018. 452,633. 9 Net income from unrelated business activities, whether or not the business is regularly carried on 10 Other income. Do not include gain or loss from the sale of capital assets (Explain 11 Total support. Add lines 7 through 10 28424497. 12 Gross receipts from related activities, etc. (see instructions) 12 17,783,642. 13 First five years. If the Form 990 is for the organization's first, second, third, fourth, or fifth tax year as a section 501(c)(3) organization, check this box and stop here ..... Section C. Computation of Public Support Percentage 14 Public support percentage for 2018 (line 6, column (1) divided by line 11, column () 14 98.41 % 15 Public support percentage from 2017 Schedule A, Part II, line 14 15 98.19 16a 33 1/3% support test - 2018. If the organization did not check the box on line 13, and line 14 is 33 1/3% or more, check this box and stop here. The organization qualifies as a publicly supported organization b 33 1/3% support test - 2017. If the organization did not check a box on line 13 or 16a, and line 15 is 33 1/3% or more, check this box and stop here. The organization qualifies as a publicly supported organization 17a 10% -facts-and-circumstances test - 2018. If the organization did not check a box on line 13, 16a, or 16b, and line 14 is 10% or more, and if the organization meets the "facts-and-circumstances" test, check this box and stop here. Explain in Part VI how the organization meets the "facts-and-circumstances" test. The organization qualifies as a publicly supported organization b 10%-facts-and-circumstances test - 2017. If the organization did not check a box on line 13, 16a, 16b, or 17a, and line 15 is 10% or more, and if the organization meets the "facts-and-circumstances" test, check this box and stop here. Explain in Part VI how the organization meets the "facts-and-circumstances" test. The organization qualifies as a publicly supported organization 18 Private foundation. If the organization did not check a box on line 13, 16a, 16b. 17a, or 17b, check this box and see instructions Schedule A (Form 990 or 990-EZ) 2018 Part VI.) ............ e X No Yes Liberty Memorial Association d/b/a Schedule D (Form 990) 2018 National WWI Museum and Memorial **-***2673 Page 2 Part ili Organizations Maintaining Collections of Art, Historical Treasures, or Other Similar Assets continued) 3 Using the organization's acquisition, accession, and other records, check any of the following that are a significant use of its collection items (check all that apply): a X Public exhibition d X Loan or exchange programs b X Scholarly research Other c X Preservation for future generations 4 Provide a description of the organization's collections and explain how they further the organization's exempt purpose in Part XII. 5 During the year, did the organization solicit or receive donations of art, historical treasures, or other similar assets to be sold to raise funds rather than to be maintained as part of the organization's collection? Yes Part IV Escrow and Custodial Arrangements. Complete if the organization answered "Yes" on Form 990, Part IV, line 9, or reported an amount on Form 990, Part X, line 21. 1a Is the organization an agent, trustee, custodian or other intermediary for contributions or other assets not included on Form 990, Part X? No b If "Yes," explain the arrangement in Part Xlll and complete the following table: Amount c Beginning balance 1c d Additions during the year 1d e Distributions during the year 1e f Ending balance .......... 1f 2a Did the organization include an amount on Form 990, Part X, line 21, for escrow or custodial account liability? Yes No b If "Yes," explain the arrangement in Part XIII. Check here if the explanation has been provided on Part XIII Part V Endowment Funds. Complete if the organization answered "Yes" on Form 990, Part IV, line 10. (a) Current year (b) Prior year (c) Two years back (d) Three years back e Four years back 1a Beginning of year balance 3,120, 316. 2,639,389. 2,598,737. 2,729,729 2,738,400. b Contributions 264,970. 273,596. 10,000. c Net investment earnings, gains, and losses -161,277. 331,426. 153, 107. -21,150. 109,819. d Grants or scholarships e Other expenditures for facilities and programs 252, 157. 124,095. 122,455. 109,842. 118,490. f Administrative expenses g End of year balance 2,971,852. 3,120,316. 2,639,389. 2,598,737. 2,729,729. 2 Provide the estimated percentage of the current year end balance (line 1g, column (a)) held as: a Board designated or quasi-endowment 9.21 % b Permanent endowment 82.37 % c Temporarily restricted endowment 8.42 % The percentages on lines 2a, 2b, and 2c should equal 100%. 