Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Answer the two questions written in bold in the last paragraph . Bond Valuation and Interest Rate Risk in practice the value of bonds, as

Answer the two questions written in bold in the last paragraph .

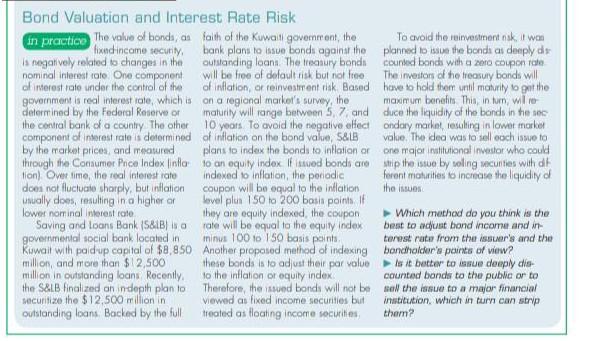

Bond Valuation and Interest Rate Risk in practice the value of bonds, as faith of the Kuwail governeront, the To avoid the reinvestment nik, wan fixed income security bank plans to issue bonds against the planned to save the bondi as deeply dis la negatively related to changes in the outstanding loans. The treasury bondi counted bondi with a 200 coupon nominal Interest rate One component will be free of default risk but not free The investons of the treasury bonds will of interest rate under the control of the of inflation of reinvestment risk Based have to hold them until maturity to get the government is real interest rate, which is on a regional market's survey, the maximum benefits This, in turn, wille determined by the Federal Reserve or maturity will range between 5, 7 and duce the liquidity of the bonds in the the central bank of a country. The other 10 years. To avoid the negative elect ondary market lesulting in lowet market component of Interest rate is determined of inflation on the bond value, 5&18 vale. The idea was to sell och issue to by the market prices, and measured plans to index the bonds to Inflation or one major rutitutional investor who could through the Consumer Price Index finilo to an equity Index If ved bondi aro trip the issue by oling vacun ties with dh tion) Over time, the real interest rate indexed to inflation, the periodic ferent matters to increase the liquidity does not fluctuato sharply, but inflation coupon will be equal to the inflation mually does, resulting in a higher or level plan 150 to 200 basin point if lower nominal Interest rate they are equity Indexed, the coupon Which method do you think is the Saving and loans Bank (581B) is rate will be equal to the equity Index best to adjust bond Income and in governmental social bank located in minus 100 101 50 basis point, terest rate from the issuer's and the Kuwait with paid up capital of $8,850 Another proposed method of indexing bondhour's point of view? million, and more than $12,500 these bonds is to adjust their par value Is it better to sue deeply dis- million in outstanding loans Recently, to the inflation or equity index counted bonds to the public or to the S&LB finalized an indepth plan to Therefore, the voed bonds will not be to the issue to a major financial securitize the $12,500 million in Viewed as fixed income securities but institution, which in turn can strip outstanding loans Bocked by the full treated as floating Income securities them? the issues Bond Valuation and Interest Rate Risk in practice the value of bonds, as faith of the Kuwail governeront, the To avoid the reinvestment nik, wan fixed income security bank plans to issue bonds against the planned to save the bondi as deeply dis la negatively related to changes in the outstanding loans. The treasury bondi counted bondi with a 200 coupon nominal Interest rate One component will be free of default risk but not free The investons of the treasury bonds will of interest rate under the control of the of inflation of reinvestment risk Based have to hold them until maturity to get the government is real interest rate, which is on a regional market's survey, the maximum benefits This, in turn, wille determined by the Federal Reserve or maturity will range between 5, 7 and duce the liquidity of the bonds in the the central bank of a country. The other 10 years. To avoid the negative elect ondary market lesulting in lowet market component of Interest rate is determined of inflation on the bond value, 5&18 vale. The idea was to sell och issue to by the market prices, and measured plans to index the bonds to Inflation or one major rutitutional investor who could through the Consumer Price Index finilo to an equity Index If ved bondi aro trip the issue by oling vacun ties with dh tion) Over time, the real interest rate indexed to inflation, the periodic ferent matters to increase the liquidity does not fluctuato sharply, but inflation coupon will be equal to the inflation mually does, resulting in a higher or level plan 150 to 200 basin point if lower nominal Interest rate they are equity Indexed, the coupon Which method do you think is the Saving and loans Bank (581B) is rate will be equal to the equity Index best to adjust bond Income and in governmental social bank located in minus 100 101 50 basis point, terest rate from the issuer's and the Kuwait with paid up capital of $8,850 Another proposed method of indexing bondhour's point of view? million, and more than $12,500 these bonds is to adjust their par value Is it better to sue deeply dis- million in outstanding loans Recently, to the inflation or equity index counted bonds to the public or to the S&LB finalized an indepth plan to Therefore, the voed bonds will not be to the issue to a major financial securitize the $12,500 million in Viewed as fixed income securities but institution, which in turn can strip outstanding loans Bocked by the full treated as floating Income securities them? the issuesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started