Answered step by step

Verified Expert Solution

Question

1 Approved Answer

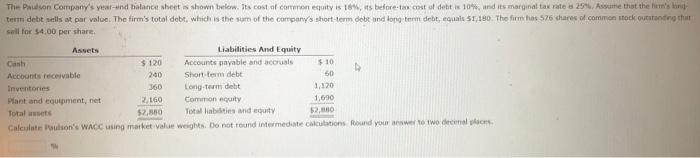

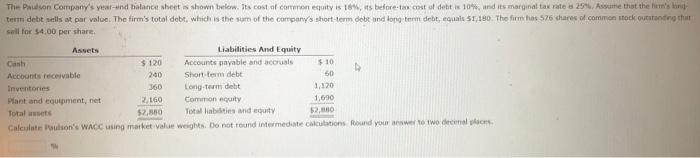

Answer this 2 part problem correctly for thumbs up. The Paulson Company's year-und balance sheets shown below. Its cost of common equity is 18%, s

Answer this 2 part problem correctly for thumbs up.

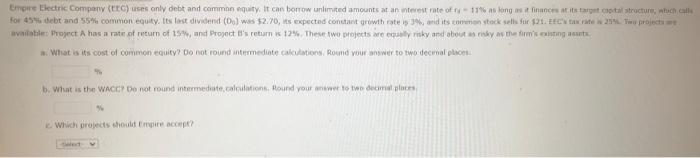

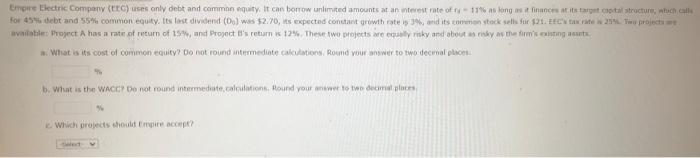

The Paulson Company's year-und balance sheets shown below. Its cost of common equity is 18%, s before-tax cost of debt 10% and its marginal tax rates 29. Assume that the he's kind term debt sells at par value. The firm's total debt, which is the sum of the company's short-term debt and long term debt, quis 51 180. The film has 76 shares of common stock outstanding thu sell for $4.00 per share. Assets Liabilities And Equity Cash $ 120 Accounts payable and accruals $10 Accounts receivable 200 Short term debe 50 Inventories 360 Long-term debit 1,120 Plant and equipment, net 2,160 Common equity 1,690 Totalt $2,500 Totabilities and equity $2,00 Calculate Pulson's WACC using market value weights. Do not found intermediate calculations. Round your answer to two decal more Electric Company (c) se only debt and common equity. It can borrow unlimited amounts at an were rate of 11 as long as it finances its total structure, which alle For 45 debt and 55% common equity. Its last dividend (D) was $2.70, its expected constant growth rate $3%, and its common stock selis ir 21 EC 21 The project vittle Phot A has a rate of return of 15% and Project 's return 12%. These two projects are equally risky and about these asut What is its cost of common equity? Do not found intermediate calculations, Round your answer to two decimal place b. What is the WACC Do not round intermediate calculation, Hound your answer to two decorat plocs Which projects should the accept

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started