Answered step by step

Verified Expert Solution

Question

1 Approved Answer

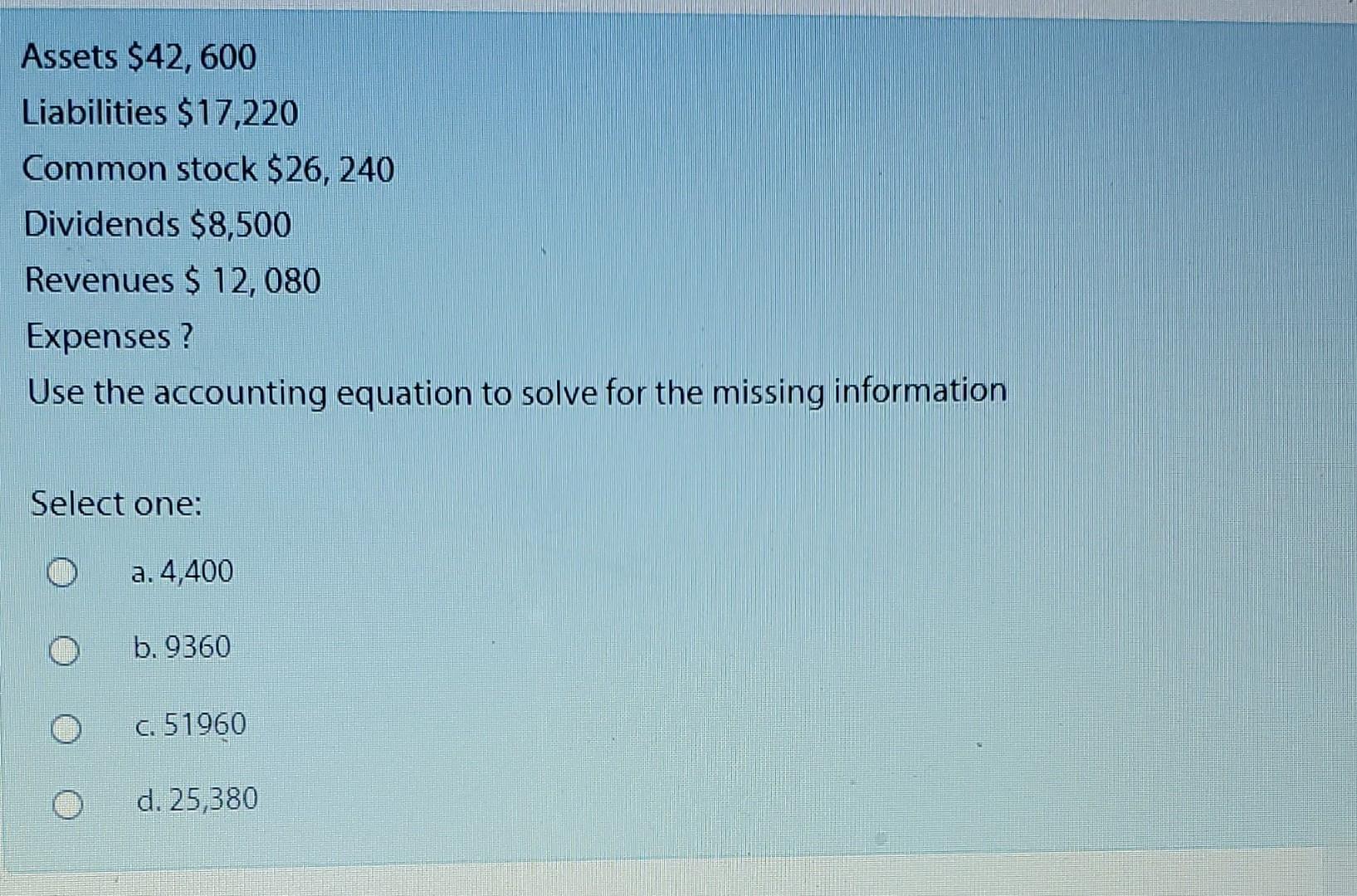

answer these multiple choice questions Use the accounting equation to solve for the missing information Select one: a. 4,400 b. 9360 c. 51960 d. 25,380

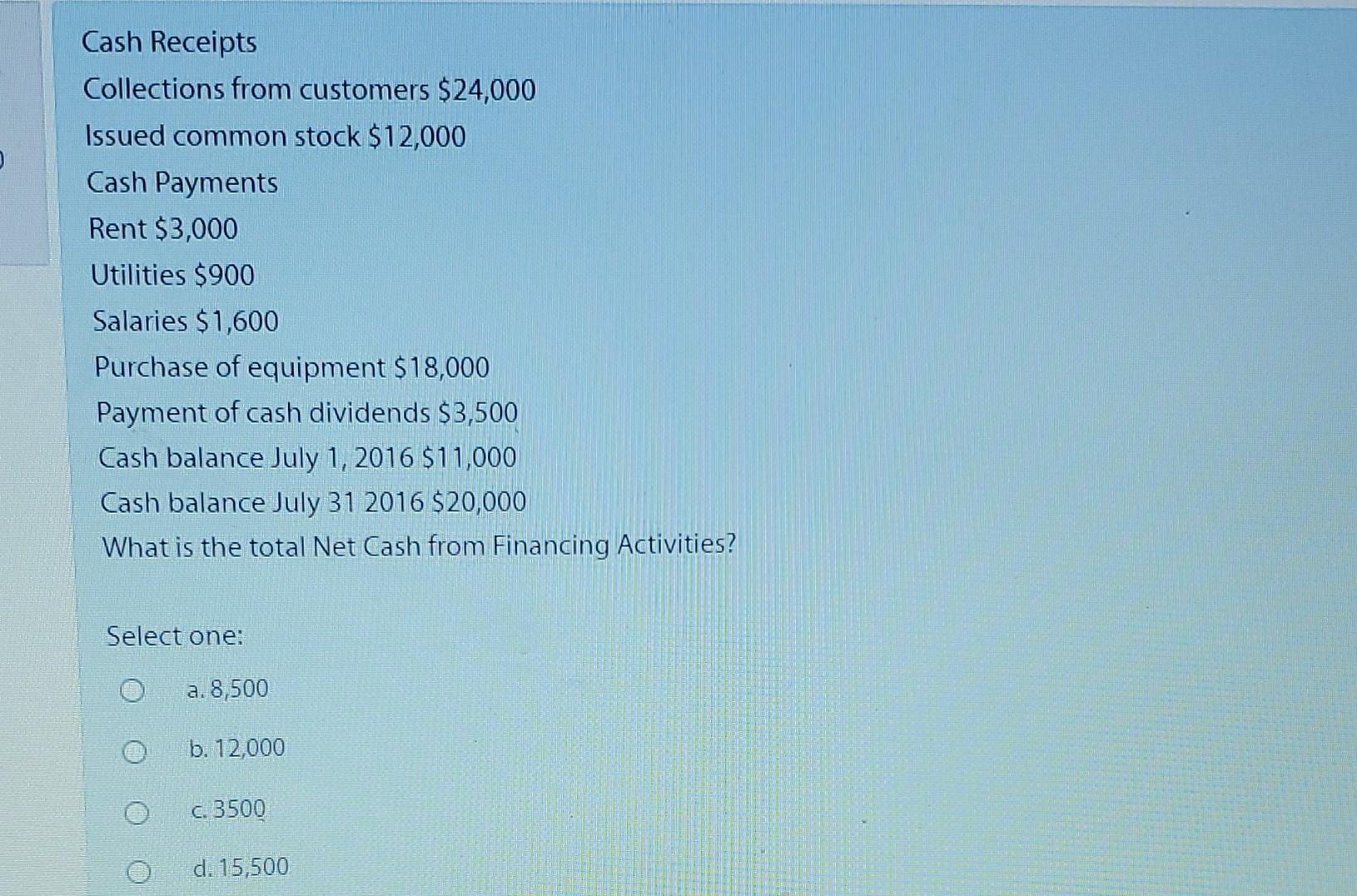

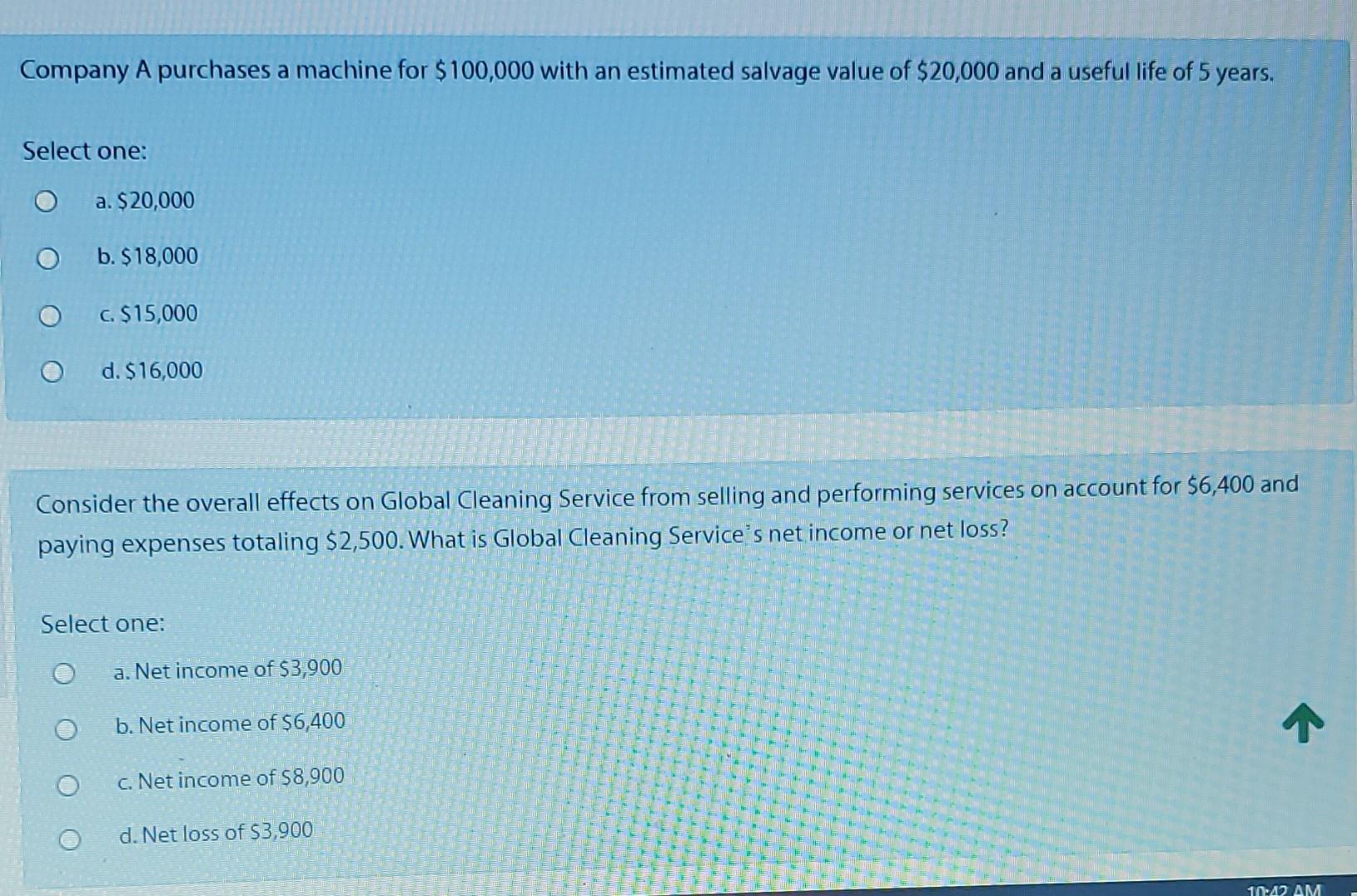

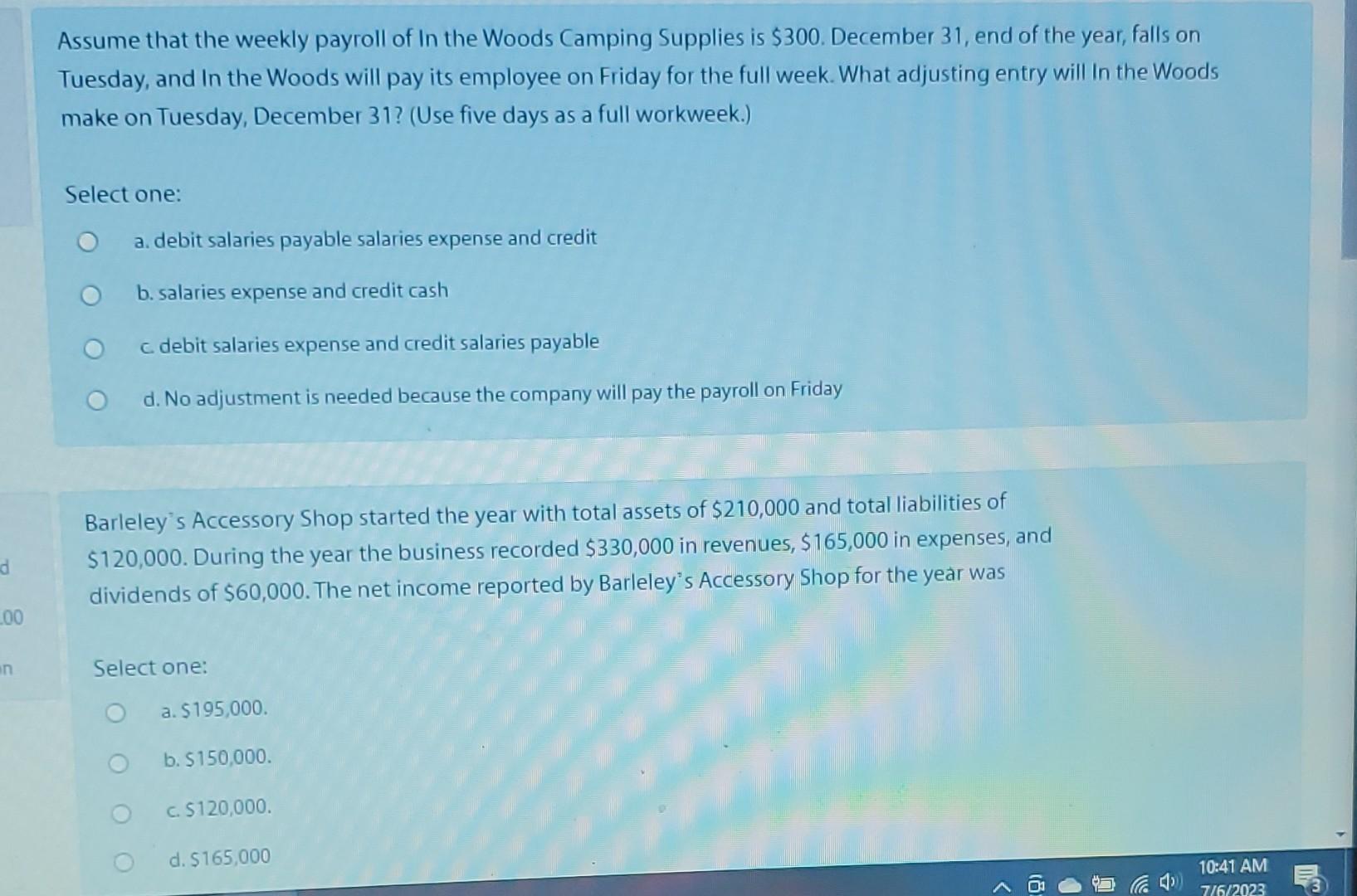

answer these multiple choice questions

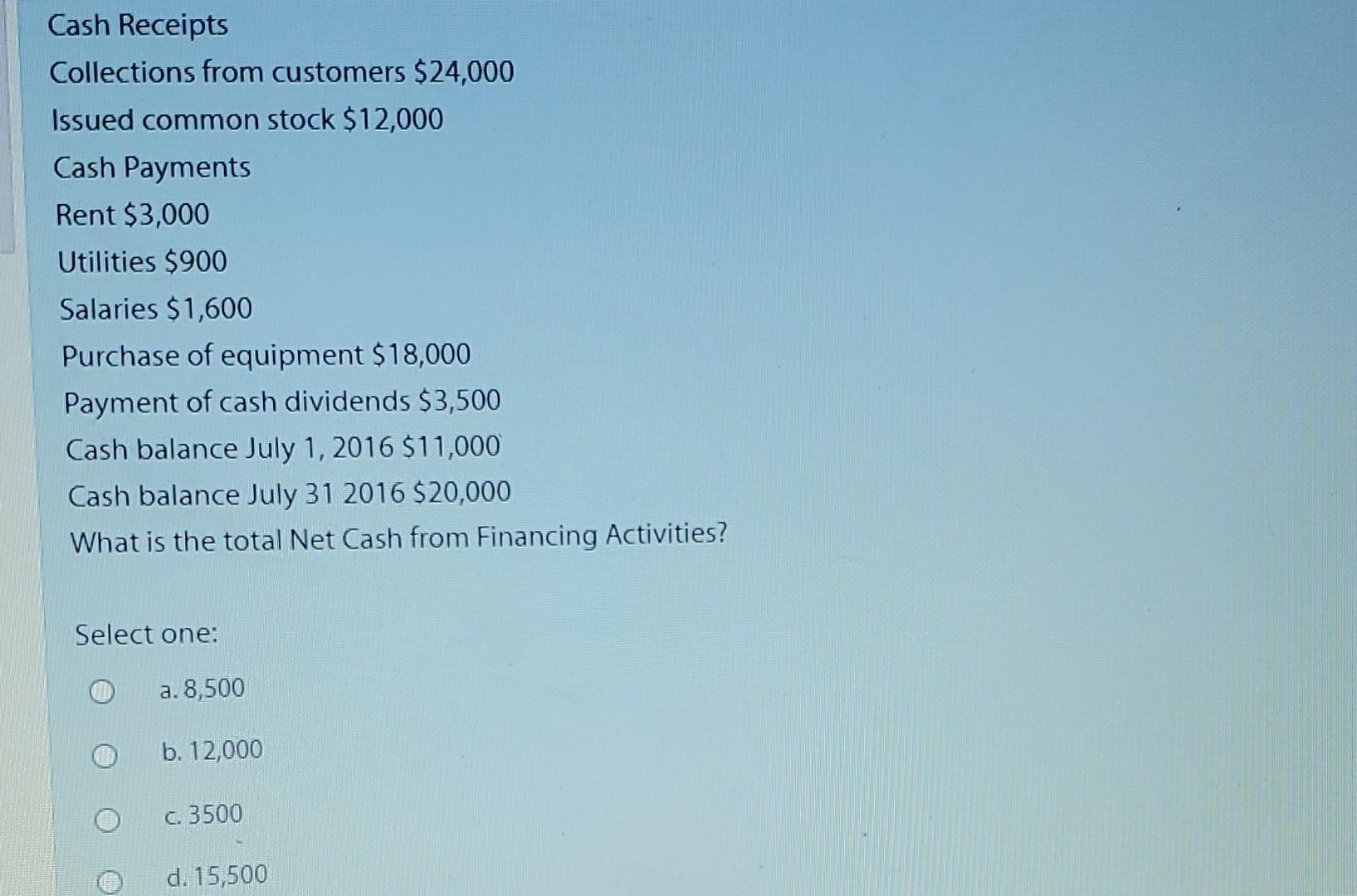

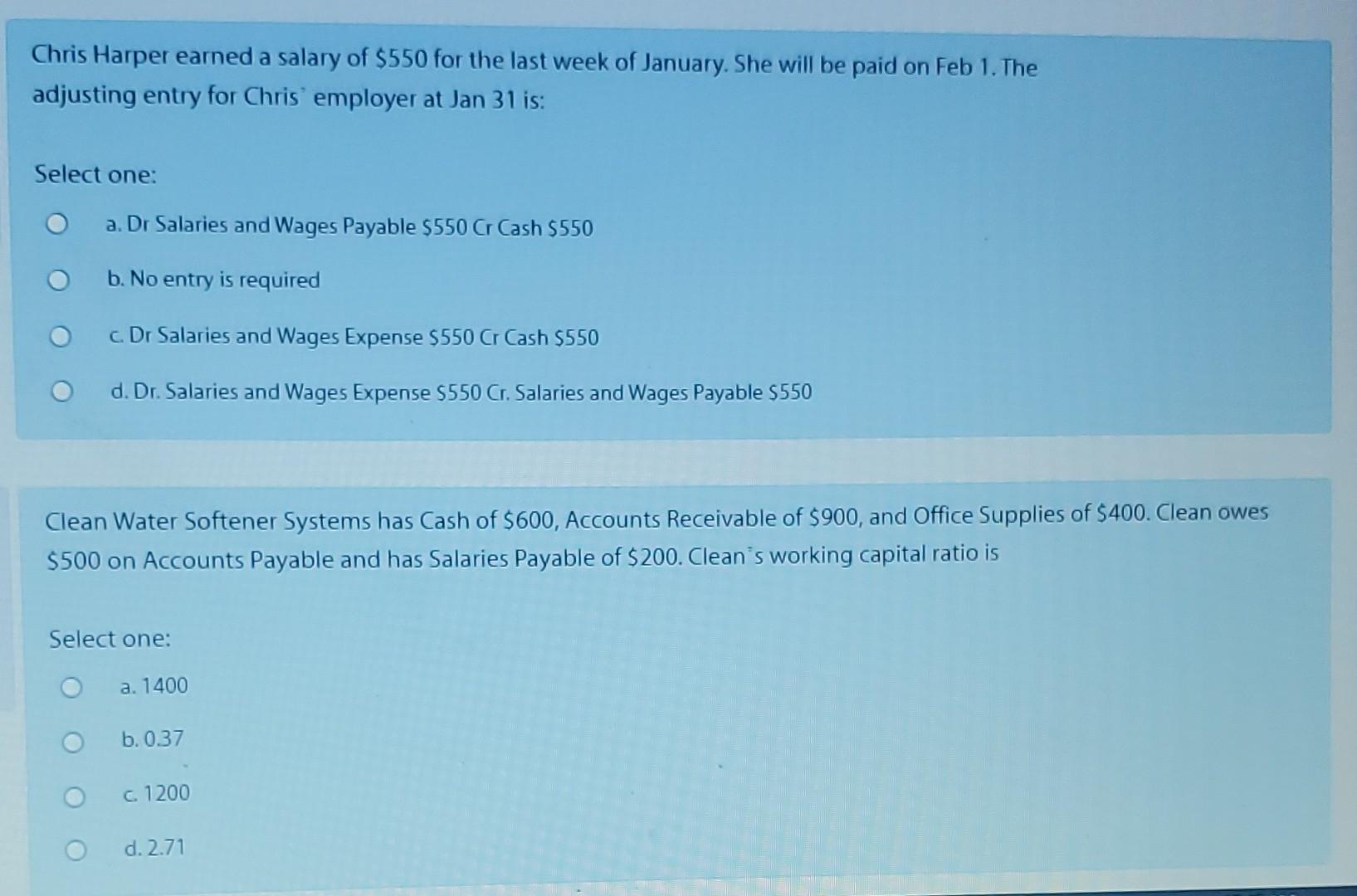

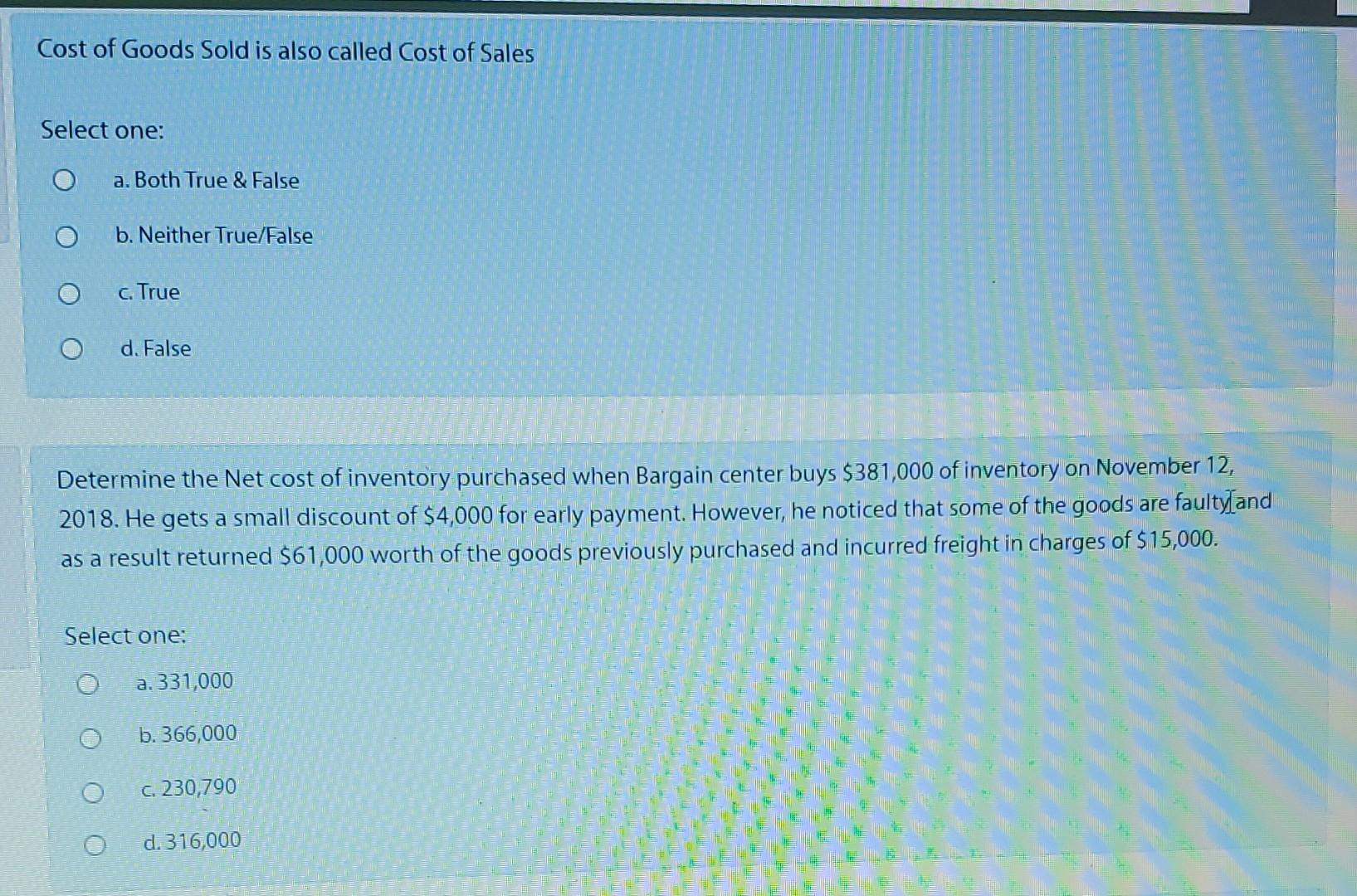

Use the accounting equation to solve for the missing information Select one: a. 4,400 b. 9360 c. 51960 d. 25,380 a. 8,500 b. 12,000 c. 3500 d. 15,500 Company A purchases a machine for $100,000 with an estimated salvage value of $20,000 and a useful life of 5 years. Select one: a. $20,000 b. $18,000 c. $15,000 d. $16,000 Consider the overall effects on Global Cleaning Service from selling and performing services on account for $6,400 and paying expenses totaling $2,500. What is Global Cleaning Service's net income or net loss? Select one: a. Net income of $3,900 b. Net income of $6,400 c. Net income of $8,900 d. Net loss of $3,900 Assume that the weekly payroll of In the Woods Camping Supplies is $300. December 31 , end of the year, falls on Tuesday, and In the Woods will pay its employee on Friday for the full week. What adjusting entry will In the Woods make on Tuesday, December 31 ? (Use five days as a full workweek.) Select one: a. debit salaries payable salaries expense and credit b. salaries expense and credit cash c. debit salaries expense and credit salaries payable d. No adjustment is needed because the company will pay the payroll on Friday Barleley's Accessory Shop started the year with total assets of $210,000 and total liabilities of $120,000. During the year the business recorded $330,000 in revenues, $165,000 in expenses, and dividends of $60,000. The net income reported by Barleley's Accessory Shop for the year was Select one: a. $195,000. b. $150,000. c. $120,000. d. $165,000 a. 8,500 b. 12,000 c. 3500 d. 15,500 Chris Harper earned a salary of $550 for the last week of January. She will be paid on Feb 1 . The adjusting entry for