Answer the following questions;

*Develop a monthly cash budget for Bluffton Pharmacy for the upcoming year.

*What recommendation can you offer Angela Crawford and Martin Rodriguez to improve their pharmacy cash flow?

* If you were Bluffton Pharmacy's banker, would you be comfortable extending a line of credit to the pharmacy?

Write a 1-2 page paper detailing the above questions , and be sure to cite your reference.

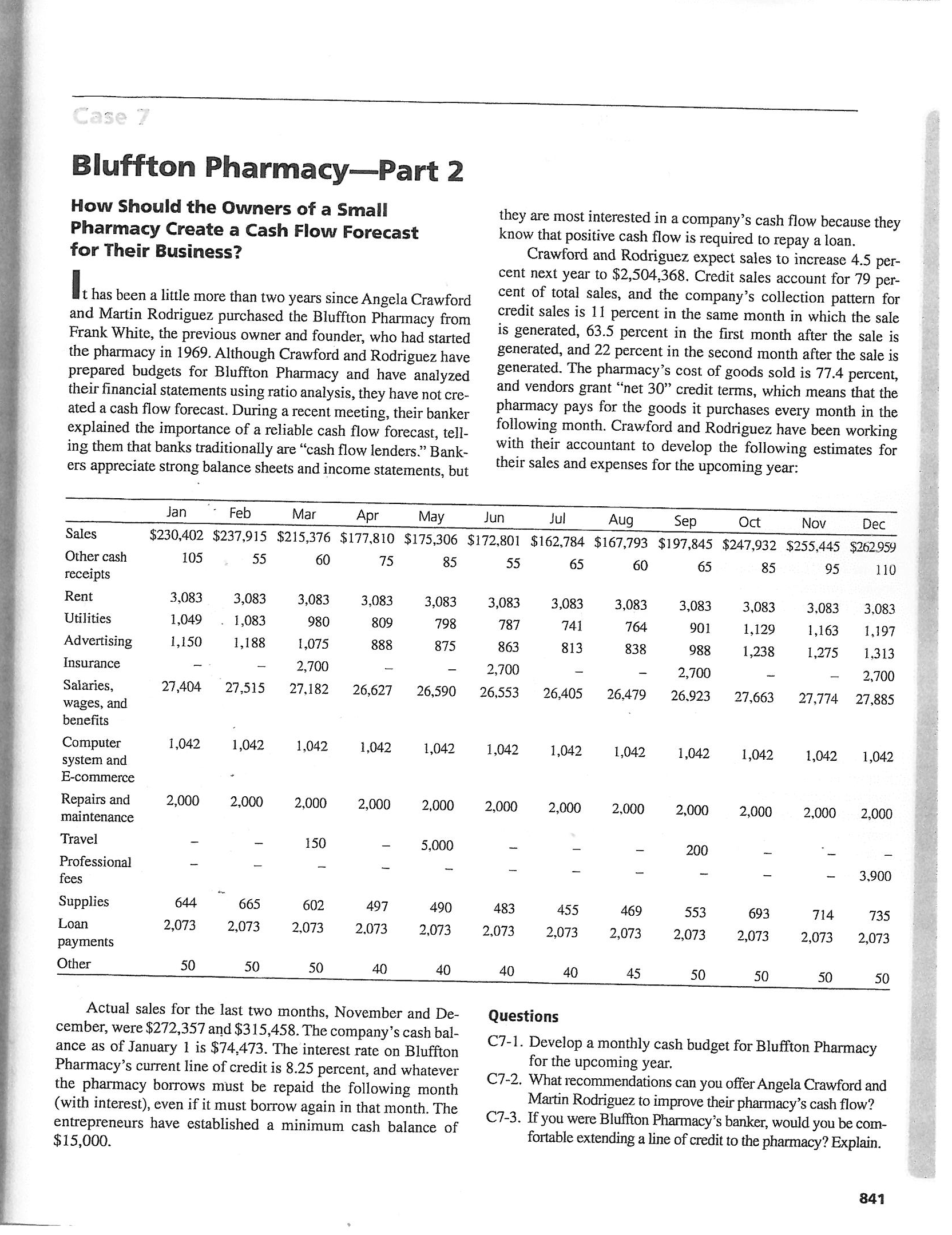

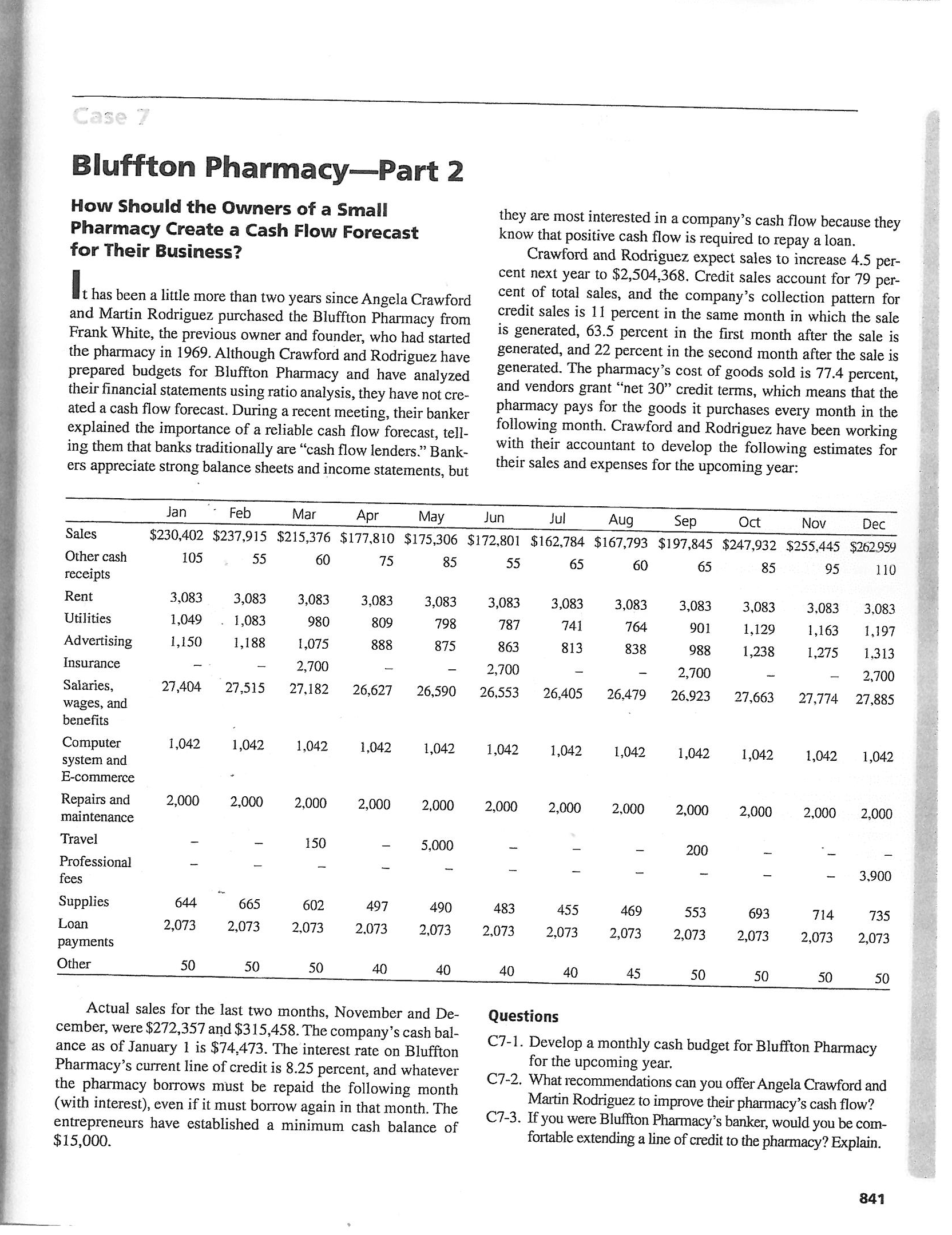

Bluff ton Pharmacy--Part 2 How Should the Owners of a Small Pharmacy Create a Cash Flow Forecast for Their Business? It has been a little more than two years since Angela Crawford and Martin Rodriguez purchased the Bluffton Pharmacy from Frank White, the previous owner and founder, who had started the pharmacy in 1969. Although Crawford and Rodriguez have prepared budgets for Bluffton Pharmacy and have analyzed their financial statements using ratio analysis, they have not created a cash flow forecast. During a recent meeting, their banker explained the importance of a reliable cash flow forecast, telling them that banks traditionally are "cash flow lenders." Bankers appreciate strong balance sheets and income statements, but they are most interested in a company's cash flow because they know that positive cash flow is required to repay a loan. Crawford and Rodriguez expect sales to increase 4.5 percent next year to $2,504,368. Credit sales account for 79 percent of total sales, and the company's collection pattern for credit sales is 11 percent in the same month in which the sale is generated, 63.5 percent in the first month after the sale is generated, and 22 percent in the second