Answer these

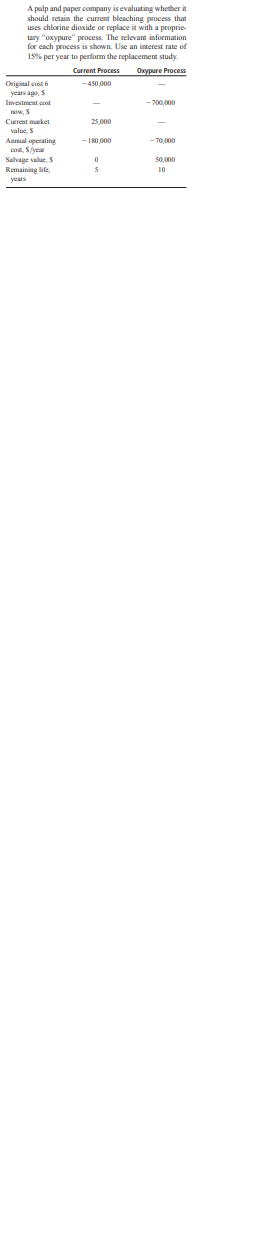

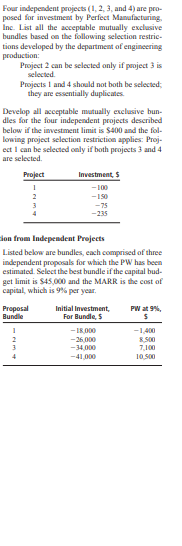

A pulp and paper company is evaluating whether it should retain the current bleaching process that uses chlorine dioxide or replace it with a proprie- tary "oxypure" process. The relevant information for each process is shown, Use an interest rate of 13% per year to perform the replacement study Current Process Oxypure Process Original cost 6 -450,000 years ago, 5 Investment cost -700,00D now, $ Current market 35 000 value, $ Annual operating - INI,OOD -7070OD Sahage value, $ 50,DOD Remaining life, YearsFour independent projects ( 1, 2, 3, and 4) are pro- posed for investment by Perfect Manufacturing Inc. List all the acceptable mutually exclusive bundles based on the following selection restric tions developed by the department of engineering production: Project 2 can be selected only if project 3 is selected. Projects 1 and 4 should not both be selected; they are essentially duplicates Develop all acceptable mutually exclusive bun- dles for the four independent projects described below if the investment limit is $400 and the fol- lowing project selection restriction applies: Proj- ect I can be selected only if both projects 3 and 4 are selected. Project Investment, $ -100 -75 -235 ion from Independent Projects Listed below are bundles, each comprised of three independent proposals for which the PW has been estimated. Select the best bundle if the capital bud- get limit is $45,000 and the MARK is the cost of capital, which is 9% per year. Proposal Initial Investment, Bundle For Bundle, $ -1,400 -36 000 8 50O -34 000 -41 000 10.500Three years ago Chicago's O'Hare Airport purchased a new fire truck. Because of flight in- creases, new fire-fighting capacity is needed once again. An additional truck of the same capac- ity can be purchased now, or a double-capacity truck can replace the current fire truck. Esti- mates are presented below. Compare the options at 12%% per year using (a) a 12-year study period and (b) a 9-year study period. Presently Owned New Purchase Double Capacity Fintest P.S -151,000 (3 years ago) -175,000 -190 000 AOC, S -1,500 -1,500 -2,500 Market value, $ Salvage value, $ 10% ofP 12% of P 10% of P Life, years 12 12 12 ExlutionFor the last 2 years, The Health Company has experienced a fixed cost of $850,000 per year and an (r - v) value of $1.25 per unit for its multivitamin line of products. International competition has become severe enough that some financial changes must be made to keep market share at the current level. (a) Perform a spreadsheet-based graphical anal- ysis to estimate the effect on the breakeven point if the differen etween revenue and variable cost per unit somewhere between 1% and 15% of its current value. (b) If fixed costs and revenue per unit remain at their current values, what type of change must take place to make the breakeven point go down? (This is an extension of Problem 13.15) Expand the analysis performed in Problem 13.15 by chang- ing the variable cost per unit. The financial man- ager estimates that fixed costs will fall to $730,000 when the required production rate to break even is at or below 600,000 units. What happens to the breakeven points over the (r - v) range of 1%: to 13%% increase as evaluated previously?\f