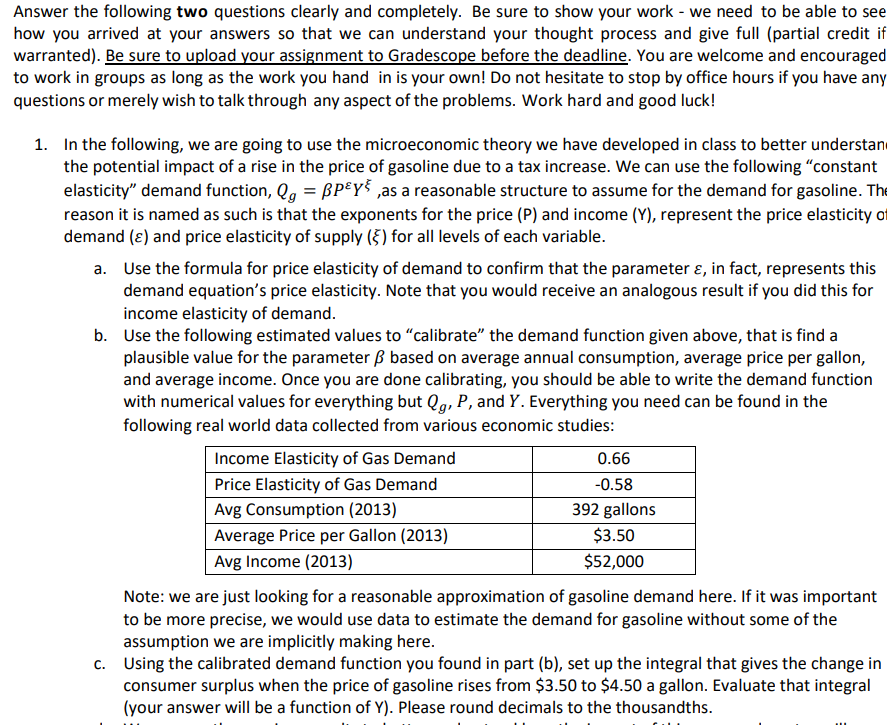

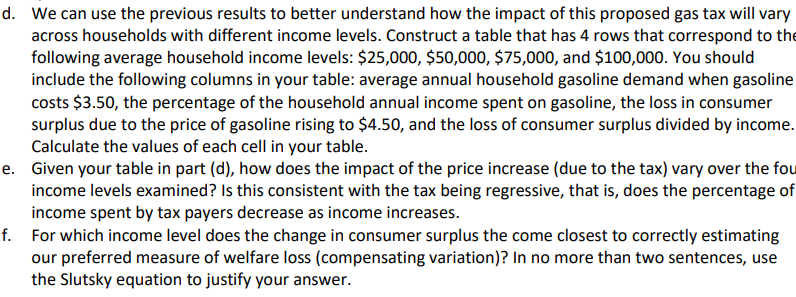

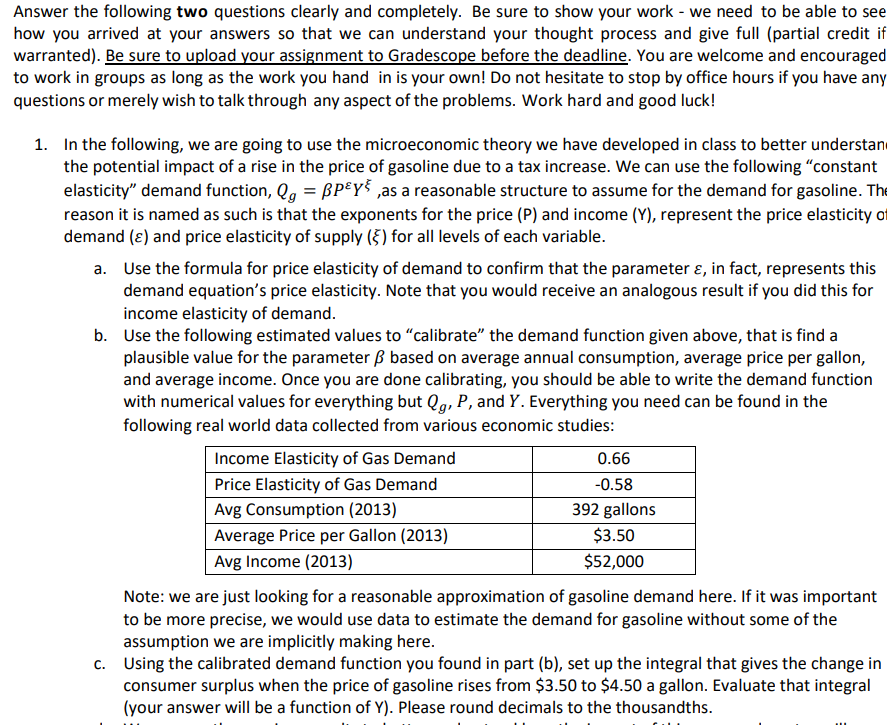

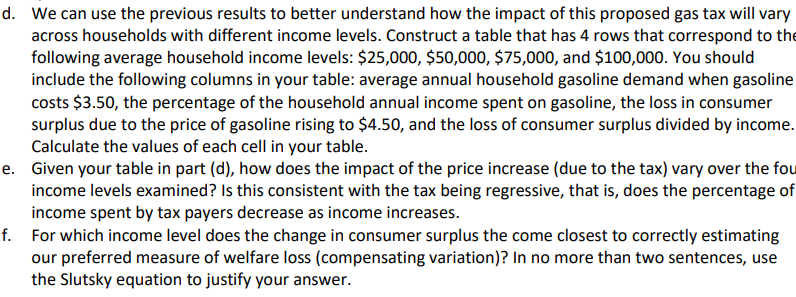

Answer the following two questions clearly and completely. Be sure to show your work - we need to be able to see how you arrived at your answers so that we can understand your thought process and give full (partial credit if warranted). Be sure to upload your assignment to Gradescope before the deadline. You are welcome and encouraged to work in groups as long as the work you hand in is your own! Do not hesitate to stop by office hours if you have any questions or merely wish to talk through any aspect of the problems. Work hard and good luck! 1. In the following, we are going to use the microeconomic theory we have developed in class to better understan the potential impact of a rise in the price of gasoline due to a tax increase. We can use the following constant elasticity demand function, lg = BP&y ,as a reasonable structure to assume for the demand for gasoline. The reason it is named as such is that the exponents for the price (P) and income (Y), represent the price elasticity of demand () and price elasticity of supply (5) for all levels of each variable. a. Use the formula for price elasticity of demand to confirm that the parameter &, in fact, represents this demand equation's price elasticity. Note that you would receive an analogous result if you did this for income elasticity of demand. b. Use the following estimated values to calibrate the demand function given above, that is find a plausible value for the parameter based on average annual consumption, average price per gallon, and average income. Once you are done calibrating, you should be able to write the demand function with numerical values for everything but Qg, P, and Y. Everything you need can be found in the following real world data collected from various economic studies: Income Elasticity of Gas Demand 0.66 Price Elasticity of Gas Demand -0.58 Avg Consumption (2013) 392 gallons Average Price per Gallon (2013) $3.50 Avg Income (2013) $52,000 Note: we are just looking for a reasonable approximation of gasoline demand here. If it was important to be more precise, we would use data to estimate the demand for gasoline without some of the assumption we are implicitly making here. C. Using the calibrated demand function you found in part (b), set up the integral that gives the change in consumer surplus when the price of gasoline rises from $3.50 to $4.50 a gallon. Evaluate that integral (your answer will be a function of Y). Please round decimals to the thousandths. d. We can use the previous results to better understand how the impact of this proposed gas tax will vary across households with different income levels. Construct a table that has 4 rows that correspond to the following average household income levels: $25,000, $50,000, $75,000, and $100,000. You should include the following columns in your table: average annual household gasoline demand when gasoline costs $3.50, the percentage of the household annual income spent on gasoline, the loss in consumer surplus due to the price of gasoline rising to $4.50, and the loss of consumer surplus divided by income. Calculate the values of each cell in your table. e. Given your table in part (d), how does the impact of the price increase (due to the tax) vary over the fou income levels examined? Is this consistent with the tax being regressive, that is, does the percentage of income spent by tax payers decrease as income increases. f. For which income level does the change in consumer surplus the come closest to correctly estimating our preferred measure of welfare loss (compensating