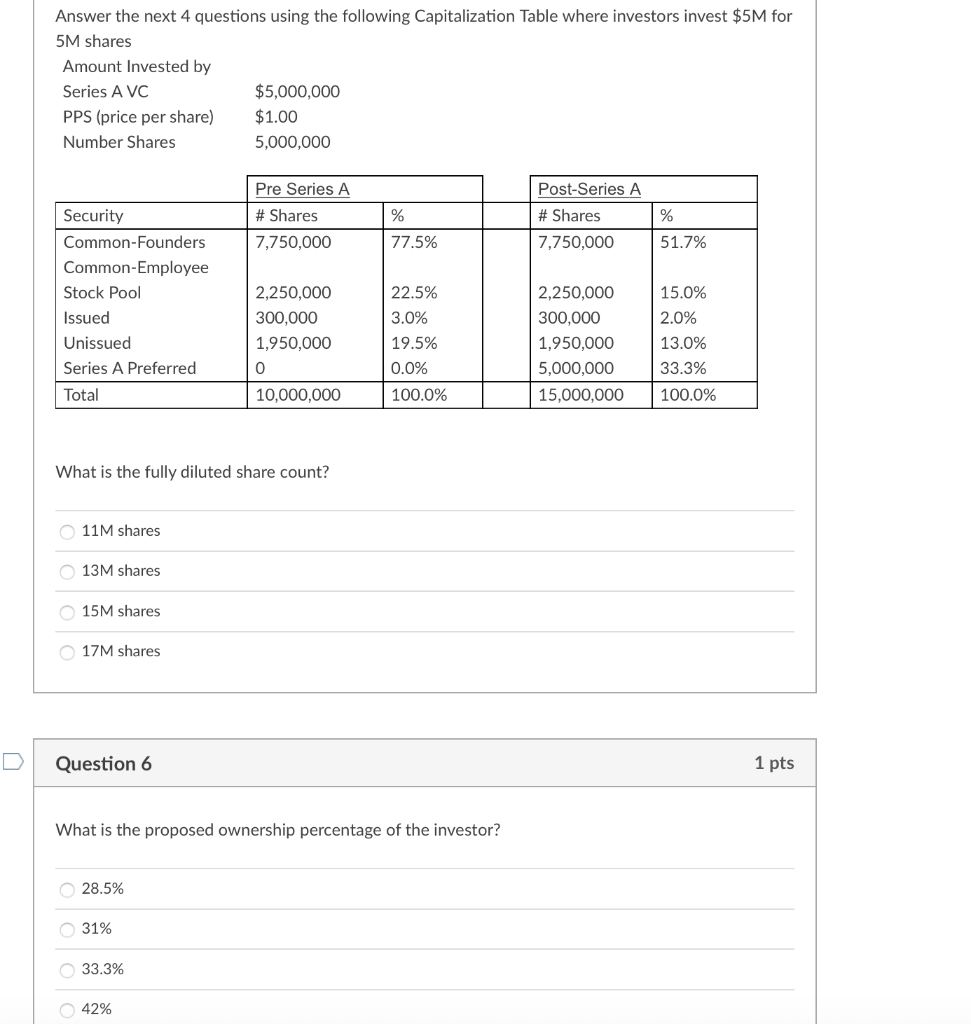

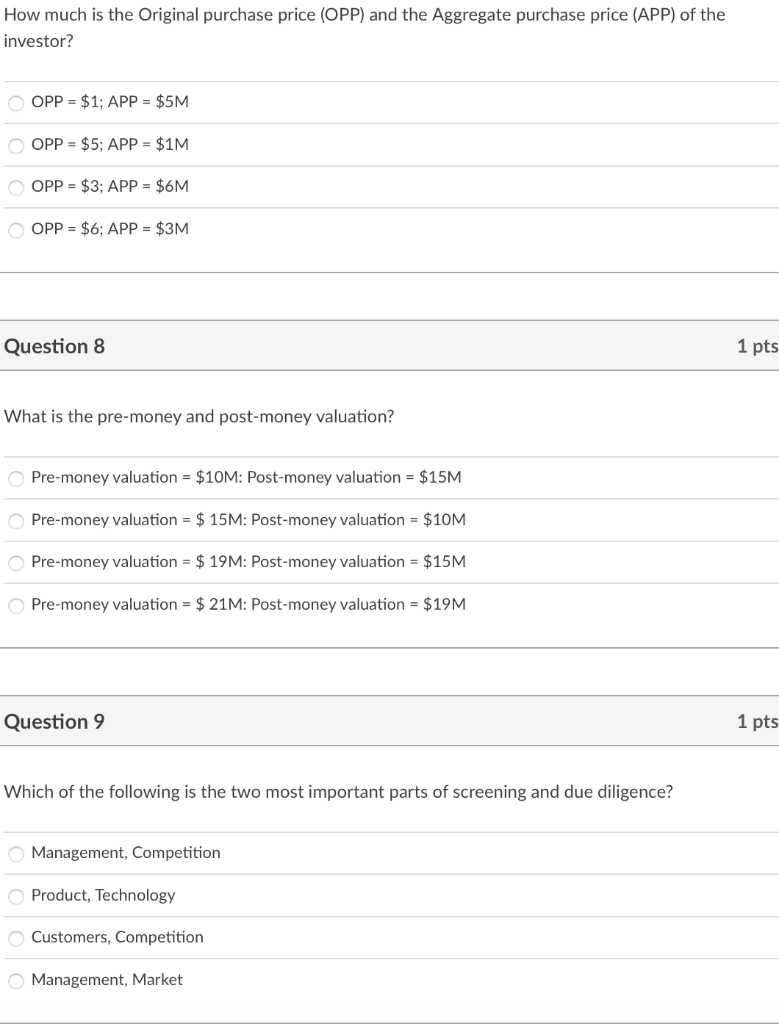

Answer the next 4 questions using the following Capitalization Table where investors invest $5M for 5M shares Amount Invested by Series AVC $5,000,000 PPS (price per share) $1.00 Number Shares 5,000,000 Pre Series A # Shares 7,750,000 % 77.5% Post-Series A # Shares 7,750,000 % 51.7% Security Common-Founders Common-Employee Stock Pool Issued Unissued Series A Preferred Total 2,250,000 300,000 1,950,000 0 22.5% 3.0% 19.5% 0.0% 2,250,000 300,000 1,950,000 5,000,000 15,000,000 15.0% 2.0% 13.0% 33.3% 100.0% 10,000,000 100.0% What is the fully diluted share count? 11M shares 13M shares 15M shares 17M shares Question 6 1 pts What is the proposed ownership percentage of the investor? 28.5% 31% 33.3% 42% How much is the Original purchase price (OPP) and the Aggregate purchase price (APP) of the investor? OPP = $1; APP = $5M OPP = $5; APP = $1M OPP = $3; APP = $6M OPP = $6; APP = $3M Question 8 1 pts What is the pre-money and post-money valuation? Pre-money valuation = $10M: Post-money valuation = $15M Pre-money valuation = $ 15M: Post-money valuation = $10M Pre-money valuation = $ 19M: Post-money valuation = $15M Pre-money valuation = $ 21M: Post-money valuation = $19M Question 9 1 pts Which of the following is the two most important parts of screening and due diligence? Management, Competition Product, Technology