Answered step by step

Verified Expert Solution

Question

1 Approved Answer

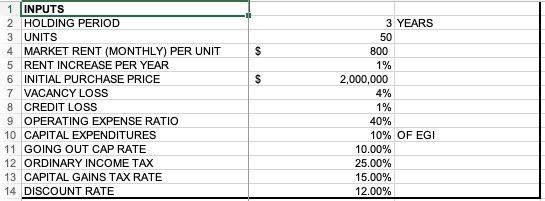

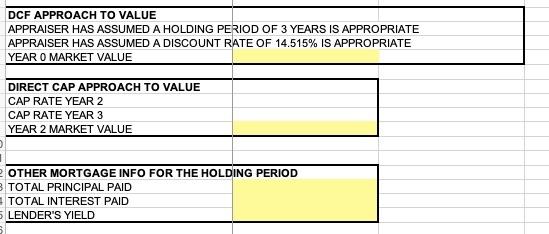

answer the yellow highlighted questions based on the information in the first photo $ $ 1 INPUTS 2 HOLDING PERIOD 3 UNITS 4 MARKET RENT

answer the yellow highlighted questions based on the information in the first photo

$ $ 1 INPUTS 2 HOLDING PERIOD 3 UNITS 4 MARKET RENT (MONTHLY) PER UNIT 5 RENT INCREASE PER YEAR 6 INITIAL PURCHASE PRICE 7 VACANCY LOSS 8 CREDIT LOSS 9 OPERATING EXPENSE RATIO 10 CAPITAL EXPENDITURES 11 GOING OUT CAP RATE 12 ORDINARY INCOME TAX 13 CAPITAL GAINS TAX RATE 14 DISCOUNT RATE 3 YEARS 50 800 1% 2,000,000 4% 1% 40% 10% OF EGI 10.00% 25.00% 15.00% 12.00% DCF APPROACH TO VALUE APPRAISER HAS ASSUMED A HOLDING PERIOD OF 3 YEARS IS APPROPRIATE APPRAISER HAS ASSUMED A DISCOUNT RATE OF 14.515% IS APPROPRIATE YEAR O MARKET VALUE DIRECT CAP APPROACH TO VALUE CAP RATE YEAR 2 CAP RATE YEAR 3 YEAR 2 MARKET VALUE OTHER MORTGAGE INFO FOR THE HOLDING PERIOD TOTAL PRINCIPAL PAID TOTAL INTEREST PAID LENDER'S YIELD $ $ 1 INPUTS 2 HOLDING PERIOD 3 UNITS 4 MARKET RENT (MONTHLY) PER UNIT 5 RENT INCREASE PER YEAR 6 INITIAL PURCHASE PRICE 7 VACANCY LOSS 8 CREDIT LOSS 9 OPERATING EXPENSE RATIO 10 CAPITAL EXPENDITURES 11 GOING OUT CAP RATE 12 ORDINARY INCOME TAX 13 CAPITAL GAINS TAX RATE 14 DISCOUNT RATE 3 YEARS 50 800 1% 2,000,000 4% 1% 40% 10% OF EGI 10.00% 25.00% 15.00% 12.00% DCF APPROACH TO VALUE APPRAISER HAS ASSUMED A HOLDING PERIOD OF 3 YEARS IS APPROPRIATE APPRAISER HAS ASSUMED A DISCOUNT RATE OF 14.515% IS APPROPRIATE YEAR O MARKET VALUE DIRECT CAP APPROACH TO VALUE CAP RATE YEAR 2 CAP RATE YEAR 3 YEAR 2 MARKET VALUE OTHER MORTGAGE INFO FOR THE HOLDING PERIOD TOTAL PRINCIPAL PAID TOTAL INTEREST PAID LENDER'S YIELD Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started