Answered step by step

Verified Expert Solution

Question

1 Approved Answer

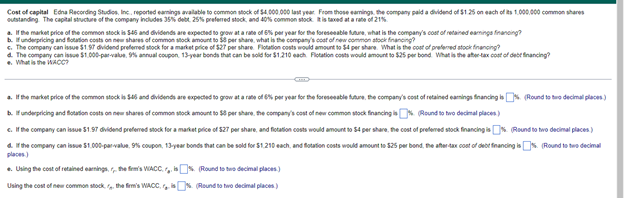

answer the following questions outstanding the capital structure of the company indludes 35% debt 25% preferred stock, and 40% common stock tistaxed at a rate

answer the following questions

outstanding the capital structure of the company indludes 35% debt 25% preferred stock, and 40% common stock tistaxed at a rate of 21% company polda duldend of $125 on each of los 1.000.000 common share If the market price of the common stock is 545 and dividends are expected to grow at a rate of 6% per year for the foreseeable for what is the company's cost of retained earning financing b. Funderpricing and fortions on shares of common stock amount to sper share what is the company's cost of new.common stock financing s. The company cane S1 ST dividend preferred stock for a market price of S27 per share Flotation costs would amount to St per share. What is the cost of preferred to financing 4. The company cane 1.000-pa-alue annual coupon 13 year bonds that can be sold for $1.210 cach Plotation costs would amount to 825 per bond What is the atte-tax cost of financing What is the WACC? 2. If the market price of the common stock to $95 and ovidends are expected to grow at a rate of 6% per year for the foreseeable to the company's cost of retained earning financingh (Round 19 two decimal place) B. IF underpelicing and Potion costs on new show of common stock amount to Sper share the company's cost of the common stock financing O Round to two decimal place) c. If the company can issue 51.97 dividend preferred stock for a market price of 527 per share, and flotation costs would amount to 54 per share, the cost of preferred stock financingis ( Round to ho decinal places) 4. In the company can issue 51.000-panvale, 9% coupon, 13-year bonds that can be sold for $1.290 each, and Rotation costs would amount to 25 per bond, the after tax cost of debt financing is OK (Round to two decimal places) . Using the cost of retained earnings, the firm's WACC Round is bus decimal places) Using the cost of new common stock is the firm's WACC Round totivo decimal places)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started