Answer the following questions for Intel

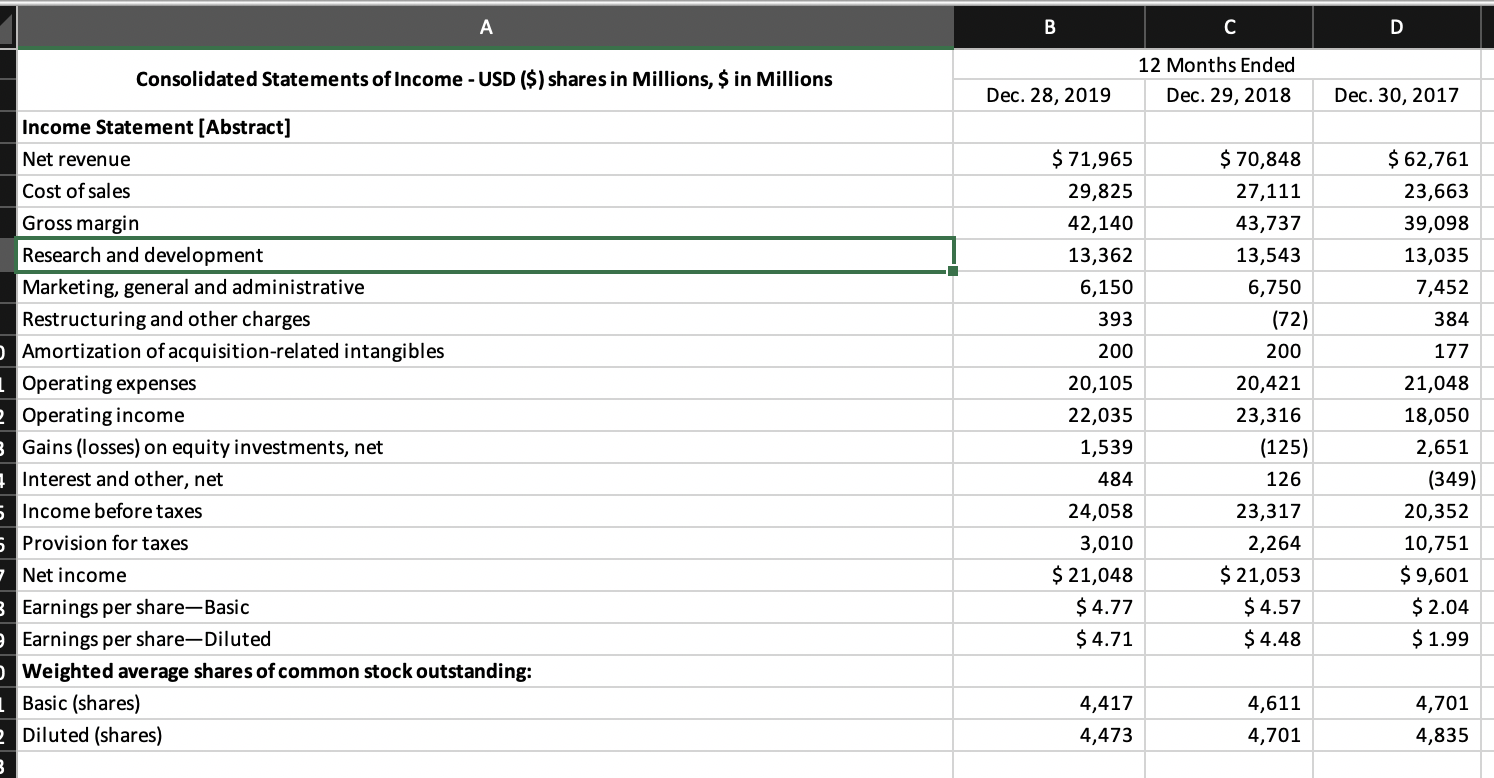

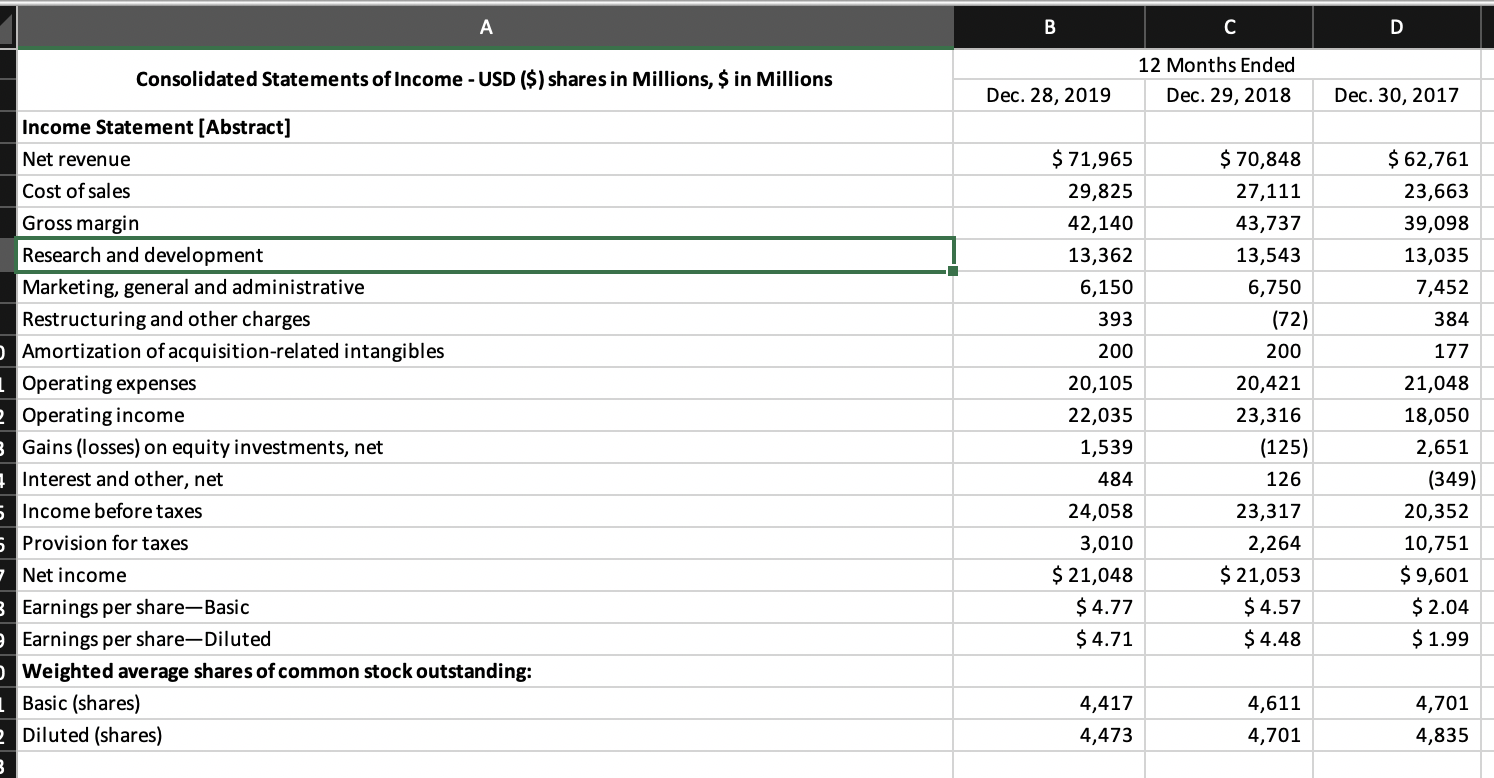

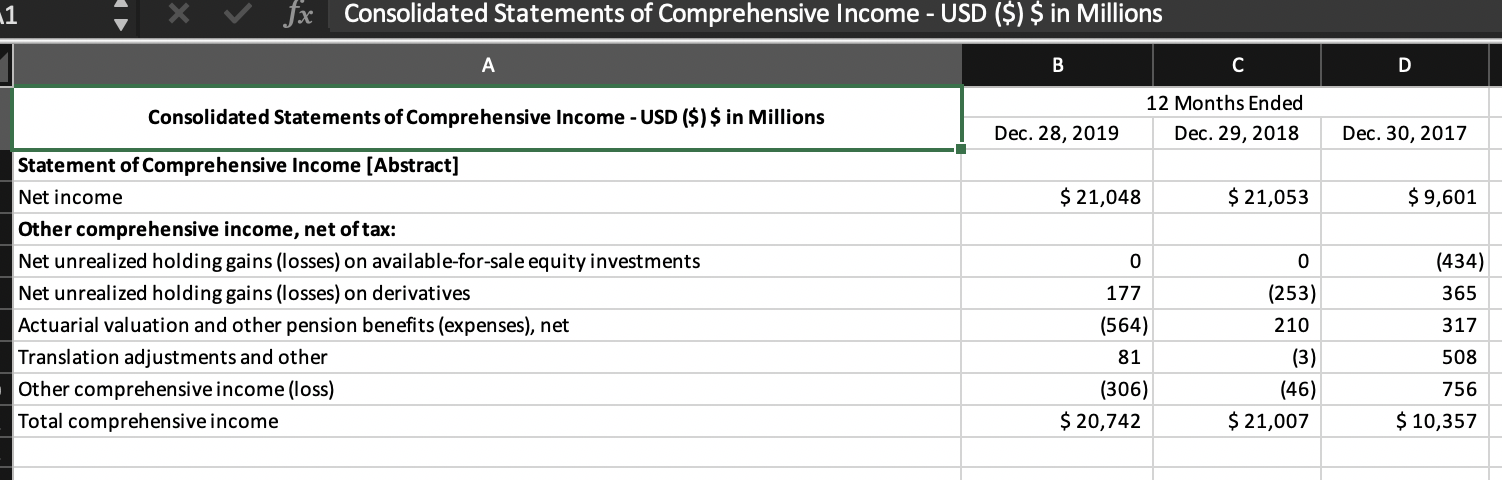

(a) Using the Consolidated Statements of Income (or Operations), analyze the profitability of by preparing a common-size income statement for the past six years. In addition, calculate sales growth and operating expense growth for each two year period (2018 vs 2017, 2017 vs 2016 etc) presented, as well as effective tax rates for all years.

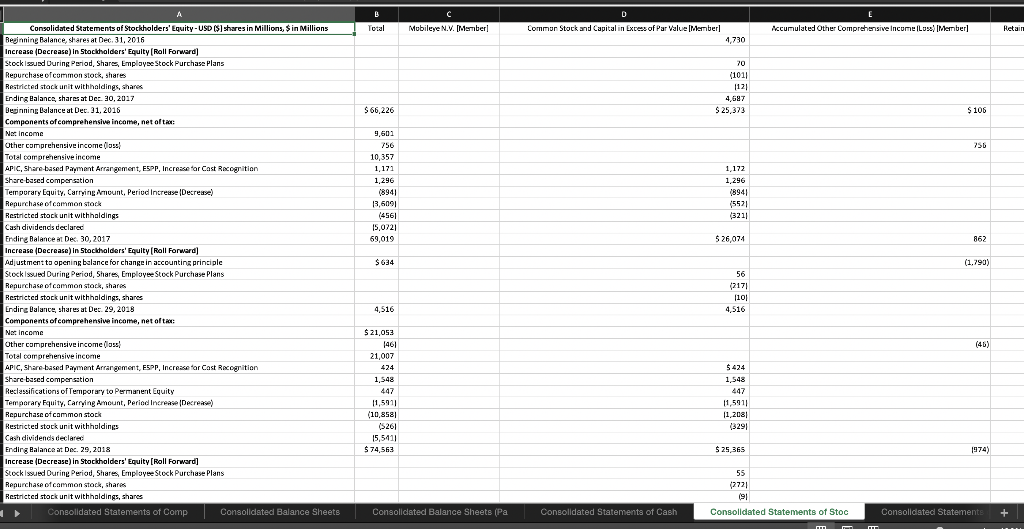

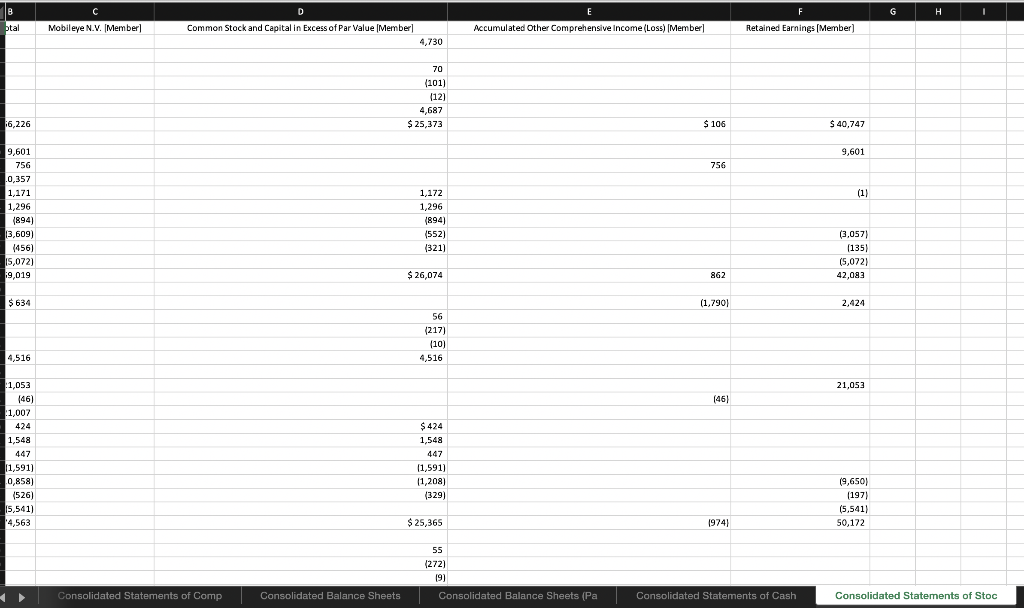

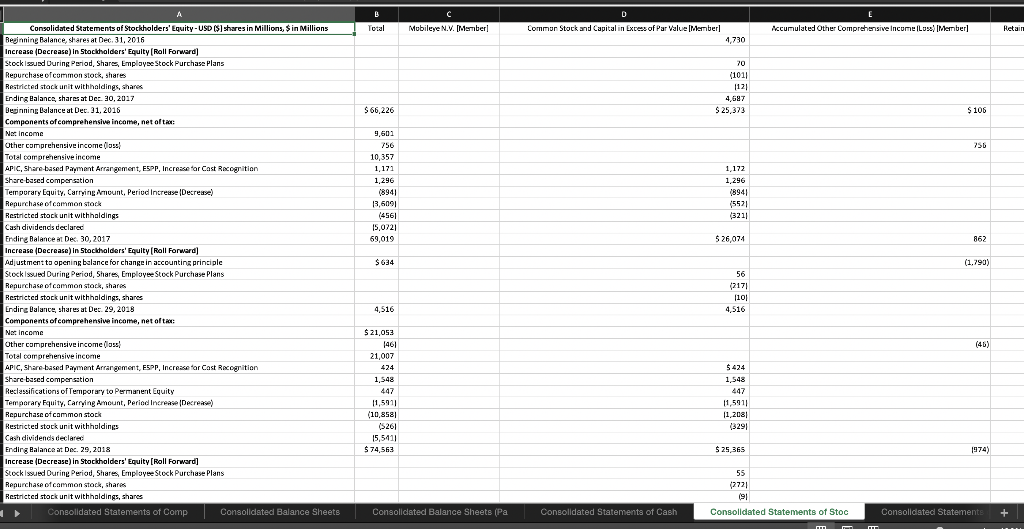

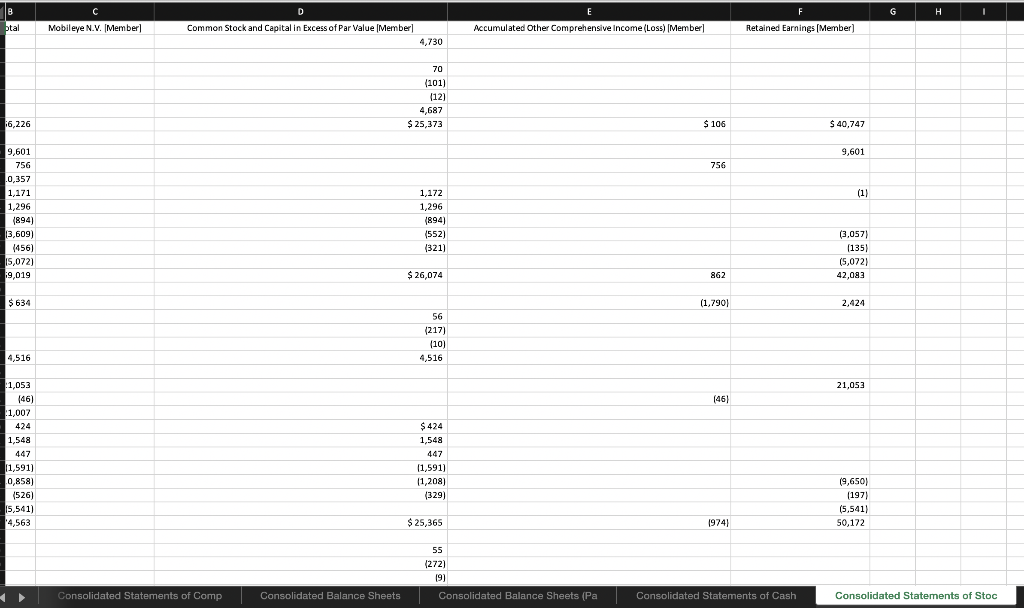

(b) Using the consolidated Statements of Stockholders Equity, explain the key reasons for the changes in the common stock, accumulated other comprehensive income, and retained earnings accounts. Evaluate these changes.

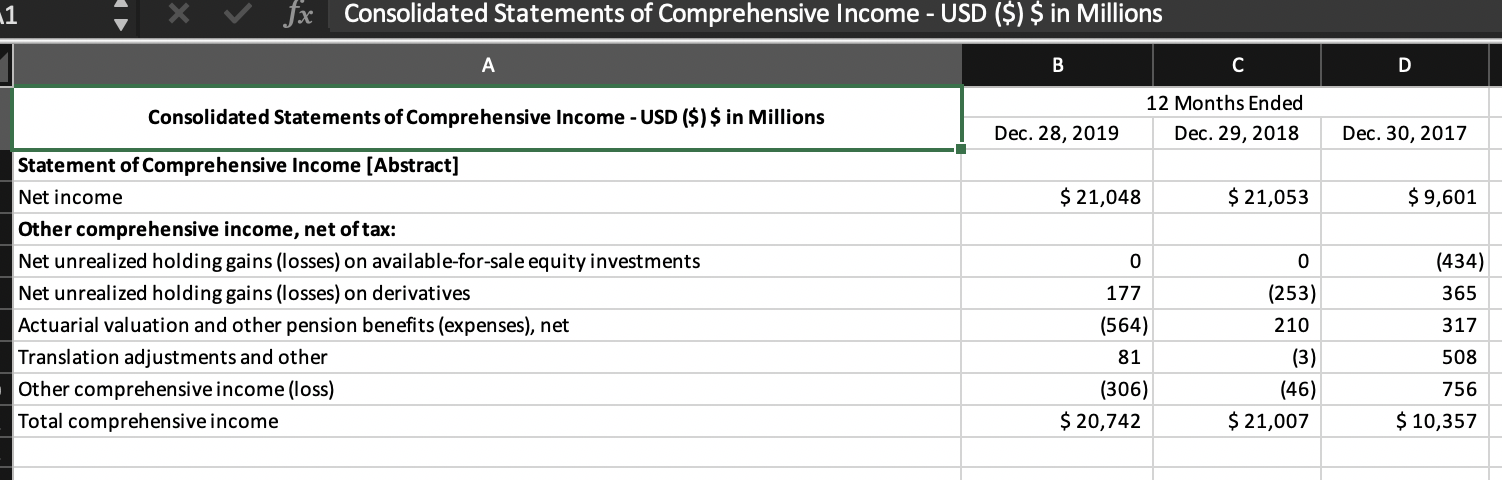

A B C D Consolidated Statements of Income - USD ($) shares in Millions, $ in Millions 12 Months Ended Dec. 29, 2018 Dec. 28, 2019 Dec. 30, 2017 $ 71,965 29,825 42,140 13,362 6,150 393 200 Income Statement(Abstract] Net revenue Cost of sales Gross margin Research and development Marketing, general and administrative Restructuring and other charges Amortization of acquisition-related intangibles 1 