Answered step by step

Verified Expert Solution

Question

1 Approved Answer

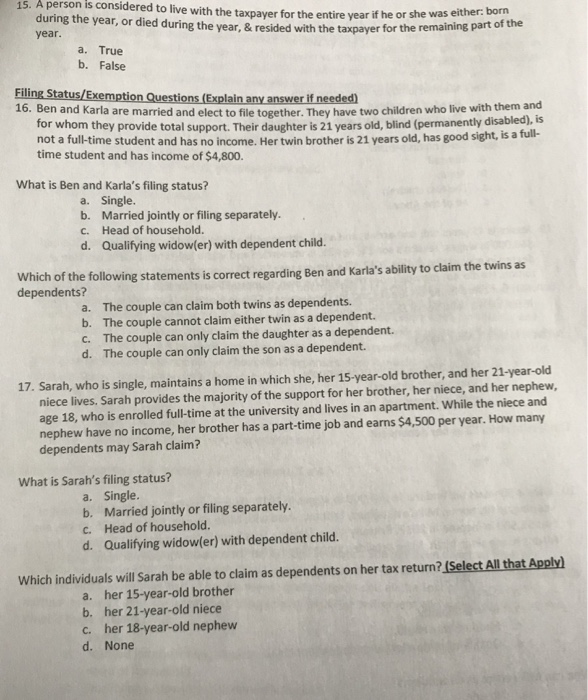

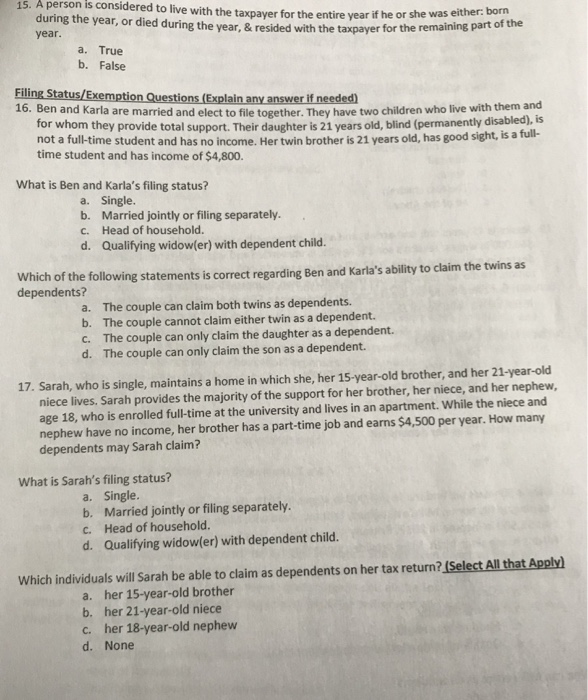

Answer the questions in the picture 15. A person is considered to live with the taxpayer for the entire year if he or she was

Answer the questions in the picture

15. A person is considered to live with the taxpayer for the entire year if he or she was either: born during the year, or died during the year, & resided with year. the taxpayer for the remaining part of the a. True b. False stions (Explain a if 16. Ben and Karla are married and elect to file together. They have two children who live with them a sabled),is for whom they provide total support. Their daughter is 21 years old, blind (permanently d not a full-time student and has no income. time student and has income of $4,800. Her twin brother is 21 years old, has good sight, is a full- What is Ben and Karla's filing status? a. b. c. d. Single. Married jointly or filing separately. Head of household. Qualifying widow(er) with dependent child. garding Ben and Karla's ability to claim the twins as Which of the following statements is correct re dependents? The couple can claim both twins as dependents. The couple cannot claim either twin as a dependent. The couple can only claim the daughter as a dependent. The couple can only claim the son as a dependent. a. b. c. d. niece lives. Sarah provides the majority of the support for her brother, her niece, and her nephew, age 18, who is enrolled full-time at the university and lives in an apartment. While the niece and nephew have no income, her brother has a part-time job and earns $4,500 per year. How many dependents may Sarah claim? 17. Sarah, who is single, maintains a home in which she, her 15-year-old brother, and her 21-year-old What is Sarah's filing status? a. b. c. d. Single Married jointly or filing separately. Head of household. Qualifying widow(er) with dependent child. Which individuals will Sarah be able to claim as dependents on her tax return? (Select All that Apply a. her 15-year-old brother b. her 21-year-old niece c. her 18-year-old nephew d. None

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started