Question

The GreatOreCo mining company wishes to determine whether it should proceed to develop a copper mine for a lease that it owns. There would be

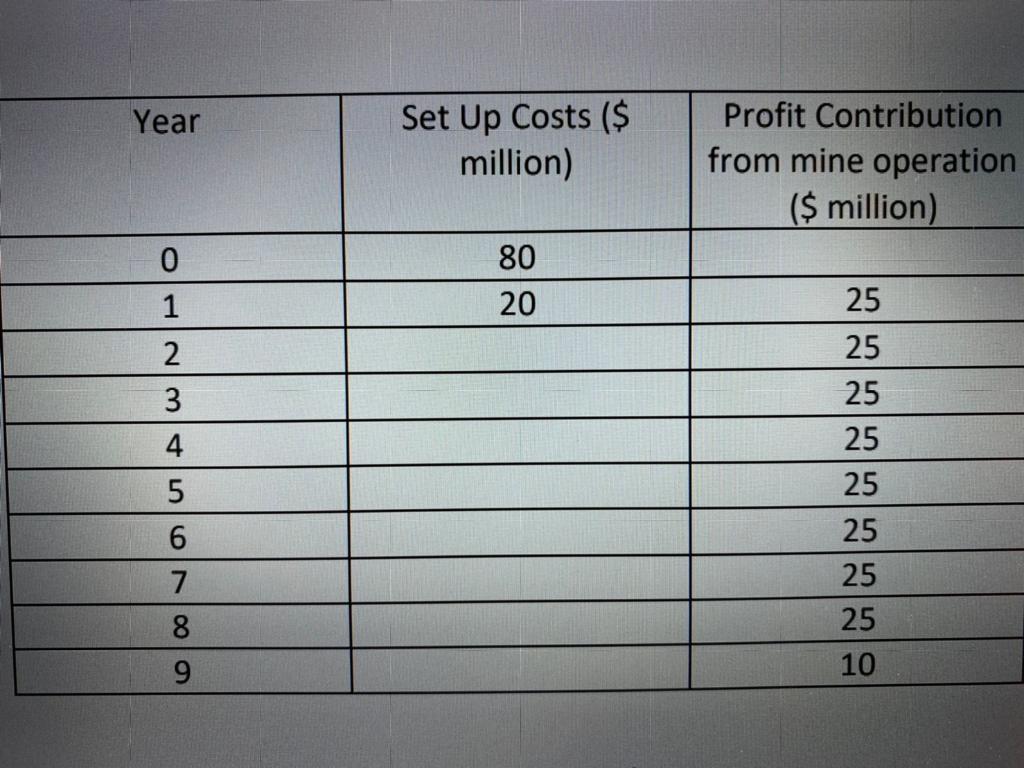

The GreatOreCo mining company wishes to determine whether it should proceed to develop a copper mine for a lease that it owns. There would be substantial development costs involved, and the mine would be expected to have a life span of nine years. The company would also be faced with environmental rehabilitation costs when the mine is closed down, and this is reflected by a smaller contribution in the mines final year of operation. Projected costs and yields have been determined and the resulting cash flows are summarised in the table below:

To compare the investment in the copper mine with other possible investments that GreatOreCo could make, management need to know the Internal Rate of Return (IRR) for the proposed copper mine. The IRR is the discount rate j1 for which the NPV of the project is zero. That is, the j1 rate for which PV(set up costs) = PV(operational profit contributions)

To compare the investment in the copper mine with other possible investments that GreatOreCo could make, management need to know the Internal Rate of Return (IRR) for the proposed copper mine. The IRR is the discount rate j1 for which the NPV of the project is zero. That is, the j1 rate for which PV(set up costs) = PV(operational profit contributions)

1 Derive and present the equation of equivalence that is appropriate for this scenario. Do NOT seek to simplify the expression. NB [Hint: Have expressions involving the 80 and the 20 on the left hand side, and expressions involving the 25s and the 10 on the right hand side. This is a Price is Right type of problem].

2 Using an estimate of j1=18%, determine the value of the left hand side (costs) and the right hand side (profit contributions) of the equation of equivalence

3 Present your next three estimates of j1 and the corresponding value of the right hand side of the equation of equivalence. Ensure that for each of these three steps you explain why you increased or decreased the value of j1. This question need to present first, and then Ensure each three steps and explain.

4 Determine a value of j1, for which the Left Hand Side (LHS) and Right hand Side (RHS) of the equation of equivalence vary by no more than $1000.00.

Year Set Up Costs ($ million) Profit Contribution from mine operation ($ million) 80 20 0 1 2 3 4 5 25 25 25 25 25 25 25 25 10 6 7 8 9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started