:Answer the questions and show your working.

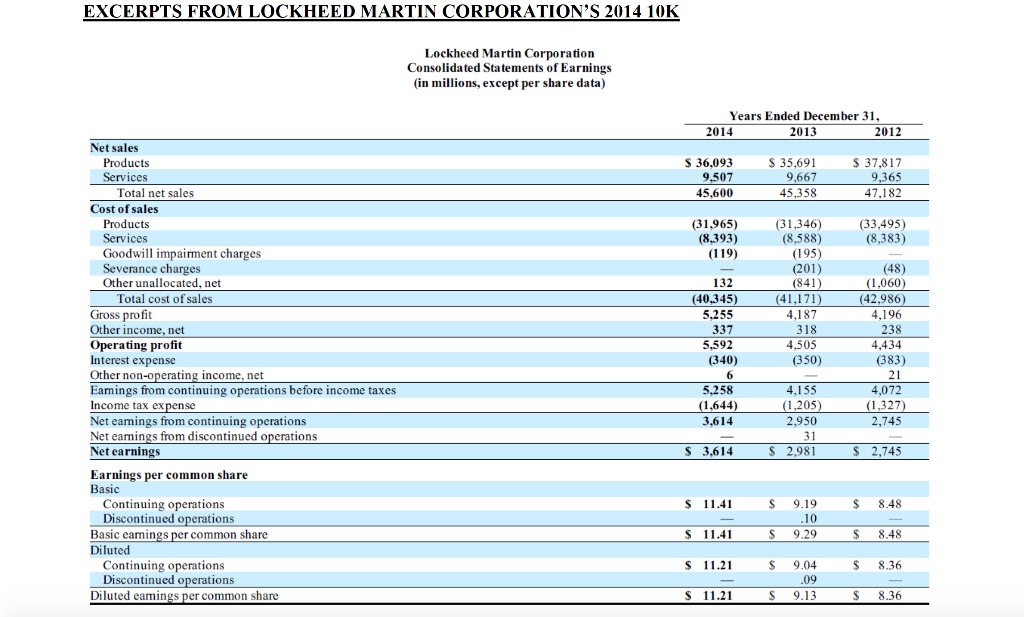

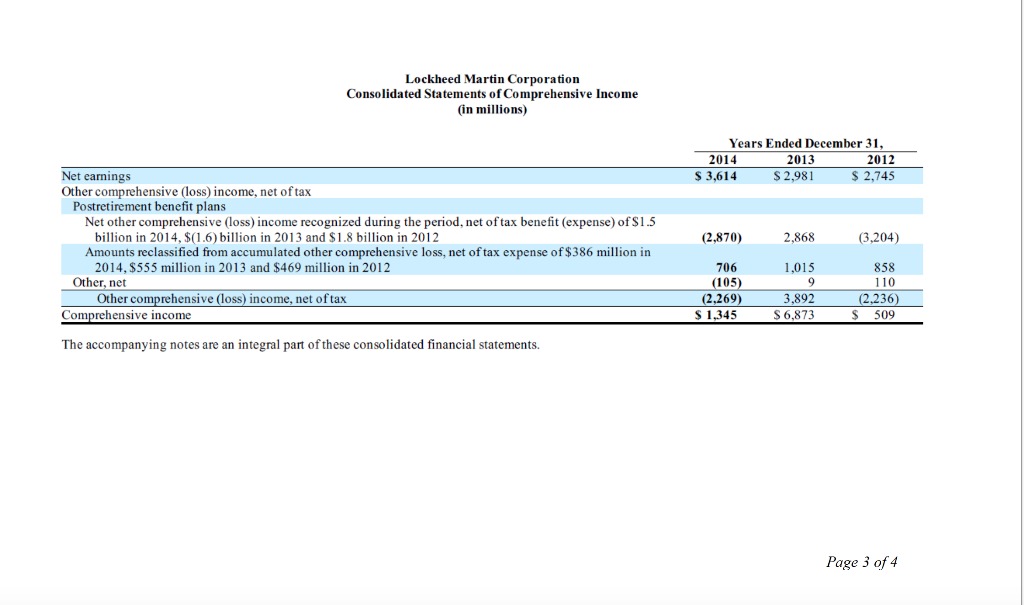

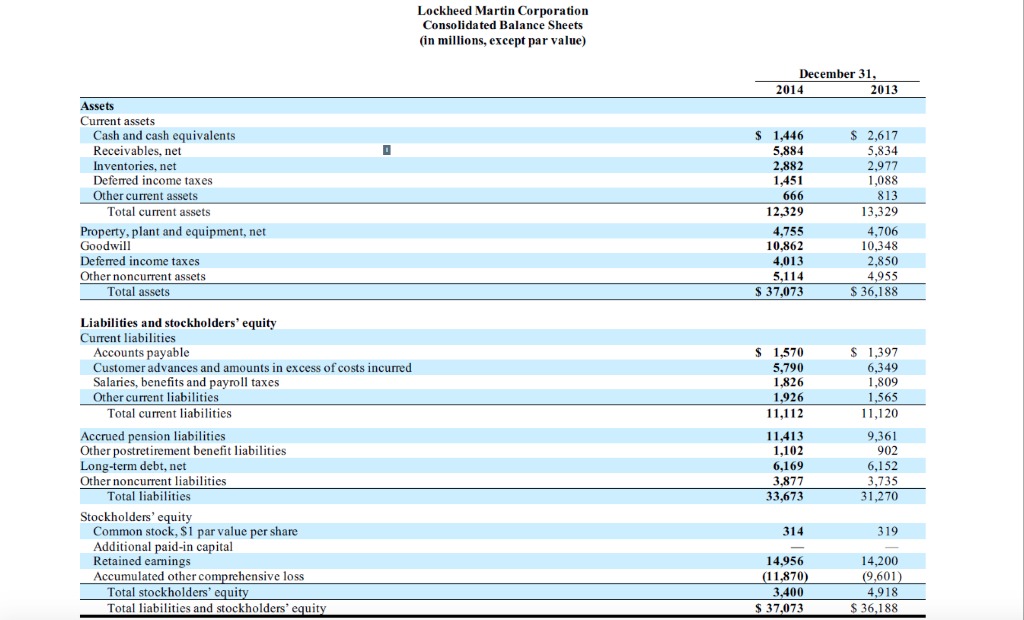

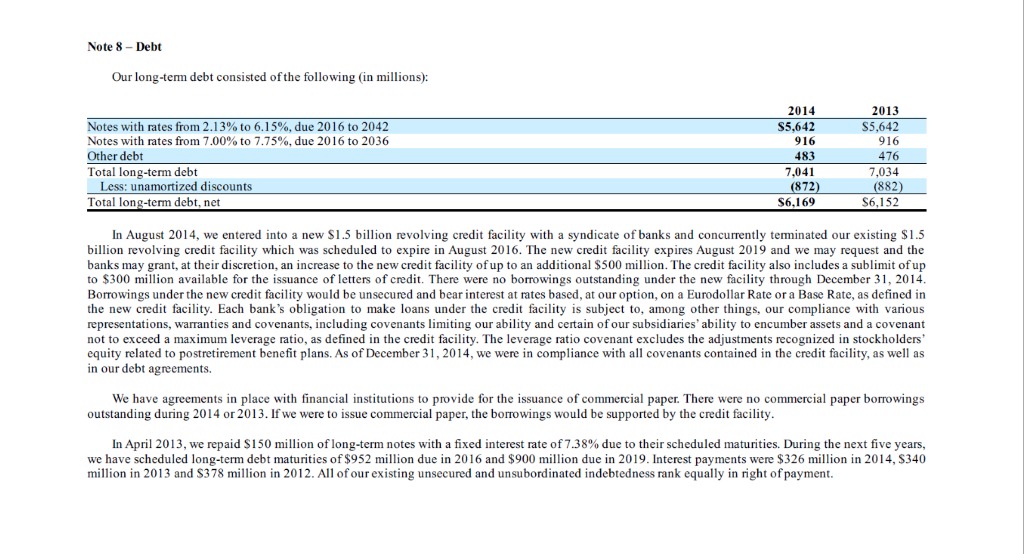

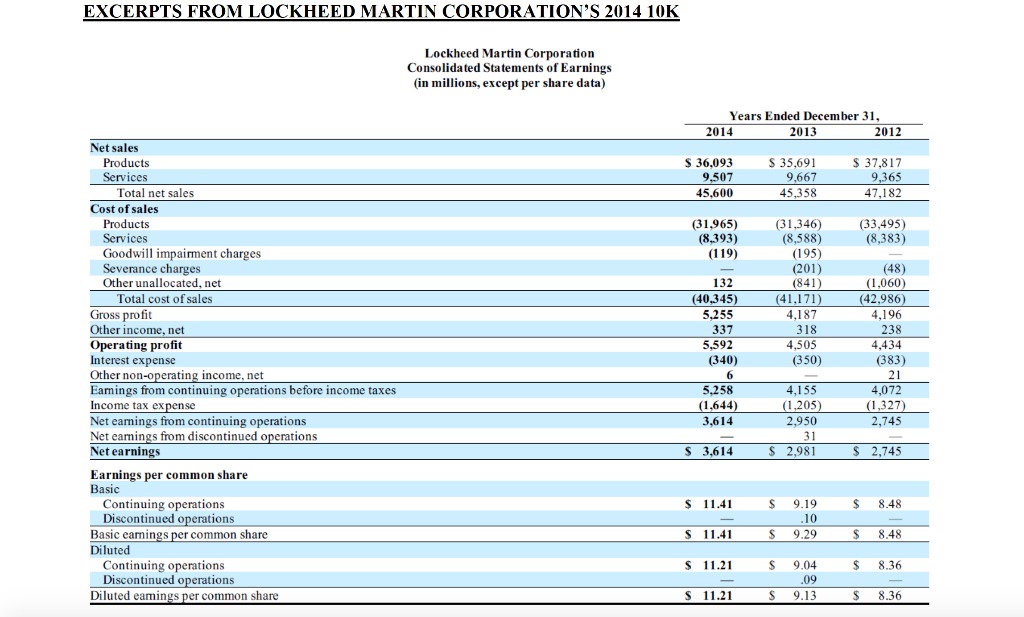

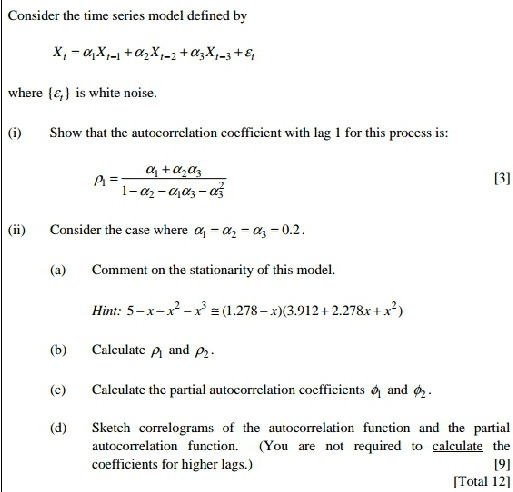

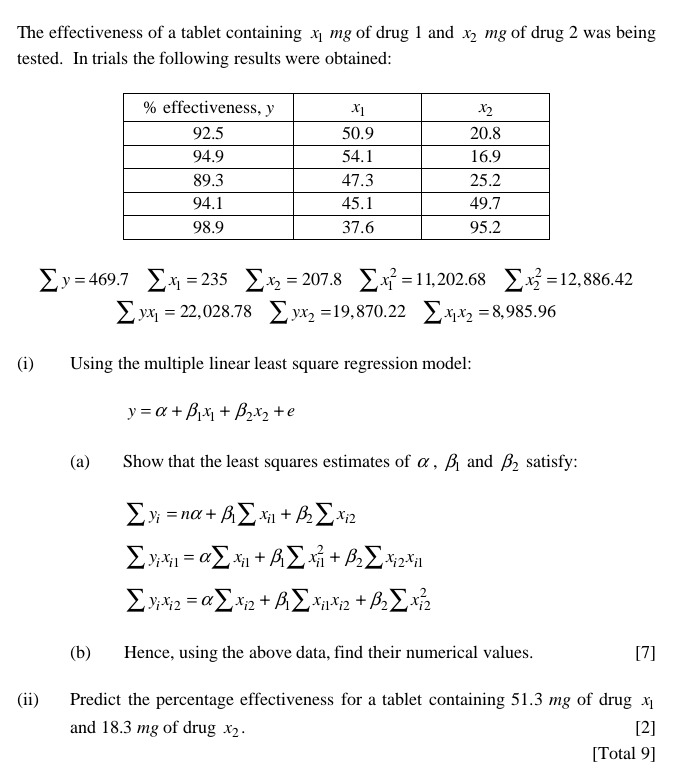

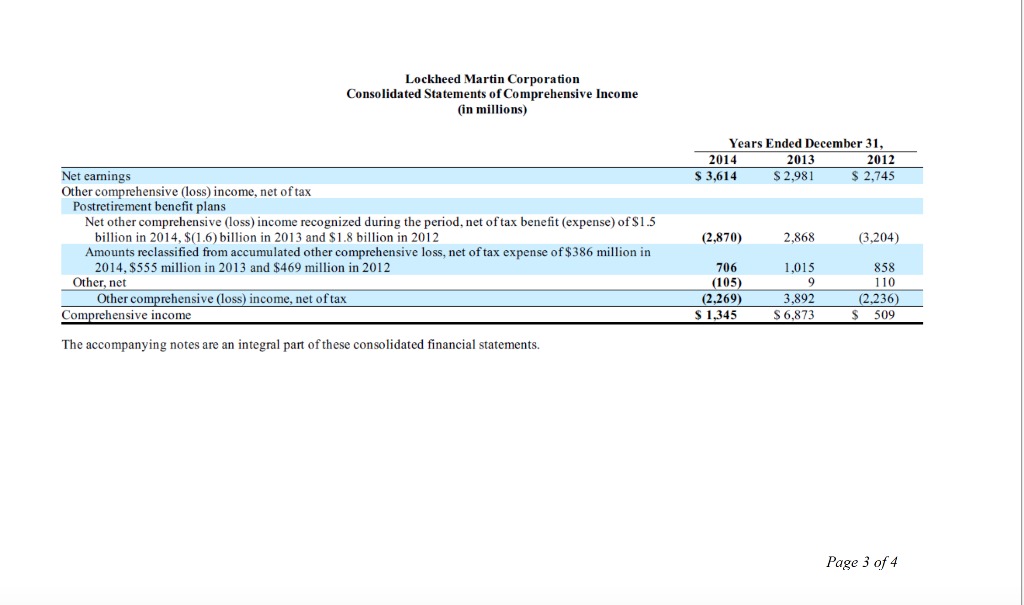

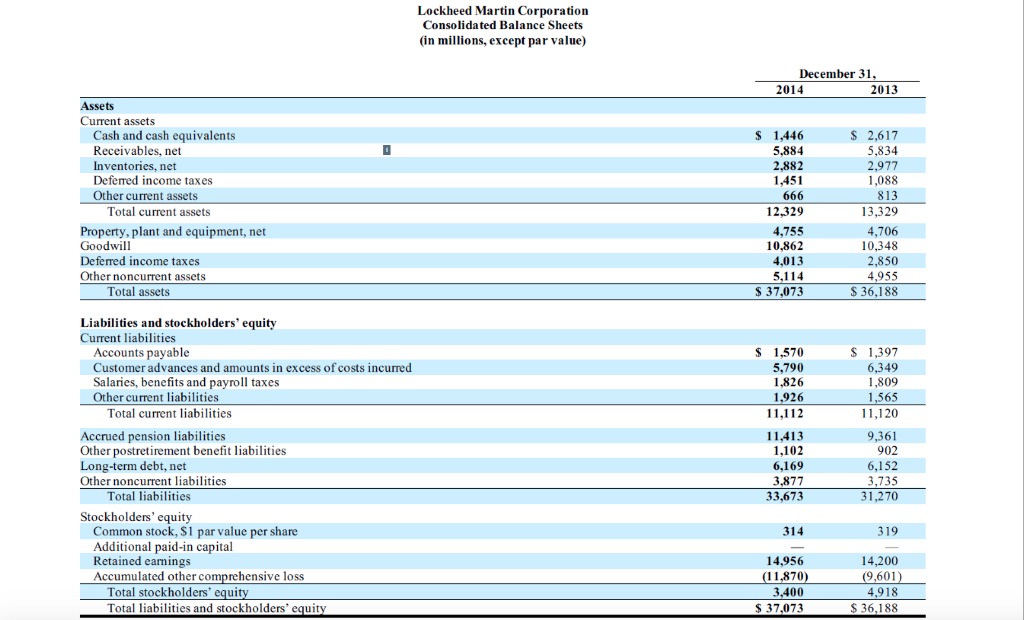

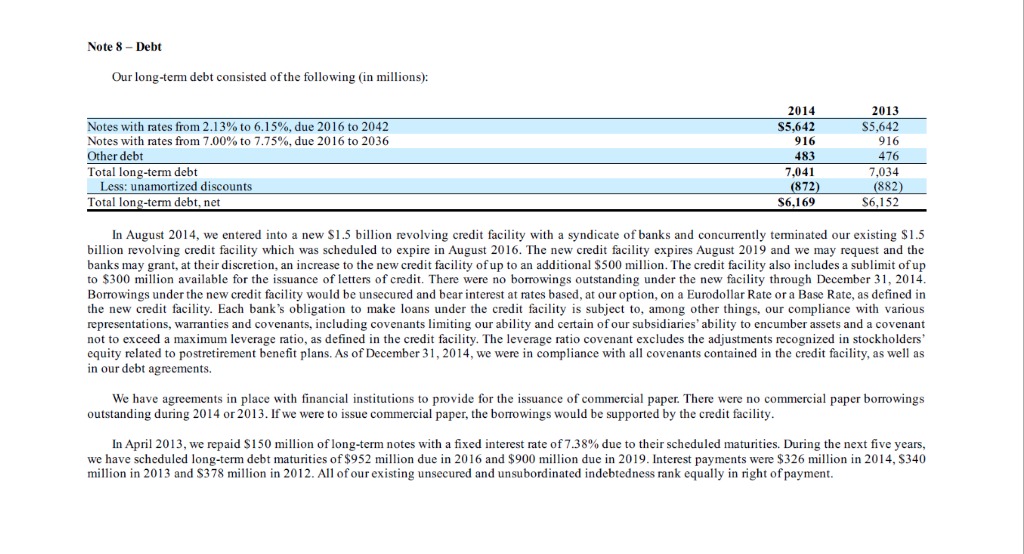

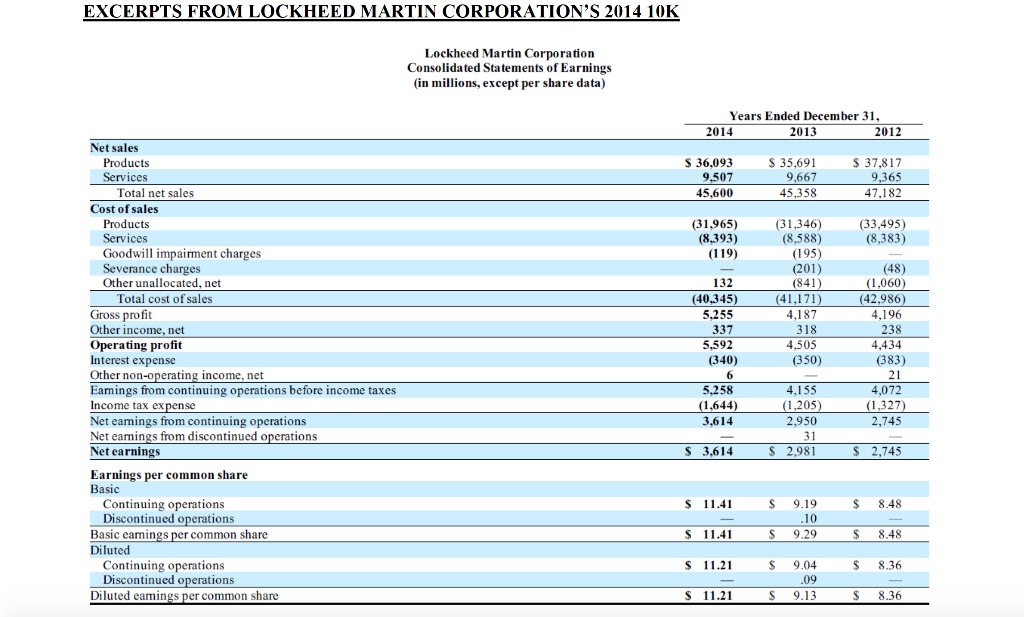

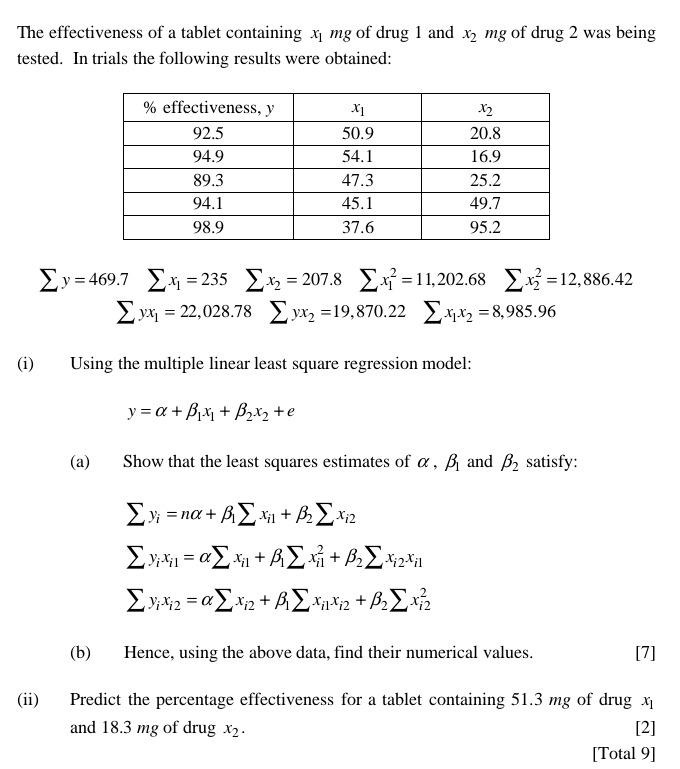

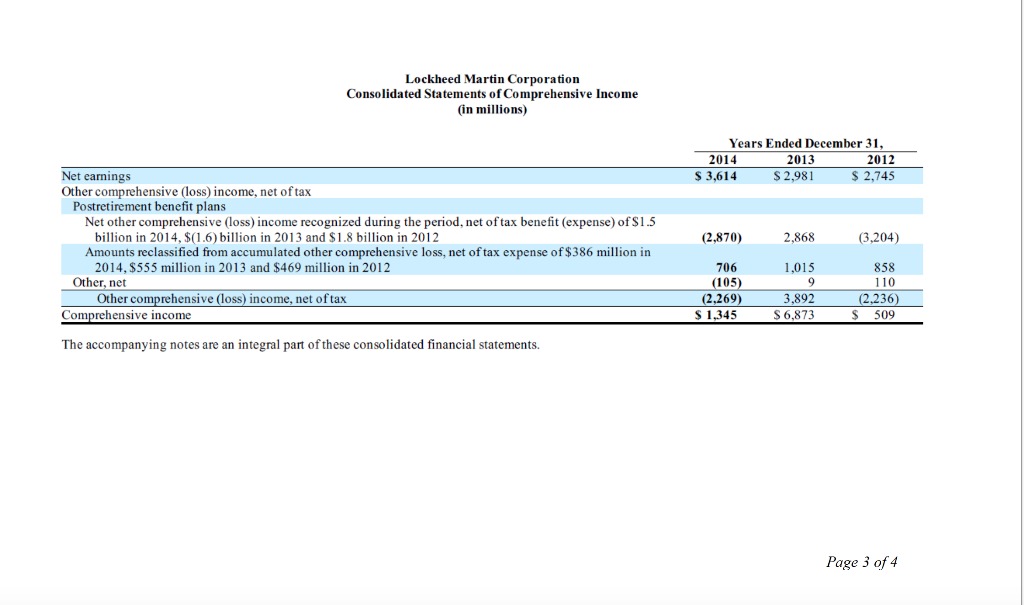

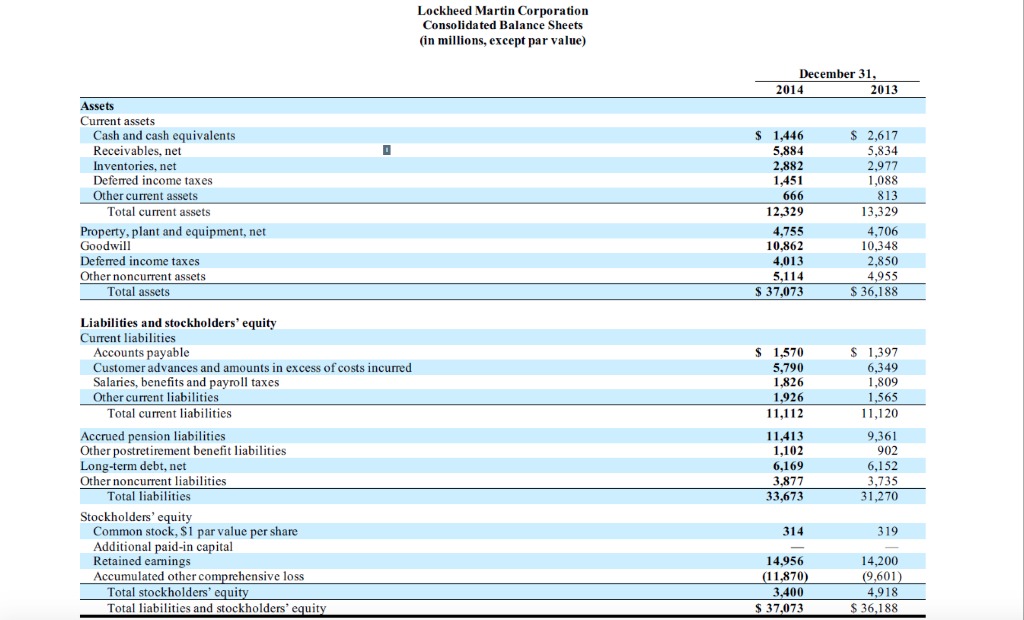

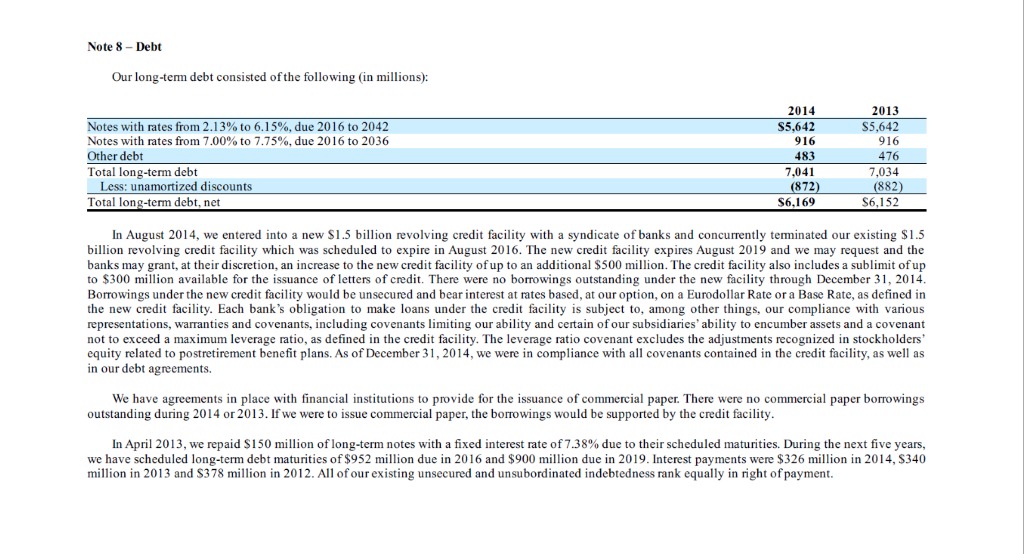

EXCERPTS FROM LOCKHEED MARTIN CORPORATION'S 2014 10K Lockheed Martin Corporation Consolidated Statements of Earnings (in millions, except per share data) Years Ended December 31, 2014 2013 2012 Net sales Products $ 36.093 $ 35,691 $ 37,817 Services 9.507 9.667 9,365 Total net sales 45.600 45,358 47,182 Cost of sales Products (31,965) (31,346) (33,495) Services (8,393) (8,588) (8,383) Goodwill impairment charges (119) (195) Severance charges (201) (48) Other unallocated, net 132 (841) (1,060 Total cost of sales (40.345) (41,171 (42,986) Gross profit 5.255 4.187 4,196 Other income, net 337 318 238 Operating profit 5,592 4,505 4,434 Interest expense (340) (350) (383) Other non-operating income, net 21 Earnings from continuing operations before income taxes 5,258 4,155 4,072 Income tax expense (1,644) (1,205) (1,327) Net earnings from continuing operations 3,614 2,950 2,745 Net earnings from discontinued operations 31 Net earnings $ 3,614 $ 2,981 $ 2,745 Earnings per common share Basic Continuing operations $ 11.41 $ 9.19 $ 8.48 Discontinued operations 10 Basic earnings per common share $ 11.41 $ 9.29 $ 8.48 Diluted Continuing operations $ 11.21 $ 9.04 $ 8.36 Discontinued operations 09 Diluted earnings per common share $ 11.21 $ 9.13 $ 8.36Consider the time series model defined by where {{, ) is white noise. (i) Show that the autocorrelation coefficient with lag 1 for this process is: A = [3] 1 - a2 - 0 03- 03 (ii) Consider the case where of - 0, - 0, - 0.2 (a) Comment on the stationarity of this model. Hint: 5-x- x- - x = (1.278-x)(3.912 + 2.278x+ x-) (b) Calculate p) and py. (c) Calculate the partial autocorrelation coefficients o and . (d) Sketch correlograms of the autocorrelation function and the partial autocorrelation function. (You are not required to calculate the coefficients for higher lags.) 19] [Total 12]The effectiveness of a tablet containing 11 mg of drug 1 and 1:2 mg of drug 2 was being tested. In trials the following results were obtained: 92.5 23.3 94.9 39.5 25.2 94.1 49.2 m 95.: Z}: =4s99 21:1 = 235 252 = 232.3 21:11:11,23233 25.3 =12.335.42 Zyxl = 22112393 2292 =19,39o.22 21:11:: =3.935.95 (i) Using the multiple linear least square regression model: }' = 51' +5111 + 3212 +3 [3] Show that the least squares estimates