Question: answer these problems An engineer with Haliburton calculated the AW values shown for a presently owned machine by using estimates be obtained from the vendor

answer these problems

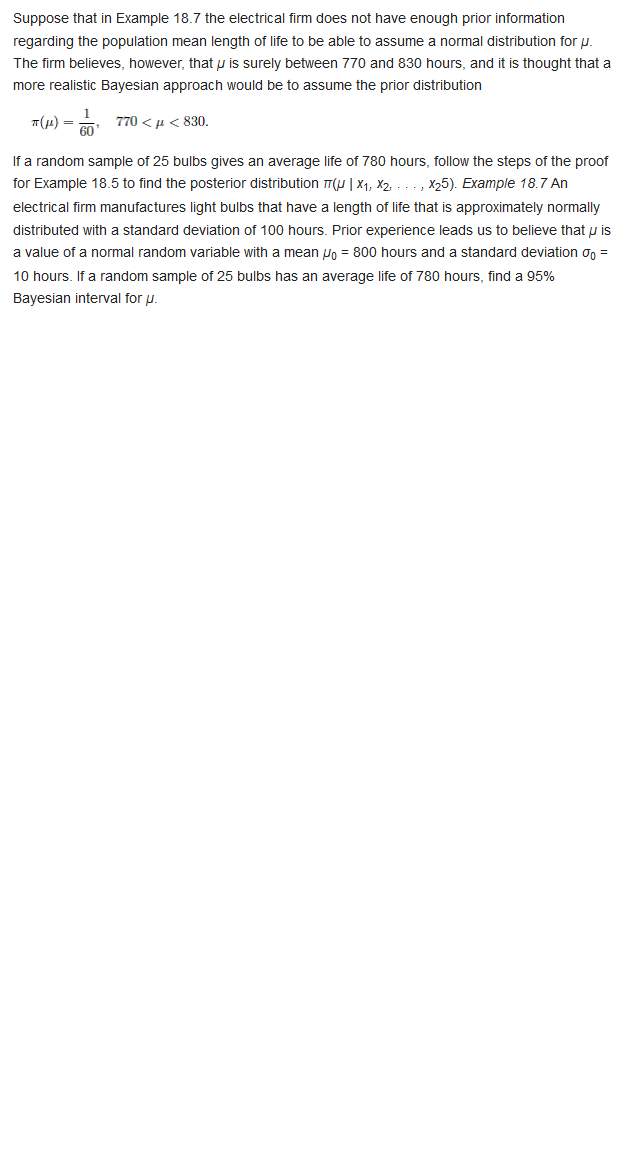

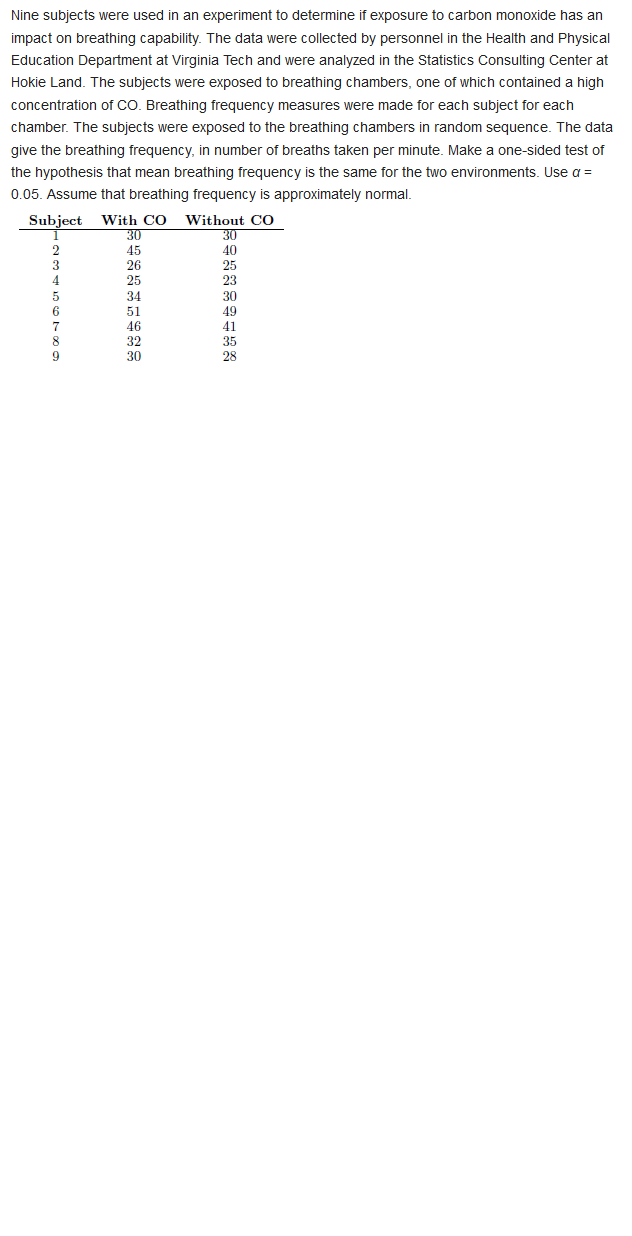

An engineer with Haliburton calculated the AW values shown for a presently owned machine by using estimates be obtained from the vendor and company records. Retention AW Value. Period, Years 5 per Year -RI, OOD -87,DOD -890OD -95,000 A challenger has an economic service life of 7 years with an AW of $ 86,000 per year. Assume that used machines like the one presently owned will always be available and that the MARR is 12%% per year. If all future costs remain as esti- mated for the analysis, the company should pur- chase the challenger: [a) Now (b) After 2 years [o) After 3 years () NeverTwo equivalent pieces of quality inspection equipment are being considered for purchase by Square D Electric. Machine 2 is expected to be versatile and technologically advanced enough to provide net income longer than machine 1. Machine 1 Machine 2 First cool, $ 12000 8.000 Annual NCF, 5 3,000 1,000 (years 1-5). 3,000 (years 6-14) Maximum life, years The quality manager used a return of 13% per year and software that incorporates Equa- tions (13.8] and [13.9] to recommend machine I because it has a shorter payback period of 657 years at 1 = 15%. The computations are summarized here $30306 per year Cash flow neglected by peryback analysis Machine I - 6.57 $12.DO0 Cash flows neglected $5000 per year by payback aralysis $1006 per year Machine 2 1, - 952 Figure 13-7 Illustration of payback periods and neglected net cash flows, Example 13.5. Machine 1: 0. = 657 years, which is less than the 7-year life Equation used: 0 = -12,000 + 3000(P/4,13%,a) Machine 2: 0, = 9.52 years, which is less than the 14-year life. Equation used 0 = -8000 + 1000(P/4,15%,5) + 3000( P/A,15%on, -5KP/F.15%%,5) Recommendation: Select machine 1 w, use a 13%% PW analysis to compare the machines and comment on any difference in the ommendation.\f\fIn conducting a replacement study wherein the planning horizon is unspecified, list three assump- tions that are inherent in an annual worth analysis of the defender and challenger. A civil engineer who owns his own design/build/ operate company purchased a small crane 3 years ago at a cost of $60,000. At that time, it was ex- pecied to be used for 10 years and then traded in for its salvage value of $10,000. Due to increased construction activities, the company would prefer in trade for a new, larger crane now that will cost $80 000. The company estimates that the old crane can be used, if necessary, for another 3 years, at which time it would have a $23,000 estimated market value. Its current market value is estimated in be $39,000, and if it is used for another 3 years, it will have M&O costs (exclusive of operator costs of $17,000 per year. Determine the values of P. w. S, and ADC that should be used for the exist- ing crane in a replacement analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts