Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer the following two questions on this paper. Work in groups of 2 or 3 people. Each person who wishes to get credil for this

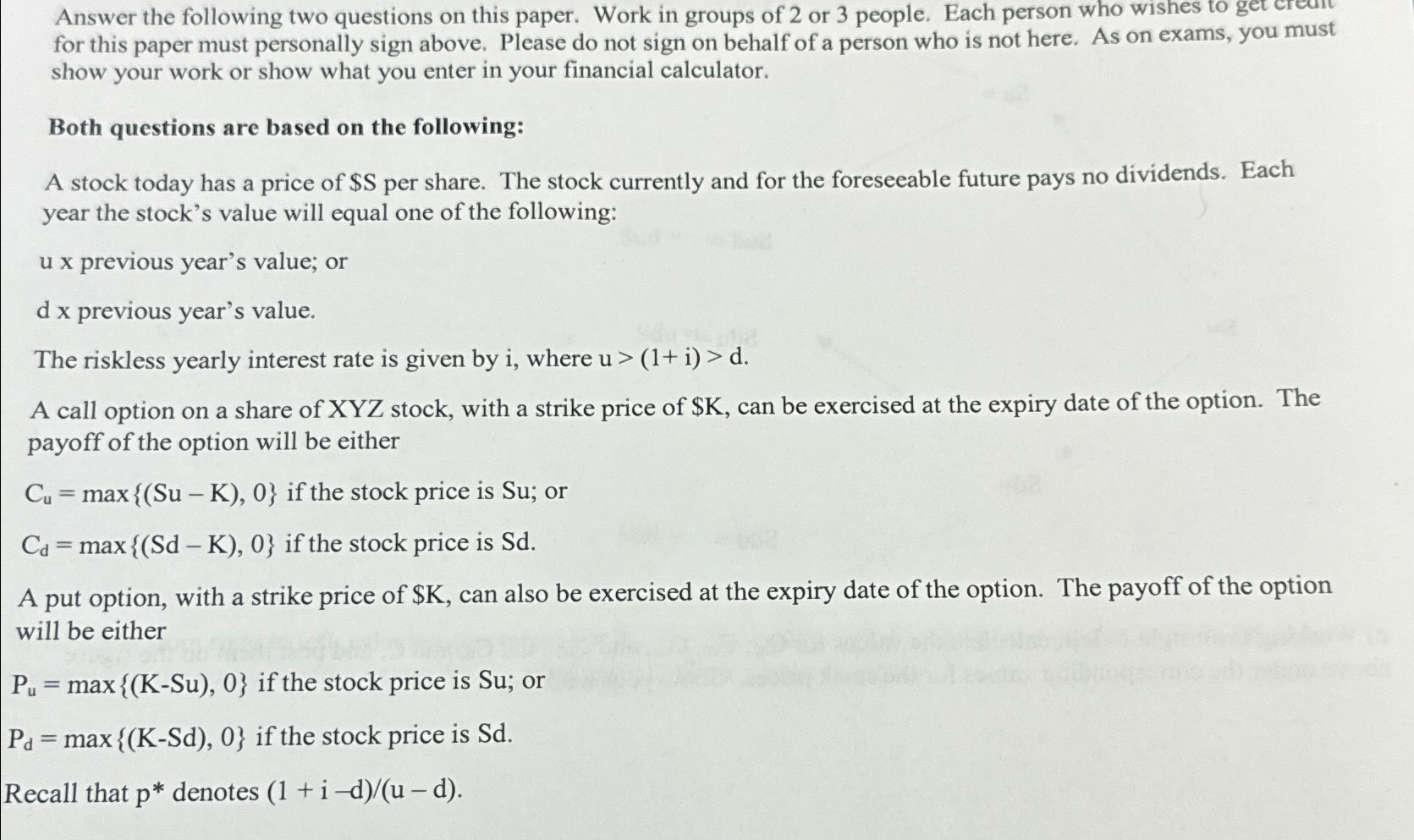

Answer the following two questions on this paper. Work in groups of or people. Each person who wishes to get credil for this paper must personally sign above. Please do not sign on behalf of a person who is not here. As on exams, you must show your work or show what you enter in your financial calculator.

Both questions are based on the following:

A stock today has a price of $ per share. The stock currently and for the foreseeable future pays no dividends. Each year the stock's value will equal one of the following:

ux previous year's value; or

previous year's value.

The riskless yearly interest rate is given by where

A call option on a share of XYZ stock, with a strike price of $ can be exercised at the expiry date of the option. The payoff of the option will be either

max if the stock price is ; or

max if the stock price is

A put option, with a strike price of $ can also be exercised at the expiry date of the option. The payoff of the option will be either

max if the stock price is ; or

max if the stock price is

Recall that denotes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started