3a Are there endowment funds not in the possession of the organization that are held and administered for the organization by: Yes No i) unrelated organizations () X (i) related organizations 3alii) b If "Yes" on line 3a(ii), are the related organizations listed as required on Schedule R? 4 Describe in Part XIII the intended uses of the organization's endowment funds. Part VI Land, Buildings, and Equipment. Complete if the organization answered "Yes" on Form 990, Part IV, line 11a. See Form 990, Part X, line 10. Description of property (a) Cost or other (b) Cost or other (c) Accumulated (d) Book value basis (investment) basis (other) depreciation 1a Land b Buildings c Leasehold improvements 12,849,890. 4,565,196. 8,284,694. d Equipment 2,438, 328. 866, 268. 1,572,060. e Other ....... Total. Add lines 1a through 1e. (Column (dl must equal Form 990. Part X. column (B), line 10c.) 9,856,754. Schedule D (Form 990) 2018 3b 832052 10-29-18 27 1 2 2e 3 4 Liberty Memorial Association d/b/a Schedule D (Form 990 2018 National WWI Museum and Memorial **-***2673 Page 4 Part XI Reconciliation of Revenue per Audited Financial Statements With Revenue per Return. Complete if the organization answered "Yes" on Form 990, Part IV, line 12a. Total revenue, gains, and other support per audited financial statements 1 9,881,498. Amounts included on line 1 but not on Form 990, Part VIII, line 12: a Net unrealized gains (losses) on investments 2a - 414, 676. b Donated services and use of facilities 2b c Recoveries of prior year grants 2c d Other (Describe in Part XIII.) 2d 369,958. Add lines 2a through 2d -44, 718. 3 Subtract line 2e from line 1 9,926 , 216. Amounts included on Form 990, Part VIII, line 12, but not on line 1: a Investment expenses not included on Form 990, Part VIII, line 75 4a 14,180. b Other (Describe in Part XIII.) 4b 127,768. c Add lines 4a and 4b 4c 141,948. 5 Total revenue. Add lines 3 and 4c. (This must equal Form 990. Part I. line 12.) 10,068, 164. Part XII Reconciliation of Expenses per Audited Financial Statements With Expenses per Return. Complete if the organization answered "Yes" on Form 990, Part IV, line 12a. Total expenses and losses per audited financial statements 9,188,682. 2 Amounts included on line 1 but not on Form 990, Part IX, line 25: a Donated services and use of facilities 2a b Prior year adjustments c Other losses 2c d Other (Describe in Part XIII.) 2d 369,958. . Add lines 2a through 2d 2e 369,958. Subtract line 2e from line 1 8,818,724. Amounts included on Form 990, Part IX, line 25, but not on line 1: a Investment expenses not included on Form 990, Part VIII, line 70 4a 14,180. b Other (Describe in Part XIII.) 4b 172,642. c Add lines 4a and 4b 4c 186,822. Total expenses. Add lines 3 and 4c. (This must.equal For 990. Part I. line 18.) 5 9,005,546. Part XIII Supplemental Information. Provide the descriptions required for Part lines 3, 5, and 9; Part III, lines 1a and 4; Part IV, lines 1b and 2b; Part V, line 4; Part X, line 2; Part XI, lines 2d and 4b; and Part XII, lines 2d and 4b. Also complete this part to provide any additional information 1 1 2b 3 4 Part X, Line 2: The NWWIMM is exempt from Federal income taxes under Section 501(c)(3) of the Internal Revenue Code. The NWWIMM follows GAAP related to uncertain tax positions. The Organization's accounting policy is to provide liabilities for uncertain income tax provisions when a liability is probable and estimable. The NWWIMM had no uncertain income tax positions for the year ended December 31, 2018, and is not aware of any violation of its tax status as an organization exempt from income taxes. The NWWIMM is no longer subject to audits for Federal or state purposes for years prior to 2015. 832054 10-29-18 Schedule D (Form 990) 2018 29 **-***2673 Page 5 Liberty Memorial Association d/b/a Schedule D (Form 990 2018 National WWI Museum and Memorial Part XIII Supplemental Information continued) Part XI, Line 20 - Other Adjustments: NWWIMM store cost of goods sold Part XI, Line 4b - Other Adjustments: Direct donor benefits expenses Part XII, Line 2d - Other Adjustments: NWWIMM store cost of goods sold Part XII, Line 4b - Other Adjustments: Collection purchases Direct donor benefits expenses Part III, Line la: The grand opening of the expanded NWWIMM, designated by the United States Congress as the National World War I Museum in 2004, took place on December 2, 2006. The expanded Museum houses and displays a significant portion of the Museum's collection of objects and artifacts. This rich collection has grown to more than 333,000 artifacts as of December 31, 2018. Pursuant to the guidelines of the American Association for State and Local History (AASLH), the collection has not been capitalized because the AASLH believes that collections are not financial assets, but constitute a separate category of resource directly fulfilling institutional missions, legal