Answer these Questions

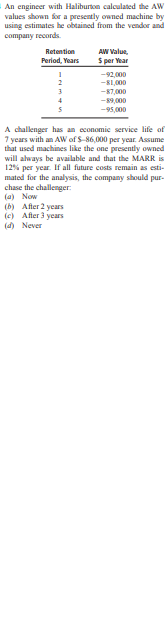

A pulp and paper company is evaluating whether it should retain the current bleaching process that uses chlorine dioxide or replace it with a proprie- tary "oxypure" process. The relevant information for each process is shown, Use an interest rate of 13% per year to perform the replacement study Current Process Oxypure Process Original cost 6 -450,000 years ago, 5 Investment cost -700,00D now, $ Current market 35 000 value, $ Annual operating - INI,OOD -7070OD Sahage value, $ 50,DOD Remaining life, YearsAn industrial engineer at a fiber-optic manufacture ing company is considering two robots to reduce costs in a production line. Robot X will have a first cost of $82,000, an annus and opera- tion (M.&Oj cost of $30,000, and salvage values of $50,000, $42,000, and $35,000 after 1, 2, and years, respectively. Robot Y will have a first cost of $97,000, an annual M&( cost of $27,000, and salvage values of $60,000, $51,000, and $42,000 after 1, 2, and 3 years, respectively. Which robot should be selected if a 2-year study period is speci- fied at an interest rate of 15% per year and replace- ment after I ye an option? A 3-year-old machine purchased for $140,000 is not able to meet today's market demands. The machine can be upgraded wow for $70,000 or sold to a sub- contracting company for $40,000. The current ma- chine will have an annual operating cost of $85,000 per year and a $30,000 salvage value in 3 years. If upgraded, the presently owned machine will be re- taimed for only 3 more years, then replaced with a machine to be used in the man facture of several other product lines. Th which will serve the company now and for at least years, will cost $220,000. Its salvage value will be $50 000 for years I through 4: $20,000 after 5 years; and $10,000 thereafter. It will have an estimated op- erating cost of $65,000 per year. You want to per- form an economic analysis at 15%% per year using a 3-year planning horizon. a) Should the company replace the presently owned machine now, or do it 3 years from now? [bj Compare the capital recovery requirements for the replacement machine (challenger) over the study period and an expected life of 8 years.An engineer with Haliburton calculated the AW values shown for a presently owned machine by using estimates be obtained from the vendor and company records. Retention AW Value. Period, Years 5 per Year -RI, OOD -87,DOD -890OD -95,000 A challenger has an economic service life of 7 years with an AW of $ 86,000 per year. Assume that used machines like the one presently owned will always be available and that the MARR is 12%% per year. If all future costs remain as esti- mated for the analysis, the company should pur- chase the challenger: [a) Now (b) After 2 years [o) After 3 years () NeverIn conducting a replacement study wherein the planning horizon is unspecified, list three assump- tions that are inherent in an annual worth analysis of the defender and challenger. A civil engineer who owns his own design/build/ operate company purchased a small crane 3 years ago at a cost of $60,000. At that time, it was ex- pecied to be used for 10 years and then traded in for its salvage value of $10,000. Due to increased construction activities, the company would prefer in trade for a new, larger crane now that will cost $80 000. The company estimates that the old crane can be used, if necessary, for another 3 years, at which time it would have a $23,000 estimated market value. Its current market value is estimated in be $39,000, and if it is used for another 3 years, it will have M&O costs (exclusive of operator costs of $17,000 per year. Determine the values of P. w. S, and ADC that should be used for the exist- ing crane in a replacement analysis