Answered step by step

Verified Expert Solution

Question

1 Approved Answer

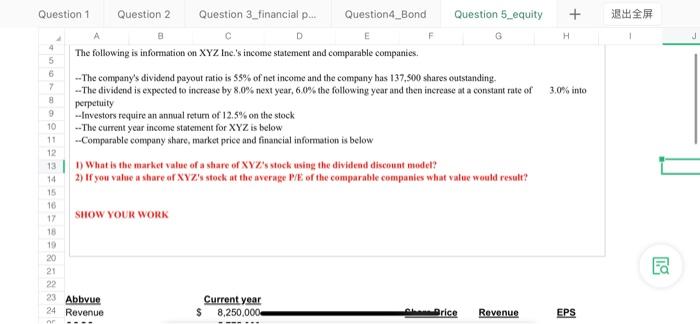

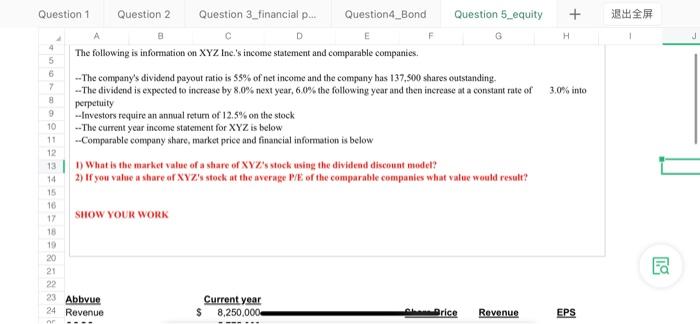

answer the question use the excel formula. Shower me the formula. Question 1 Question 2 Question 3_financial p... Question4_Bond Question 5 equity + D E

answer the question use the excel formula.

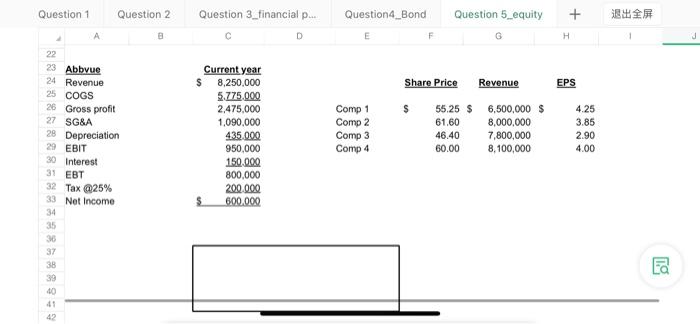

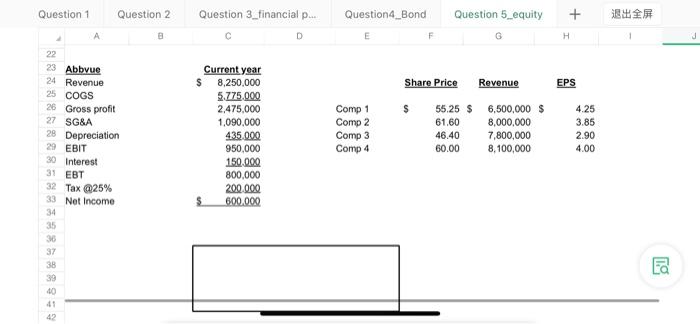

Question 1 Question 2 Question 3_financial p... Question4_Bond Question 5 equity + D E F G H 4 5 6 7 8 9 10 3.0% into The following is information on XYZ Inc.'s income statement and comparable companies. --The company's dividend payout ratio is 55% of net income and the company has 137,500 shares outstanding --The dividend is expected to increase by 8,0% next year, 60% the following year and then increase at a constant rate of perpetuity --Investors require an annual return of 12.5% on the stock --The current year income statement for XYZ is below --Comparable company share, market price and financial information is below 13 ) What is the market value of a share of XYZ's stock using the dividend discount model? 2) If you value a share of XYZ's stock at the average of the comparable companies what value would result? 11 12 SHOW YOUR WORK 16 17 18 19 20 21 22 23 Abbvue 24 Revenue Current year 8,250,000 Price Revenue EPS Question 1 Question 2 Question 3 financial p... Question Bond Question 5 equity + B D F H Share Price Revenue EPS Current year $ 8,250.000 5.775.000 2.475,000 1.090.000 435.000 950,000 150.000 800,000 200.000 600.000 Comp 1 Comp 2 Comp 3 Comp 4 55.25 $ 61.60 46.40 60.00 6,500,000 $ 8,000,000 7,800,000 8,100,000 22 23 Abbvue 24 Revenue 25 COGS 26 Gross profit 27 SGSA 28 Depreciation 29 EBIT 30 Interest 31 EBT 32 Tax a25% 33 Net Income 34 35 36 37 38 39 40 41 4.25 3.85 2.90 4.00 Ea Shower me the formula.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started