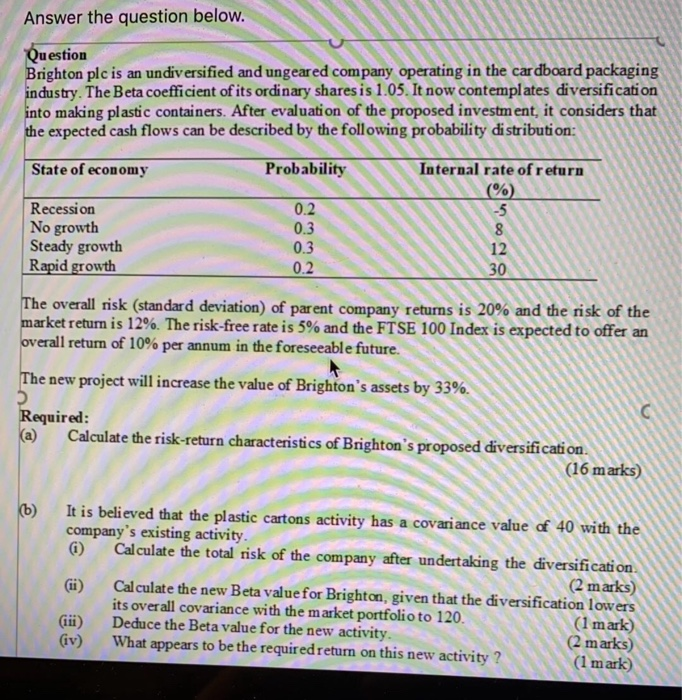

Answer the question below. Question Brighton plc is an undiversified and ungeared company operating in the cardboard packaging industry. The Beta coefficient of its ordinary shares is 1.05. It now contemplates diversification into making plastic containers. After evaluation of the proposed investment, it considers that the expected cash flows can be described by the following probability distribution: State of economy Probability Internal rate of return 0. 28 0.3 Recession No growth Steady growth Rapid growth 0.3 02 30 The overall risk (standard deviation) of parent company returns is 20% and the risk of the market return is 12%. The risk-free rate is 5% and the FTSE 100 Index is expected to offer an overall return of 10% per annum in the foreseeable future. The new project will increase the value of Brighton's assets by 33%. Required: (a) Calculate the risk-return characteristics of Brighton's proposed diversification. (16 marks) It is believed that the plastic cartons activity has a covariance value of 40 with the company's existing activity. (1) Calculate the total risk of the company after undertaking the diversification (2 marks) (ii) Calculate the new Beta value for Brighton, given that the diversification lowers its overall covariance with the market portfolio to 120. (1 mark) (iii) Deduce the Beta value for the new activity. (2 marks) (iv) What appears to be the required return on this new activity ? (1 mark) Answer the question below. Question Brighton plc is an undiversified and ungeared company operating in the cardboard packaging industry. The Beta coefficient of its ordinary shares is 1.05. It now contemplates diversification into making plastic containers. After evaluation of the proposed investment, it considers that the expected cash flows can be described by the following probability distribution: State of economy Probability Internal rate of return 0. 28 0.3 Recession No growth Steady growth Rapid growth 0.3 02 30 The overall risk (standard deviation) of parent company returns is 20% and the risk of the market return is 12%. The risk-free rate is 5% and the FTSE 100 Index is expected to offer an overall return of 10% per annum in the foreseeable future. The new project will increase the value of Brighton's assets by 33%. Required: (a) Calculate the risk-return characteristics of Brighton's proposed diversification. (16 marks) It is believed that the plastic cartons activity has a covariance value of 40 with the company's existing activity. (1) Calculate the total risk of the company after undertaking the diversification (2 marks) (ii) Calculate the new Beta value for Brighton, given that the diversification lowers its overall covariance with the market portfolio to 120. (1 mark) (iii) Deduce the Beta value for the new activity. (2 marks) (iv) What appears to be the required return on this new activity ? (1 mark)