Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer the question Answer this question The following transactions pertains to Maram Merchandising Company: 1. The company invested $50,000 cash in Reef branch. 2. The

Answer the question

Answer this question

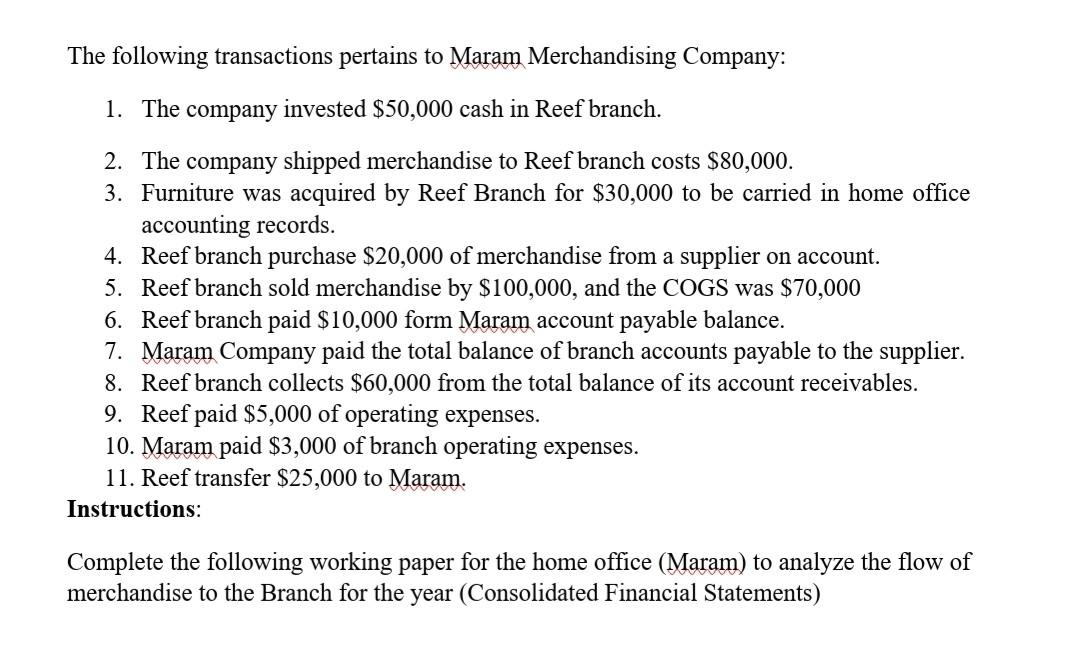

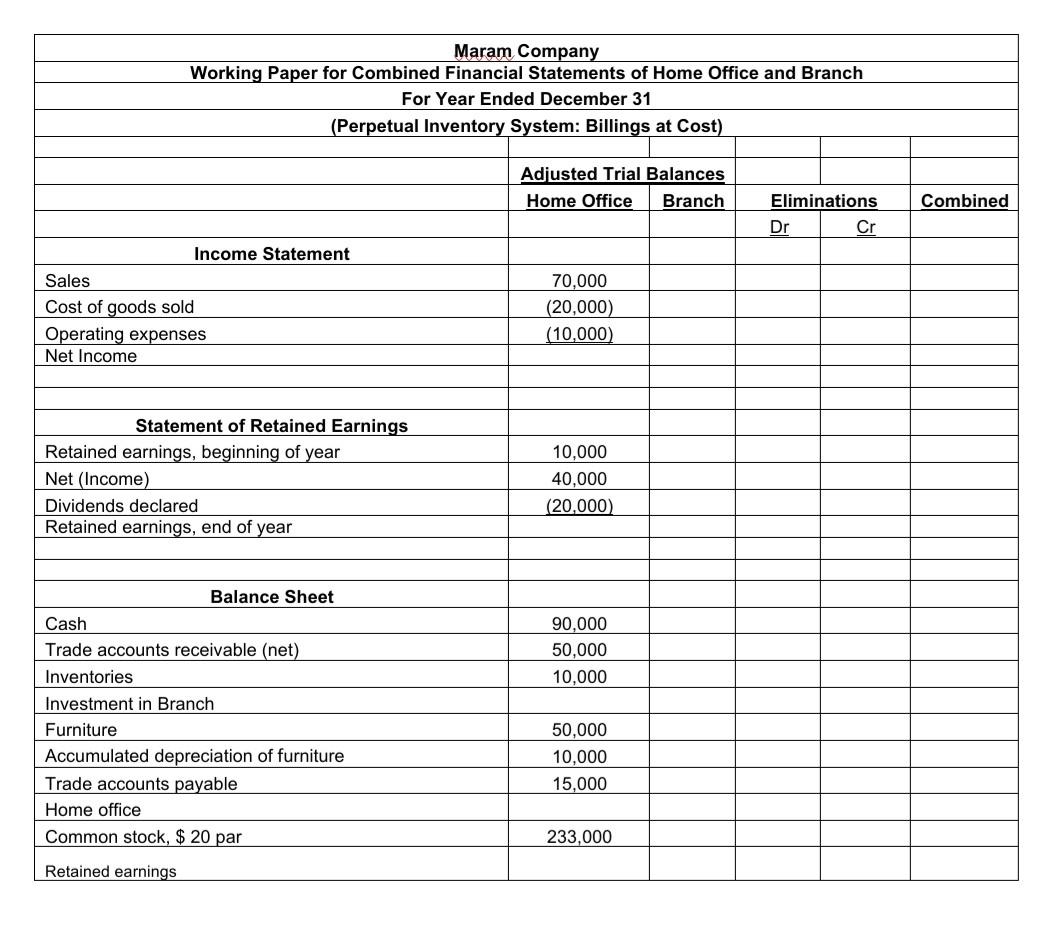

The following transactions pertains to Maram Merchandising Company: 1. The company invested $50,000 cash in Reef branch. 2. The company shipped merchandise to Reef branch costs $80,000. 3. Furniture was acquired by Reef Branch for $30,000 to be carried in home office accounting records. 4. Reef branch purchase $20,000 of merchandise from a supplier on account. 5. Reef branch sold merchandise by $100,000, and the COGS was $70,000 6. Reef branch paid $10,000 form Maram account payable balance. 7. Maram Company paid the total balance of branch accounts payable to the supplier. 8. Reef branch collects $60,000 from the total balance of its account receivables. 9. Reef paid $5,000 of operating expenses. 10. Maram paid $3,000 of branch operating expenses. 11. Reef transfer $25,000 to Maram. Instructions: Complete the following working paper for the home office (Maram) to analyze the flow of merchandise to the Branch for the year (Consolidated Financial Statements) Maram Company Working Paper for Combined Financial Statements of Home Office and Branch For Year Ended December 31 (Perpetual Inventory System: Billings at Cost) Adjusted Trial Balances Home Office Branch Combined Eliminations Dr Cr Income Statement Sales Cost of goods sold Operating expenses Net Income 70,000 (20,000) (10,000) Statement of Retained Earnings Retained earnings, beginning of year Net (Income) Dividends declared Retained earnings, end of year 10,000 40,000 (20,000) 90.000 50,000 10,000 Balance Sheet Cash Trade accounts receivable (net) Inventories Investment in Branch Furniture Accumulated depreciation of furniture Trade accounts payable Home office Common stock, $ 20 par 50,000 10,000 15,000 233,000 Retained earnings The following transactions pertains to Maram Merchandising Company: 1. The company invested $50,000 cash in Reef branch. 