month after the sale is generated. The pharmacy's cost of goods sold is 77.4 percent, and vendors grant "net 30" credit terms, which means that the pharmacy pays for the goods it purchases every month in the following month. Crawford and Rodriguez have been working with their accountant to develop the following estimates for their sales and expenses for the upcoming year: Actual sales for the last two months, November and December, were $272,357 and $315,458. The company's cash balance as of January 1 is $74,473. The interest rate on Bluffton Pharmacy's current line of credit is 8.25 percent, and whatever the pharmacy borrows must be repaid the following month (with interest), even if it must borrow again in that month. The entrepreneurs have established a minimum cash balance of $15,000. Questions Develop a monthly cash budget for Bluffton Pharmacy for the upcoming year. What recommendations can you offer Angela Crawford and Martin Rodriguez to improve their pharmacy's cash flow? If you were Bluffton Pharmacy's banker, would you be comfortable extending a line of credit to the pharmacy? Explain. Bluff ton Pharmacy--Part 2 How Should the Owners of a Small Pharmacy Create a Cash Flow Forecast for Their Business? It has been a little more than two years since Angela Crawford and Martin Rodriguez purchased the Bluffton Pharmacy from Frank White, the previous owner and founder, who had started the pharmacy in 1969. Although Crawford and Rodriguez have prepared budgets for Bluffton Pharmacy and have analyzed their financial statements using ratio analysis, they have not created a cash flow forecast. During a recent meeting, their banker explained the importance of a reliable cash flow