Answer the problem 2, 5, 8, 11, 16, 18 and explain

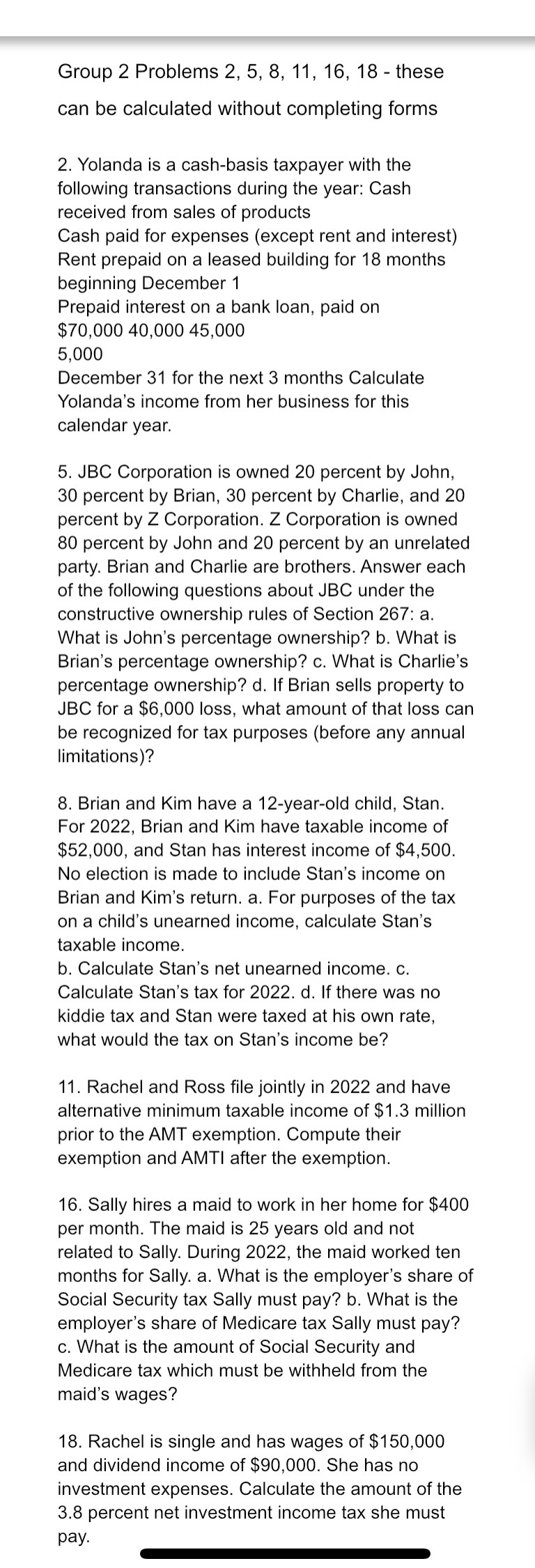

Group 2 Problems 2, 5, 8, 11, 16, 18 - these can be calculated without completing forms 2. Yolanda is a cash-basis taxpayer with the following transactions during the year: Cash received from sales of products Cash paid for expenses (except rent and interest) Rent prepaid on a leased building for 18 months beginning December 1 Prepaid interest on a bank loan, paid on $70,000 40,000 45,000 5,000 December 31 for the next 3 months Calculate Yolanda's income from her business for this calendar year. 5. JBC Corporation is owned 20 percent by John, 30 percent by Brian, 30 percent by Charlie, and 20 percent by Z Corporation. Z Corporation is owned 80 percent by John and 20 percent by an unrelated party. Brian and Charlie are brothers. Answer each of the following questions about JBC under the constructive ownership rules of Section 267: a. What is John's percentage ownership? b. What is Brian's percentage ownership? c. What is Charlie's percentage ownership? d. If Brian sells property to JBC for a $6,000 loss, what amount of that loss can be recognized for tax purposes (before any annual limitations)? 8. Brian and Kim have a 12-year-old child, Stan. For 2022, Brian and Kim have taxable income of $52,000, and Stan has interest income of $4,500. No election is made to include Stan's income on Brian and Kim's return. a. For purposes of the tax on a child's unearned income, calculate Stan's taxable income. b. Calculate Stan's net unearned income. c. Calculate Stan's tax for 2022. d. If there was no kiddie tax and Stan were taxed at his own rate, what would the tax on Stan's income be? 11. Rachel and Ross file jointly in 2022 and have alternative minimum taxable income of $1.3 million prior to the AMT exemption. Compute their exemption and AMTI after the exemption. 16. Sally hires a maid to work in her home for $400 per month. The maid is 25 years old and not related to Sally. During 2022, the maid worked ten months for Sally. a. What is the employer's share of Social Security tax Sally must pay? b. What is the employer's share of Medicare tax Sally must pay? . What is the amount of Social Security and Medicare tax which must be withheld from the maid's wages? 18. Rachel is single and has wages of $150,000 and dividend income of $90,000. She has no investment expenses. Calculate the amount of the 3.8 percent net investment income tax she must pay. L)