responsibilities and fiduciary obligations. The NWWIMM has agreed to follow the AASLH's "Statement of Professional Standards and Ethics", which specifically concludes that collections shall not be capitalized nor treated as financial assets. Accessions to the collection, which often include multiple artifacts, totaled 197 and 228 in 2018 and 2017, Schedule D (Form 990) 2018 882055 10-29-18 30 Liberty Memorial Association d/b/a Schedule D (Form 990) 2018 National WWI Museum and Memorial Part XII Supplemental Information continued **-*** 2673 Page 5 respectively. Part III, Line 4: The NWWIMM's collection of over 333,000 objects and artifacts, including vehicles, uniforms, firearms, photographs and military records promote and cultivate the history of World War I through public exhibition, educational programming and scholarly research. Part V, Line 4: The NWWIMM's permanently restricted net assets consist of a permanent endowment fund established in connection with the award of a $500,000 National Endowment for the Humanities (NEH) Challenge Grant to the NWWIMM and related matching contributions of $1,500,000. The income from the $2,000,000 endowment is to be used 90% for educational programming and 10% for artifact acquisition. The NWWIMM seeks to create various endowed funds to support all aspects of Museum operations, care and upkeep of the Memorial and upkeep of the grounds. A comprehensive fundraising campaign "Call to Duty" is supporting these initiatives. Board-designated endowment consists of an endowment fund established in 2009 to provide resources to support the NWWIMM's operations. Schedule D (Form 990) 2018 832055 10-29-18 SCHEDULE O (Form 990 or 990-EZ) 2018 Department of the Treasury Internal Revenue Service Name of the organization OMB No. 1545-0047 Supplemental Information to Form 990 or 990-EZ Complete to provide information for responses to specific questions on Form 990 or 990-EZ or to provide any additional information. Attach to Form 990 or 990-EZ. Open to Public Go to www.irs.gov/Form990 for the latest information. Inspection Liberty Memorial Association d/b/a Employer identification number National WWI Museum and Memorial **-***2673 Form 990, Part I, Line 1, Description of Organization Mission: remembering, interpreting, and understanding the Great War and its enduring impact on the global community, by: establishing the Museum and Memorial as the foremost interpreter and resource for insight into the Great War and its enduring impact; providing first-class visitor and virtual experience, and delivering increasingly engaging and accessible activities and speriences to diverse audiences; developing and enriching philanthropic relationships and programs necessary to ensure long-term sustainability; establishing the Museum and Memorial as a 'must-see' destination, and source of civic pride; and engaging and inspiring key constituents to contribute to the excellence of the National WWI Museum and Memorial. Form 990, Part III, Line 1, Description of Organization Mission: insight into the Great War and its enduring impact; providing first-class visitor and virtual experience, and delivering increasingly engaging and accessible activities and experiences to diverse audiences; developing and enriching philanthropic relationships and programs necessary to ensure long-term sustainability; establishing the Museum as a 'must-see' destination, and source of civic pride; and engaging and inspiring key constituents to contribute to the excellence of the Museum and Memorial. Form 990, Part III, Line 4a, Program Service Accomplishments: all. In 2017, the Museum and Memorial added the Wylie Gallery, a 4,100-square foot space for travelling exhibitions. LHA For Paperwork Reduction Act Notice, see the Instructions for Form 990 or 990-EZ. 832211 10-10-18 41 Schedule O (Form 990 or 990-EZ) (2018) Schedule O (Form 990 or 990-EZ 2018 Name of the organization Liberty Memorial Association d/b/a National WWI Museum and Memorial Page 2 Employer identification number **-***2673 As of December 31, 2018, the NWWIMM currently employs 39 full-time and 7 part-time staff. Additionally, in 2018 434 volunteers provided over 66,268 hours of service. Volunteers greet guests, provide expert tours, provide guidance, support special projects, assist with promotion, answer all questions, and help to lend a warm, human dimension to multifaceted stories of war and world history. The NWWIMM receives financial support from local, national and international sources. Donors include a wide array of individuals, corporations, and foundations whose support has helped to build enhanced programming and fund operational support for the Museum and Memorial. Admissions, facility rentals, retail, the Over There Cafe, and other initiatives