Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer the TRUE or FALSE. Choose it, read the sentences please thankyou. PLEASE ANSWER IT ALL. I DONT HAVE ENOUGH QUESTIONS TO POST IT. I

Answer the TRUE or FALSE. Choose it, read the sentences please thankyou. PLEASE ANSWER IT ALL. I DONT HAVE ENOUGH QUESTIONS TO POST IT. I REACHED 20 QUESTIONS ALREADY! .

Answer 9, 10,11,12,13 and 14. Answer it all please thank you

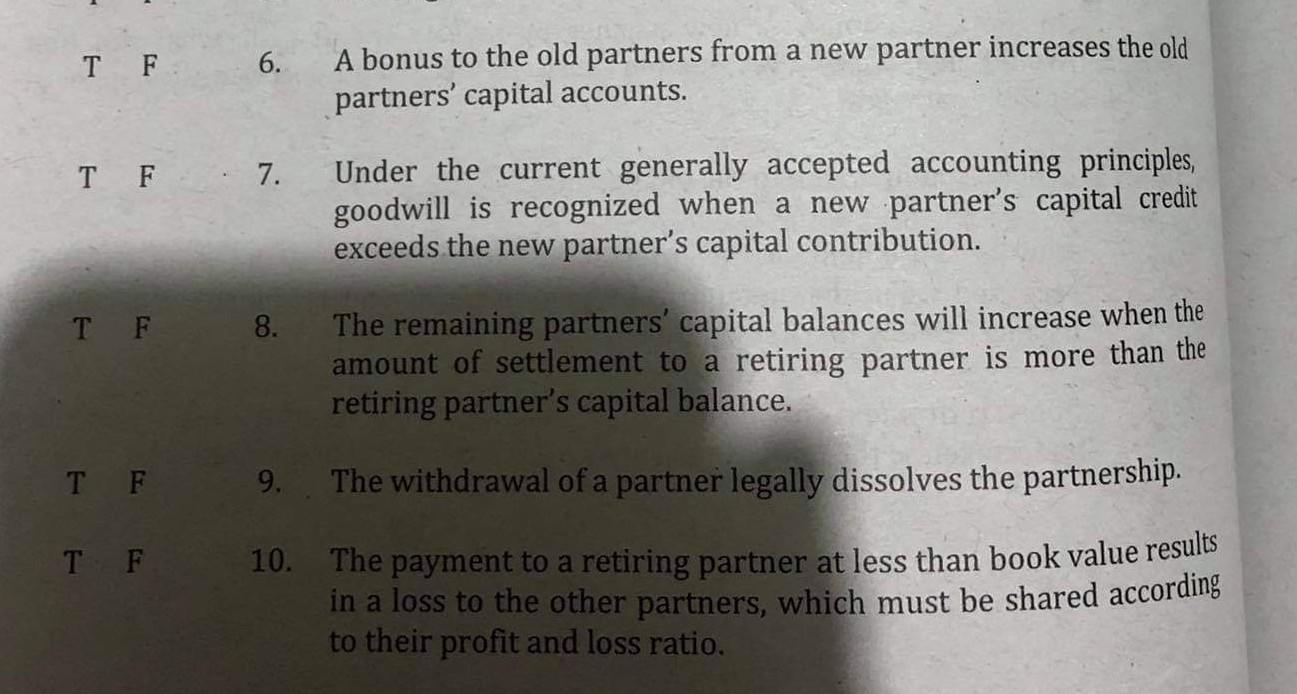

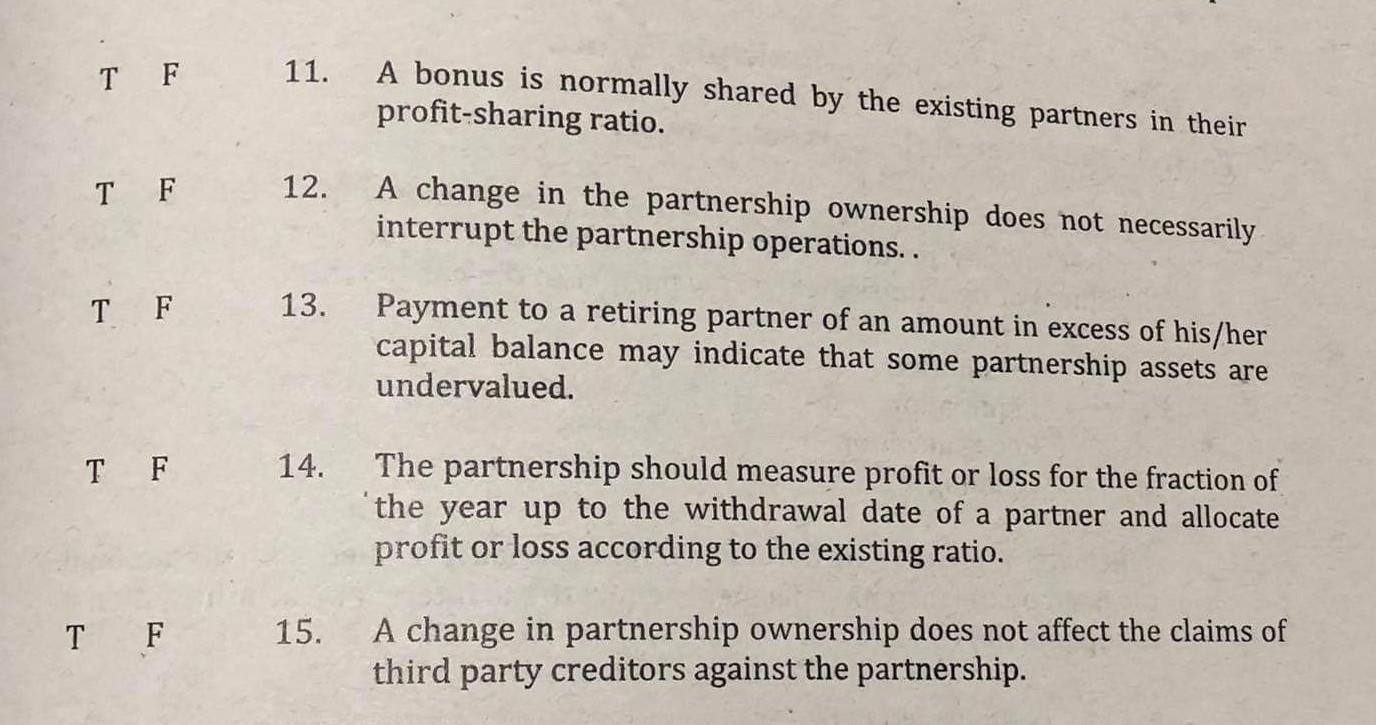

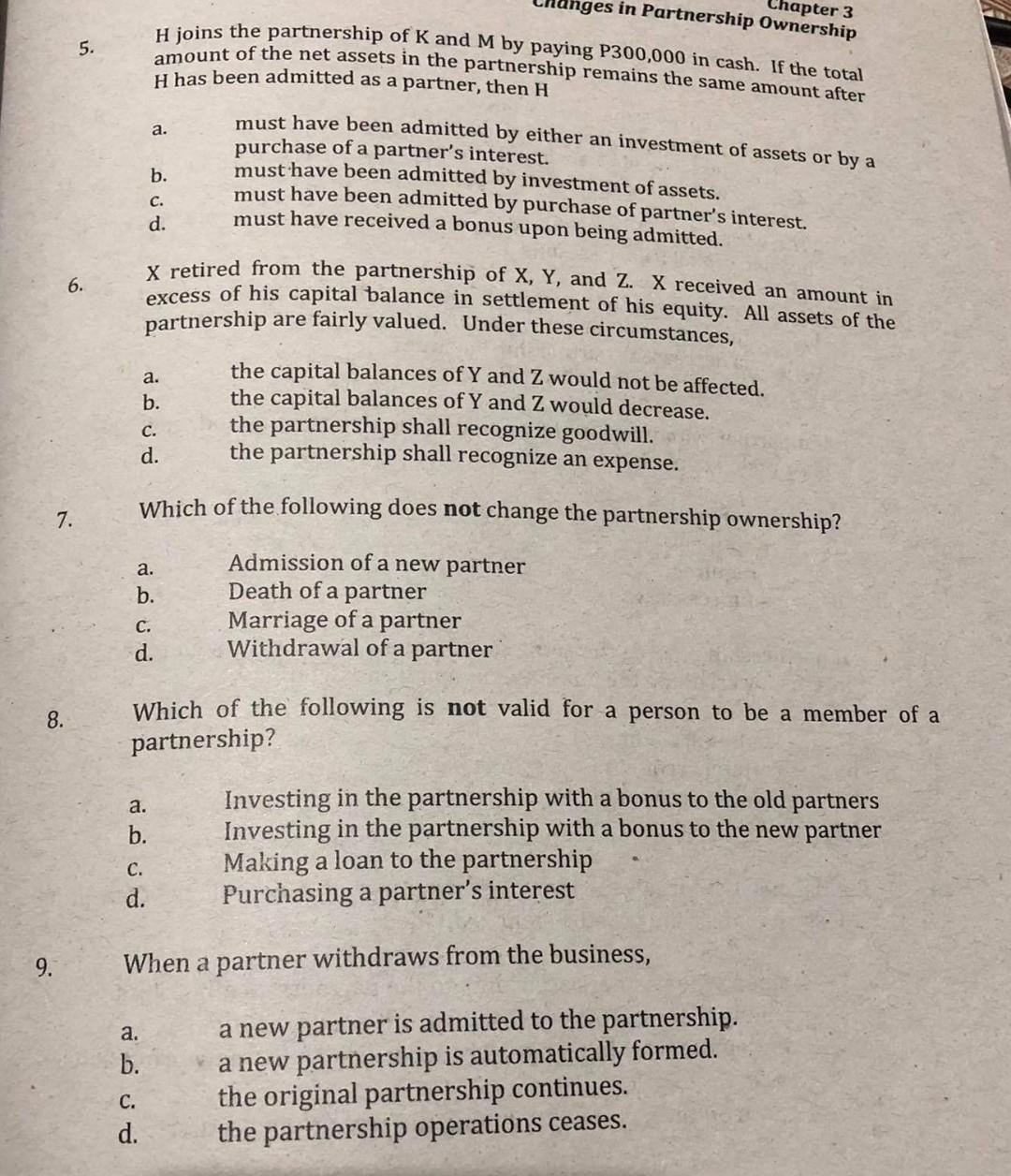

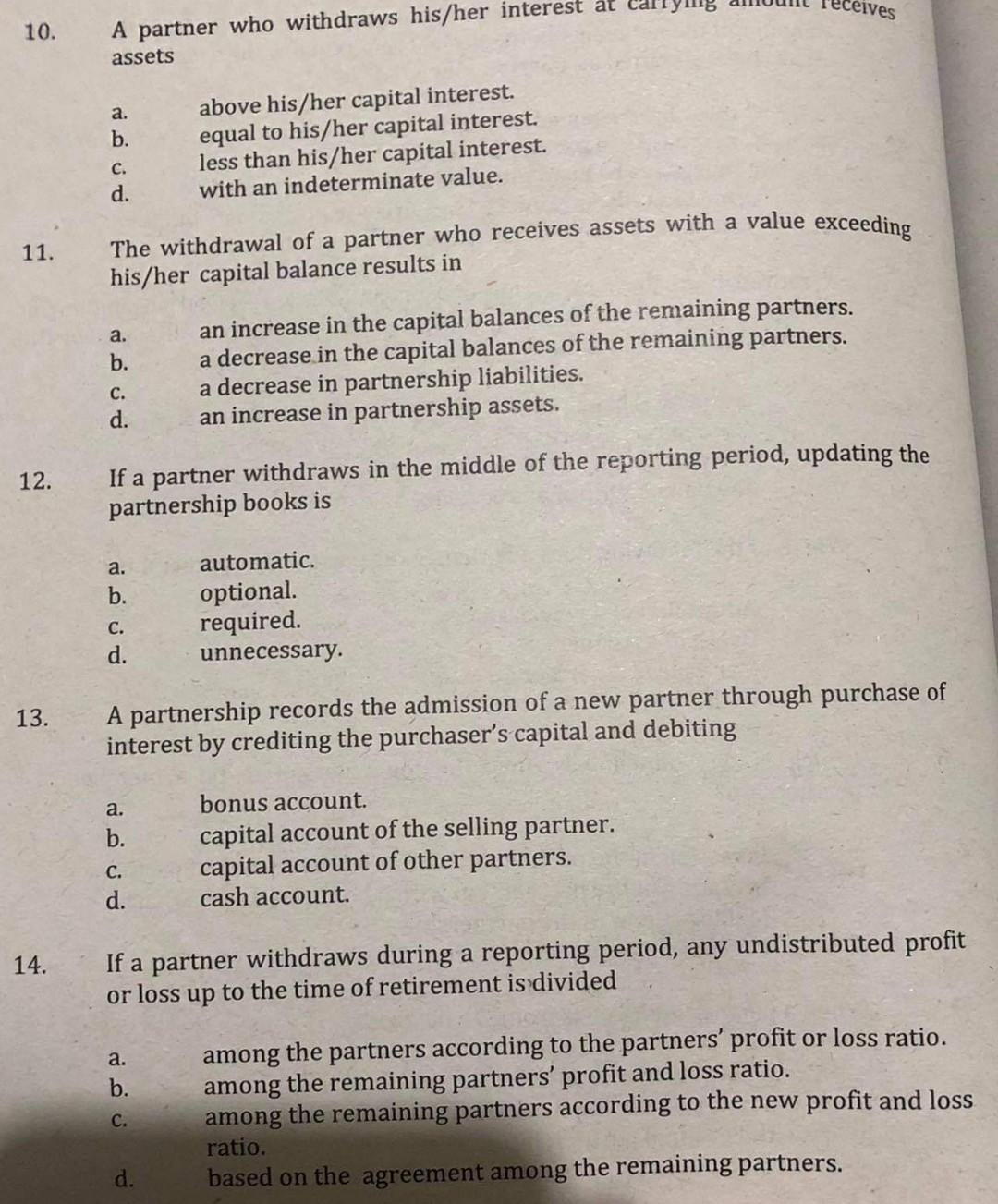

T F 6. A bonus to the old partners from a new partner increases the old partners' capital accounts. T F. 7. Under the current generally accepted accounting principles, goodwill is recognized when a new partner's capital credit exceeds the new partner's capital contribution. T F 8. The remaining partners' capital balances will increase when the amount of settlement to a retiring partner is more than the retiring partner's capital balance. TF 9. The withdrawal of a partner legally dissolves the partnership. TF 10. The payment to a retiring partner at less than book value results in a loss to the other partners, which must be