Question

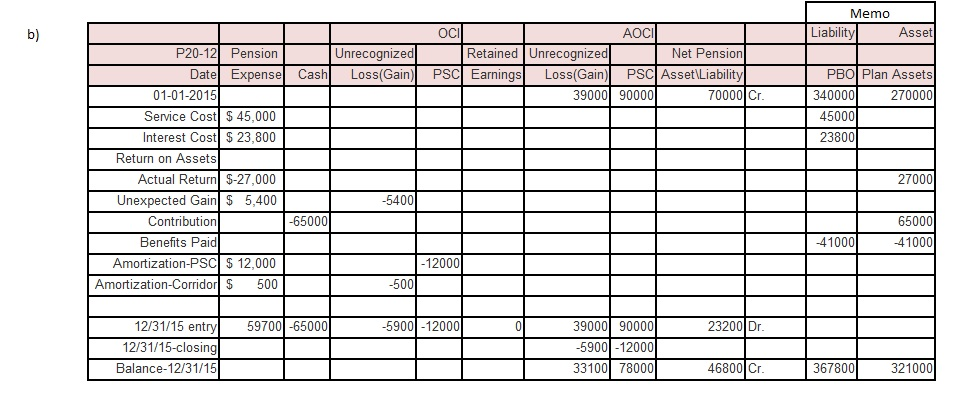

ANSWER THE FOLLOWING QUESTIONS RELATED TO THIS PENSION WORKSHEET 1. Based on the information found in this pension worksheet give the journal entry that would

ANSWER THE FOLLOWING QUESTIONS RELATED TO THIS PENSION WORKSHEET

1. Based on the information found in this pension worksheet give the journal entry that would be required at the end of 2015.

2. Assume the company has revenue of $300,000 in 2015 and the companys only expense is related to its pension plan, what is the companys net income for 2015.

3. Using the information from part 3, what is the amount of the companys comprehensive income for 2015?

4. Describe how the Cell located at 12/31/15-closing under Net Pension would be presented in the companys 2015 financial statements.

5. Assume the company has contributed capital of $800,000 on December 31, 2015, Assume, after considering the companys net income for 2015; it has retained earnings of $500,000. Using the information from the spreadsheet, what is the companys total stockholders equity on December 31, 2015?

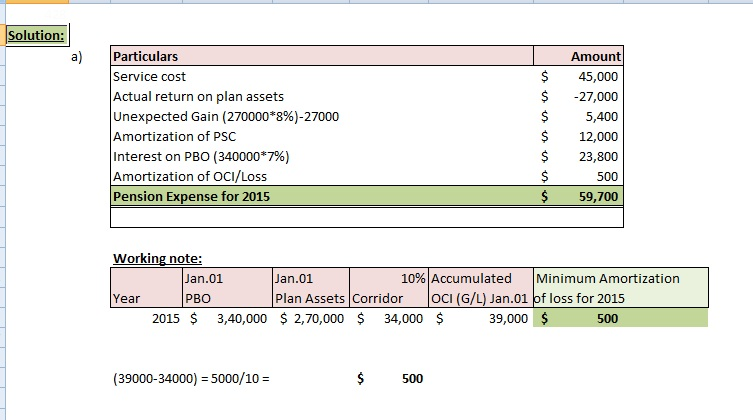

lution a) Particulars Service cost Actual return on plan assets Unexpected Gain (270000*8%)-27000 Amortization of PSC Interest on PBO (3400001796) Amortization of OCI/Loss Pension Expense for 2015 Amount $45,000 $27,000 $ 5,400 $ 12,000 $ 23,800 500 $ 59,700 Working note: Jan.01 10% Accumulated Jan.01 Plan Assets Corridor OCI (G/L) Jan.01 of loss for 2015 Minimum Amortization Year PBO 2015 $ 3,40,000 $ 2,70,000 $ 34,000 $ 39,000 500 (39000-34000) 5000/10 500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started