Answered step by step

Verified Expert Solution

Question

1 Approved Answer

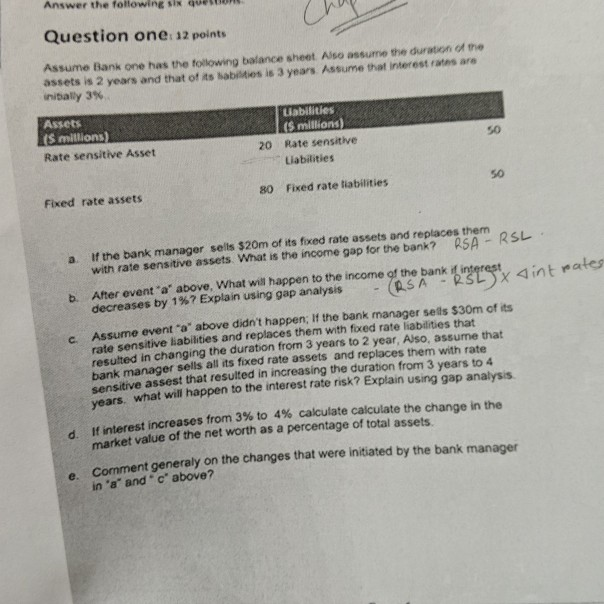

? Answer the following six quo Question one 12 points Assume Bank one has the following balance sheet Also assume the duration of the assets

?

Answer the following six quo Question one 12 points Assume Bank one has the following balance sheet Also assume the duration of the assets is 2 years and that of its abilities is 3 years. Assume that interest rates are inibally 3% Assets Liabilities (5 millions) $ millions) Rate sensitive Asset 20 Rate sensitive Liabilities 80 Fixed rate liabilities Fixed rate assets If the bank manager sells $20m of its foxed rate assets and replaces them with rate sensitive assets What is the income gap for the bank? RSA - RS it After event 'a' above, What will happen to the income of the bank if interest decreases by 1%? Explain using gap analysis (OSA - RSLX Assume event a above didn't happen, if the bank manager setts $30m of its rate sensitive liabilities and replaces them with foxed rate liabilities that resulted in changing the duration from 3 years to 2 year, Also, assume that hank manager sells all its fixed rate assets and replaces them with rate sensitive assest that resulted in increasing the duration from 3 years to 4 as what will happen to the interest rate risk? Explain using gap analysis est increases from 3% to 4% calculate calculate the change in the market value of the net worth as a percentage of total assets e. Comment generaly on the changes that were initiated by the bank manager in 'a' and above? Answer the following six quo Question one 12 points Assume Bank one has the following balance sheet Also assume the duration of the assets is 2 years and that of its abilities is 3 years. Assume that interest rates are inibally 3% Assets Liabilities (5 millions) $ millions) Rate sensitive Asset 20 Rate sensitive Liabilities 80 Fixed rate liabilities Fixed rate assets If the bank manager sells $20m of its foxed rate assets and replaces them with rate sensitive assets What is the income gap for the bank? RSA - RS it After event 'a' above, What will happen to the income of the bank if interest decreases by 1%? Explain using gap analysis (OSA - RSLX Assume event a above didn't happen, if the bank manager setts $30m of its rate sensitive liabilities and replaces them with foxed rate liabilities that resulted in changing the duration from 3 years to 2 year, Also, assume that hank manager sells all its fixed rate assets and replaces them with rate sensitive assest that resulted in increasing the duration from 3 years to 4 as what will happen to the interest rate risk? Explain using gap analysis est increases from 3% to 4% calculate calculate the change in the market value of the net worth as a percentage of total assets e. Comment generaly on the changes that were initiated by the bank manager in 'a' and above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started