shared according to their profit and loss ratio. T F 11. A bonus is normally shared by the existing partners in their profit-sharing ratio. T F 12. A change in the partnership ownership does not necessarily interrupt the partnership operations.. T F 13. Payment to a retiring partner of an amount in excess of his/her capital balance may indicate that some partnership assets are undervalued. T F 14. The partnership should measure profit or loss for the fraction of 'the year up to the withdrawal date of a partner and allocate profit or loss according to the existing ratio. T F 15. A change in partnership ownership does not affect the claims of third party creditors against the partnership. 5. nges in Partnership Ownership Chapter 3 H joins the partnership of K. and M by paying P300,000 in cash. If the total amount of the net assets in the partnership remains the same amount after H has been admitted as a partner, then H must have been admitted by either an investment of assets or by a purchase of a partner's interest. must have been admitted by investment of assets. must have been admitted by purchase of partner's interest. must have received a bonus upon being admitted. a. b. c. d. 6. X retired from the partnership of X, Y, and z. X received an amount in excess of his capital balance in settlement of his equity. All assets of the partnership are fairly valued. Under these circumstances, the capital balances of Y and Z would not be affected. the capital balances of Y and Z would decrease. the partnership shall recognize goodwill. the partnership shall recognize an expense. a. b. c. d. Which of the following does not change the partnership ownership? 7. a. b. Admission of a new partner Death of a partner Marriage of a partner Withdrawal of a partner c. d. 8. Which of the following is not valid for a person to be a member of a partnership? a. b. Investing in the partnership with a bonus to the old partners Investing in the partnership with a bonus to the new partner Making a loan to the partnership Purchasing a partner's interest 9. When a partner withdraws from the business, a. b. C. d. a new partner is admitted to the partnership. a new partnership is automatically formed. the original partnership continues. the partnership operations ceases. receives 10. A partner who withdraws his/her interest at assets a. b. above his/her capital interest. equal to his/her capital interest. less than his/her capital interest. with an indeterminate value. C. d. 11. The withdrawal of a partner who receives assets with a value exceeding his/her capital balance results in a. b. an increase in the capital balances of the remaining partners. a decrease in the capital balances of the remaining partners. a decrease in partnership liabilities. an increase in partnership assets. C. d. 12. If a partner withdraws in the middle of the reporting period, updating the partnership books is a. b. automatic. optional required. unnecessary. C. d. 13. A partnership records the admission of a new partner through purchase of interest by crediting the purchaser's capital and debiting a. b. bonus account. capital account of the selling partner. capital account of other partners. cash account. C. d. 14. If a partner withdraws during a reporting period, any undistributed profit or loss up to the time of retirement is divided a. b. C. among the partners according to the partners' profit or loss ratio. among the remaining partners' profit and loss ratio. among the remaining partners according to the new profit and loss ratio. based on the agreement among the remaining partners. dStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started