of or , ,61 and g satisfy: 2 I": =H+ 1512111+ 15221712 2 F1111 = IWEI-"1'1 + 31213 + 1522112111 ZFrIrz = 92112 + 1512111112 + 3221122 (b) Hence, using the above data, nd their numerical values. ['1'] [ii] Pmdict the percentage effectiveness for a tablet containing 51.3 mg of drug 1'1 and 13.3 mg of drug 1:2. [2] [Total 9] Lockheed Martin Corporation Consolidated Statements of Comprehensive Income (in millions) Years Ended December 31, 2014 2013 2012 Net earnings $ 3,614 $ 2,981 $ 2,745 Other comprehensive (loss) income, net of tax Postretirement benefit plans Net other comprehensive (loss) income recognized during the period, net of tax benefit (expense) of $1.5 billion in 2014, $(1.6) billion in 2013 and $1.8 billion in 2012 (2,870) 2,868 (3,204) Amounts reclassified from accumulated other comprehensive loss, net of tax expense of $386 million in 2014, $555 million in 2013 and $469 million in 2012 706 1,015 858 Other, net (105) 9 110 Other comprehensive (loss) income, net of tax (2,269) 3,892 (2,236) Comprehensive income $ 1,345 $ 6,873 $ 509 The accompanying notes are an integral part of these consolidated financial statements. Page 3 of 4Lockheed Martin Corporation Consolidated Balance Sheets (in millions, except par value) December 31, 2014 2013 Assets Current assets Cash and cash equivalents $ 1,446 $ 2,617 Receivables, net 5.884 5,834 Inventories, net 2,882 2,977 Deferred income taxes 1,451 1,088 Other current assets 666 813 Total current assets 12,329 13,329 Property, plant and equipment, net 4.755 4,706 Goodwill 10,862 10,348 Deferred income taxes 4.013 2,850 Other noncurrent assets 5.114 4.955 Total assets $ 37,073 $ 36,188 Liabilities and stockholders' equity Current liabilities Accounts payable $ 1,570 $ 1,397 Customer advances and amounts in excess of costs incurred 5,790 6,349 Salaries, benefits and payroll taxes 1,826 1,809 Other current liabilities 1.926 1,565 Total current liabilities 11,112 11,120 Accrued pension