2. The company shipped merchandise to Reef branch costs $80,000. 3. Furniture was acquired by Reef Branch for $30,000 to be carried in home office accounting records. 4. Reef branch purchase $20,000 of merchandise from a supplier on account. 5. Reef branch sold merchandise by $100,000, and the COGS was $70,000 6. Reef branch paid $10,000 form Maram account payable balance. 7. Maram Company paid the total balance of branch accounts payable to the supplier. 8. Reef branch collects $60,000 from the total balance of its account receivables. 9. Reef paid $5,000 of operating expenses. 10. Maram paid $3,000 of branch operating expenses. 11. Reef transfer $25,000 to Maram. Instructions: Complete the following working paper for the home office (Maram) to analyze the flow of merchandise to the Branch for the year (Consolidated Financial Statements) Maram Company Working Paper for Combined Financial Statements of Home Office and Branch For Year Ended December 31 (Perpetual Inventory System: Billings at Cost) Adjusted Trial Balances Home Office Branch Combined Eliminations Dr Cr Income Statement Sales Cost of goods sold Operating expenses Net Income 70,000 (20,000) (10,000) Statement of Retained Earnings Retained earnings, beginning of year Net (Income) Dividends declared Retained earnings, end of year 10,000 40,000 (20,000) 90.000 50,000 10,000 Balance Sheet Cash Trade accounts receivable (net) Inventories Investment in Branch Furniture Accumulated depreciation of furniture Trade accounts payable Home office Common stock, $ 20 par 50,000 10,000 15,000 233,000 Retained earningsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started