Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ANSWER THE FOLLOWING QUESTIONS Question one: If You have the following information about the Webb State Bank: Accumulated depreciation Net loans Fed Funds purchased and

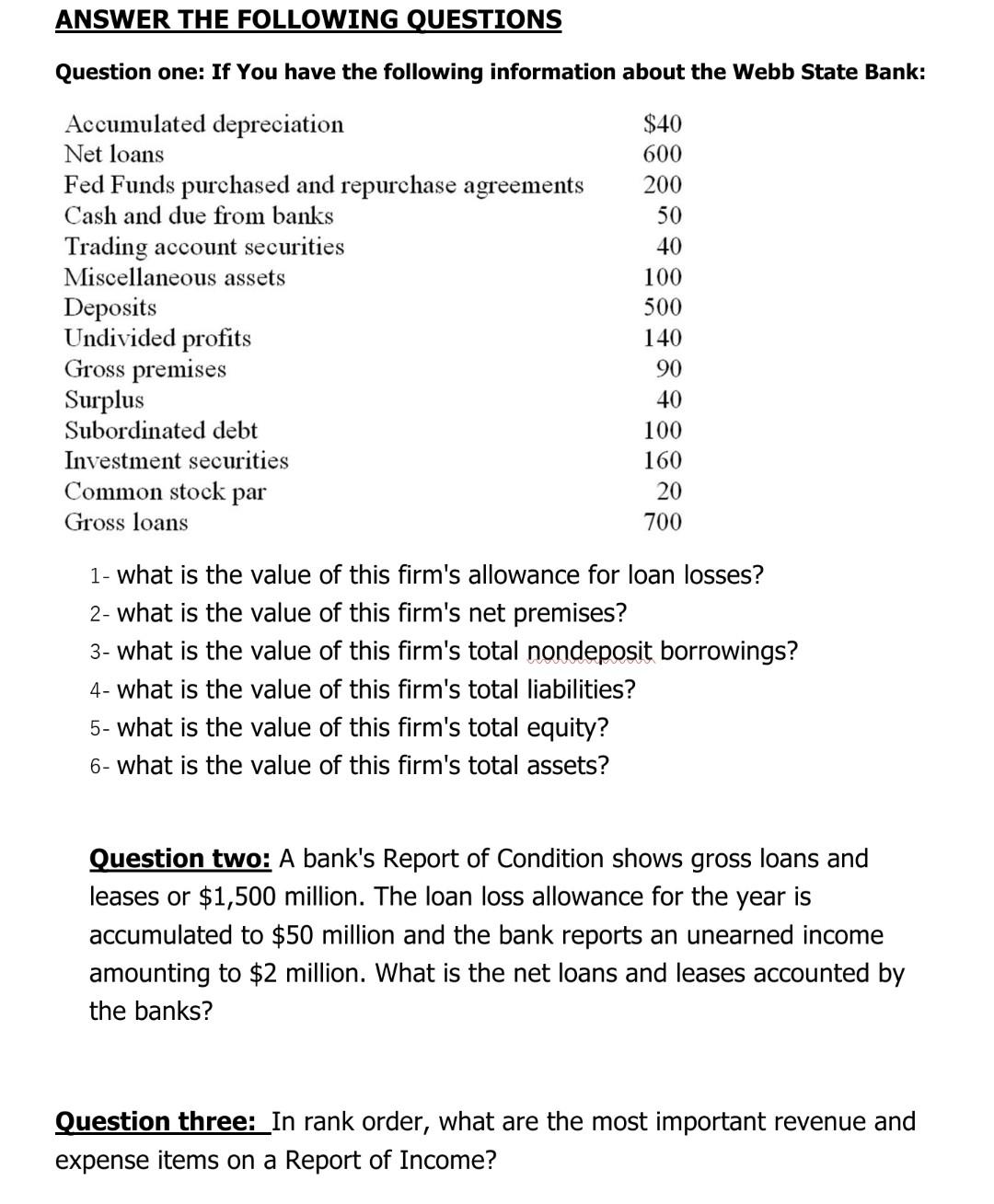

ANSWER THE FOLLOWING QUESTIONS Question one: If You have the following information about the Webb State Bank: Accumulated depreciation Net loans Fed Funds purchased and repurchase agreements Cash and due from banks Trading account securities Miscellaneous assets Deposits Undivided profits Gross premises Surplus Subordinated debt Investment securities Common stock par Gross loans $40 600 200 50 40 100 500 140 90 40 100 160 20 700 1- what is the value of this firm's allowance for loan losses? 2- what is the value of this firm's net premises? 3- what is the value of this firm's total nondeposit borrowings? 4- what is the value of this firm's total liabilities? 5- what is the value of this firm's total equity? 6- what is the value of this firm's total assets? Question two: A bank's Report of Condition shows gross loans and leases or $1,500 million. The loan loss allowance for the year is accumulated to $50 million and the bank reports an unearned income amounting to $2 million. What is the net loans and leases accounted by the banks? Question three: _In rank order, what are the most important revenue and expense items on a Report of Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started