Operating expenses - Operating income Gains (losses) on equity investments, net 1 Interest and other, net Income before taxes 5 Provision for taxes Net income 3 Earnings per share-Basic Earnings per share-Diluted Weighted average shares of common stock outstanding: Basic (shares) 2 Diluted (shares) 20,105 22,035 1,539 484 24,058 3,010 $ 21,048 $ 4.77 $ 4.71 $ 70,848 27,111 43,737 13,543 6,750 (72) 200 20,421 23,316 (125) 126 23,317 2,264 $ 21,053 $ 4.57 $ 4.48 $62,761 23,663 39,098 13,035 7,452 384 177 21,048 18,050 2,651 (349) 20,352 10,751 $ 9,601 $2.04 $ 1.99 4,417 4,473 4,611 4,701 4,701 4,835 3 1 fx Consolidated Statements of Comprehensive Income - USD ($) $ in Millions A B Consolidated Statements of Comprehensive Income - USD ($) $ in Millions 12 Months Ended Dec. 29, 2018 Dec. 28, 2019 Dec. 30, 2017 $ 21,048 $ 21,053 $ 9,601 0 0 Statement of Comprehensive Income (Abstract] Net income Other comprehensive income, net of tax: Net unrealized holding gains (losses) on available-for-sale equity investments Net unrealized holding gains (losses) on derivatives Actuarial valuation and other pension benefits (expenses), net Translation adjustments and other Other comprehensive income (loss) Total comprehensive income 177 (434) 365 317 (253) 210 (3) (46) $ 21,007 (564) 81 (306) $ 20,742 508 756 $ 10,357 B D C Mobileye