Answer the following questions. Include working notes for the working. Kindly address all questions.

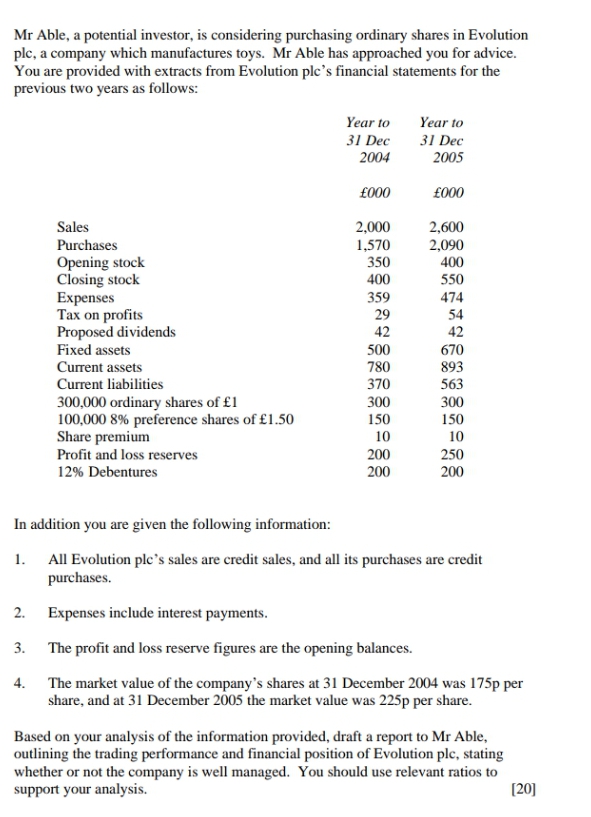

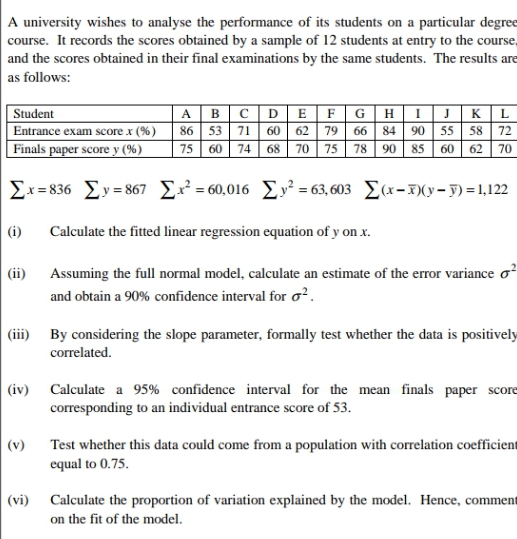

Mr Able, a potential investor, is considering purchasing ordinary shares in Evolution ple, a company which manufactures toys. Mr Able has approached you for advice. You are provided with extracts from Evolution ple's financial statements for the previous two years as follows: Year to Year to 31 Dec 31 Dec 2004 2005 to00 Sales 2,000 2,600 Purchases 1,570 2,090 Opening stock 350 400 Closing stock 400 550 Expenses 359 474 Tax on profits 29 54 Proposed dividends 42 42 Fixed assets 500 670 Current assets 780 893 Current liabilities 370 563 300,000 ordinary shares of fl 300 300 100,000 8% preference shares of $1.50 150 150 Share premium 10 10 Profit and loss reserves 200 250 12% Debentures 200 200 In addition you are given the following information: 1. All Evolution ple's sales are credit sales, and all its purchases are credit purchases. 2. Expenses include interest payments. 3. The profit and loss reserve figures are the opening balances. 4. The market value of the company's shares at 31 December 2004 was 175p per share, and at 31 December 2005 the market value was 225p per share. Based on your analysis of the information provided, draft a report to Mr Able, outlining the trading performance and financial position of Evolution plc, stating whether or not the company is well managed. You should use relevant ratios to support your analysis. [20]A university wishes to analyse the performance of its students on a particular degree course. It records the scores obtained by a sample of 12 students at entry to the course and the scores obtained in their final examinations by the same students. The results are as follows: Student A B C D E F G H K L Entrance exam score x (%) 86 53 71 62 79 84 90 55 58 72 Finals paper score y (%) 75 74 70 75 78 90 85 62 70 [x=836 _y=867 _x' = 60,016 _y' = 63,603 )(x-x)(y- y) =1,122 (i) Calculate the fitted linear regression equation of y on x. (ii) Assuming the full normal model, calculate an estimate of the error variance o and obtain a 90% confidence interval for oz. (iii) By considering the slope parameter, formally test whether the data is positively correlated. (iv) Calculate a 95% confidence interval for the mean finals paper score corresponding to an individual entrance score of 53. (v) Test whether this data could come from a population with correlation coefficien equal to 0.75. (vi) Calculate the proportion of variation explained by the model. Hence, commen on the fit of the model