forecast, telling them that banks traditionally are "cash flow lenders." Bankers appreciate strong balance sheets and income statements, but they are most interested in a company's cash flow because they know that positive cash flow is required to repay a loan. Crawford and Rodriguez expect sales to increase 4.5 percent next year to $2,504,368. Credit sales account for 79 percent of total sales, and the company's collection pattern for credit sales is 11 percent in the same month in which the sale is generated, 63.5 percent in the first month after the sale is generated, and 22 percent in the second month after the sale is generated. The pharmacy's cost of goods sold is 77.4 percent, and vendors grant "net 30" credit terms, which means that the pharmacy pays for the goods it purchases every month in the following month. Crawford and Rodriguez have been working with their accountant to develop the following estimates for their sales and expenses for the upcoming year: Actual sales for the last two months, November and December, were $272,357 and $315,458. The company's cash balance as of January 1 is $74,473. The interest rate on Bluffton Pharmacy's current line of credit is 8.25 percent, and whatever the pharmacy borrows must be repaid the following month (with interest), even if it must borrow again in that month. The entrepreneurs have established a minimum cash balance of $15,000. Questions Develop a monthly cash budget for Bluffton Pharmacy for the upcoming year. What recommendations can you offer Angela Crawford and Martin Rodriguez to improve their pharmacy's cash flow? If you were Bluffton Pharmacy's banker, would you be comfortable extending a line of credit to the pharmacy? Explain