are also successful revenue generating sources. The NWWIMM is proud of being ranked among the top 25 museums in the U.S. and the "Number One Attraction in Kansas City" by Trip Advisor, as well as one of the top 12 military museums in the world as published by CNN. In 2018, attendance at the NWWIMM, including events held in the Museum as well as the surrounding parklands was more than 640,000 (an increase of 90% over fiscal year 2013), including more than 220,000 paid admissions. In 2018, guests from six continents visited the NWWIMM. Form 990, Part III, Line 4b, Program Service Accomplishments: organizations, as well as national and international galleries and institutions, to bring our patrons the most robust and memorable 832212 10-10-18 Schedule (Form 990 or 990-EZ) (2018) 42 Schedule 0 (Form 990 or 990-EZ 2018 Name of the organization Liberty Memorial Association d/b/a National WWI Museum and Memorial Page 2 Employer identification number **-***2673 experiences to depict the Great War and its era. The NWWIMM holds a diverse collection of more than 333,000 World War I historical objects and artifacts, and active collecting continues to the present, with collection priorities responding to immediate research and exhibition needs, as well as unique opportunities when they arise. In 2018, the Museum accepted 197 new accessions into the permanent collection, each of which contains at least one object. Exhibitions offer insight on the beginnings of the war and its global nature-how and why countries went to war, how entire societies mobilized, and how the war affected civilians as well as military participants. The Museum and Memorial features several temporary exhibitions every year, and also partners with other institutions with exhibition loans. 2018 featured: the continuation of Fields of Battle, Lands of Peace: The Doughboys 1917-1918, a travelling outdoor exhibition of WWI battlefields, co-curated with photographer Michael St Maur Sheil and viewed by millions of people in the U.S. and UK; The Volunteers: Americans Join WWI, 1914-1919; John Singer Sargent "Gassed"; For Liberty: American Jewish Experience in WWI; Crucible Life & Death in 1918; The World Remembers; Devastated Lands; Diggers And Doughboys: The Art of Allies 100 Years On; Images of the Great War: America Crosses the Atlantic; Posters as Munitions; War Around Us: Soldier Artist Impressions; Revolutions! 1917. Form 990, Part III, Line 4c, Program Service Accomplishments: Furthermore, the Museum and Memorial's Hands-on History and Story Time programs served over 1,980 participants during 2018. These Schedule 832212 10-10-18 (Form 990 or 990-EZ) (2018) 43 Schedule Form 990 or 990-EZ (2018) Name of the organization Liberty Memorial Association d/b/a National WWI Museum and Memorial Page 2 Employer identification number **-***2673 participants, primarily composed of young children, are invited to explore history by handling non-accession items such as helmets and mess kits. Finally, the NWWIMM's support for educators is growing stronger. Through a variety of available educational resources including those generated through an exciting new partnership with Scholastic, the Museum and Memorial set a record with more than 14,500,000 learner participations in 2018. New curriculum is currently being created through the NWWIMM's Teacher Fellowship program as well, which celebrated its seventh year in 2018 by inviting some of the best teachers in the country to develop unique lessons at the NWWIMM which will be posted online. In partnership with the Centennial Commission in Washington D.c., a new nationwide initiative, World War I 360, launched in 2018. The online database was launched in July 2013. In 2018, 4,446 records were digitized and added to the database, raising the total to more than 36,000 items available for public access. Amenities abound to visitors of the Museum and Memorial, including audio guides in three languages plus English, motorized scooters and the acclaimed Over There Cafe. On December 26, 2018 the sixth annual Truce Tournament was held, in partnership with 2013 MLS Champions Sporting KC and The Soccer Lot, featuring a 3v3 soccer tournament held on the parklands of the Museum and Memorial and an English Premier League watch party in the NWWIMM'S 832212 10-10-18 Schedule (Form 990 or 990-EZ) (2018) 44 Schedule O (Form 990 or 990-EZ) (2018) Name of the organization Liberty Memorial Association d/b/a National WWI Museum and Memorial Page 2 Employer identification number **-*** 2673 J.C. Nichols Auditorium. Form 990, Part VI, Section B, line 11b: The Form 990 is reviewed and approved by the Finance Committee prior to filing. A copy of the Form 990 is also made available to the Board of Trustees prior to filing. Form 990, Part