Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer the questions from the information provided. As far as possible use the contribution margin model to present your answers. 2.1 Use the information provided

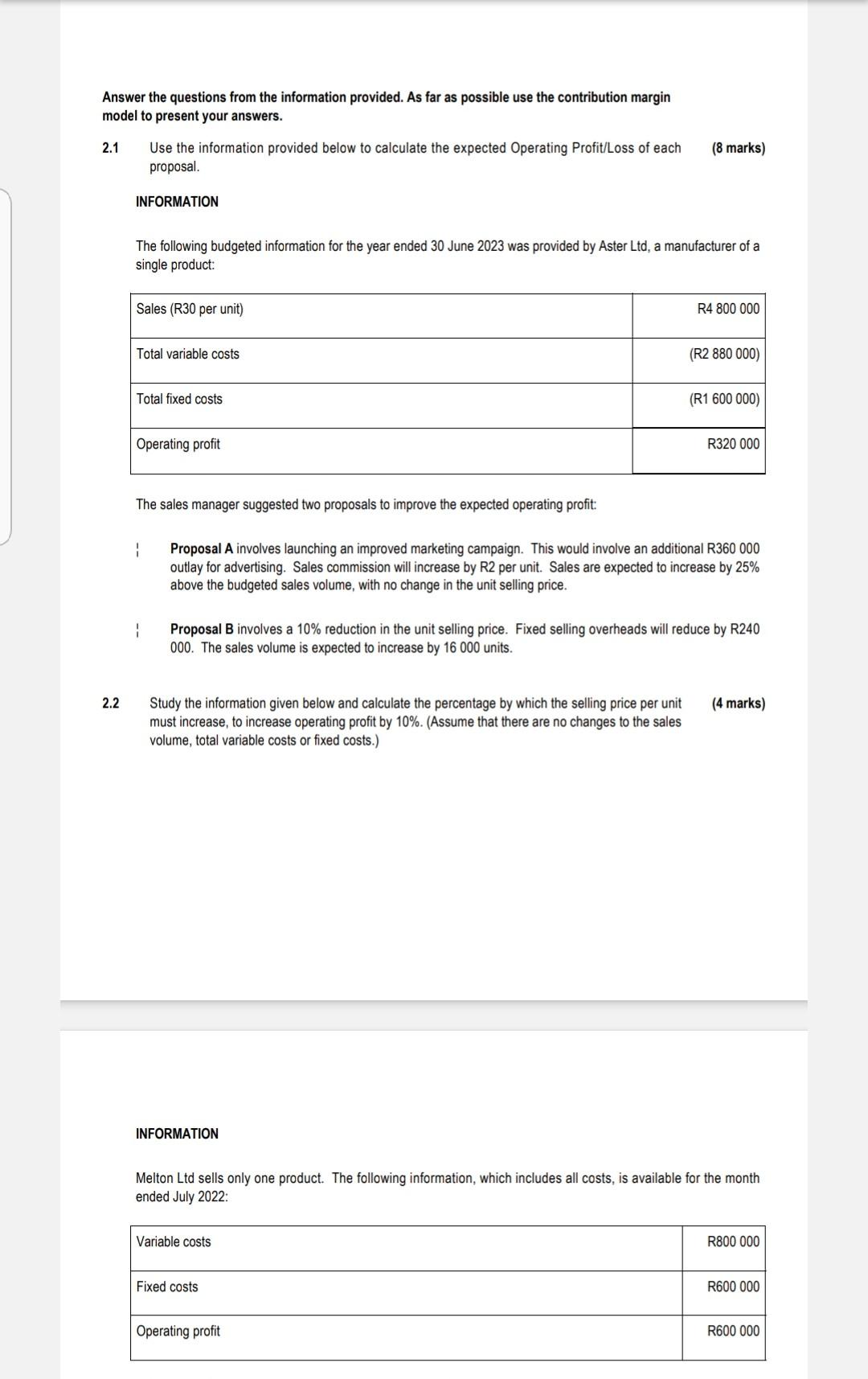

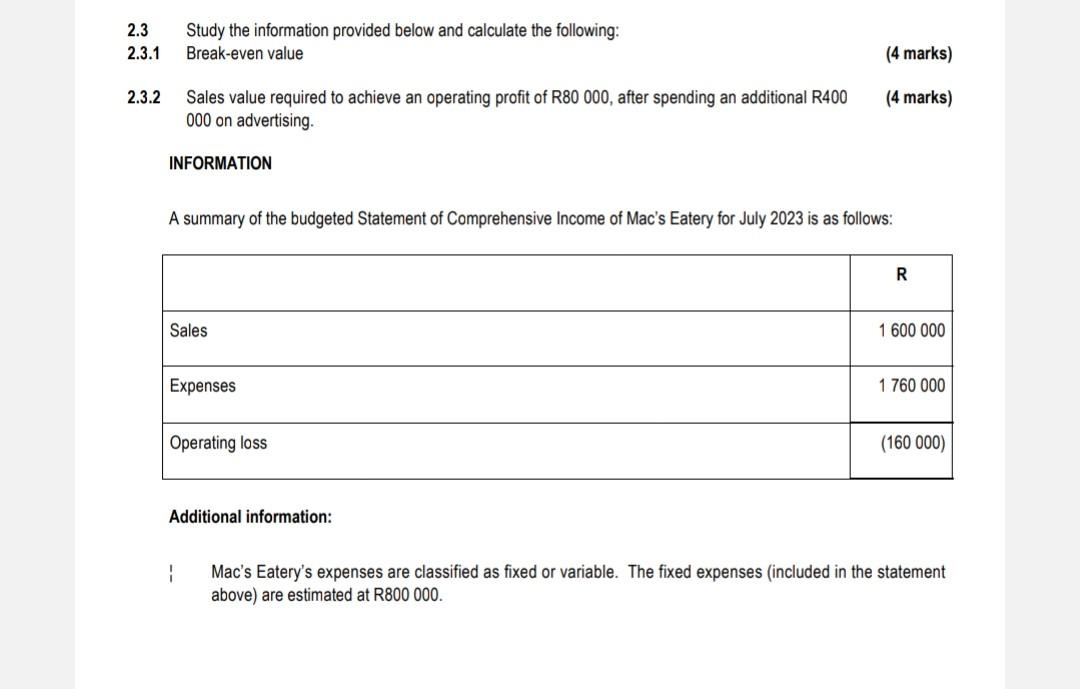

Answer the questions from the information provided. As far as possible use the contribution margin model to present your answers. 2.1 Use the information provided below to calculate the expected Operating Profit/Loss of each (8 marks) proposal. INFORMATION The following budgeted information for the year ended 30 June 2023 was provided by Aster Ltd, a manufacturer of a single product: The sales manager suggested two proposals to improve the expected operating profit: : Proposal A involves launching an improved marketing campaign. This would involve an additional R360 000 outlay for advertising. Sales commission will increase by R2 per unit. Sales are expected to increase by 25% above the budgeted sales volume, with no change in the unit selling price. Proposal B involves a 10% reduction in the unit selling price. Fixed selling overheads will reduce by R240 000. The sales volume is expected to increase by 16000 units. 2.2 Study the information given below and calculate the percentage by which the selling price per unit (4 marks) must increase, to increase operating profit by 10%. (Assume that there are no changes to the sales volume, total variable costs or fixed costs.) INFORMATION Melton Ltd sells only one product. The following information, which includes all costs, is available for the month ended July 2022 : 2.3 Study the information provided below and calculate the following: 2.3.1 Break-even value (4 marks) 2.3.2 Sales value required to achieve an operating profit of R80 000 , after spending an additional R400 (4 marks) 000 on advertising. INFORMATION A summary of the budgeted Statement of Comprehensive Income of Mac's Eatery for July 2023 is as follows: Additional information: I Mac's Eatery's expenses are classified as fixed or variable. The fixed expenses (included in the statement above) are estimated at R800 000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started