N.V. Member E Accumulated Other Comprehensive Income Los) Mernber] Total Commor Stock and Capital in excess of Par Value Member Retail 4,730 20 (1011 1121 4.697 $ 25,373 $ 66,226 $ 106 256 9,602 756 10,357 1,171 1,296 (8941 13,6091 (456) 15,0721 69,019 1.172 1,296 (8941 (5521 3211 $ 26,074 862 $634 (1.790) Consolidated Statements of Stockholders' Equity - USD ($) shares in Millions, Sin Millions Beginning Balance, shares at Dec 31, 2016 Increase (Decrease) In Stockholders' Equity (Roll Forward) Stock Issued During period, Shares, Employee Stock Purchase Plans Repurchaseofcommon stock, shares Restricted stack unit withholdings, shares Erding Balance shares at Dec 30, 2017 Beginning balance at Dec 31, 2016 Components of comprehensive income, net oftar Nec income Other comprehensive income on! Total comprehensive income APIC, Share based Payment Arrangement, EPP, Increase for Cast Recognition Share based compensation Temporary Equity, Carrying mount, Period Increase Decrease) Repurchase of common stock Restricted stock unit withholdings Cash dividends declared Erdire Balance at Dec 30, 2017 Increase (Decrease) in Stockholders' Equity (Roll Forward Adjustments opening balance for change in accounting principle Stock Issued During Period, Shares Employee Stock Purchase Plans Repurchase of common stock, shares Restricted stock