variation)? In no more than two sentences, use the Slutsky equation to justify your answer. Answer the following two questions clearly and completely. Be sure to show your work - we need to be able to see how you arrived at your answers so that we can understand your thought process and give full (partial credit if warranted). Be sure to upload your assignment to Gradescope before the deadline. You are welcome and encouraged to work in groups as long as the work you hand in is your own! Do not hesitate to stop by office hours if you have any questions or merely wish to talk through any aspect of the problems. Work hard and good luck! 1. In the following, we are going to use the microeconomic theory we have developed in class to better understan the potential impact of a rise in the price of gasoline due to a tax increase. We can use the following constant elasticity demand function, lg = BP&y ,as a reasonable structure to assume for the demand for gasoline. The reason it is named as such is that the exponents for the price (P) and income (Y), represent the price elasticity of demand () and price elasticity of supply (5) for all levels of each variable. a. Use the formula for price elasticity of demand to confirm that the parameter &, in fact, represents this demand equation's price elasticity. Note that you would receive an analogous result if you did this for income elasticity of demand. b. Use the following estimated values to calibrate the demand function given above, that is find a plausible value for the parameter based on average annual consumption, average price per gallon, and average income. Once you are done calibrating, you should be able to write the demand function with numerical values for everything but Qg, P, and Y. Everything you need can be found in the following real world data collected from various economic studies: Income Elasticity of Gas Demand 0.66 Price Elasticity of Gas Demand -0.58 Avg Consumption (2013) 392 gallons Average Price per Gallon (2013) $3.50 Avg Income (2013) $52,000 Note: we are just looking for a reasonable approximation of gasoline demand here. If it was important to be more precise, we would use data to estimate the demand for gasoline without some of the assumption we are implicitly making here. C. Using the calibrated demand function you found in part (b), set up the integral that gives the change in consumer surplus when the price of gasoline rises from $3.50 to $4.50 a gallon. Evaluate that integral (your answer will be a function of Y). Please round decimals to the thousandths. d. We can use the previous results to better understand how the impact of this proposed gas tax will vary across households with different income levels. Construct a table that has 4 rows that correspond to the following average household income levels: $25,000, $50,000, $75,000, and $100,000. You should include the following columns in your table: average annual household gasoline demand when gasoline costs $3.50, the percentage of the household annual income spent on gasoline, the loss in consumer surplus due to the price of gasoline rising to $4.50, and the loss of consumer surplus divided by income. Calculate the values of each cell in your table. e. Given your table in part (d), how does the impact of the price increase (due to the tax) vary over the fou income levels examined? Is this consistent with the tax being regressive, that is, does the percentage of income spent by tax payers decrease as income increases. f. For which income level does the change in consumer surplus the come closest to correctly estimating our preferred measure of welfare loss (compensating variation)? In no more than two sentences, use the Slutsky equation to justify your