VI, Section B, Line 12c: The organization regularly and consistently monitors and enforces compliance with the written conflict of interest policy by obtaining a disclosure form from board members and employees on an annual basis. Any potential conflict of interest for a board member or the President/CEO is referred to the Governance Committee for review. A recommendation of action, if warranted, is presented to the Executive Committee for a final determination. For employees, the President/CEO performs the review and is responsible for determining the appropriate action to be taken. Form 990, Part VI, Section B, Line 15 : The organization determines the amount of compensation for the President/CEO during an annual review by the Executive Committee. Other key employees of the organization undergo an annual review as directed by the President/CEO. A revised performance review process was implemented. Compensation was evaluated using a number of factors, including comparison to similar positions at comparative organzations (comparative based on annual budget, number of employees, industry and geographical location). Compensation was adjusted at certain positions based on this evaluation and merit. Cost of Living Adjustments (COLA) were considered for most positions. 832212 10-10-18 Schedule (Form 990 or 990-EZ) (2018) 45 1 Liberty Memorial Association d/b/a Form 990 (2018) National WWI Museum and Memorial **-***2673 Page 2 Part III Statement of Program Service Accomplishments Check if Schedule o contains a response or note to any line in this part III Briefly describe the organization's mission: The National World War I Museum and Memorial (NWWIMM) is America's museum dedicated to remembering, interpreting, and understanding the Great War and its enduring impact on the global community, by: establishing the Museum as the foremost interpreter and resource for 2 Did the organization undertake any significant program services during the year which were not listed on the prior Form 990 990-EZ? www Yes X No f "Yes, describe these new services on Schedule O. Did the organization cease conducting, or make significant changes in how it conducts, any program services? Yes X No If "Yes," describe these changes on Schedule O. Describe the organization's program service accomplishments for each of its three largest program services, as measured by expenses. Section 501(c)(3) and 501(c)(4) organizations are required to report the amount of grants and allocations to others, the total expenses, and revenue, if any, for each program service reported. 4a (Code (Expenses 4,969,384. including grants et ) (Revenues 3,288,885.) Museum & Memorial Operations : 3 4 ) venues The NWWIMM is a limestone complex built on Memorial Hill, which is adjacent to Penn Valley Park overlooking downtown Kansas City, featuring a 217-ft. tower dedicated in 1926. A capital campaign financed the restoration of the Memorial to its original grandeur in 2004, and the construction of an 80,000-square-foot Museum beneath the courtyard of the Liberty Memorial Tower. Re-opening to the public on December 2, 2006, and designated by the 113th Congress as the National WWI Museun Memorial, the an Memorial presents a comprehensive global interpretation of World War I (1914-1919) and its lasting consequences, providing a vivid and memorable experience for 4b (Code: (Expenses 1,057, 769. Including grunts of Collections Management and Research: The NWWIMM is the nation's only museum solely dedicated to preserving the history and examining the experiences of the Great War. The NWWIMM holds the world's most comprehensive collection of World War (1914-1919) objects artifacts and documents representing each belligerent nation that was involved, is the second-oldest collecting institution in the world and presents a comprehensive global interpretation of World War I and its enduring impact. During the Centennial Commemoration (2014-2019), the NWWIMM is partnering with Kansas City's finest cultural, recreational, and civic (expenses 1,610,523. Including grants of (Revenue $ Community Education Programs : 4c (Code More than 18,700 individuals visited the NWWIMM on school field trips in 2018 including subsidized visits provided by the Museum and Memorial and generous donors for more than 4,400 underserved students from diverse ethnic and socio-economic backgrounds. Subsidized students receive a free lunch and free admission, and the schools are given a stipend to assist with the cost of transportation or substitute teachers. All of these students who visit the Museum and Memorial through a class trip participate in the School at the Museum program, which includes guided tours and focused activities. 