Answer these Questions

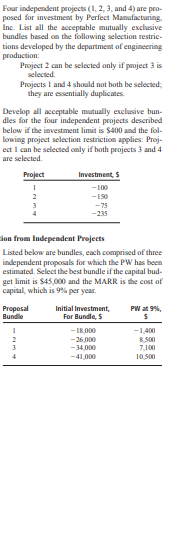

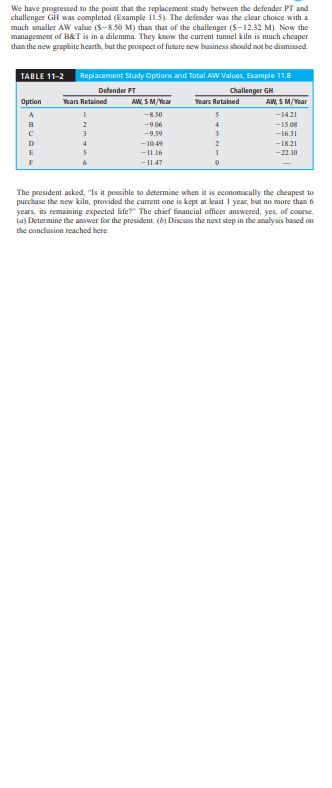

The table below shows present worth calculations of the costs associated with using a presently owned machine ( defender) and a possible replace- ment (challenger) for different numbers of years. Determine when the defender should be replaced using an interest rate of 10%% per year and a 3-year study period. Show solutions (a) by hand and (b) by spreadsheet. FW If Kept/Used Stated Number of Years Number of Years, $ Kept/Used Defender Challenger -36,000 -84,DO0 -75,DO0 -96,000 -125,00D - 102,DO0 -166,000 -217,DOD -149,000Four independent projects ( 1, 2, 3, and 4) are pro- posed for investment by Perfect Manufacturing Inc. List all the acceptable mutually exclusive bundles based on the following selection restric tions developed by the department of engineering production: Project 2 can be selected only if project 3 is selected. Projects 1 and 4 should not both be selected; they are essentially duplicates Develop all acceptable mutually exclusive bun- dles for the four independent projects described below if the investment limit is $400 and the fol- lowing project selection restriction applies: Proj- ect I can be selected only if both projects 3 and 4 are selected. Project Investment, $ -100 -75 -235 ion from Independent Projects Listed below are bundles, each comprised of three independent proposals for which the PW has been estimated. Select the best bundle if the capital bud- get limit is $45,000 and the MARK is the cost of capital, which is 9% per year. Proposal Initial Investment, Bundle For Bundle, $ -1,400 -36 000 8 50O -34 000 -41 000 10.500We have progressed to the point that the replacement study between the defender PT and challenger GH was completed (Example 11.$). The defender was the clear choice with a much smaller AW value ($-8 50 M) than that of the challenger ($-12.32 M). Now the management of B&T is in a dilemma. They know the current tunnel kiln is much cheaper than the new graphite hearth, but the prospect of future new business should not be dismissed. TABLE 11-2 Replacement Study Options and Total AW Values, Example 11.8 Defender FT Challenger GH Option Wears Retained AW, 5 M/Year Years Retained AW, 5 M/Year A -8.50 S -14.21 W N -1.06 -15.08 -9 59 1691- -10.49 -18.21 -II.16 -22.10 -11.47 The president asked, "Is it possible to determine when it is economically the cheapest to purchase the new kiln, provided the current one is kept at least I year, but no more than & years, its remaining expected life?" The chief financial officer answered, yes, of course. (a) Determine the answer for the president. (bj Discuss the next step in the analysis based on the conclusion reached here.\f\f