Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer the questions that are given below. 11. From the following list of balances and adjustments for Frutte Lemon you are required to complete a

Answer the questions that are given below.

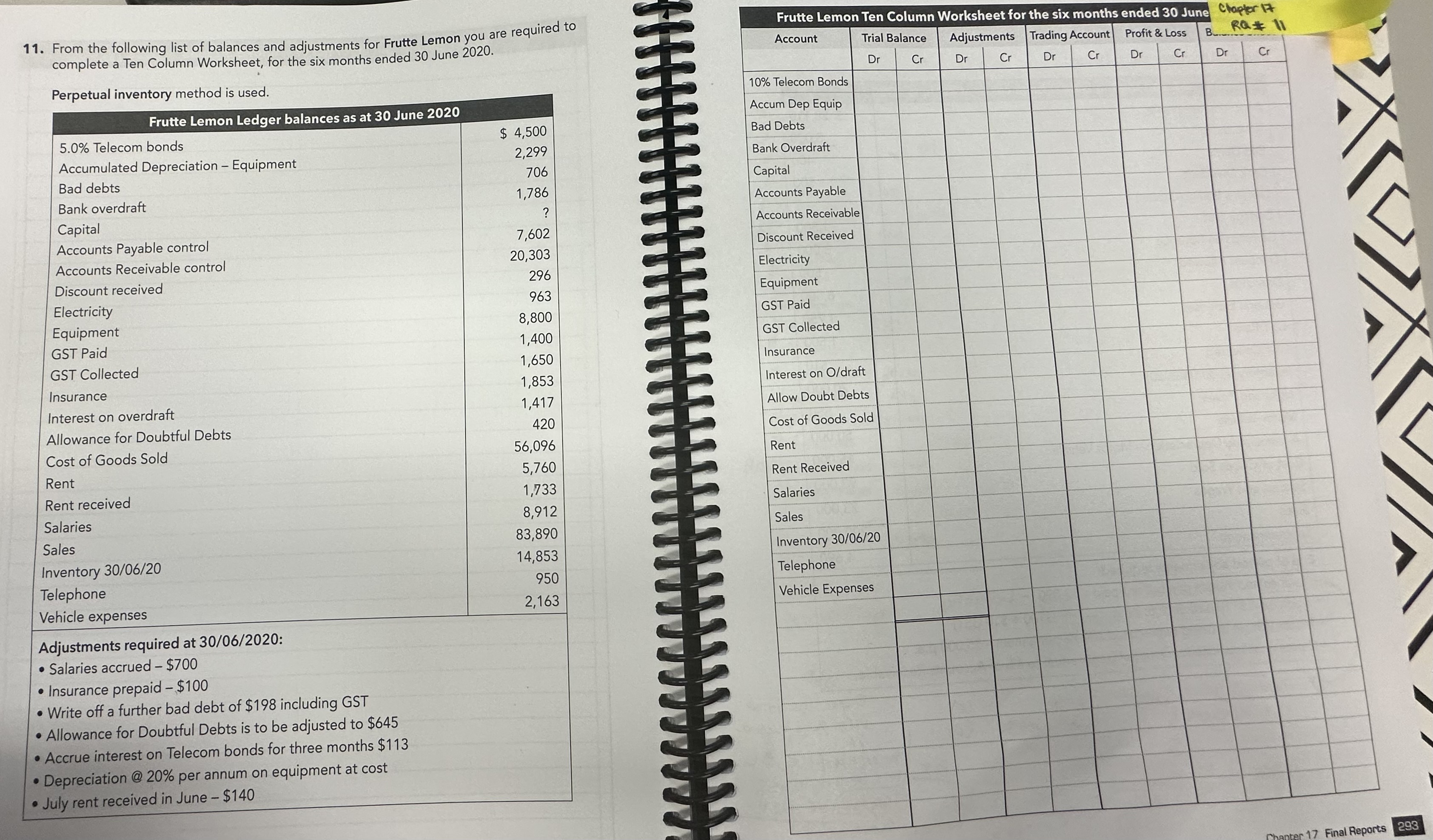

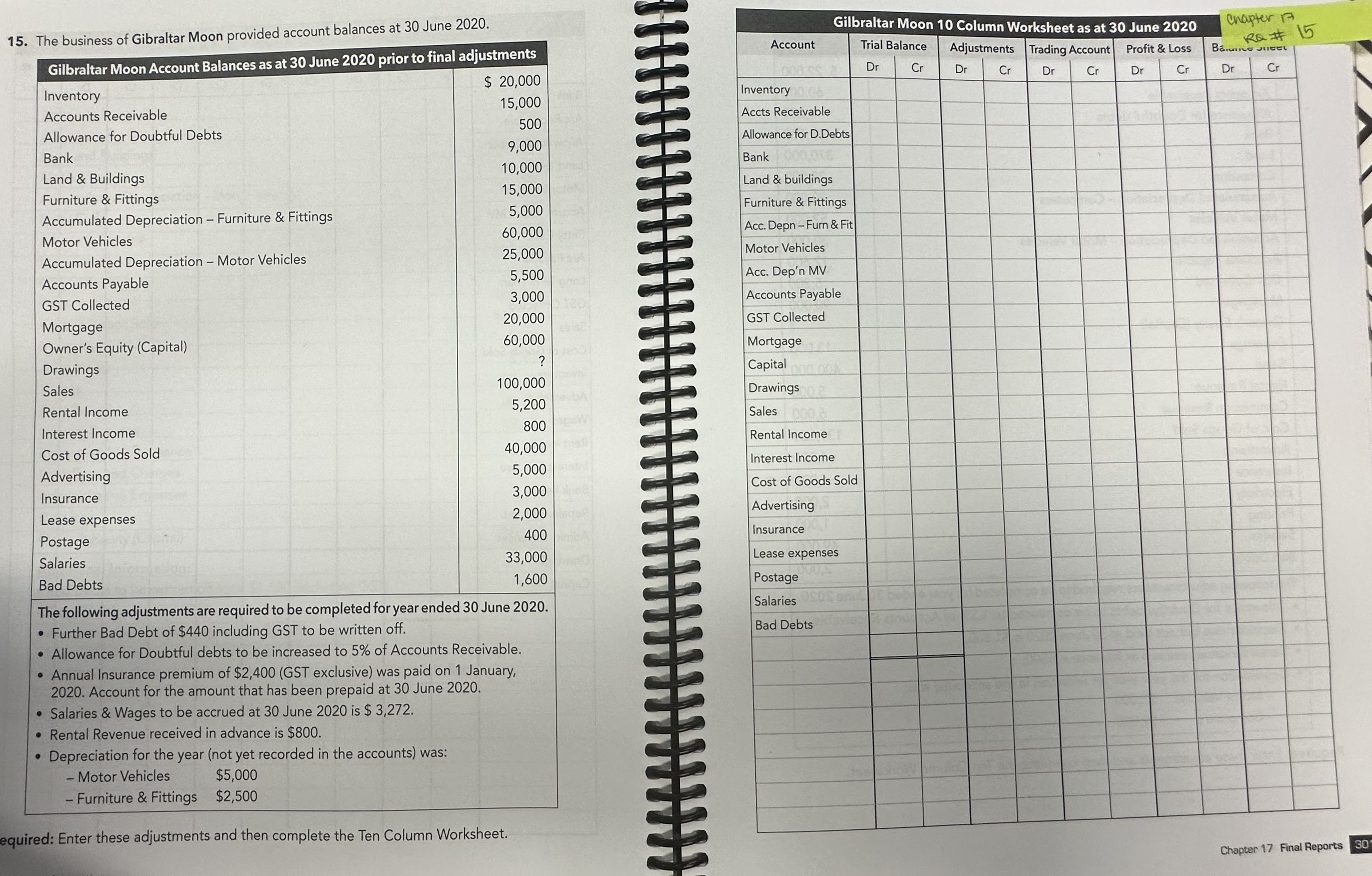

11. From the following list of balances and adjustments for Frutte Lemon you are required to complete a Ten Column Worksheet, for the six months ended 30 June 2020. Perpetual inventory method is used. Frutte Lemon Ledger balances as at 30 June 2020 5.0% Telecom bonds Accumulated Depreciation - Equipment Bad debts Bank overdraft Capital Accounts Payable control Accounts Receivable control Discount received Electricity Equipment GST Paid GST Collected Insurance Interest on overdraft Allowance for Doubtful Debts Cost of Goods Sold Rent Rent received Salaries Sales Inventory 30/06/20 Telephone Vehicle expenses 9 Adjustments required at 30/06/2020: Salaries accrued - $700 Insurance prepaid - $100 Write off a further bad debt of $198 including GST Allowance for Doubtful Debts is to be adjusted to $645 Accrue interest on Telecom bonds for three months $113 Depreciation @20% per annum on equipment at cost July rent received in June - $140 $4,500 2,299 706 1,786 ? 7,602 20,303 296 963 8,800 1,400 1,650 1,853 1,417 420 56,096 5,760 1,733 8,912 83,890 14,853 950 2,163 Frutte Lemon Ten Column Worksheet for the six months ended 30 June Chapter 17 RQ# 11 Account Trial Balance Dr Cr Adjustments Trading Account Cr Dr Profit & Loss B... Dr Dr Cr 10% Telecom Bonds Accum Dep Equip Bad Debts Bank Overdraft Capital Accounts Payable Accounts Receivable Discount Received Electricity Equipment GST Paid GST Collected Insurance Interest on O/draft Allow Doubt Debts Cost of Goods Sold Rent Rent Received Salaries Sales Inventory 30/06/20 Telephone Vehicle Expenses Dr Cr Cr PAVA Chapter 17 Final Reports 293

Step by Step Solution

★★★★★

3.39 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER To complete the Ten Column Worksheets for both Frutte Lemon and Gibraltar Moon we need to follow the adjustments provided for each company Lets ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started