answer this

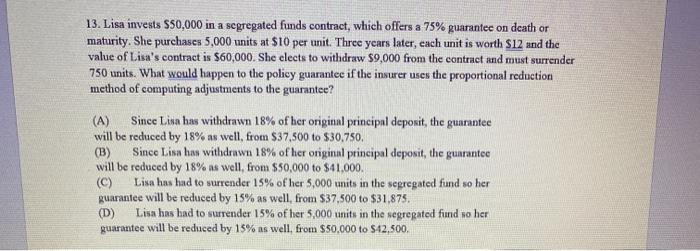

13. Lisa invests $50,000 in a segregated funds contract, which offers a 75% guarantec on death or maturity. She purchases 5,000 units at $10 per unit. Three years later, cach unit is worth S12 and the value of Lisa's contract is $60,000. She elects to withdraw $9,000 from the contract and must surrender 750 units. What would happen to the policy guarantee if the insurer uses the proportional reduction method of computing adjustments to the guarantee? (A) Since Lisa has withdrawn 18% of her original principal deposit, the guarantee will be reduced by 18% as well, from $37,500 to $30,750, (B) Since Lisa has withdrawn 18% of her original principal deposit, the guarantee will be reduced by 18% as well, from $50,000 to $41.000. (C) Lisa has had to surrender 15% of her 5,000 units in the segregated fund so her guarantee will be reduced by 15% as well, from $37.500 to $31.875. (D) Lisa has had to surrender 15% of her 5,000 units in the segregated fund so her guarantee will be reduced by 15% as well, from $50.000 to $12,500. 14. Which of the following statements about the reset guarantee under an individual variable insurance contract is correct? (A) Exercise of the resct option also restarts the maturity period for the whole policy. (B) Exercise of the reset option resets the guarantee from 75% to 100%. (C) Exercise of the reset option establishes a new base for the death benefit guarantee but not the maturity benefit guarantee. (D) Exercise of the reset option establishes the minimum guarantee to the amount of the original deposit if the fund value has fallen below 75% of the original deposit. 000 19. Joanne is a partner in an employment counselling company. She is looking for a group RRSP for five employees. The management has decided to use an insurance company to administer the plan and they are choosing between individual variable insurance contracts (IVICs) and mutual funds as the investment vehicle. Which of the following statements are correct about these investment types? (A) There is taxation of income distributions under mutual funds and tax deferral under the IVIC. (B) There is a guarantee of 75% under the IVIC during the duration of the investment (C) There is protection of the administration of the plan by the securities commission in the company's province of residence for both investment types. (D) There is the ability to appoint a beneficiary under an IVIC and thereby avoid including the value of the IVIC in the owner's estate for probate