Customers, Competition Management, Market Answer the next 4 questions using the following Capitalization Table where investors invest $5M for 5M shares Amount Invested by Series AVC $5,000,000 PPS (price per share) $1.00 Number Shares 5,000,000 Pre Series A # Shares 7,750,000 % 77.5% Post-Series A # Shares 7,750,000 % 51.7% Security Common-Founders Common-Employee Stock Pool Issued Unissued Series A Preferred Total 2,250,000 300,000 1,950,000 0 22.5% 3.0% 19.5% 0.0% 2,250,000 300,000 1,950,000 5,000,000 15,000,000 15.0% 2.0% 13.0% 33.3% 100.0% 10,000,000 100.0% What is the fully diluted share count? 11M shares 13M shares 15M shares 17M shares Question 6 1 pts What is the proposed ownership percentage of the investor? 28.5% 31% 33.3% 42% How much is the Original purchase price (OPP) and the Aggregate purchase price (APP) of the investor? OPP = $1; APP = $5M OPP = $5; APP = $1M OPP = $3; APP = $6M OPP = $6; APP = $3M Question 8 1 pts What is the pre-money and post-money valuation? Pre-money valuation = $10M: Post-money valuation = $15M Pre-money valuation = $ 15M: Post-money valuation = $10M Pre-money valuation = $ 19M: Post-money valuation = $15M Pre-money valuation = $ 21M: Post-money valuation = $19M Question 9 1 pts Which of the following is the two most important parts of screening and due diligence? Management, Competition Product, Technology Customers, Competition Management, Market