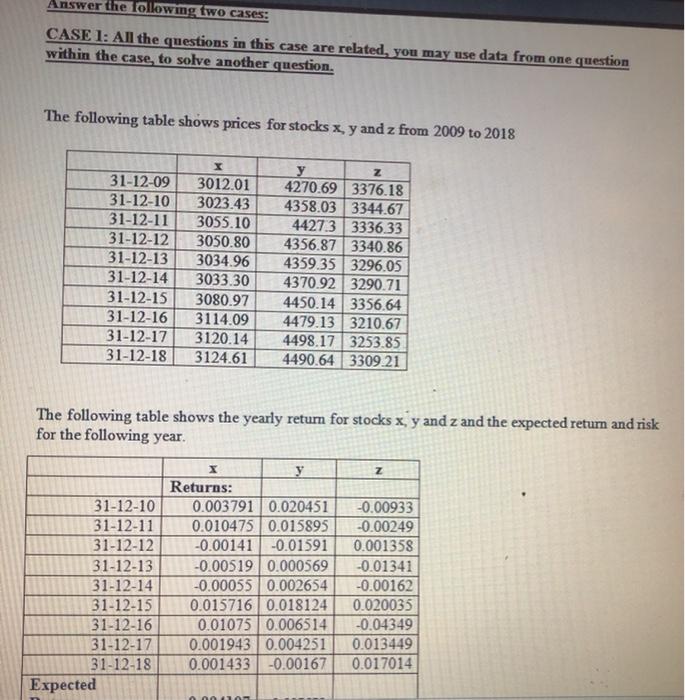

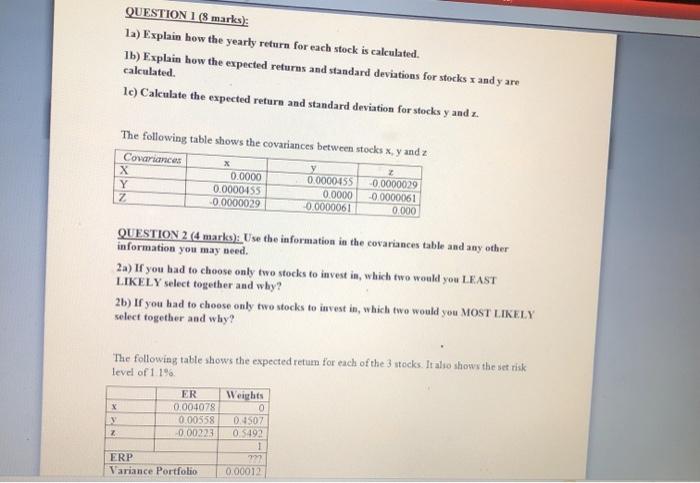

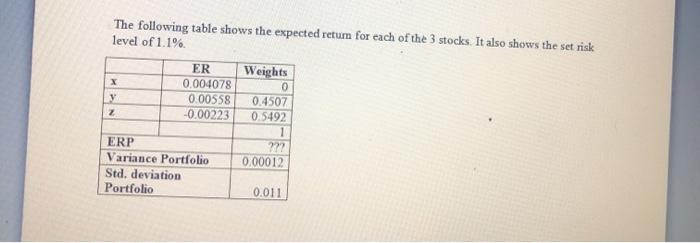

Answer the following two cases: CASE 1: All the questions in this case are related, you may use data from one question within the case, to solve another question. The following table shows prices for stocks x,y and z from 2009 to 2018 31-12-09 31-12-10 31-12-11 31-12-12 31-12-13 31-12-14 31-12-15 31-12-16 31-12-17 31-12-18 X 3012.01 3023.43 3055.10 3050.80 3034.96 3033.30 3080.97 3114.09 3120.14 3124.61 y Z 4270.69 3376.18 4358.03 3344.67 44273 3336.33 4356.87 3340.86 4359.35 3296.05 4370.92 3290.71 4450.14 3356.64 4479.13 3210.67 4498.17 3253.85 4490.64 3309.21 The following table shows the yearly return for stocks x, y and z and the expected return and risk for the following year. Z 31-12-10 31-12-11 31-12-12 31-12-13 31-12-14 31-12-15 31-12-16 31-12-17 31-12-18 Expected y Returns: 0.003791 0.020451 0.010475 0.015895 -0.00141 -0.01591 -0.005190.000569 -0.00055 0.002654 0.015716 0.018124 0.01075 0.006514 0.001943 0.004251 0.001433 -0.00167 -0.00933 -0.00249 0.001358 -0.01341 -0.00162 0.020035 -0.04349 0.013449 0.017014 QUESTION 1 (8 marks): la) Explain how the yearly return for each stock is calculated. 1b) Explain how the expected returns and standard deviations for stocks I andy are calculated. 1) Calculate the expected return and standard deviation for stocks y and z. The following table shows the covariances between stocks x,y and 2 Covariances X Y Z X 0.0000 0.0000455 00000029 0.0000455 0.0000 0.0000061 -0.0000029 -0.0000061 0.000 QUESTION 2 (4 marks): Use the information in the covariances table and any other information you may need. 2a) If you had to choose only two stocks to invest in, which two would you LEAST LIKELY select together and why? 2b) If you had to choose only two stocks to invest in, which two would you MOST LIKELY select together and why? The following table shows the expected return for each of the 3 stocks. It also shows the set risk level of 11% X ER 0.004078 0.00558 -0.00223 2 Weights 0 0.1507 0 5492 1 7 0.00012 ERP Variance Portfolio The following table shows the expected retum for each of the 3 stocks. It also shows the set risk level of 1.1% ER Weights 0.004078 0 y 0.00558 0.4507 z -0.00223 0.5492 I ERP Variance Portfolio Std. deviation Portfolio 27? 0.00012 0.011