4d Other program services (Describe in Schedule O.) (Expenses including grants of Revenues 4e Total program service expenses 7,637,676. Form 990 (2018) 832002 12-31-18 See Schedule o for Continuation(s) 2 210719 310454 08732 2018.04000 LIBERTY MEMORIAL ASSOCIAT 08732_1 Liberty Memorial Association d/b/a Form 990 (2018) National WWI Museum and Memorial **-***2673 Page 7 Part VII Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees, and independent Contractors Check if Schedule o contains a response or note to any line in this Part VII Section A. Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees 1a Complete this table for all persons required to be listed. Report compensation for the calendar year ending with or within the organization's tax year. List all of the organization's current officers, directors, trustees (whether individuals or organizations), regardless of amount of compensation. Enter-O- in columns (D). (E), and (F) if no compensation was paid. List all of the organization's current key employees, if any. See instructions for definition of "key employee." List the organization's five current highest compensated employees (other than an officer, director, trustee, or key employee) who received report- able compensation (Box 5 of Form W-2 and/or Box 7 of Form 1099-MISC) of more than $100,000 from the organization and any related organizations. List all of the organization's former officers, key employees, and highest compensated employees who received more than $100,000 of reportable compensation from the organization and any related organizations. List all of the organization's former directors or trustees that received, in the capacity as a former director or trustee of the organization, more than $10,000 of reportable compensation from the organization and any related organizations. List persons in the following order: individual trustees or directors; institutional trustees, officers; key employees; highest compensated employees; and former such persons. Check this box if neither the organization nor any related organization compensated any current officer director, or trustee. (A) (B) (C) (D) (E) (F) Name and Title Average Position (do not check more than one Reportable Reportable Estimated hours per box, unless person is both an compensation compensation amount of week officer and a director frusteel from from related other (list any the organizations compensation hours for organization (W-2/1099-MISC) from the related (W-2/1099-MISC) organization organizations and related below organizations line) (1) Mark Jorgenson 1.00 Board Member X 0. 0. 0. (2) Kevin J Rooney 2.00 Treasurer/Board Member x X 0. 0. 0. (3) Elaine Drodge Koch 2.00 Vice Chair/Board Member x X 0. 0. 0. Brad Bergman 1.00 Board Member X 0. 0. 0. (5) Emanuel Cleaver IT 1.00 Board Member x 0. 0. 0. (6) Dan Crumb 1.00 Board Member x 0. 0. 0. (7) Peter J desilva 1.00 Board Member 0. 0. (8) Mark Henderson 3.00 Chair/Board Member X 0. 0. (9) Mary Jane Judy 1.00 Board Member X 0. 0. 0. (10) Gordon Lansford 1.00 Board Member 0. 0. 0. (11) David Mecklenburg 1.00 her Board Member X 0. 0. 0. (12) Marty Nevshemal 1.00 ha Board Member X 0. 0. 0. - (13) Kent Sunderland 1.00 Board Member X 0. 0. 0. an (14) Scott Van Genderen 1.00 Board Member X 0. 0. 0. (15) Julie Wilson 1.00 Board Member X cice 0. 0. 0. (16) Richard B Young, Jr 1.00 Board Member x 0. 0. 0. (17) Teresa Rynard 1.00 Director/Kansas City Parks 0. 0. 0. 932007 12-31-18 Form 990 (2018) 7 210719 310454 08732 2018.04000 LIBERTY MEMORIAL ASSOCIAT 08732 (4) 0. 0. 1 Individual trustee or director Institutional truste ay employee Officer employee Liberty Memorial Association d/b/a Form 990 (2018) National WWI Museum and Memorial **-***2673 Page 8 Part VII Section A. Officers, Directors, Trustees, Key Employees, and Highest Compensated Employees (continued) (A) (B) (C) (D) (E) (F) Name and title Average Position (do not check more than one Reportable Reportable Estimated hours per box, unless person is both an compensation compensation amount of week officer and a director/trustee) from from related other (list any the organizations compensation hours for organization (W-2/1099-MISC) from the related (W-2/1099-MISC) organization organizations and related below organizations line) (18) Dave Ebbrecht 1.00 Board Member X 0 0. 0. (19) Andrea Hendricks 1.00 Board Member X 0 0 0. (20) Tim Kristl 1.00 Board Member X 0. 0. 0. (21) Ram Shankar 2.00 Secretary/Board Member X 0 0. 0. (22) John Sherman 1.00 Board Member X 0. 0. 0. (23) Matthew C Naylor 40.00 President/CEO x 315,000. 0. 17,020. (24) Michael L House 40.00 Senior Vice President X 151,600. 0. 17,076. 4 5 1b Sub-total 466,600. 0. 34,096. c Total from continuation sheets to Part VII, Section A 0. 0. 0. d Total (add lines 1b and 10........ 466,600. 0. 34,096. 