unit withholdings, shares Endirg Balance shares at Dec 29, 2018 Components of comprehensive income, net ofte Net Income Other comprehensive income Total comprehensive income APIC, Share-based Payment Arrangement, ESPP, Increase for Cast Recognition Share based compensation Reclassifications of Temporary to Permanent Equity Temporary Equity, Carrying amount, Period Increase Decreas) Repurchase of common stock Restricted stock unit withholdings Cash dividends declared Ending Balance at Dec 29, 2018 Increase (Decrease) in Stockholders' Equity [Roll Forward] Stock Issued During Period, Shares Employee Stock Purchase Plans Repurchase of common stock, shares Restricted stock unit withholdings, shares Consolidated Statements of Comp Consolidated Balance Sheets 56 2171 1101 4,516 4,516 (46) $ 424 $21,053 1461 21.007 424 1,548 447 11,5911 (10,8581 (5261 15,5411 $ 74,563 1,548 447 11.5911 11,2081 (3291 $ 25,365 1974) 55 (2721 (91 Consolidated Statements of Stoc Consolidated Balance Sheets (Pa Consolidated Statements of Cash Consolidated Statement + MI B D E F G . C Mobileye N.V. Member btal Common Stock and Capital in Excess of Par Value Member Accumulated Other Comprehensive Income (Loss) Member Retained Earnings (Member) 4,730 70 (101) (12) 4,687 $ 25,373 16,226 $ 106 $ 40,747 9,601 756 (1) 9,601 756 0,357 1,171 1,296 (894) 