Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer the following questions with the Starbucks company 10K: Describe the format of the income statement (single-step, multi-step, hybrid) and identify why you describe it

Answer the following questions with the Starbucks company 10K:

Answer the following questions with the Starbucks company 10K:

- Describe the format of the income statement (single-step, multi-step, hybrid) and identify why you describe it that way.

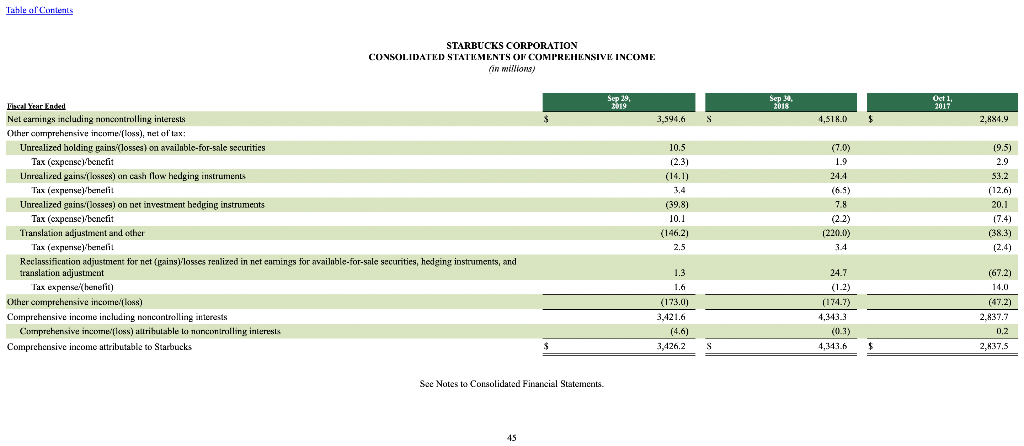

- What items are included as part of the companys other comprehensive income? Does the company report comprehensive income as a continuation of the income statement or as a separate statement?

- Utilize the footnote addressing significant accounting policies to identify the method used to depreciate PP&E.

- Think about the business model utilized by your selected company (how do they sell their products or services to customers). Utilize the footnote addressing significant accounting policies to summarize how they recognize revenue and any specific issues related to revenue recognition that they need to consider given their business model. Examples could include selling on credit, receiving payments in advance, sales returns, gift cards, collectability concerns, etc.

- Evaluate the trend in sales/revenue over the past three years. Calculate the year over year percentage change in revenue. Discuss what you believe is driving the change in sales considering what you know about the company, the industry, and the overall economic conditions.

- Evaluate the trend in net income over the past three years.

- Calculate profit margin (net income as a percent of revenue). Perform vertical analysis on key items (calculating each item as a percentage of revenue) of the income statement to help identify reasons for the change in profit margin rates between years.

- Calculate the year over year percentage change in net income. Compare the percentage change in revenue from question #5 to the percentage change in net income.

- Analyze and discuss your findings.

- Compute your companys current ratio and debt to equity ratio for both years presented in the balance sheet. Analyze and discuss what these ratios tell you about the company.

- Select a competitor and calculate current ratio and profit margin for the competitors most recent year. Compare to your calculations for your company. Analyze and discuss.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started