2 Total number of individuals (including but not limited to those listed above) who received more than $100,000 of reportable compensation from the organization 3 Yes No 3 Did the organization list any former officer, director, or trustee, key employee, or highest compensated employee on line 1a? if "Yes," complete Schedule J for such individual 3 X For any individual listed on line 1a, is the sum of reportable compensation and other compensation from the organization and related organizations greater than $150,000? If "Yes," complete Schedule J for such individual 4 X 5 Did any person listed on line 1a receive or accrue compensation from any unrelated organization or individual for services rendered to the organization? If "Yes." complete Schedule J for such person ....... X Section B. Independent Contractors 1 Complete this table for your five highest compensated independent contractors that received more than $100,000 of compensation from the organization. Report compensation for the calendar year ending with or within the organization's tax year. (A) (B) (C) Name and business address Description of services Compensation JE Dunn Construction Construction 1001 Locust Street, Kansas City, MO 64106 services 2,287,677. Scholastic Educational PO Box 416851, Boston, MA 02241 materials 393,895. Allied Barton Security Services LLC PO Box 828854, Philadelphia, PA 19182 Security services 282,872. Minnesota Elevator Inc Elevator design, PO Box 129, St. Clair, MN 56080 build and repair 282,030. Tessitura Network, Inc PO Box 203410, Dallas, TX 75320 software services 264,093. 2 Total number of independent contractors (including but not limited to those listed above) who received more than $100,000 of compensation from the organization 9 Form 990 (2018) 83200B 12-31-18 8 210719 310454 08732 2018.04000 LIBERTY MEMORIAL ASSOCIAT 08732 **-*** 2673 Page 9 (C) Unrelated business revenue (D) Revenue excluded from tax under 512 - 514 sections 1a Contributions, Gifts, Grants and Other Similar Amounts Liberty Memorial Association d/b/a Form 990 (2018) National WWI Museum and Memorial Part VIII Statement of Revenue Check if Schedule o contains a response or note to any line in this Part VIII (A) (B) Total revenue Related or exempt function revenue 1 a Federated campaigns b Membership dues 1b 210, 775. c Fundraising events 1c 960, 863 d Related organizations 1d e Government grants (contributions) 1e 816,344. f All other contributions, gifts, grants, and similar amounts not included above 16 4,077,781. g Nancash contributions Included in lines 1a-16: $ h Total. Add lines 1a-1f 6,065, 763. Business Code 2 a Admissions 900099 3,107,044. 3,107,044. b Museum programs 900099 181,841. 181, 841. Program Service Revenu e 3,288,885. 70,018, 70,018. 163,777. 163,777. f All other program service revenue 9 Total. Add lines 2a-2f 3 Investment income (including dividends, interest, and other similar amounts) 4 Income from investment of tax-exempt bond proceeds 5 Royalties O Real W Personal 6 a Gross rents b Less: rental expenses ......... c Rental income or (loss) d Net rental income or (loss) 7 a Gross amount from sales of (1) Securities (ii) Other assets other than inventory 1,071,273. b Less: cost or other basis and sales expenses 907, 496. c Gain or loss) 163,777. d Net gain or loss) 8 a Gross income from fundraising events (not including $ 960,863, of contributions reported on line 1c). See Part IV, line 18 54,571. b Less: direct expenses b 19,576. c Net income or (loss) from fundraising events 9 a Gross income from gaming activities. See Part I, line 19 b Less: direct expenses c Net income or loss) from gaming activities 10 a Gross sales of inventory, less returns and allowances 814,684. b Less: cost of goods sold b 369,958. c Net income or loss from sales of inventory Miscellaneous Revenue Business Code 11 a b Other Revenue a 34,995. 34,995. b 444,726. 444,726. d All other revenue e Total. Add lines 11a-11d Total revenue. See instructions 12 10,068, 164, 3,288,885. 0. 713,516. Form 990 (2018) 832009 12-31-18 Page 10 Liberty Memorial Association d/b/a Form 990 (2018) National WWI Museum and Memorial **_*** 2673 Part IX Statement of Functional Expenses Section 501(c) 3) and 501(c)(4) organizations must complete all columns. All other organizations must complete column A). Check if Schedule o contains a response or note to any line in this part IX Do not include amounts reported on lines 6b, (A) (B) (C) (D) Total expenses Program service Management and Fundraising 7b, 8b, 9b, and 10b of Part VIII. expenses general expenses expenses 1 Grants and other assistance to domestic organizations and domestic governments. See Part IV, line 21 2 Grants and other assistance to domestic individuals. See Part IV, line 22 3 Grants and other assistance to foreign organizations, foreign governments, and foreign individuals. See Part IV, lines 15 and 16 4 Benefits paid to or for members 127,768. 