Question

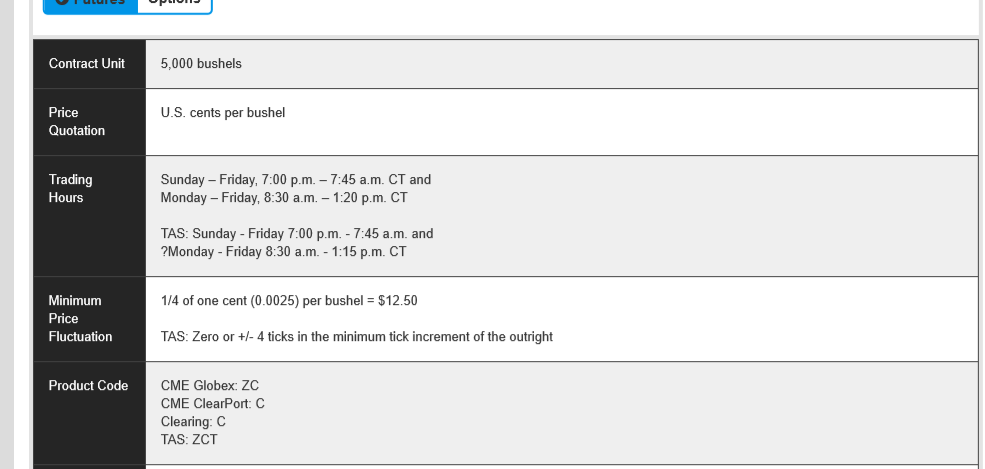

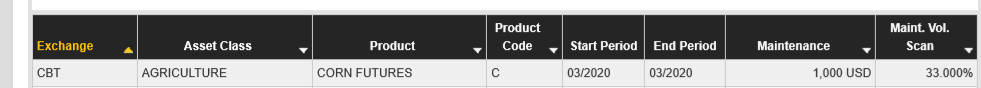

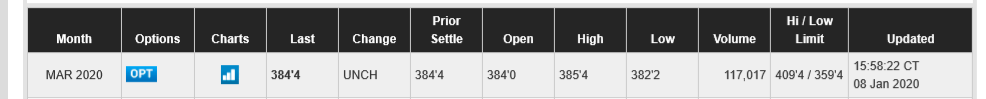

Answer the following questions for Hw1-Exhibit2 (Corn) (25 points) use March 2020 quotations Assume that you short one corn future and you only deposit money

Answer the following questions for Hw1-Exhibit2 (Corn) (25 points) use March 2020 quotations

Assume that you short one corn future and you only deposit money equal to the initial margin (assume initial margin is 10% greater than the maintenance margin) what is your account balance for the following days: (please mention if any deposits were made and how much)

1. Day 0 (today) 2. Day 1 closing futures price declined by 5% 3. Day 2 closing futures price declined by 2.5% 4. Day 3 closing futures price increased by 5% 5. Day 4 closing futures price declined by 5%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started