Chris' employer at Jan 31 is: Select one: a. Dr Salaries and Wages Payable $550Cr Cash $550 b. No entry is required c. Dr Salaries and Wages Expense $550Cr Cash $550 d. Dr. Salaries and Wages Expense $550 Cr. Salaries and Wages Payable $550 Clean Water Softener Systems has Cash of $600, Accounts Receivable of $900, and Office Supplies of $400. Clean owes $500 on Accounts Payable and has Salaries Payable of $200. Clean's working capital ratio is Select one: a. 1400 b. 0.37 c. 1200 d. 2.71 Cost of Goods Sold is also called Cost of Sales Select one: a. Both True \& False b. Neither True/False c. True d. False Determine the Net cost of inventory purchased when Bargain center buys $381,000 of inventory on November 12 , 2018. He gets a small discount of $4,000 for early payment. However, he noticed that some of the goods are faulty]and as a result returned $61,000 worth of the goods previously purchased and incurred freight in charges of $15,000. Select one: a. 331,000 b. 366,000 c. 230,790 d. 316,000 Use the accounting equation to solve for the missing information Select one: a. 4,400 b. 9360 c. 51960 d. 25,380 a. 8,500 b. 12,000 c. 3500 d. 15,500 Company A purchases a machine for $100,000 with an estimated salvage value of $20,000 and a useful life of 5 years. Select one: a. $20,000 b. $18,000 c. $15,000 d. $16,000 Consider the overall effects on Global Cleaning Service from selling and performing services on account for $6,400 and paying expenses totaling $2,500. What is Global Cleaning