Answered step by step

Verified Expert Solution

Question

1 Approved Answer

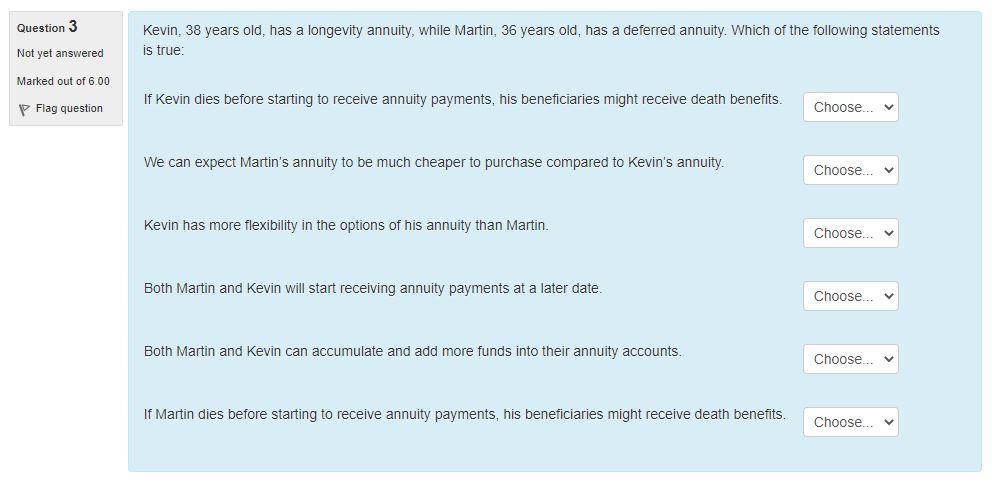

Answer these whether true or false? Question 3 Kevin, 38 years old, has a longevity annuity, while Martin, 36 years old, has a deferred annuity.

Answer these whether true or false?

Question 3 Kevin, 38 years old, has a longevity annuity, while Martin, 36 years old, has a deferred annuity. Which of the following statements is true Not yet answered Marked out of 6.00 If Kevin dies before starting to receive annuity payments, his beneficiaries might receive death benefits. Flag question Choose... We can expect Martin's annuity to be much cheaper to purchase compared to Kevin's annuity Choose... Kevin has more flexibility in the options of his annuity than Martin. Choose... Both Martin and Kevin will start receiving annuity payments at a later date. Choose... Both Martin and Kevin can accumulate and add more funds into their annuity accounts. Choose... If Martin dies before starting to receive annuity payments, his beneficiaries might receive death benefits. ChooseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started