Question

Answer the questions included in the case study in a Word document and submit an Excel file with the required amortization table. Please show your

Answer the questions included in the case study in a Word document and submit an Excel file with the required amortization table. Please show your formulas!

Financing Building Costs of Saint Louis University:

Saint Louis University is building a $17,000,000 office and classroom building in St. Louis in Missouri, and is planning to finance the construction at a 75% loan-to-value ratio, meaning that the borrowed money corresponds to 75% of the value of the building. The balance of 25% will be paid in cash up front. This loan has a twelve-year maturity, calls for monthly payments, and is contracted at an interest rate of 6.5%.

Using the above information, answer the following questions.

1. What is the monthly payment?

Answer:

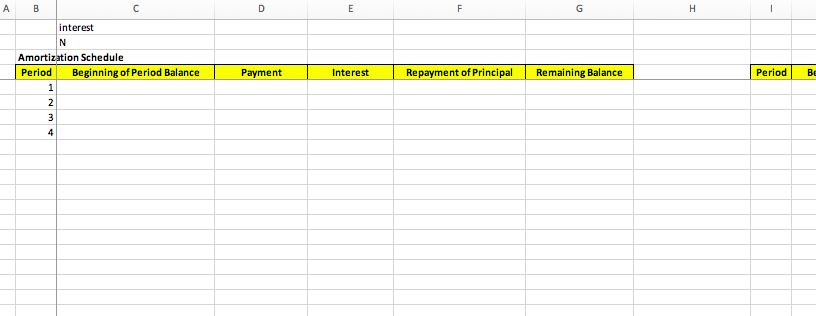

2. Using the provided Excel file, construct the amortization table in the spread sheet named "AmortizTable".

3. How much of the first payment is interest?

Answer:

4. How much of the first payment is principal?

Answer:

5. How much will Saint Louis University owe on this loan after making monthly payments for four years (the amount owed immediately after the forty-eight payment)?

Answer:

6. Should this loan be refinanced after four years with a new eight-year 5.5% loan, if the cost to refinance is $215,000? (This means that the refinance cost must be added to the owed amount at the end of four years).

Answer:

7. Returning to the original twelve-year 6.5% loan, how much is the loan payment if these payments are scheduled for quarterly rather than monthly payments?

Answer:

8. For this loan with quarterly payments, how much will Saint Louis University owe on this loan after making quarterly payments for four years (the amount owed immediately after the sixteenth payment)? (Hint: you can use the provided Excel file and do the estimations in the spread "Sheet2")

Answer:

9. What is the effective annual rate (EAR) on the original twelve-year 6.5% loan?

Answer:

10. For the original twelve-year 6.5% loan, how much is paid in interest over the entire life of the loan?

Answer:

11. For the twelve-year 6.5% loan, what is the total construction cost including financial cost?

Answer:

12. How much is the difference in the total construction cost between the original twelve-year 6.5% loan with monthly payments and the twelve-year 6.5% loan with quarterly payments?

Answer:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started