liabilities 11.413 9.361 Other postretirement benefit liabilities 1,102 902 Long-term debt, net 6,169 6,152 Other noncurrent liabilities 3.877 3,735 Total liabilities 33,673 31,270 Stockholders' equity Common stock, $1 par value per share 314 319 Additional paid-in capital Retained earnings 14,956 14,200 Accumulated other comprehensive loss (11,870) (9,601) Total stockholders equity 3,400 4,918 Total liabilities and stockholders' equity $ 37,073 $ 36,188Note 8 - Debt Our long-term debt consisted of the following (in millions): 2014 2013 Notes with rates from 2.13% to 6.15%, due 2016 to 2042 $5,642 $5,642 Notes with rates from 7.00% to 7.75%, due 2016 to 2036 916 916 Other debt 483 476 Total long-term debt 7.041 7,034 Less: unamortized discounts (872) (882 Total long-term debt, net $6,169 $6,152 In August 2014, we entered into a new $1.5 billion revolving credit facility with a syndicate of banks and concurrently terminated our existing $1.5 billion revolving credit facility which was scheduled to expire in August 2016. The new credit facility expires August 2019 and we may request and the banks may grant, at their discretion, an increase to the new credit facility of up to an additional $500 million. The credit facility also includes a sublimit of up to $300 million available for the issuance of letters of credit. There were no borrowings outstanding under the new facility through December 31, 2014. Borrowings under the new credit facility would be unsecured and bear interest at rates based, at our option, on a Eurodollar Rate or a Base Rate, as defined in the new credit facility. Each bank's obligation to make loans under the credit facility is subject to, among other things, our compliance with various representations, warranties and covenants, including covenants limiting our ability and certain of our subsidiaries' ability to encumber assets and a covenant not to exceed a maximum leverage ratio, as defined in the credit facility. The leverage ratio covenant excludes the adjustments recognized in stockholders' equity related to postretirement benefit plans. As of December 31, 2014, we were in compliance with all covenants contained in the credit facility, as well as in our debt agreements. We have agreements in place with financial institutions to provide for the issuance of commercial paper. There were no commercial paper borrowings outstanding during 2014 or 2013. If we were to issue commercial paper, the borrowings would be supported by the credit facility. In April 2013, we repaid $150 million of long-term notes with a fixed interest rate of 7.38% due to their scheduled maturities. During the next five years, we have scheduled long-term debt maturities of $952 million due in 2016 and $900 million due in 2019. Interest payments were $326 million in 2014, $340 million in 2013 and $378 million in 2012. All of our existing unsecured and unsubordinated indebtedness rank equally in right of payment