3,609) (456) 15,072) 19,019 1,172 1,296 (894) (552) (321) (3,057) (135) (5,0721 42,083 $ 26,074 862 $ 634 (1,7901 2,424 56 (217) (10) 4,516 4,516 21,053 (46) 1,053 146) 1,007 424 1.548 447 11,591) 0,858) (526) 15,541) 14,563 $ 424 1,548 447 (1,591) 11,208) (329) (9,650) (1971 (5,5411 50,172 $ 25,365 19741 55 (272) 19) Consolidated Balance Sheets (Pa Consolidated Statements of Comp Consolidated Balance Sheets Consolidated Statements of Cash Consolidated Statements of Stoc A B C D Consolidated Statements of Income - USD ($) shares in Millions, $ in Millions 12 Months Ended Dec. 29, 2018 Dec. 28, 2019 Dec. 30, 2017 $ 71,965 29,825 42,140 13,362 6,150 393 200 Income Statement(Abstract] Net revenue Cost of sales Gross margin Research and development Marketing, general and administrative Restructuring and other charges Amortization of acquisition-related intangibles 1 Operating expenses - Operating income Gains (losses) on equity investments, net 1 Interest and other, net Income before taxes 5 Provision for taxes Net income 3 Earnings per share-Basic Earnings per share-Diluted Weighted average shares of common stock outstanding: Basic (shares) 2 Diluted (shares) 20,105 22,035 1,539 484 24,058 3,010 $ 21,048 $ 4.77 $ 4.71 $ 70,848 27,111 43,737 13,543 6,750 (72) 200 20,421 23,316 (125) 126 23,317 2,264 $ 21,053 $ 4.57 $ 4.48 $62,761 