Service's net income or net loss? Select one: a. Net income of $3,900 b. Net income of $6,400 c. Net income of $8,900 d. Net loss of $3,900 Assume that the weekly payroll of In the Woods Camping Supplies is $300. December 31 , end of the year, falls on Tuesday, and In the Woods will pay its employee on Friday for the full week. What adjusting entry will In the Woods make on Tuesday, December 31 ? (Use five days as a full workweek.) Select one: a. debit salaries payable salaries expense and credit b. salaries expense and credit cash c. debit salaries expense and credit salaries payable d. No adjustment is needed because the company will pay the payroll on Friday Barleley's Accessory Shop started the year with total assets of $210,000 and total liabilities of $120,000. During the year the business recorded $330,000 in revenues, $165,000 in expenses, and dividends of $60,000. The net income reported by Barleley's Accessory Shop for the year was Select one: a. $195,000. b. $150,000. c. $120,000. d. $165,000 a. 8,500 b. 12,000 c. 3500 d. 15,500 Chris Harper earned a salary of $550 for the last week of January. She will be paid on Feb 1 . The adjusting entry for Chris' employer at Jan 31 is: Select one: a. Dr Salaries and Wages Payable $550Cr Cash $550 b. No entry is required c. Dr Salaries and Wages Expense $550Cr Cash $550 d. Dr. Salaries and Wages Expense $550 Cr. Salaries and Wages Payable $550 Clean Water Softener Systems has Cash of $600, Accounts Receivable of $900, and Office Supplies of $400. Clean owes $500 on Accounts Payable and has Salaries Payable of $200. Clean's working capital ratio is Select one: a. 1400 b. 0.37 c. 1200 d. 2.71 Cost of Goods Sold is also called Cost of Sales Select one: a. Both True \& False b. Neither True/False c. True d. False Determine the Net cost of inventory purchased when Bargain center buys $381,000 of inventory on November 12 , 2018. He gets a small discount of $4,000 for early payment. However, he noticed that some of the goods are faulty]and as a result returned $61,000 worth of the goods previously purchased and incurred freight in charges of $15,000. Select one: a. 331,000 b. 366,000 c. 230,790 d. 316,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started