127,768. 5 Compensation of current officers, directors, trustees, and key employees 848,514. 509,109. 254,554. 84,851. 6 Compensation not included above, to disqualified persons (as defined under section 4958(1)(1)) and persons described in section 4958(c)(3)(B) 7 Other salaries and wages 1,742,434. 1,463,035. 135,986. 143,413. 8 Pension plan accruals and contributions (include section 401(k) and 403(b) employer contributions) 135,342. 119,101. 10,692. 5,549. 9 Other employee benefits 307,344. 238,735. 43,088. 25,521 10 Payroll taxes 192,930. 151,776. 24,133. 17,021. 11 Fees for services (non-employees): a Management b Legal 37,157. 1,858. 33, 441. 1,858. c Accounting 16,100. 805. 14,490. 805. d Lobbying e Professional fundraising services. See Part IV, line 17 117,543. 117,543. f Investment management fees 14,180. 14,180. g Other. (If line 11g amount exceeds 10% of line 25, column (A) amount, list line 11g expenses on Sch O.) 609,943. 489,790. 117,772. 2,381. 12 Advertising and promotion 346,907. 294, 271. 2,500. 50,136. 13 Office expenses 62,504. 56,358. 4,719. 1,427. 14 Information technology 335,882. 335, 187. 535. 160. 15 Royalties 16 Occupancy 662,666. 662,666. 17 Travel 72,958. 43,439. 29,447. 72. 18 Payments of travel or entertainment expenses for any federal, state, or local public officials 19 Conferences, conventions, and meetings 29,423. 11,137. 12,472. 5,814. 20 Interest 21 Payments to affiliates 22 Depreciation, depletion, and amortization 656,987. 656,987 23 Insurance 80,098. 75, 270. 3,314. 1,514. 24 Other expenses. Itemize expenses not covered above. (List miscellaneous expenses in line 24e. If line 24e amount exceeds 10% of line 25, column (A) amount, list line 24e expenses on Schedule 0.) Educational expenses 890,562. 888,901. 535. 1,126. b Repairs and maintenance 697,048. 697,028. 7. 13. c Programs, artifact acqu 437, 171. 437,171. d Printing fees 133,985. 88,782. 50. 45,153. e All other expenses 450,100. 288,502. 49,798. 111,800. 25 Total functional expenses. Add lines 1 through 24e 9,005,546. 7,637,676. 751, 713. 616,157. 26 Joint costs. Complete this line only if the organization reported in column (B) joint costs from a combined educational campaign and fundraising solicitation. Check here Diffollowing SOP 98-2 (ASC 958-720) 832010 12-31-18 Form 990 (2018) 10 Assets Liberty Memorial Association d/b/a Form 990 (2018) National WWI Museum and Memorial **-*** 2673 Page 11 Part X Balance Sheet Check if Schedule O contains a response or note to any line in this part X (A) (B) Beginning of year End of year 1 Cash -non-interest-bearing 164, 331. 1 674,492. 2 Savings and temporary cash investments 3,326,315. 2 4,609,892. 3 Pledges and grants receivable, net 3,276,244. 3 2,698,717. 4 Accounts receivable, net 178,283.4 316,814. 5 Loans and other receivables from current and former officers, directors, trustees, key employees, and highest compensated employees. Complete Part II of Schedule L 6 Loans and other receivables from other disqualified persons (as defined under section 4958(1)(1)), persons described in section 4958(c)(3)(B), and contributing employers and sponsoring organizations of section 501(C)(9) voluntary employees' beneficiary organizations (see instr). Complete Part II of SchL 6 7 Notes and loans receivable, net 7 8 Inventories for sale or use 139,351. 8 155,075. 9 Prepaid expenses and deferred charges 66,630. 9 79,680. 10a Land, buildings, and equipment: cost or other basis. Complete Part VI of Schedule D 10a 15, 288, 218. b Less: accumulated depreciation 10b 5,431,464. 10,126 , 219 10c 9,856,754. 11 Investments - publicly traded securities 4,174,986. 11 3,658,460. 12 Investments - other securities. See Part IV, line 11 12 13 Investments - program-related. See Part IV, line 11 13 14 Intangible assets 14 15 Other assets. See Part IV, line 11 15 16 Total assets. Add lines 1 through 15 (must equal line 34) 21,452 ,359. 16 22,049,884. 17 Accounts payable and accrued expenses 353,825. 17 320,913. 18 Grants payable 18 19 Deferred revenue 239, 308. 19 221,803. 20 Tax-exempt bond liabilities 20 21 Escrow or custodial account liability. Complete Part IV of Schedule D 21 22 Loans and other payables to current and former officers, directors, trustees, key employees, highest compensated employees, and disqualified persons. Complete Part II of ScheduleL 22 23 Secured mortgages and notes payable to unrelated third parties 23 24 Unsecured notes and loans payable to unrelated third parties 24 25 Other liabilities (including federal income tax, payables to related third parties, and other liabilities not included on lines 17-24). Complete Part X of Schedule D 25 26 Total liabilities. Add lines 17 throu