23,663 39,098 13,035 7,452 384 177 21,048 18,050 2,651 (349) 20,352 10,751 $ 9,601 $2.04 $ 1.99 4,417 4,473 4,611 4,701 4,701 4,835 3 1 fx Consolidated Statements of Comprehensive Income - USD ($) $ in Millions A B Consolidated Statements of Comprehensive Income - USD ($) $ in Millions 12 Months Ended Dec. 29, 2018 Dec. 28, 2019 Dec. 30, 2017 $ 21,048 $ 21,053 $ 9,601 0 0 Statement of Comprehensive Income (Abstract] Net income Other comprehensive income, net of tax: Net unrealized holding gains (losses) on available-for-sale equity investments Net unrealized holding gains (losses) on derivatives Actuarial valuation and other pension benefits (expenses), net Translation adjustments and other Other comprehensive income (loss) Total comprehensive income 177 (434) 365 317 (253) 210 (3) (46) $ 21,007 (564) 81 (306) $ 20,742 508 756 $ 10,357 B D C Mobileye N.V. Member E Accumulated Other Comprehensive Income Los) Mernber] Total Commor Stock and Capital in excess of Par Value Member Retail 4,730 20 (1011 1121 4.697 $ 25,373 $ 66,226 $ 106 256 9,602 756 10,357 1,171 1,296 (8941 13,6091 (456) 15,0721 69,019 1.172 1,296 (8941 (5521 3211 $ 26,074 862 $634 (1.790) Consolidated Statements of Stockholders' Equity - USD ($) shares in Millions, Sin Millions Beginning Balance, shares at Dec 31, 2016 Increase (Decrease) In Stockholders' Equity (Roll Forward) Stock Issued During period, Shares, Employee Stock Purchase Plans Repurchaseofcommon stock, shares Restricted stack unit withholdings, shares Erding Balance shares at Dec 30, 2017 Beginning balance at Dec 31, 2016 Components of comprehensive income, net oftar Nec income Other comprehensive income on! Total comprehensive income APIC, Share based Payment Arrangement, EPP, Increase for Cast Recognition Share based compensation Temporary Equity, Carrying mount, Period Increase Decrease) Repurchase of common stock Restricted stock unit withholdings Cash dividends declared Erdire Balance at Dec 30, 2017 Increase (Decrease) in Stockholders' Equity (Roll Forward Adjustments opening balance for change in accounting principle Stock Issued During Period, Shares Employee Stock Purchase Plans Repurchase of common stock, shares Restricted stock unit withholdings, shares Endirg Balance shares at Dec 29, 2018 Components of comprehensive income, net ofte Net Income Other comprehensive income Total comprehensive income APIC, Share-based Payment Arrangement, ESPP, Increase for Cast Recognition Share based compensation Reclassifications of Temporary to Permanent Equity Temporary Equity, Carrying amount, Period Increase Decreas) Repurchase of common stock Restricted stock unit withholdings Cash dividends declared Ending Balance at Dec 29, 2018 Increase (Decrease) in Stockholders' Equity [Roll Forward] Stock Issued During Period, Shares Employee Stock Purchase Plans Repurchase of common stock, shares Restricted stock unit withholdings, shares Consolidated Statements of Comp Consolidated Balance Sheets 56 2171 1101 4,516 4,516 (46) $ 424 $21,053 1461 21.007 424 1,548 447 11,5911 (10,8581 (5261 15,5411 $ 74,563 1,548 447 11.5911 11,2081 (3291 $ 25,365 1974) 55 (2721 (91 Consolidated Statements of Stoc Consolidated Balance Sheets (Pa Consolidated Statements of Cash Consolidated Statement + MI B D E F G . C Mobileye N.V. Member btal Common Stock and Capital in Excess of Par Value Member Accumulated Other Comprehensive Income (Loss) Member Retained Earnings (Member) 4,730 70 (101) (12) 4,687 $ 25,373 16,226 $ 106 $ 40,747 9,601 756 (1) 9,601 756 0,357 1,171 1,296 (894) 3,609) (456) 15,072) 19,019 1,172 1,296 (894) (552) (321) (3,057) (135) (5,0721 42,083 $ 26,074 862 $ 634 (1,7901 2,424 56 (217) (10) 4,516 4,516 21,053 (46) 1,053 146) 1,007 424 1.548 447 11,591) 0,858) (526) 15,541) 14,563 $ 424 1,548 447 (1,591) 11,208) (329) (9,650) (1971 (5,5411 50,172 $ 25,365 19741 55 (272) 19) Consolidated Balance Sheets (Pa Consolidated Statements of Comp Consolidated Balance Sheets Consolidated Statements of Cash Consolidated Statements of Stoc